Yesterday's media reaction to the resurgence of COVID-19 infections in the GBP/USD, unrealized gains, annual average profit ¥1,017,943 of AMA_GBPUSD

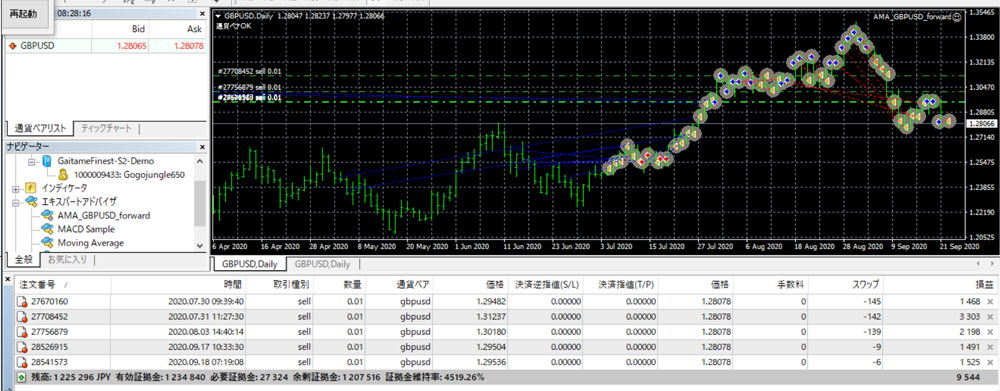

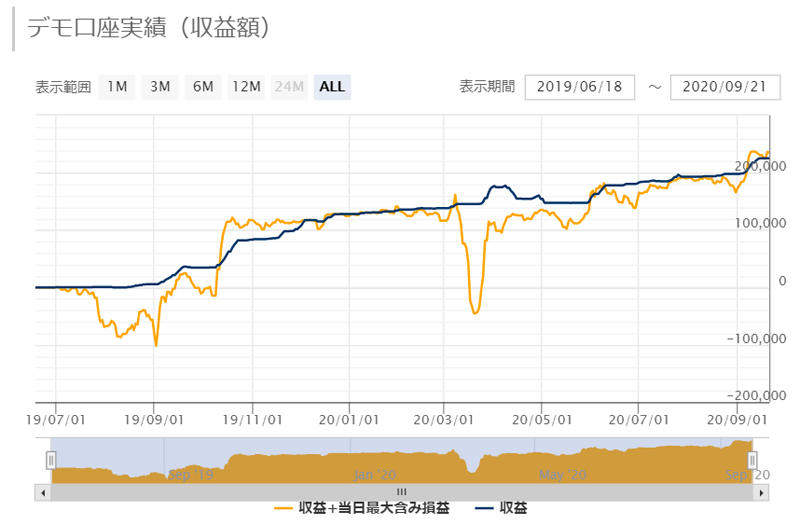

Among EAs that reacted to the declines in stocks, pounds, and euros triggered by yesterday's London-time reports of renewed concerns about coronavirus infections in the UK, AMA_GBPUSD, which forwards 0.01 lot (1,000 currency units) and can hold up to 26 positions, and is designed to hold even more positions, is continuing to trade with large unrealized gains due to this move.AMA_GBPUSD It is continuing to trade with large unrealized gains due to this move.

Indeed, as the developer I-nun-sama says, 'trades that are being conducted strategically for asset formation while bearing unrealized losses and unrealized gains, something I don't quite understand, but...'

As of 14:50 on September 22 (Tuesday), AMA_GBPUSD unrealized profit status

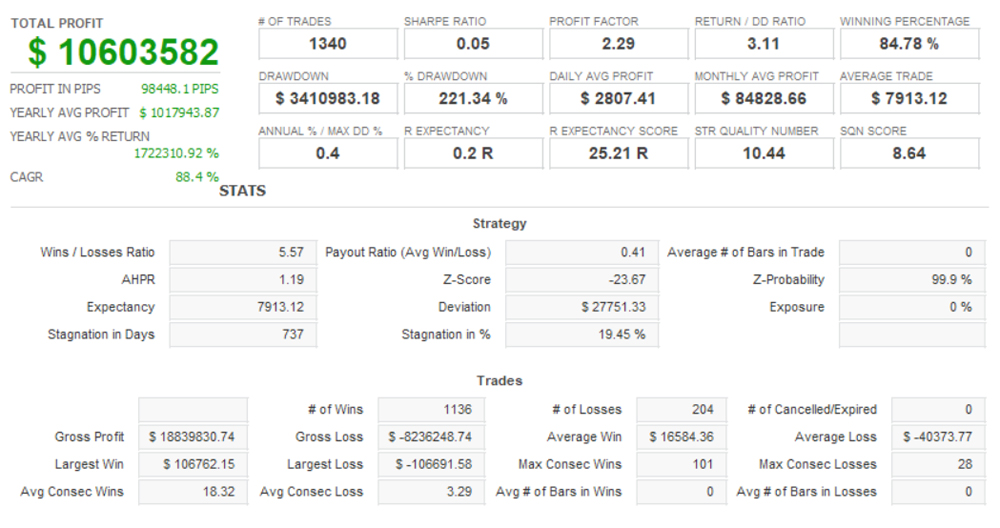

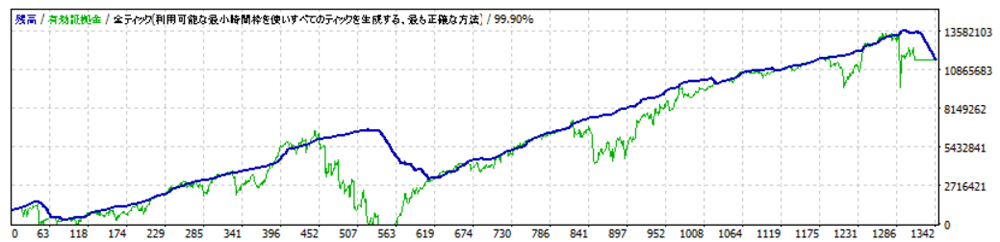

From the backtest results of TDS,let's take a look at the performance of AMA_GBPUSD.

Note: although the units are in dollars, the backtest data are based on Japanese yen with OANDA JAPAN as the base currency, so the units are in Japanese yen.

Annual average profit: ¥1,017,943

Win rate: 85.78%

Average number of trades per year: 134

Average profit per trade: ¥16,584

Average loss per trade: ▲¥40,373

Risk-reward ratio: 0.4108

Maximum drawdown: ¥3,410,983

Risk-return rate: 3.10

This is how it stands.

Profits accumulate quite aggressively, and the maximum drawdown is by no means small.

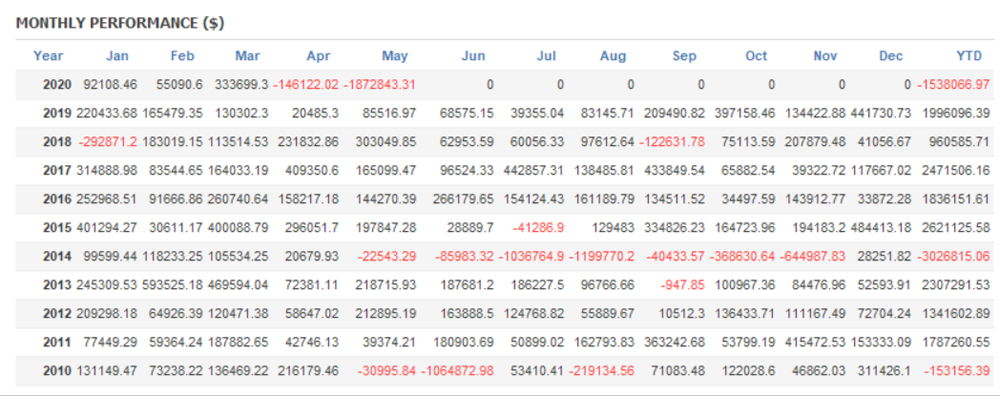

In annual terms, there were losses in 2010 and 2014.

Regarding 2020, since the backtest ended while positions were held, the yearly total appears to be a loss, but in GogoJungle's forward test it turned to unrealized gains in June 2020 and profit-taking was realized.

There are periods when unrealized losses are endured and there are substantial drawdowns, but much like investment funds, depending on market conditions the gains can be offset by unrealized losses; when the market improves, profits accumulate again, so this could be considered a trade aimed at asset-building.

A few days ago, a person from a foreign brokerage that forms and manages a fund listed on the Tokyo Stock Exchange told me that fund uses FX; perhaps a similar trading logic is at work.

written by Hayakawa