Backtesting for 17 years is available! Safe operation is also possible, as is speculative trading 'FIREBIRD_E'

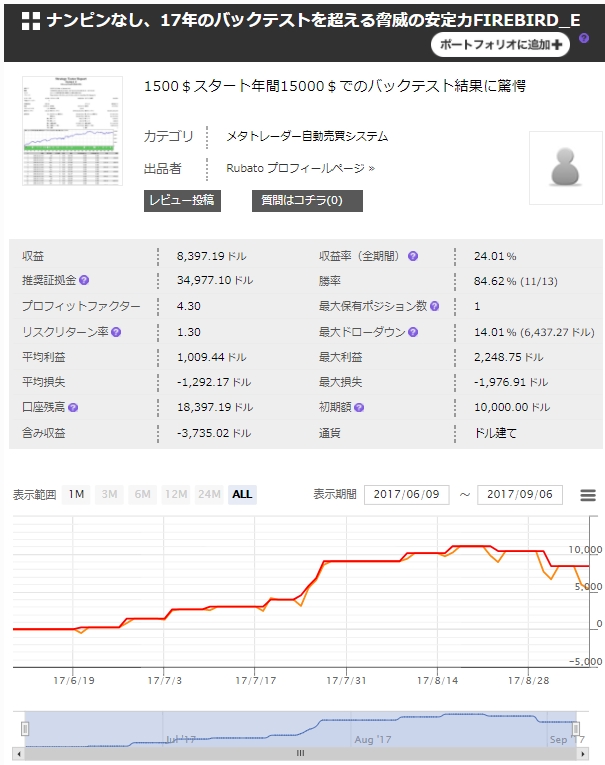

■ Forward 3 months: +$8,000

Thus far, over the forward three months, realized P/L is +$8,379, with a maximum drawdown of $6,437.

Both gains and losses are large because it runs at 5 lots even though it is a single-position operation.

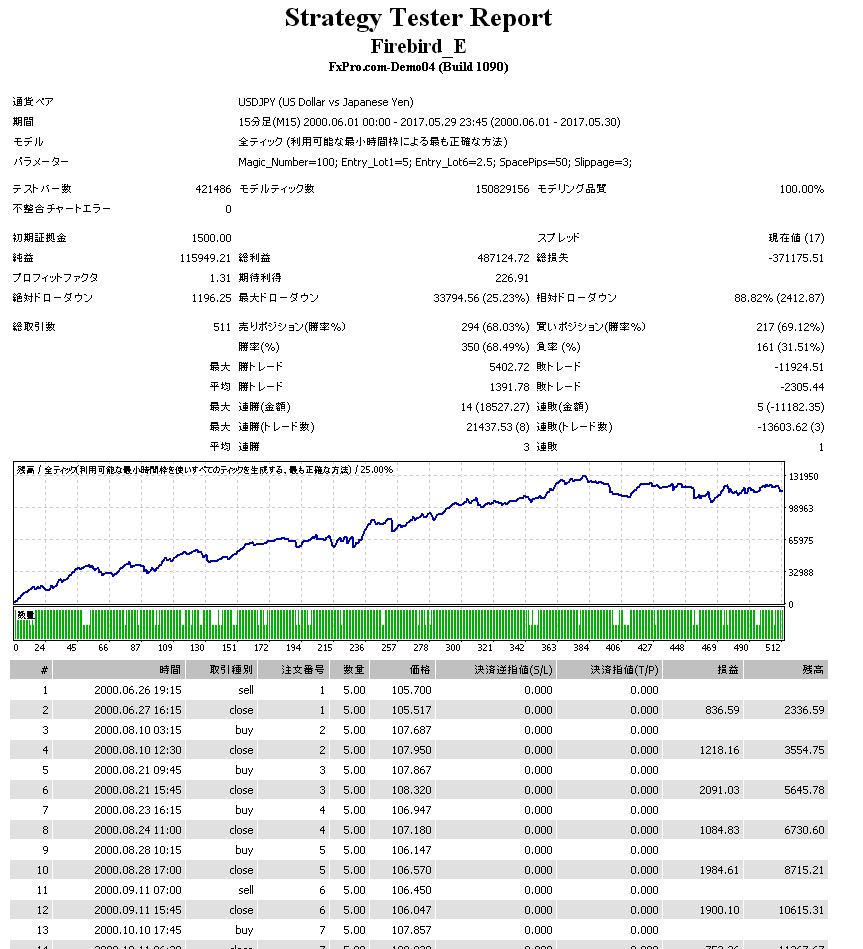

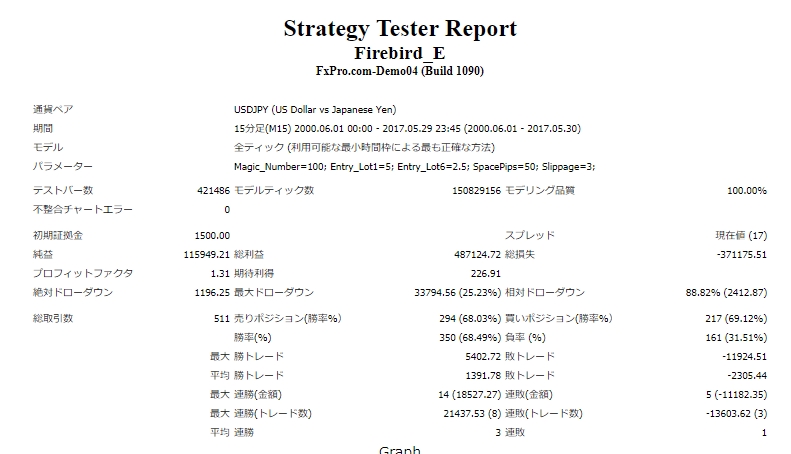

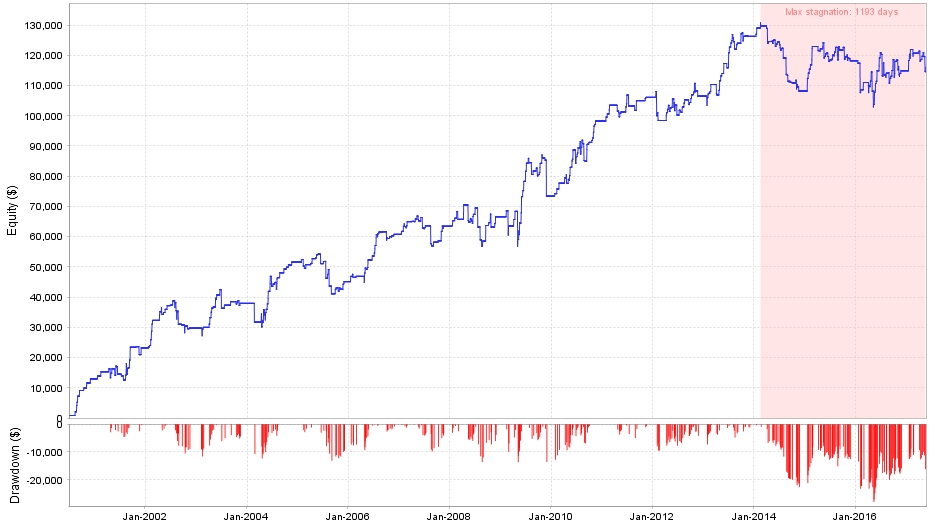

■ What do the 17-year backtest results look like?

$1,500 ⇒ $115,949

The maximum drawdown during the period is $33,794.

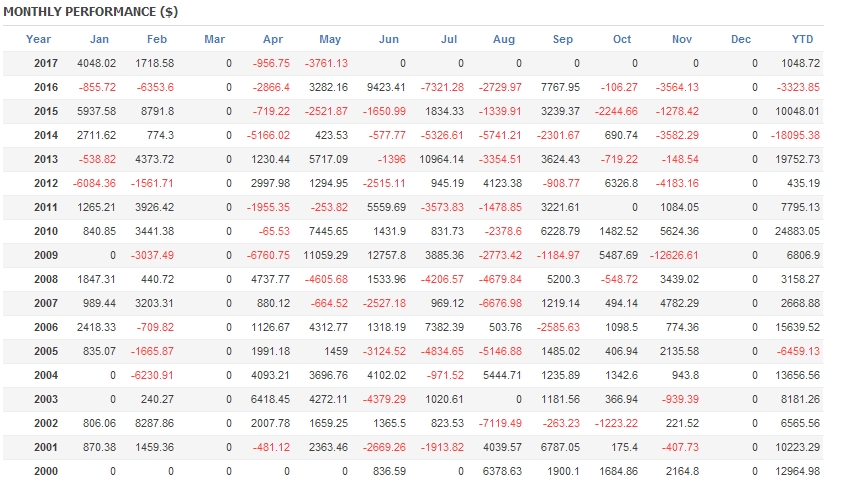

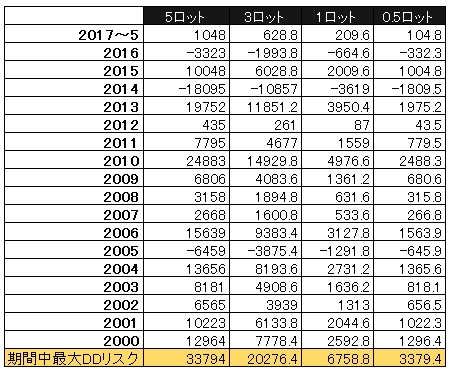

【Backtest results by month】

In the 17-year backtest from 2000, the years 2005, 2014, and 2016 were negative in total for the year.

If you had started trading in those off years, a 1,000,000-yen account could be at risk of ruin.

Looking at the backtest equity curve, the last couple of years have been underperforming, but the shape suggests we may be entering a period of upward growth.

■ Safe operation (leverage 25x)

This is a summary of annual profit with fixed lots.

The maximum DD risk is not annual but comes from the 17-year backtest, but

With a 0.5-lot operation, the maximum drawdown is $3,379, so if you want to keep DD to about 30%, a 1,000,000 yen account with 0.5 lots would be safe, with no risk of account ruin.

In that case,the expected average annual profit is $644, about 6% annually.

If you want to take a bit more risk and pursue profits,

With 1.0 lot on a 1,000,000 yen account, you could barely withstand the maximum drawdown.

In that case, the average expected annual profit is $1,288, yielding about 12.8% annual return.

For an account with leverage 25x, you cannot hold 5 lots with 1,000,000 yen, so

If you expect the same profits as the forward, you would need roughly 3.5 million yen in required margin.

■ 15-copy Limited Campaign

15-copy Special Limited Price

¥100,000 → ¥29,800

‘No averaging down, FIREBIRD_E with stability that surpasses the 17-year backtest’

$1,500 start, annual $15,000 backtest results are astonishing