Is this stock really the Dow's current star? Mr. Tetsuo Inoue

Mr. Tetsuo Inoue: Market Trends. From the November 18, 2020 issue, this time, in addition to market commentary, we will also deliver Mr. Inoue's technical analysis data.

Trend 1165: Is this stock really the Dow's main driver right now? 1

Regarding the sharp rise in the U.S. stock market this time, I wrote at the outset that it is not a risk-on move but a “return reversal” move, and pointed out the unwinding selling of sectors (stocks) that had been leading up to now, and the buying back of stocks (sectors) that had been shorted as well; this led to moves in indices described as “decoupling,” “twist,” and “mixed,” and while the indices subsided last week, there is no real “twist” in the indices, but the pattern is reemerging among individual stocks/sectors.

And to prove that, I created a new chart.

There are two triggers for this return reversal, I believe, but they are: “As the presidential election approached, buybacks appeared as part of unwinding (since further fiscal spending was not forthcoming),” and “Because the election forecast favored Democrat Biden, sectors benefiting from fiscal expansion and environmental energy sectors were being sought, and there was profit-taking spreading among major telecommunications industry stocks that Democrats want to regulate,” and “Bright news about the coronavirus vaccine suggested a future revival for sectors that had been heavily impacted by the pandemic.”

Regarding the last part, as noted, Pfizer, developed in collaboration with BioNTech, has shown highly effective results (over 90%), and the FDA (U.S. Food and Drug Administration) was expected to apply for emergency use authorization for the vaccine; following this, the other day Moderna Biology (biopharmaceutical) also announced that, based on early data, its vaccine shows an efficacy of 94.5% and will similarly apply to the FDA. By the way, influenza vaccine efficacy is typically 50% to 60% each year. A figure above 90% is an extremely high number.

Please look at the chart; when discussing the return reversal, Boeing (currently among the 5,146 outstanding orders, about 80% are for the “737 MAX,” which is currently grounded; the FAA has indicated that fixes are in the final review stage and could be approved within days, possibly as early as the 18th), and among the five monitoring companies, excluding Amgen and Honeywell International, three others (Microsoft, Apple, Salesforce.com; Salesforce.com was added on 8/31) contributed to Dow—the Dow's contributions; I plotted the Dow’s cumulative changes from 11/6 (the weekend before the explosive rally on 11/9); blue line (left axis) shows the Dow’s cumulative change, gray (right axis) shows Boeing’s cumulative Dow contribution, orange (right axis) shows the monitoring three companies’ cumulative Dow contributions.

There’s probably no need for further explanation. The Dow and Boeing have matched in shape up to this point; for the three companies (total, cumulative), the Dow rose by $1,468, while Boeing contributed a negative $82. In other words, the lead actor up to now has been “Boeing.”

And can this lead actor continue to push the Dow higher? That is unlikely. The reasons: “not of that kind,” and “they have never created a market capable of driving the index higher.” And then big news hit Tesla. (To be continued)

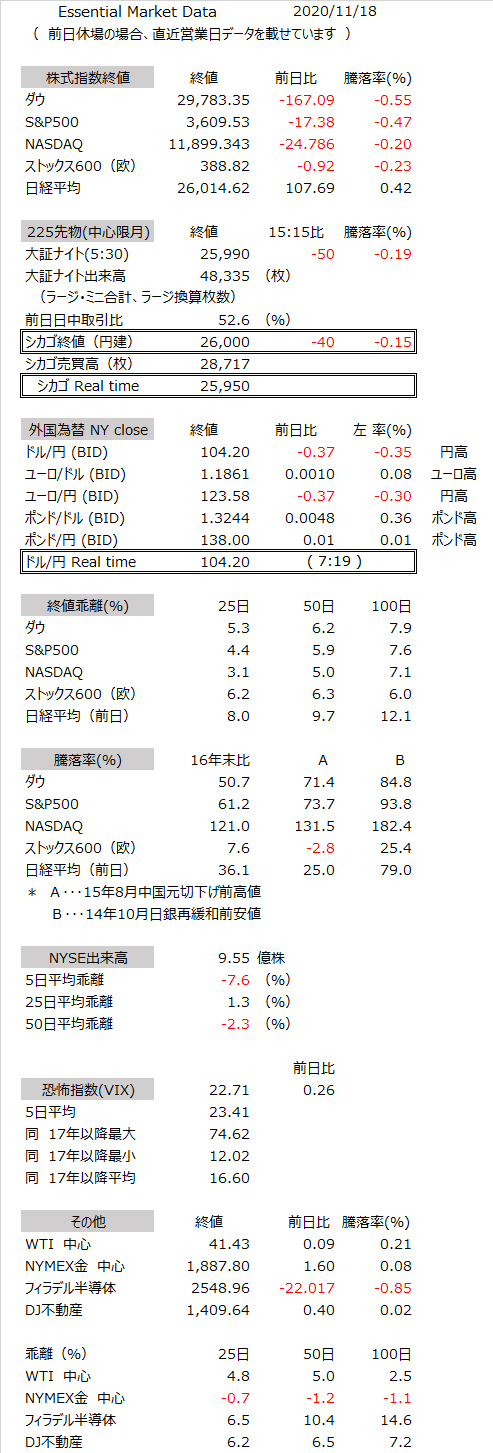

201118MD – Chicago cash value is slightly below 26,000 yen

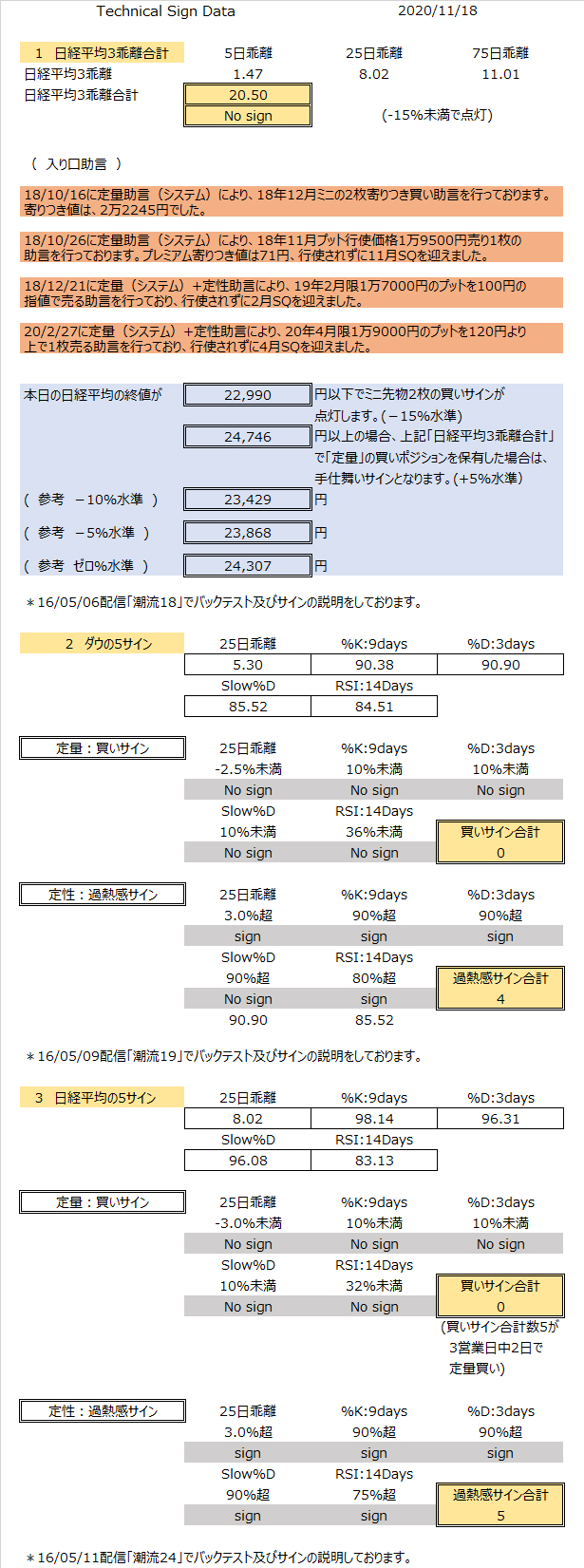

201118: Nikkei Average heating-up signal remains fully lit for five days, RSI total rises to 154.18%

written by hayakawa

× ![]()