What is the famous EA that uses a reversal method in range markets and mild-trend markets, with an average annual profit of ¥81,286 (0.1 lot operation)?

“In March and April, the COVID market stagnated, but the current surge is amazing!” Such voices are heardFlashes for EURUSD.

Indeed, aside from that timing, the performance has been steadily improving, and the recent winning streak is remarkable.

The logic, as described by the developer, Trader Kaibe, specializes in ranging markets and mild trending markets, and consists of repeatedly buying at recent lows to close at highs, or selling at highs to close at lows.

The EUR/USD range-market appearance rate is said to be around 70% to 80%, and as the rate moves up and down, it involves repeatedly entering contrarian positions; because this method closely matches the characteristics of EUR/USD, its performance in GogoJungle's forward tests has been outstanding.

GogoJungleのフォワードテスト

Also, as the developer's view, similar to most scalping EAs, big indicator releases or sudden moves from key figures are not his strong suit, so pausing during those times will further improve performance. I think that's true, and if someone who is good at discretionary trading using fundamentals and technical analysis times the pause, performance will be considerably better than a fully automated operation.

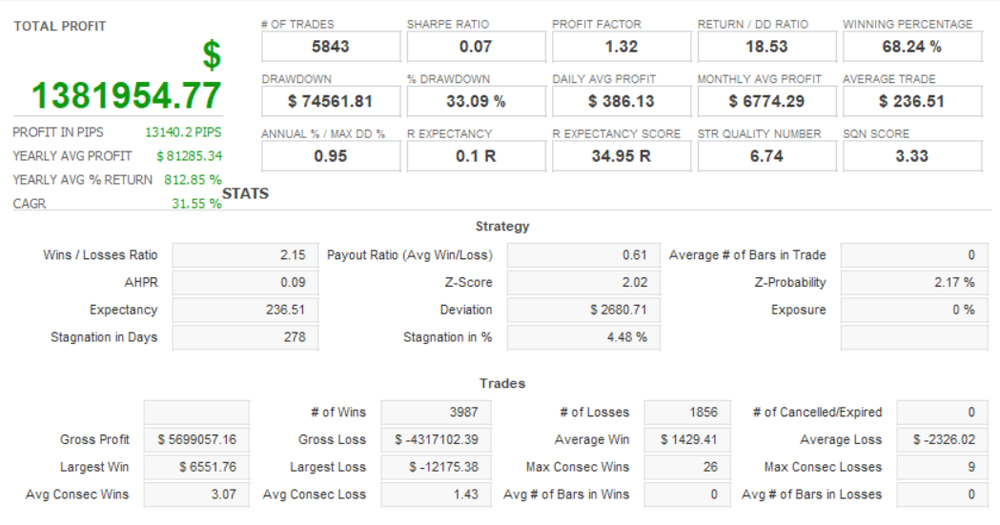

This kind ofFlashes for EURUSD, but we have conducted a 17-year TDS backtest with a 0.1-lot unit operation, so let's look at the results when that data is run through Quant Analyzer4.

※The units below are in dollars, but since these are backtest results for a yen-denominated FX broker account, the actual values are in ¥.

Quant Analyzer 4 の表示

Total Profit ¥1,381,954

Annual average profit ¥81,286

Maximum Drawdown ¥80,731 (5.65%)

Risk-Return Ratio 17.11

Average profit ¥1,429

Average loss ¥2,326

Risk-Reward Ratio 0.6144

Win rate 68.24%

This is the case. The win rate is close to the EUR/USD range-market appearance rate, so it can be considered a market-appropriate method.

It can be regarded as a solid method.

Risk-Return Ratio 17.11, and with the high win rate of 68.24%, the value of the risk-reward ratio 0.6144 shows it as an excellent EA.

Year/Month performance

Looking at yearly results, 2020 reflects test results only up to May, so the downturn in performance during the COVID market is evident,

but since then performance has risen and is now positive.

Before 2019, there was not a single losing year.

Finally, when calculating annual yield,

the calculation formula for the recommended margin (based on 25x leverage) used in GogoJungle's system-trade performance measurement is

10,000 units × exchange rate of the trading currency in Japanese Yen ÷ 25 × average number of lots ÷ 0.1 × maximum number of positions + maximum loss (using the backtest maximum drawdown)×2

Therefore,

¥1,240,526(today's rate)÷25×average number of lots÷0.1×1 position + ¥35,092(maximum drawdown)×2

Recommended margin is, ¥211,083.

Annual average profit ¥81,286, so the annual yield is 38.51%.

written by Hayakawa