VIX falling below 20 accurately predicted a NASDAQ decline of more than 3% — Mr. Tetsuo Inoue

In Mr. Tetsuo Inoue's "Market Trends," both NASDAQ's drop of more than 3% on February 25 and last week's drop of more than 3% on March 18 are accurately analyzed as having occurred after the VIX had recorded two consecutive days below 20.

Please take a look at the sharp article from March 19.

Publication date: 2021/03/19 08:44

Trend 1245: The Most Notable "Check." Last night's NASDAQ had a bad assist

The second of two events this week, the Bank of Japan's Monetary Policy Decision Meeting, ends today, and an announcement including a "check" (a summary of results) will be made, but it is the "most anticipated."

As always, and especially in March, with the fiscal year-end in mind (3/31), market-friendly, non-disruptive considerations are often shown; since the 3/12 Mainichi Shimbun report "the principle of purchases at a pace of 6 trillion yen per year" was removed, similar speculative articles have circulated, and yesterday an article stated that "the target of 6 trillion yen per year will be removed and the stance to buy only during market turmoil will be clarified"; but all of these are not "observational articles" but "trial-balloon articles."

A "trial balloon" is something used in advance to gauge whether such a development would unsettled the market; it's like a patch test where information is leaked on purpose to see the reaction from above, and the BOJ may be relieved by the market's reaction so far.

If the content actually reported is announced this time, there may be smug comments in the market like "a correct choice from the perspective of long-term market health," but I am bracing for a possible temporary drop. If I try to predict the BOJ's thinking, the phrase "purchases at a pace of 6 trillion yen per year in normal times" would be removed, but (as a precaution for sharp stock declines) the "upper limit of 12 trillion yen" would not be removed and would be kept as a sign of a safety net to limit the impact on the market; however, that may not be the case.

There are two reasons.

The impact on the Nikkei Average is larger relative to the TOPIX, and more importantly, the market uses the level of the Nikkei Average as a thermometer, and another factor is "last night's NASDAQ decline rate."

Regarding the former, the BOJ's main ETF purchases target TOPIX-type, Nikkei 225-type, and (else) the JPX-Nikkei 400-type; since the majority of purchases are TOPIX-type, you might wonder "what are they saying?" but in fact ETF purchases began in 2010 at an annual pace of 450 billion yen, and as the purchase quotas expanded, the Nikkei 225-type became the main target at first, resulting in the BOJ becoming a large shareholder in Nikkei 225 constituent stocks. For 225 stocks versus 1,800 stocks, the impact of buying the same amount on individual stocks differs, and the same applies to selling. Of course, this time they are not selling, but the expected buying impact on the 225 stocks will surely decrease.

And the latter, NASDAQ, fell 3.02% last night, as noted in the MD; this is the first drop over 3% since 2/25's 3.51%. The previous instance was 3.73% on 10/28 of last year.

As for the "3.73%" on 10/28, as detailed in the Trend, it occurred when the market was unsettled by Democratic House Speaker Pelosi's obstructionist rejection of an additional coronavirus relief spending bill ahead of the presidential election; and 2/25, of course, was the fanfare for the current "unstable market" environment driven by rising rates.

Last night's decline rate was comparable to those, but I think it is a "rebound"—a rebound in the VIX after the drop.

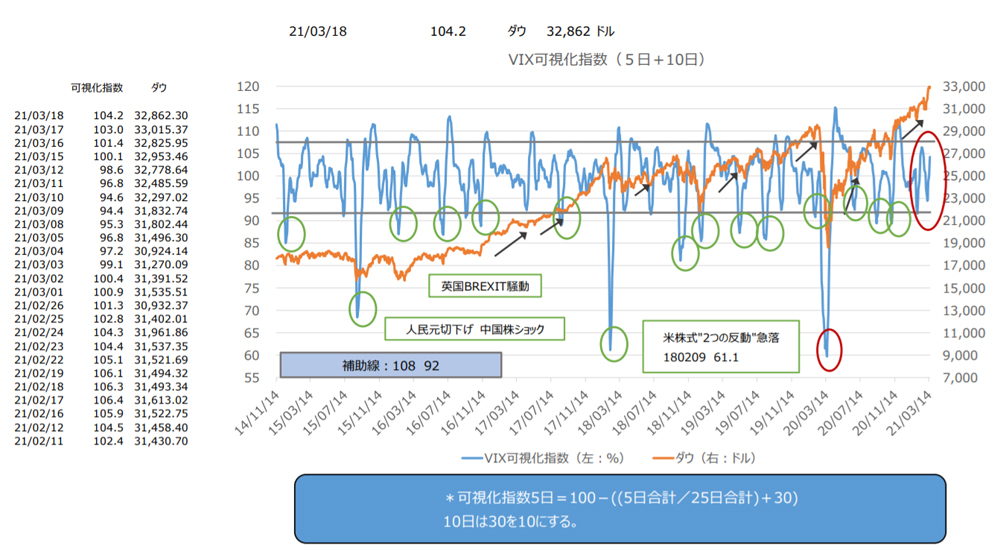

The VIX had been below 20 for two consecutive days up to the day before yesterday, but this below-20 had appeared only on 2/12 for a single day, and previously it can be traced back to 2/21 last year before the COVID main shock day. If that 2/12 below-20 ultimately caused the 3%+ drop on 2/25 as a rebound, then last night's 3%+ drop could be seen as a rebound from the run of two days below 20 until the day before yesterday. A VIX visualization index graph is attached; please note it has risen sharply in the past few days.

The second of two events this week, the Bank of Japan's Monetary Policy Decision Meeting, ends today, and an announcement including a "check" (a summary of results) will be made, but it is the "most anticipated."

As always, and especially in March, with the fiscal year-end in mind (3/31), market-friendly, non-disruptive considerations are often shown; since the 3/12 Mainichi Shimbun report "the principle of purchases at a pace of 6 trillion yen per year" was removed, similar speculative articles have circulated, and yesterday an article stated that "the target of 6 trillion yen per year will be removed and the stance to buy only during market turmoil will be clarified"; but all of these are not "observational articles" but "trial-balloon articles."

A "trial balloon" is something used in advance to gauge whether such a development would unsettled the market; it's like a patch test where information is leaked on purpose to see the reaction from above, and the BOJ may be relieved by the market's reaction so far.

If the content actually reported is announced this time, there may be smug comments in the market like "a correct choice from the perspective of long-term market health," but I am bracing for a possible temporary drop. If I try to predict the BOJ's thinking, the phrase "purchases at a pace of 6 trillion yen per year in normal times" would be removed, but (as a precaution for sharp stock declines) the "upper limit of 12 trillion yen" would not be removed and would be kept as a sign of a safety net to limit the impact on the market; however, that may not be the case.

There are two reasons.

The impact on the Nikkei Average is larger relative to the TOPIX, and more importantly, the market uses the level of the Nikkei Average as a thermometer, and another factor is "last night's NASDAQ decline rate."

Regarding the former, the BOJ's main ETF purchases target TOPIX-type, Nikkei 225-type, and (else) the JPX-Nikkei 400-type; since the majority of purchases are TOPIX-type, you might wonder "what are they saying?" but in fact ETF purchases began in 2010 at an annual pace of 450 billion yen, and as the purchase quotas expanded, the Nikkei 225-type became the main target at first, resulting in the BOJ becoming a large shareholder in Nikkei 225 constituent stocks. For 225 stocks versus 1,800 stocks, the impact of buying the same amount on individual stocks differs, and the same applies to selling. Of course, this time they are not selling, but the expected buying impact on the 225 stocks will surely decrease.

And the latter, NASDAQ, fell 3.02% last night, as noted in the MD; this is the first drop over 3% since 2/25's 3.51%. The previous instance was 3.73% on 10/28 of last year.

As for the "3.73%" on 10/28, as detailed in the Trend, it occurred when the market was unsettled by Democratic House Speaker Pelosi's obstructionist rejection of an additional coronavirus relief spending bill ahead of the presidential election; and 2/25, of course, was the fanfare for the current "unstable market" environment driven by rising rates.

Last night's decline rate was comparable to those, but I think it is a "rebound"—a rebound in the VIX after the drop.

The VIX had been below 20 for two consecutive days up to the day before yesterday, but this below-20 had appeared only on 2/12 for a single day, and previously it can be traced back to 2/21 last year before the COVID main shock day. If that 2/12 below-20 ultimately caused the 3%+ drop on 2/25 as a rebound, then last night's 3%+ drop could be seen as a rebound from the run of two days below 20 until the day before yesterday. A VIX visualization index graph is attached; please note it has risen sharply in the past few days.

written by Hayakawa

× ![]()