An indicator that displays a certain rule of the Nikkei 225, 'Miko Night (Messiah)'

A multifunctional indicator dedicated to binary trading

'Maya' and 'Sakuya' are developed and marketed by "Massan"

The new indicator is, astonishingly,“Nikkei 225”!

Maya and Sakuya were complex, so there were parts that were difficult for beginners, but

this time's Nikkei 225-only indicator 'Miko Night (Mesaiya)' is very simple, so

you shouldn't have trouble with how to operate it.

■ Turning the mysterious master's method that turned 1 Nikkei 225 Mini into 10 million in a year into an indicator

“Miko Night (Mesaiya)” is an indicator developed at the request of a user,

It is said that a certain Mr. M discovered a certain rule for the Nikkei 225, and by applying it to trading a single Nikkei 225 Mini, he earned 10 million yen in profit in one year.

For MINI, the margin is 60,000–80,000 yen (for Rakuten Securities, the Nikkei 225 2 mini requires a margin of 78,000 yen per contract), and with one mini, roughlya 100-yen move yields about 10,000 yen in profit.

The Nikkei 225 is volatile, and it often moves by several hundred yen in a day, so the price range seems to offer more profit opportunities than FX, but even so, earning 10 million yen requires substantial price movements and many trades to reach it...

What is the secret method that earned 10 million yen per year, exactly what is that method…

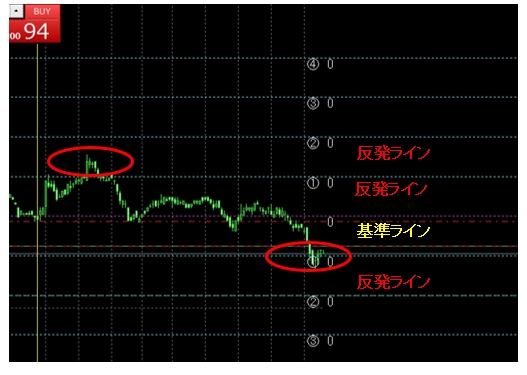

■ A perfect reversal?! The rebound line can be known in advance!

According to Mr. M, the Nikkei 225 repeatedly rebounds within a fixed range around a certain baseline.

If you know that rule, you could do it manually, but to automate the daily manual tasks, we made an indicator for MT4.

The green dotted line is the rebound line for that day, but

do you see that around the rebound line it returns to the reference line?

(Continuation of the image above) After that, it reaches the lower rebound line and temporarily stops.

(This,) the reference line and rebound line change daily, but

that line drawing is done by 'Miko Night (Mesaiya)'. Right.

■ Trading strategy is up to you.

What 'Miko Night (Mesaiya)' reveals are only the reference line and the rebound line.

The basic trading strategy is to use contrarian trading at the rebound line and take profits as it moves back to the lower (or upper) line.

Trading.

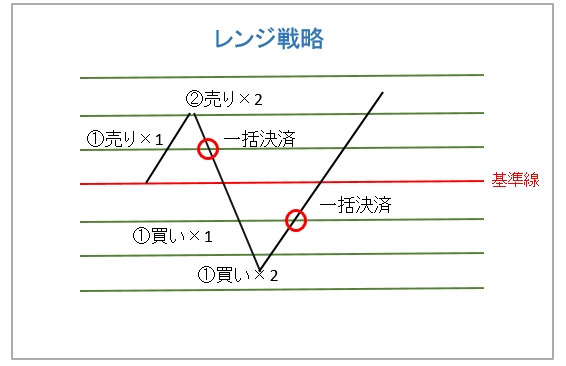

When a narrow-range market persists, simply repeating contrarian trades seems fine, but

in situations where the market moves decisively in a trend direction, contrarian trading is indeed scary...

If you have ample funds, averaging down is possible, but if you average down several times and end up cutting losses, the damage can be substantial.

The damage can be substantial.

There are several possible strategies using this line!

① Define the number of trades and use contrarian Martingale!

In a mid- to long-term ranging market, place stop orders at rebound lines 1, 2, 3, 4 with lots of 1x, 2x, 4x, 6x respectively, and if at some point it rebounds to the line below, close the position.

You can place contrarian trades above and below the reference line.

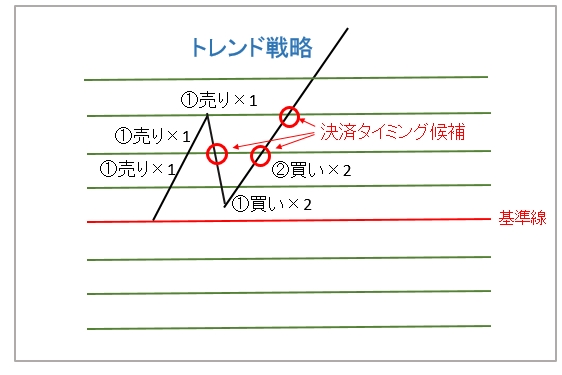

② Follow the trend direction with double lots while also doing contrarian trades

When a mid- to long-term trend exists, enter in the trend direction with double the lot size relative to the contrarian rebound line. If the price reverses on the contrarian side, take profits, and if you continue in the trend, you can also increase profits.

If the price moves in one direction by three or four lines from the reference line, to aim for the trend-following,

close the contrarian positions at break-even, and when a reversal in the trend direction is confirmed,

enter with double the lots.

With the above strategies, a single position is difficult, so decide on total lots and

do staggered entries.

(Easy to say, but when you actually do it, humans tend to hesitate quite a bit...)

■ Manual limit-order trading with a Nikkei 225 brokerage account is fine,

There is a spread, but it's also worth trying semi-automatic trading with MT4 CFD charts!

Because 'Miko Night (Mesaiya)' only draws lines, entry and exit should be done in a Nikkei 225 account

by placing OCO orders, or by trying MT4 CFD as well.

If you use MT4, you can use line-trade EAs and settlement assistance tools to engage in semi-discretionary trading.

.

■ What monthly return and price width can you expect?

It's probably what everyone is curious about, but

the line width and the reference line are part of the method, so unfortunately we can't disclose them.

Not that it’s an incredibly feature-rich indicator, but

This is an indicator that contains an amazing method!This is the "Miko Night (Mesaiya)" that can be said to contain an amazing method!