Find 100 Baggers (100x Stocks)! November 16, 2020 issue

【This Week's Video Here】

https://youtu.be/lGICEAg01Ls

※The video is 32 minutes long.

2. Points

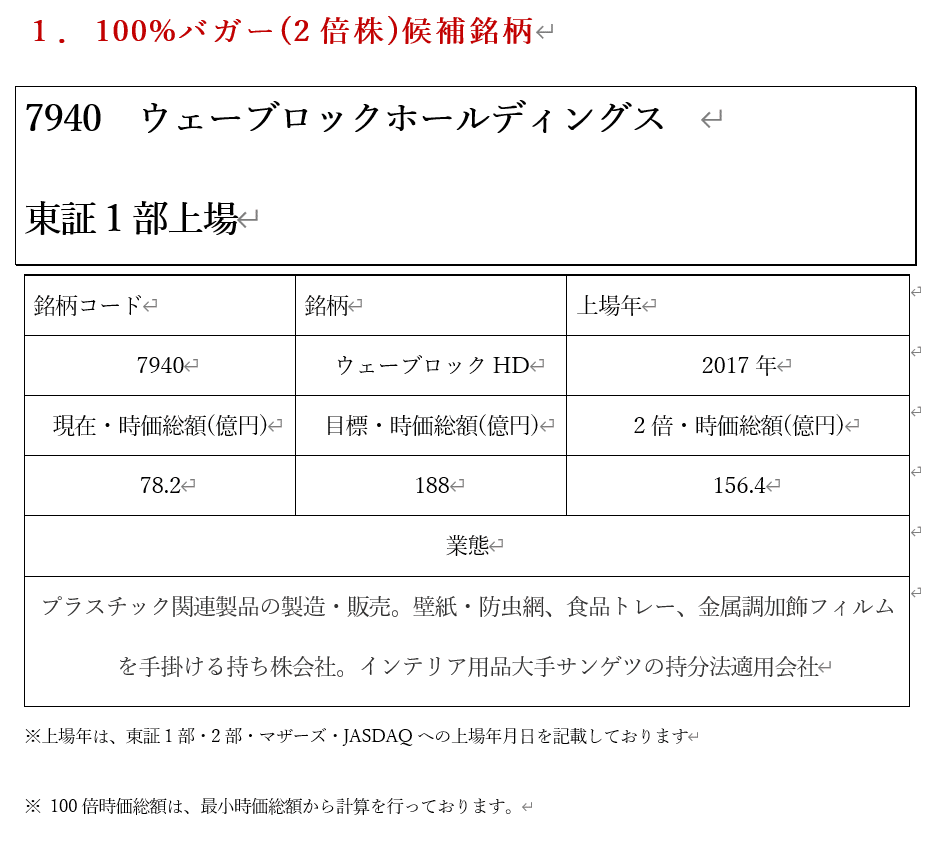

1. A holding company that handles plastic-related products. Its business is becoming more diversified and earnings stability is high, but it is not at all valued by market participants. Among the chemical sector listed on the Tokyo Stock Exchange First Section, its PER is the lowest, and it is not popular at all.

2. The reason the company is not being valued is that, as a holding company, it bundles multiple businesses, making it difficult to see overall growth and risk of the business. In other words, a strong conglomerate discount is in effect, and the sense of bargain remains unshaken.

3. Because the products handled are general-purpose items such as wallpapers and window screens, there is concern that it may be pulled into price competition. On the other hand, a new field of metallic-looking decorative films for automobiles has also been growing, indicating that they are not ignoring growth opportunities.

4. The company has a high dividend yield, with a payout ratio of 30% and a yield of 4.2%. Also, last year they conducted a large share buyback, and their capital policy appears to be considered in a timely manner, suggesting stable business and a low likelihood of significant dividend cuts.

5. The current stock price level is at a level where sustained annual profit decline of 25% for more than five years would be implied, which seems overly pessimistic for the company's performance. If an average operating profit growth rate of 3.0% per year over the last five years can be projected, a rise to a market capitalization of 18.8 billion yen (stock price 1,690 yen) is expected.

For more, please see the PDF file.