I'm glad about the detailed analyses and strategies for three currency pairs — Kosei Hashimoto's 'FX Outlook'

Today's USD/JPY (June 26) publication date: 2017/06/26 09:03

(Strategy) Will this week see a breakout from the range?

(Comment)

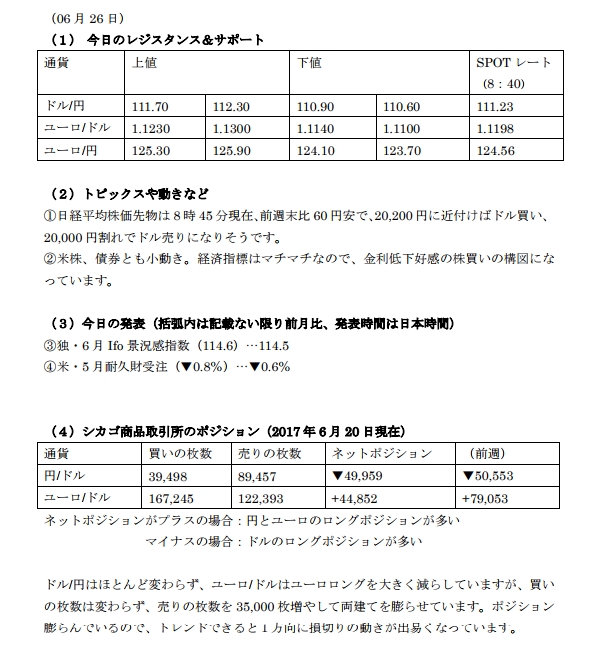

The USD/JPY weekly chart has little price movement, and the upside is capped by the 90-week moving average at 111.51 and the 25-week moving average at 112.32. In the near term, since it has broken above the resistance from the high, it doesn't seem likely that the dollar will fall immediately.

It looks like it will stay in a range centered around the 111 yen area, as last week. However, this week's end is based on the weekly, monthly, and quarterly charts, so a volatile move is possible.

The June opening price is 110.80 yen, and the range is 108.83 to 111.78, so the current spot shows a slightly long lower wick on a bullish candle. Last month formed a bearish candle, so selling into rallies with the high at 114.37 as a top is suggested; if it ends this week in the 112s, early next month would see a dollar decline after testing the retrace high. Conversely, if it falls below 110.80, upside will be limited. A break below 110 within the week would be a warning sign.

This week, the range is 110.20–112.40, and if it exceeds the upper bound there is room to move up to around 113.30–113.40. If by the weekend it is near 113, next month could also target the 114 range. We'll carefully draw selling opportunities. On the downside, if it breaks 110, there is room down to around 109, so we would look for selling opportunities in the 110s.

If you are willing to take risk after this week, selling rallies in the 112–114.30 zone, but at present this is not highly recommended.

Today the range centers on 111.00–111.65 yen, with a going-back sale near 111.60 and a stop at 112.45. The downside battle will be around 111. In the Tokyo session, we will lightly buy the dips below 111.10 with a stop at 110.55. (June 26 09:02, 1 USD = 111.26 JPY)

EUR/JPY (June 26) publication date: 2017/06/26 09:04

(Strategy) Euro range, counter-trend

(Comment)

The EUR/JPY weekly chart shows a small bullish candle, but having broken the resistance from the recent high, there is upside room up to 125.80–125.90. The 90-week moving average (122.35) and the 90-month moving average (122.02) are descending, so euro strength has not been confirmed. The monthly chart is currently a doji, with an opening at 124.53 and a high of 125.30.

Technically, the euro finished above 120 yen in December last year, so the long-term outlook suggests euro strength, but the buying zone may be 120–121, or there could be a pullback to 118 or 114; the trend is heading toward rising moving averages, but the current downward pressure is suppressing an upward trend.

This week, the range is 122.50–125.90, with a pullback sell around 125.80 and a stop at 126.45. For those willing to take risk, selling lightly at 125.30 resistance could increase exposure.Downside: buy the dips under 123, with a stop at 121.90. The monthly close/open is around 124.53, with the high at 125.30.

Today, the range is 124.10–125.30, a contrarian move. Sell on rallies around 125.20, with a stop at 125.55, or place the stop at 126.45 within the weekly range. On the downside, buy the dips around 124.20 or lower, with a stop at 123.65. If in the overseas session it is trading below 124.50, we'll take a wait-and-see approach to buying. (June 26 09:03, 1 euro = 124.59 yen)

EUR/USD (June 26) publication date: 2017/06/26 09:05

(Strategy) Euro range, counter-trend

(Comment)

The EUR/USD weekly chart has formed a dragonfly doji indicating a failed attempt to test lower; the lower bound remains above 1.11, and for five weeks it has stayed within the 1.1110–1.13 range. This week too, this range will persist.

The trend will respond after a range breakout. Since the monthly opening is 1.1239, even if a bullish close is in the 1.1240–1.13 zone, it has not closed above the two-previous high, so chasing higher is risky. Conversely, a close below 1.12 would make 1.13 very heavy.

This week, selling into the 1.1280–1.13 zone with a stop at 1.1345, or a weekend close at 1.1325. The downside buy is around 1.1120–1.1130, but keep positions light or take profits as they come; stop at 1.1060. If it ends below 1.1070, there is downside room to around 1.0730–1.0740, so a medium-term dip-buying setup.

Today, the range is 1.1140–1.1230; contrarian.Sell on rallies around 1.1220 with a stop at 1.1265. The downside buy is around 1.1150 with a stop at 1.1090. (June 26 09:05, 1 EUR = 1.1200 USD)

===============================================

Weekly outlook and daily trading strategies for USD/JPY, EUR/JPY, and EUR/USD

3,240 yen per month!

Read daily to improve market analysis skills!

===============================================