Not speculative even in FX; using an AUD/NZD range-trading EA for asset management FX

Today I spoke with investor S, who began investing in stocks more than 30 years ago, has about 15 years of FX experience, and has also invested in a single apartment building; they are now retired early and living comfortably on investment income.

What left a strong impression was that they advised not to start real estate investment anew because there are risks such as their son taking on debt or tenants leaving; investments should be pursued to earn income beyond one's main job and to understand the economy and global trends, but if you invest, investment trusts that can grow substantially simply by being held for a long time are good, yet FX with a small principal and high yield should be pursued, they advised.

As someone who often hears that the growth path for an investor is FX, stocks, and someday real estate investment, this was a fresh perspective.

Their FX trading uses RSI"EA Tsukuru" , an EA (expert advisor) built with it, to perform semi-automatic entries, with exits manual and trailing stops, aiming to take 50 to 100 pips in contrarian trades.

They use two timeframes, and since hearing at a seminar that Mr. Koshiro Nishiyama says to always include a stop loss, they began setting appropriate values, which eliminated large unrealized losses and stabilized trading.

The RSI trading method, we would like to have the opportunity to have them explain in detail, but they are also practicing trades using a range-trading EA that turns FX from speculation into asset management, and this time I would like to present that asset-management EA.

The EA used is,Egoist_Repeat_AUDNZD_M1.

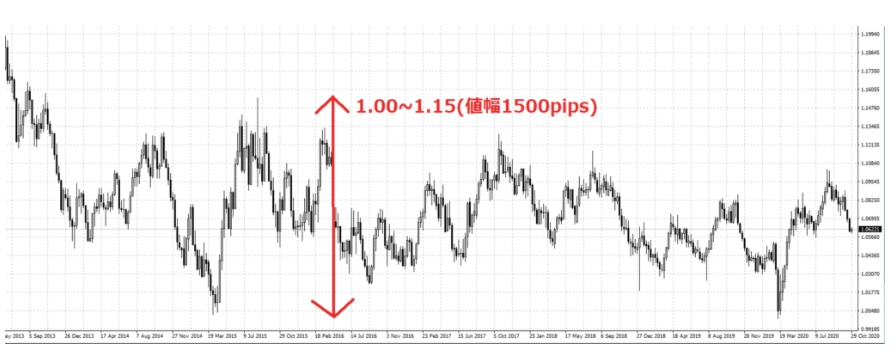

It's a range-trade type EA, but in reality many traders are afraid of it and avoid it because if the rate moves outside the expected range, held positions incur large unrealized losses; as explained by the EA developer Pikkoro on his page, it has been operating on AUD/NZD, forming a range of about 1,500 pips from late 2013 to the present.

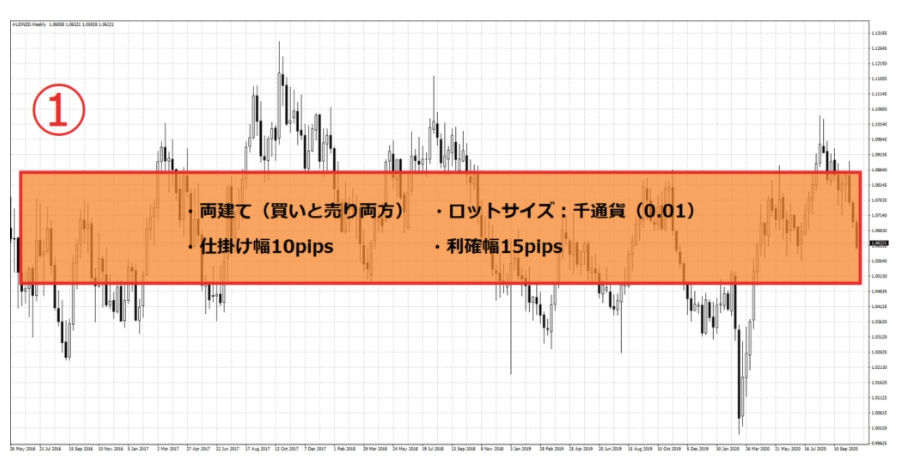

Near the middle of the range, the price zone that tends to move back and forth more frequently can be configured to allow both buy and sell trades as shown below, increasing opportunities to profit.

The price zones outside of the central zone are set to trade in only one direction, either sell or buy.

Range trading takes positions at regular intervals, so if the range width is as large as 1,500 pips, you can end up holding a substantial number of positions, and the required margin becomes large, which is a concern.

In fact, according to the developer Pikkoro's page, setting in 0.1 lots with 10-pip increments would require about 4.89 million yen in margin, but S uses larger step sizes and limits to at most about 30 positions, so even a personal account can be comfortably handled with around 800,000 yen for 0.1-lot trades, greatly reducing required margin and risk.

And as another danger of range trading, when the rate deviates from the expected range, S manually adds a large hedge position in the opposite direction to offset the breakout, after looking at RSI and other indicators.

Trends in AUD/NZD can be anticipated by looking at the policy rates of Australia and New Zealand, so when a trend appears they check the policy rates and enter hedge positions.

Afterward, they close all positions and wait for the market to revert to a range, which is their trading method.

The fact that many Japanese FX companies offer range-trade automated trading systems also reflects the underlying belief that FX for asset management rather than speculation is an excellent form of investment.

FX for asset management with a small principal and high yield is a wonderful financial instrument, and doing it on MT4 with low spreads seems to be the best option.

written by Hayakawa