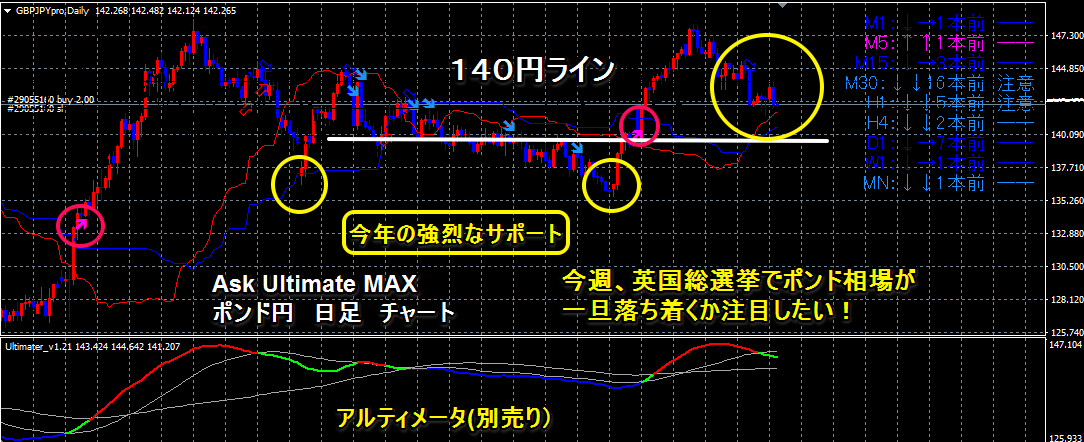

GBP/JPY approaches an important point again! Will it rebound? Or is it the year's lowest point?

GBPJPY rose to around 148 yen riding the Trump rally after the UK’s exit from the EU (Brexit).

It retraced, and although it was pressured by selling, there wasn’t enough downward momentum.

It again retraced to the high territory of the Trump rally.

Recently, it has been pressured by yen appreciation and the upcoming UK general election,

depending on the content of this week’s UK general election, it may break below an important line again,

or will the pound-related factors run out for now and resume a rebound? It’s very interesting.

The chart is on a daily timeframe, and if the 140 yen level is clearly broken, as the year’s lows come into play,

as anticipated, it surged, but the high could not exceed the Trump rally high.

As the UK general election approaches, incidents of terrorism may occur and Prime Minister May’s Conservative Party

could fall short of seats in the polls, suggesting another stir‑up in the market.

At this point, it would be prudent to compare with the chart and wait for the election results before taking a position.

Lately, it has been supported around 142 yen on the daily chart by the cloud upper line, the weekly chart by the baseline and conversion lines,

but until the election, a few days remain, and there is a possibility of a drop toward an important point around 140 yen.

There is a possibility of decline to around 140 yen.

GBPJPY is a cross rate of USDJPY and GBPUSD, so USDJPY is finding support around 110 yen in the near term,

while GBPUSD, more than the near-term support, is entering the Ichimoku cloud on the weekly chart,

and with the recent dollar weakness, the price has returned to the point of whether it can break 1.30.

If USDJPY can find support around 110 yen in the near term, it may gradually start to rise,

and if the UK general election passes smoothly, with the break of 1.30 in GBPUSD, GBPJPY is expected to start rising again.

In any case, we will be watching the pound market after the June 8 UK general election!

Market Compass April 1, 2017 Article

★Will the yen be sold and stocks rally in the new financial year?!

GBPJPY emergency response article! A real drop or a correction decline?

There are many more GBPJPY articles in “Market Compass.”

★ Experience the ultimate dip with a combined approach!Master the ultimate trait through Full San Trade!

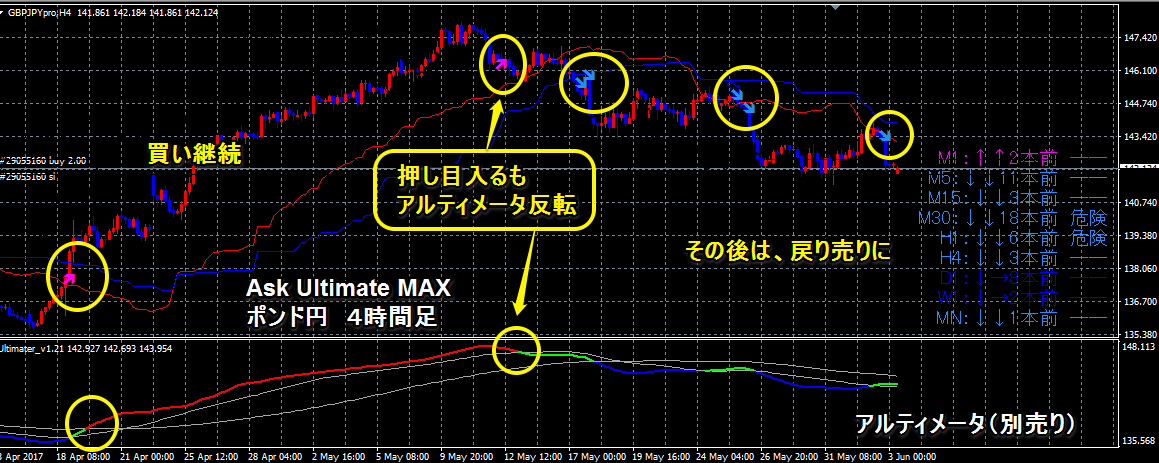

★ P.S. Here is the chart! I don’t want to disclose it much, but this is the 4-hour chart!

★ Limited time: up to 30% OFF, last chance!