10/5 market analysis

Nice to have you again today.

This is Elle.

Real-time tweets are available here.

twitter

※This article does not指示, or recommend trading timing.

Please make your own investment decisions.

These are the positions of IMM speculative funds.

Dollar net shorts have decreased from 33.9 billion to 30.4 billion dollars.

The dollar index rose 1.76% in September. Underlying risk from elections, a sluggish economic recovery, and additionaleconomic measures has accelerated a flight to quality amid Congressional gridlock.

Dollar net shorts have decreased from 33.9 billion to 30.4 billion dollars.

The dollar index rose 1.76% in September. Underlying risk from elections, a sluggish economic recovery, and additionaleconomic measures has accelerated a flight to quality amid Congressional gridlock.

※ Reprinted from Reuters

The author shares the same view.

Regarding election risk and additional Covid-19 economic measures, these are issues that will resolve with time, so at this moment they can be considered temporary risks.

However, a sluggish economy is a concern even for Fed Chair Powell due to weak employment statistics, and may remain a weight for a while; yet Friday’s jobs data disappointed, the reaction in New York was strong and buyers stepped in.

There was a large rebound as news of President Trump’s condition being mild spread.

Economic indicators had only a minor impact on stock prices.

As noted before, institutions and funds have been slow to buy stocks, but when positive news appears, reactions are very strong and there is an impression that they rush to buy to avoid missing out.

From a technical perspective, a head-and-shoulders pattern is forming, and I’d like to see how the neck line reacts.

The chart has been moving cleanly, so watching the lower neck line should be enough.

The chart has been moving cleanly, so watching the lower neck line should be enough.

The dollar index formed a short-term channel and rebounded at the lower bound and horizontal cross.

I’d like to keep an eye on the 93.5 horizontal level and look a bit more toward a stronger dollar.

I’d like to keep an eye on the 93.5 horizontal level and look a bit more toward a stronger dollar.

The Nikkei Average still seems to be in a long box range...

It looks like it will continue fluctuating between 23,600 and 22,800 for a while.

I don’t think trendlines are very meaningful, so let's focus on horizontal rates.

I’d like to buy on dips below 23,000.

It looks like it will continue fluctuating between 23,600 and 22,800 for a while.

I don’t think trendlines are very meaningful, so let's focus on horizontal rates.

I’d like to buy on dips below 23,000.

EUR/JPY hasn’t moved much, but as I’ve mentioned in the feed, over time it is gradually headed downward.

Entry won’t be possible until about 1.175 with this movement.

No noticeable movement, so I’d set alerts and keep monitoring rather than acting.

Entry won’t be possible until about 1.175 with this movement.

No noticeable movement, so I’d set alerts and keep monitoring rather than acting.

Cable (GBP/USD) is moving with arrows in mind, but the 4-hour candle is swinging up and down for long periods, making entries difficult.

I’d like to pull a dip-buy entry near the light blue horizontal level around 1.284.

With high volatility and wide ranges, vague levels will be risky for both long and short positions.

With high volatility and wide ranges, vague levels will be risky for both long and short positions.

USD/CAD is largely moving in line with the dollar index, lacking clear direction.

I’m looking for a dip-buy around the 1.324 horizontal level.

I’m looking for a dip-buy around the 1.324 horizontal level.

There has been no notable change in strategy since last week.

Dow-Nikkei spread long

As U.S. stock risks become evident, the chart has risen, but I plan to take profits at around the half retracement.

Or

As U.S. stock risks become evident, the chart has risen, but I plan to take profits at around the half retracement.

Or

Profit-taking if the lower dip low breaks below 4280.

Summary

For a while, I feel I will be swept by the ongoing updates on President Trump’s condition.

I want to proceed with caution by paying attention to the headlines.

I want to proceed with caution by paying attention to the headlines.

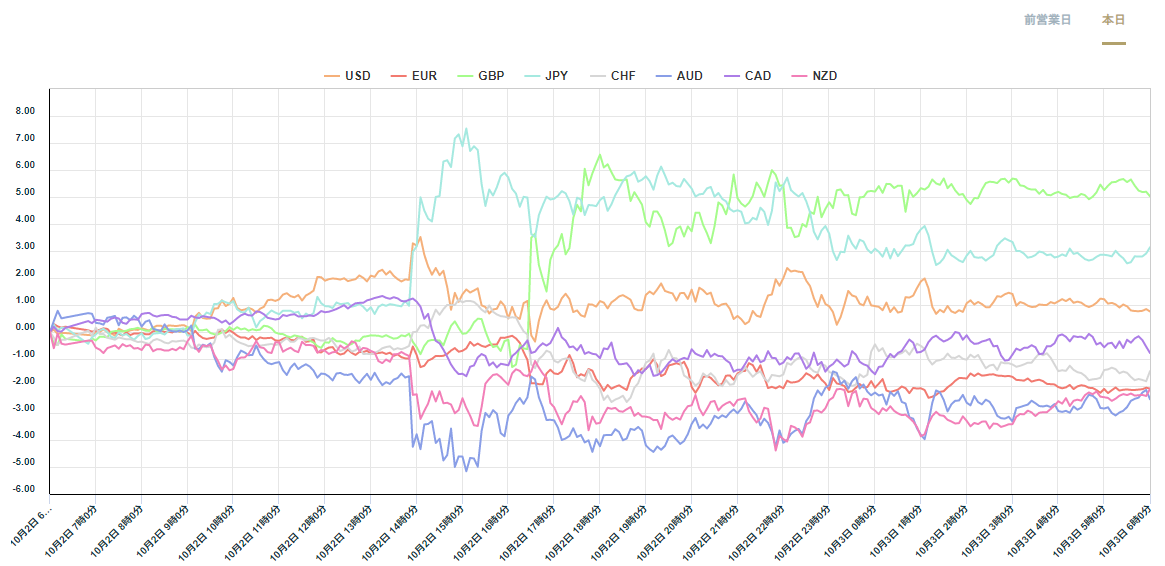

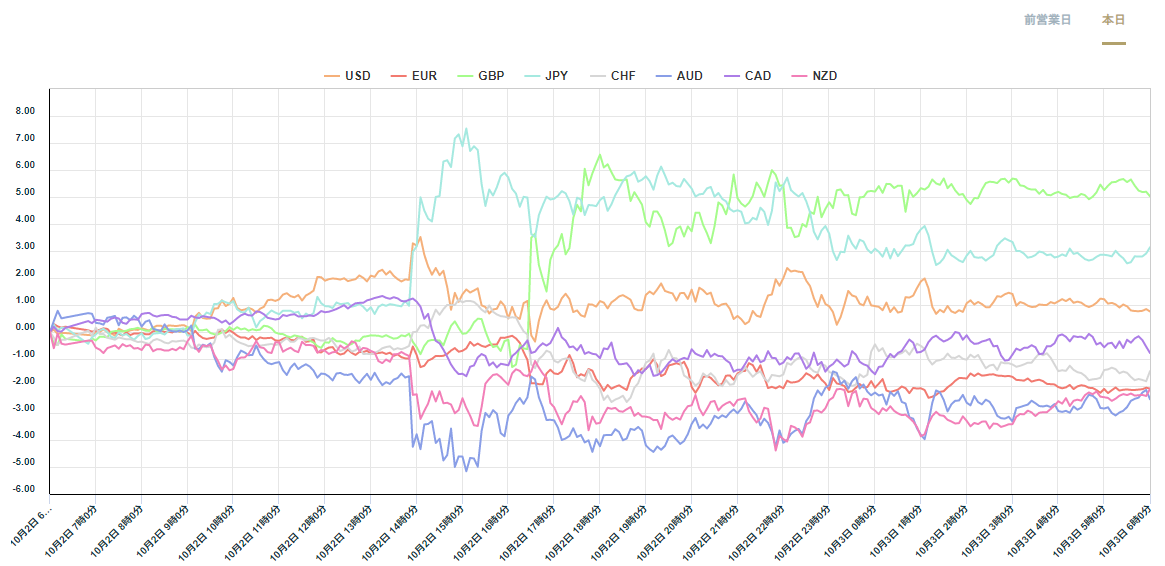

Currency strength has been flat since the Covid-19 infection news, making judgments difficult.

Despite risk being present, the pound has remained firm, which is noteworthy.

Please check the analysis together with the charts.

Despite risk being present, the pound has remained firm, which is noteworthy.

Please check the analysis together with the charts.

× ![]()