Early morning 4:00–7:00, an EA in which scalping works effectively

The best-selling right nowPremia_Scal_USDJPY_M1 is an USD/JPY scalping EA by developer JAM, entering in the early morning in Japan time Morning Shot USDJPY M5, and the forward results for the most recent six months show a profit of ¥836,400 with a win rate of 96.91%, and the P/L chart has risen sharply.

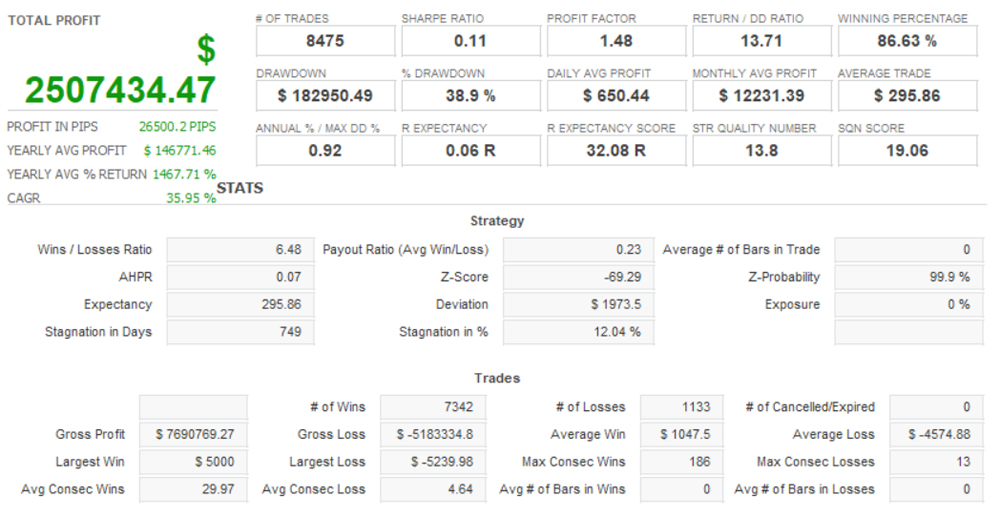

Premia_Scal_USDJPY_M1As more customers who purchased it are also seeking the JAM-developed EA, we ran the 17-year backtest results of TDS through Quant Analyzer4.

※The units are in dollars, but the backtest was conducted in yen, so please view it in yen (¥).

Quant Analyzer4 results

Total profit ¥2,507,434

Average annual profit ¥146,771

Maximum drawdown ¥196,646 (11.33%)

Risk-reward ratio 12.75

Average profit ¥1,047

Average loss ¥4,578

Risk-reward ratio 0.2287

This is the result. It is a backtest result for 0.1 lot with simple interest, so it can be considered very favorable.

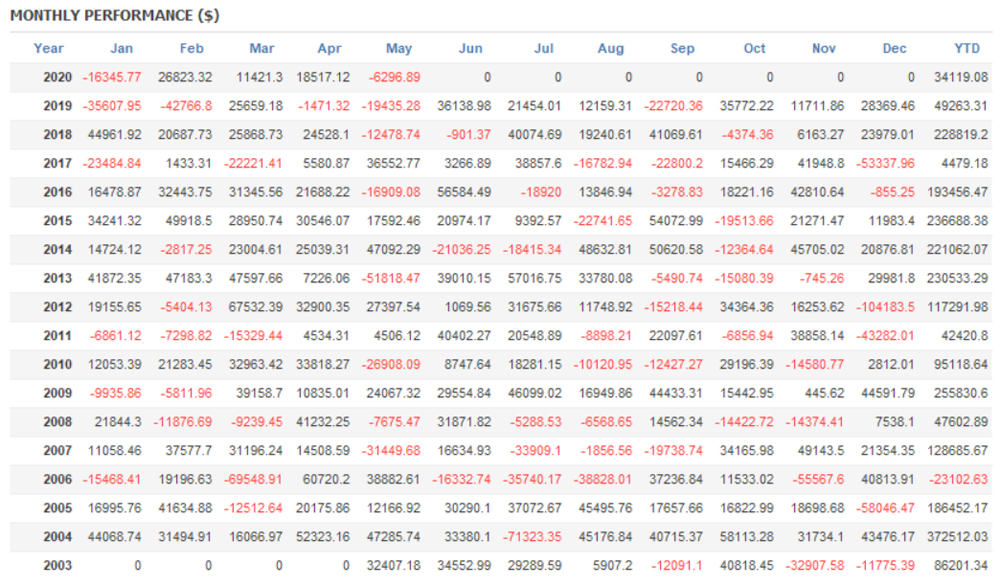

Yearly and Monthly Results

Looking by year, every year except 2006 was profitable on an annual total basis.

The backtest period covers 17 years up to May 20, 2020, so, as noted at the top, the most recent six months’ revenue of ¥836,400 is not included, making 2020 likely to be a fairly strong year.

Finally, the usual annual return calculation shows.

The calculation formula for the recommended margin used in GogoJungle's system-trade performance measurement (assuming 25x leverage) is

10,000 units × the traded currency's rate in Japanese yen ÷ 25 × average number of lots ÷ 0.1 × maximum number of positions + maximum loss (using the backtest's maximum drawdown) × 2×2

Therefore,

¥1,059,600 (today's rate) ÷ 25 × average number of lots÷0.1 ×7 positions + ¥196,646 (maximum drawdown)×2

The recommended margin is¥699,980.

Annual average profit¥146,771, so annual return20.96%.

Written by Hayakawa