FX Trading Strategy 1113

Thank you for subscribing as always.

To trade with high accuracy, multi-timeframe chart analysis is essential.

The analysis I have acquired over more than 15 years of FX experience is simple, using moving averages and MACD for multi-timeframe chart analysis.

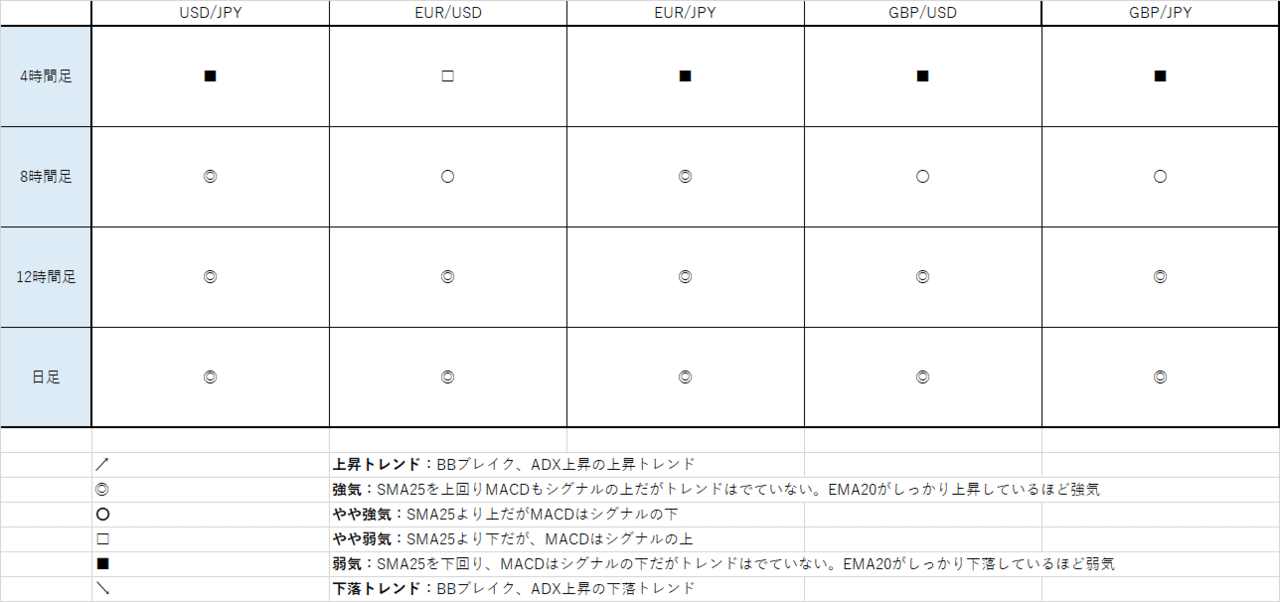

The Daily Trading Strategy is mainly information for day trading, and regarding four timeframes—4-hour, 8-hour, 12-hour, and daily—we

create a trend table and describe that day's strategy (long, short, or wait-and-see), so the strategy is clear at a glance.

Analysis currencies

FX: USD/JPY, EUR/USD, EUR/JPY, GBP/USD, GBP/JPY

◇ Trading strategies

The trend table and each currency's trading strategy as of today at 17:00.

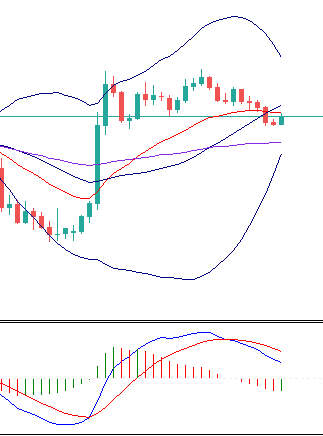

● USD/JPY

Analysis, strategy: The 4-hour chart has broken below SMA25 and turned bearish. However, the daily EMA20-SMA25 near 104.9 provides strong support in this area. When considering on the daily basis, it is a scenario to consider long, but the 4-hour SMA25 is rising, so it may take some time for a rise. If the price falls below the morning low, it will fall below the daily SMA25, risking a larger drop. Since it has already moved down to the daily SMA25, we will take a wait-and-see approach for now.

Analysis of EUR/USD, EUR/JPY, GBP/USD, and GBP/JPY is paid.