Dramatically increase with NZDCAD! 「Cyclone_M5NZDCAD」

【Concept】

By targeting minor currency pairs and trading on swing,

it is also believed to have high robustness to the trading environment (long-term edge).

With compounding, the second position in the same direction has a slight increase in lot size.

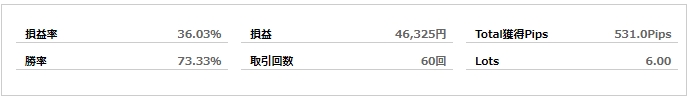

■Forward Analysis

Two months of forward operation

60 trades, 531 pips earned and it is progressing smoothly.

The growth is gradual but steady.

Forward requires at least three months of observation, so please use as reference.

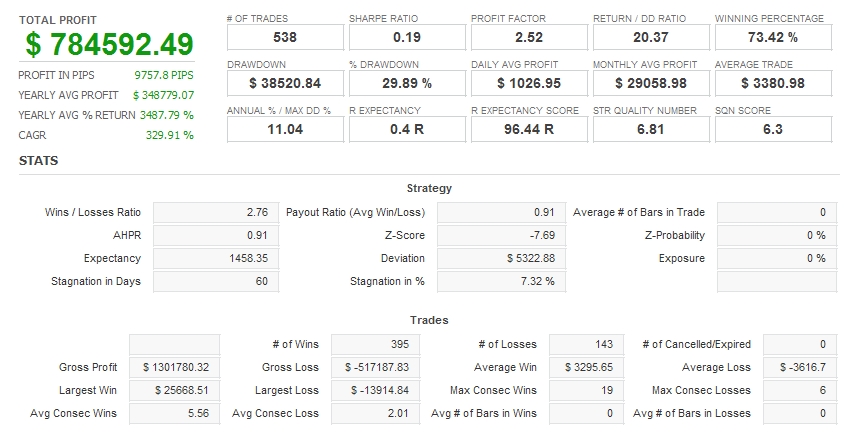

■Backtests show annual XX pips under simple interest!

Backtests show...Initial margin was 100,000 yen.

With 1,000,000 yen, annual returns of over 30% would be nice, so the figures were on a different scale.

In 2 years and 3 months, +784,591 yen, a 780% increasehas occurred.

With simple interest, this earned pips is quite powerful.

Let's take a closer look!

We analyzed the backtest data using an analysis tool called QuantAnalyzer.

(Although it is denoted in dollars, the backtest currency is yen.)

Although this is a two-year backtest, the annual return is +348%, indicating a high rate of return.

Average earnings of 3,295 yen, operating at 0.1 lot, so more than 30 pips.

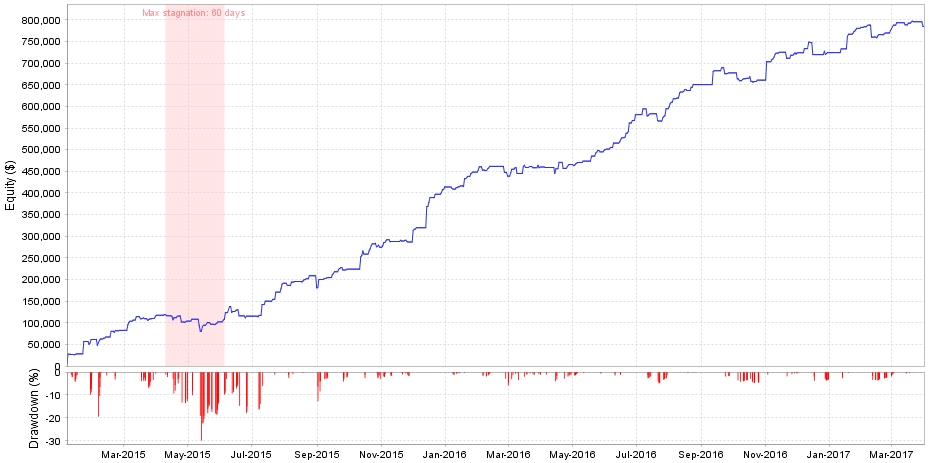

You can also see when the largest drawdown occurred.

During the 60 days from April to May 2015, there was the largest drawdown relative to the account balance.

Specifically, with a 100,000 yen margin, there was a drawdown of -12,039 yen in April, a -12% drawdown.

Looking at the annual returns, around 400,000 yen and 320,000 yen, it is a type where losses are small relative to the returns, so even if operated during the worst period, it would turn positive in 3–4 months.

■Note

One point to note is, because NZDCAD is a minor currency pair, the spread is wide.

Since spreads below 0.5 pips are unlikely as with USD/JPY or EUR/USD, when planning to operate with your FX broker,

it is recommended to perform a backtest taking NZDCAD's spread into account.

By the way, fx-on forward operation runs on OANDA Japan,

NZDCAD spread is fluctuating around 20-30 points (2-3 pips).

The EA's spread filter is5 pips, so we recommend FX brokers where NZDCAD spread stays within 5 pips.

However, although it operates on a 5-minute chart, it is a swing-oriented EA with long holding times, so apart from the spread, there is likely little deviation from backtests..

For currency pairs with wide spreads, increasing trading frequency leads to spread disadvantage,

so to avoid spread loss, you should widen the TP range or reduce trading frequency.

In that regard, Cyclone_M15NZDCAD has a good balance between trading frequency and average pips gained (about 30 pips).

A rare EA that can be expected to earn more than 3,000 pips per year with minor currencies!

- NZDCAD 5-minute chart day-trading to swing EA

- Maximum number of positions: 2

- Average monthly trades: 20-30

- Annual return expected around 3000 pips

- 2-year backtest max drawdown: 52,757 yen (0.1 lot)

- Compounding feature also available

[Cyclone] Spin Buy/Sell! NZDCAD M5 Dedicated Contrarian Double Swing