Annual return 60.36%, maximum drawdown ¥35,092, an EA that uses logic to automatically calculate trendlines — Katasankaku

EUR/CHF, a scalping EA that holds only one positionKata-Sankaku is, like the one created by the same developer es-sama, also a one-position scalping-day EAMisuji. Similarly, by holding only one position, it has been steadily increasing its performance while keeping risk relatively low.

Kata-Sankaku's logic automatically calculates the price levels that form trend lines, and by targeting the EUR/CHF's tendency to range, it executes high-frequency contrarian scalping trades.

GogoJungle's forward test uses compounding in 1.0-lot units, but later the trading results will mirror the backtest described by the TDS below.

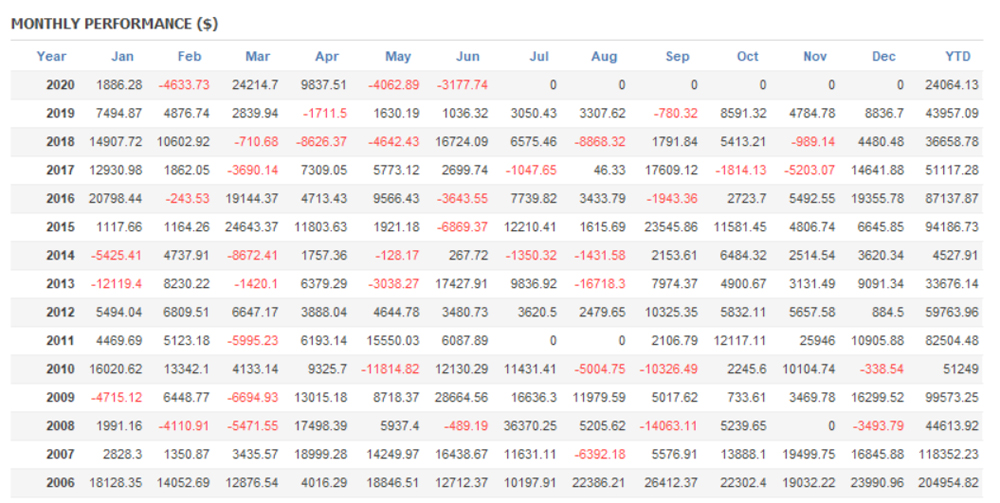

We will review the 14-year TDS backtest results when operating at 0.1 lot with safe, simple-interest operation.

Note: The units below are in dollars, but these are backtest results from a yen-denominated FX broker account, so the actual values are in yen (JPY).

Quant Analyzer 4 Display

Total profit: ¥1,036,337

Annual average profit: ¥72,299

Maximum drawdown: ¥35,092 (2.53%)

Risk-return ratio: 29.53

Average profit: ¥797

Average loss: ¥1,297

Risk-reward ratio: 0.6145

Win rate: 74.09%

This indicates a high risk-return ratio as well, and based on the balance between the risk-reward ratio and the win rate, over 14 years

you can see that profits have steadily accumulated.

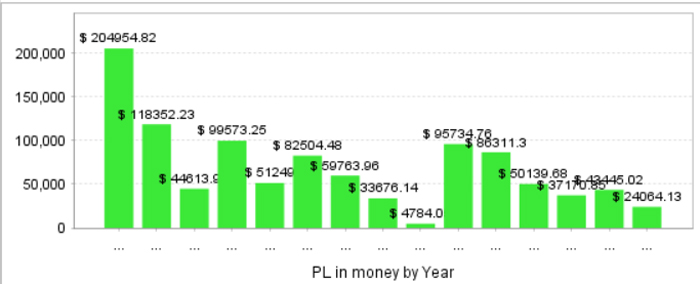

Yearly and Monthly Performance

Looking at yearly and monthly results, there has been no year in the past 14 years with a loss in any year.

In 2020, by about half a year up to June, it recorded an increase of ¥24,000, and since then, including the forward test mentioned above, the performance has continued to be favorable compared with recent years.

Annual return calculation

The calculation formula for the recommended margin used in GogoJungle's system-trade performance measurement (assuming 25x leverage) is

10,000 units × the Japanese yen rate of the traded currency ÷ 25 × average lot count ÷ 0.1 × maximum number of positions + maximum loss (backtest maximum drawdown) × 2×2

is

¥1,240,000(today's rate) ÷ 25 × average lot÷0.1×1 position + ¥35,092 (maximum drawdown)×2

Recommended margin is, ¥119,784.

Annual average profit: ¥72,299, so the annual return is 60.36%.

Written by Hayakawa