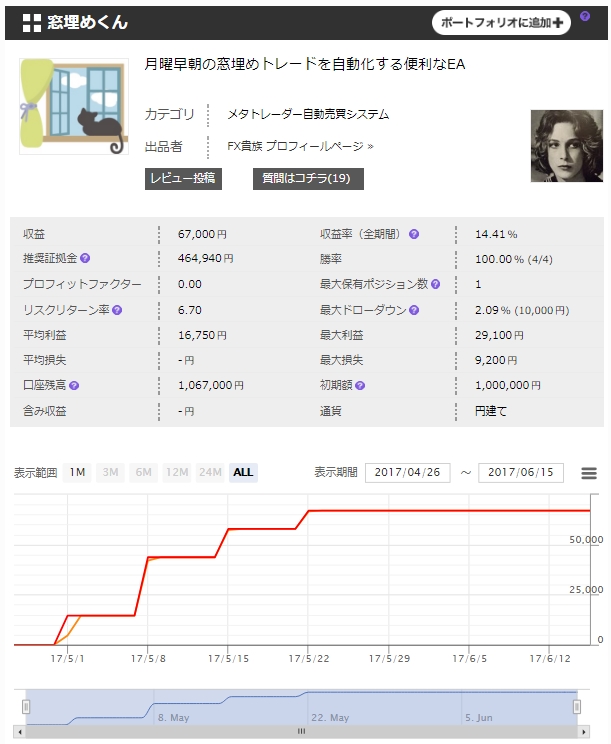

Even with few trading opportunities, earnings are 20% annual yield↑ — delving into the secret behind the high PF of "Gap-Filler-kun".

Since forward testing, "Profit Factor 0" = win rate of 100% has been maintained.

EA for USD/JPY“Window Fill-kun”.

We reveal the secrets behind entry frequency, expected profits, and the high win rate as shown by backtests!

■The logic is simple, but a “filter” that does not enter blindly is effective!?

The entry logic is very simple.

Enter when there is a gap at the start of Monday’s trading.

The TP (take profit) to SL (stop loss) ratio is 2:1 or higher, and it’s designed to stay profitable with a win rate above 50%.

Window-fill trades are an age-old technique, but if they’re profitable, why doesn’t everyone do them?

1. I can’t wake up by 6:00 a.m. Monday morning (me)

2. The win rate is unstable (a string of losses can break one’s spirits)

3. No clear rules for stop loss and take profit (profits are taken quickly, but it’s hard to cut losses)

So, perhaps many people end up doing it in a half-hearted, hazy way.

With an EA, it will automatically enter trades, so the time-related issue and effort of (1) are resolved, right?

The issues are (2) and (3), but (3) is ideal with a TP:SL ratio of 2:1 or greater.

As for (2), entering immediately as soon as a gap opens does not stabilize the win rate.

Therefore, Window Fill-kun defines the "gap".

By default, gaps must be at least 5 pips and under 90 pips.

By choosing not to enter in other cases, we have stabilized the win rate.

Also, the limit and stop are adjusted according to the size of the gap (window),

which may be part of why profitability is good.

■The low number of entries is unsatisfying, but the anticipated profitability more than compensates for it

With a weekly opportunity and an entry filter,

there are times when you won’t enter even once in a month.

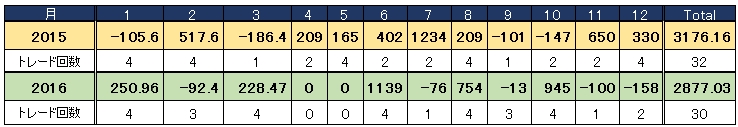

In backtests of the last two years, there were periods of "no entries for two months."

(Based on the two-year backtest results for 2015-2016)

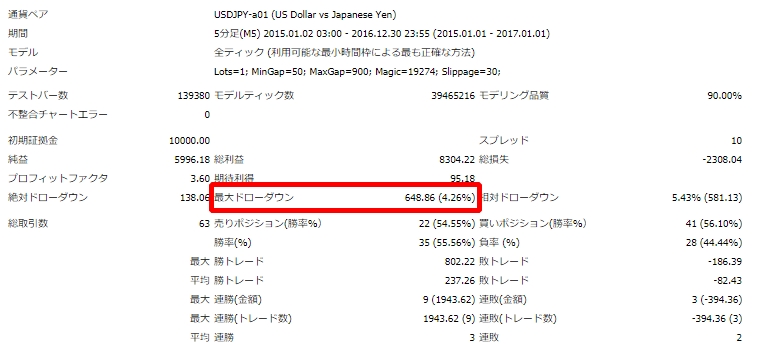

Backtests were run with 1.0 lot, yielding about $3,000 per year (about 300 pips).

Even including losing streaks, the maximum drawdown is $648, and relative to account funds (5%), net profit is +$5,996, showing the profitability.

Recommended lot size is about 0.1 lot for every 100,000 yen.

Considering profitability, an annual return of 20–30% is feasible, so compared to other EAs with higher trade frequency, this is not inferior.

■Is a 50% win rate okay?

Originally, the win rate isn’t exceptionally high, hovering around the 50% range for “Window Fill-kun,” but

Average win amount is $237, average loss amount is $82 and the risk/reward is 2.89:1, so

A 50% win rate is not a problem at all.

Since it’s once a week, you might feel it’s a pity to lose the few chances, but that’s

a risk that is already accounted for, so you don’t need to get too fussy about it.

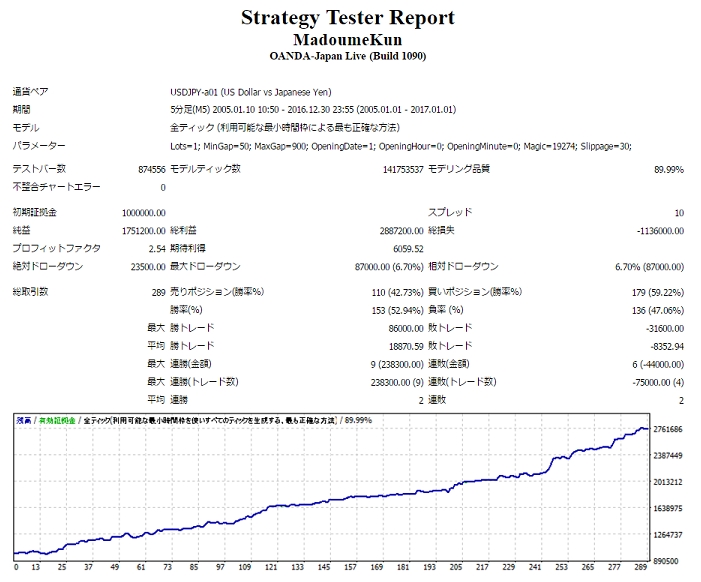

■11Annual backtests also show a maximum drawdown of 87 pips

If you’re curious about longer-term backtests, please try the 11-year backtest!

Since the lot is manual, you could increase by 0.1 lot for every 100,000 yen you add.

Currently performing superbly; “Window Fill-kun” is available up to 35 units.

14,800円⇒ 9,800円

That’s how it stands!

A convenient EA to automate Monday early-morning window-fill trades