9/11 market analysis and short column

I look forward to your guidance today as well.

This is ERE desu.

We conduct real-time tweets here.

twitter

※This article does not indicate or recommend any trading timing.

Please make your own investment decisions.

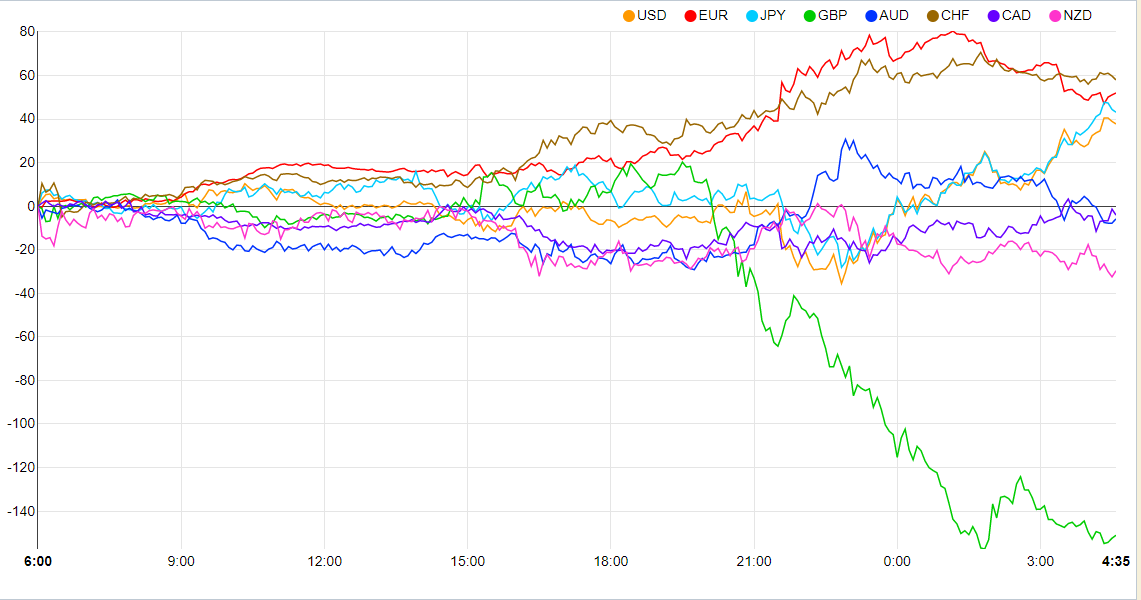

ECB monetary policy decision meeting resulted in no rate change, no additional easing, a mildly euro-supportive tone, and slight GDP improvement with inflation rate decreasing.

As for chart movement, it has the familiar ECB pattern—an exaggerated back-and-forth rally.

Although statements were somewhat softer, I think the 1.20 level remains strongly in the market’s mind.

Even earlier on 1.19, the dollar index stayed firm.

The euro was clearly bought, so this was a meeting that favored euro-buying.

Technically, the trend is downward for now, but the basic expectation is to continue euro-buying.

Although statements were somewhat softer, I think the 1.20 level remains strongly in the market’s mind.

Even earlier on 1.19, the dollar index stayed firm.

The euro was clearly bought, so this was a meeting that favored euro-buying.

Technically, the trend is downward for now, but the basic expectation is to continue euro-buying.

However, U.S. stocks continue to fall, and the dollar is being bought.

The back-and-forth between EUR/USD and USD/CHF suggests that the euro-dollar pair is hard to buy, while euro-sterling is feeling the pound market's influence.

Let's remember the flow.

In a few days’ time, when U.S. stocks pull back, there will likely be episodes of buying EUR/GBP, continuing the flow.

The back-and-forth between EUR/USD and USD/CHF suggests that the euro-dollar pair is hard to buy, while euro-sterling is feeling the pound market's influence.

Let's remember the flow.

In a few days’ time, when U.S. stocks pull back, there will likely be episodes of buying EUR/GBP, continuing the flow.

The dollar-yen rose slightly after breaking the red line and then retraced.

I took profits before New York close.

If it comes down again, I’d like to enter.

Misinterpreting fundamentals analysescan lead to painful outcomes (short column)

Movements in response to monetary policy are common, and if one can read monetary policy well, one can catch the trend.

For the pound, what matters is how the market interprets this bill’s submission—understanding this is about reading that reaction.

From the announcement to actual submission, how markets bake in expectations matters; once facts appear, the flow ends.

In other words, trading after news is too late; following fundamentals means understanding what the market will bake in, with news serving only as a confirmation tool.

Many people misunderstand this and tweet, Why now, with this news?

Markets apply pressure by baking in policy expectations with authorities.

They express their views on decisions in the form of policy rates.

That leads to shorts covering and, if the authorities bow to pressure, further trends emerge—that cycle repeats.

What’s important in learning fundamentals is to grasp near-term schedules, current rate levels, and where the asset stands in the global context, then infer authorities’ decisions.

Then determine the significance of the decision, accumulate it, and incorporate it into the year-long trend assessment.

The market is only visible through accumulation; major trends are grasped through that process.

Daily news, regardless of decision, is a small event, and immediate reactions can be large, but if you are drawn by each single event, you may lose sight of your goals.

This area needs to be viewed with a multi-timeframe perspective.

Also today’s ECB has steered toward exchange-rate tolerance.

In reality, there were probably few tools left to deploy at the moment.

In reality, there were probably few tools left to deploy at the moment.

In this case, since expectations were already baked in before the announcement, touching around 1.175 would have made for a good trade by taking profits there.

Trade by aiming for what’s priced in rather than chasing the facts.

Trade by aiming for what’s priced in rather than chasing the facts.

ECB’s characteristic is that its moves are hard to predict until they occur; unlike the Fed or BoJ, the EU is a many-country body with a consensus system.

This is why the outcome cannot be anticipated in advance.

This is why the outcome cannot be anticipated in advance.

Perhaps it’s hindsight, but not having recently raised euro-dollar analysis was because it’s hard to read.

If it has come this far, shifting to other assets may carry less risk and be better for trading.

If it has come this far, shifting to other assets may carry less risk and be better for trading.

Today’s market analysis

The Dow Jones fell sharply after hitting the channel’s upper bound.

Near the lower bound of the downward channel and around the 27200 horizontal, I’m watching for a reversal; if confirmed, I’d go long.

I’d set limit orders with a 20-30 pips stop.

Not a bad place, but if it breaks, I must look toward 26000.

Near the lower bound of the downward channel and around the 27200 horizontal, I’m watching for a reversal; if confirmed, I’d go long.

I’d set limit orders with a 20-30 pips stop.

Not a bad place, but if it breaks, I must look toward 26000.

The outlook remains the same as yesterday, but profit-taking remains strong, and while undervaluation may attract buying, there is no appetite to push higher, so daily ranges are wide with shifting directions.

Because volatility is high, I may reduce position sizes to about half to manage risk.

Because volatility is high, I may reduce position sizes to about half to manage risk.

Dollar-Yen

No change.

105.80 might be acceptable.

Range-bound market; think of it as a point where it would be nice if it comes.

Range-bound market; think of it as a point where it would be nice if it comes.

Pound-Index

It has broken lower after all.

It’s moving gently toward 1.60; I want to target a pullback selling opportunity.

It’s moving gently toward 1.60; I want to target a pullback selling opportunity.

It’s a strong decline, so I must be broad in taking positions, but I’m watching near these two horizontal levels.

Lower than that carries higher risk, so I won’t enter there.

Lower than that carries higher risk, so I won’t enter there.

Line break led to a sharp yen rally near the close in New York, pushing back down.

However, the Nikkei is expected to stay firm, and yen buying probably won’t last long.

If it rolls around the 76.8 horizontal, I expect a further rise, so I’ll watch for a short-term break.

If alerted, I’ll monitor price movements.

However, the Nikkei is expected to stay firm, and yen buying probably won’t last long.

If it rolls around the 76.8 horizontal, I expect a further rise, so I’ll watch for a short-term break.

If alerted, I’ll monitor price movements.

I think placing limit orders is a bit risky, so I’d prefer to enter based on price action.

Dollar-CANA

Profit-taking was done yesterday.

I will wait with a lower limit order at the blue line.

I will wait with a lower limit order at the blue line.

EUR-USD

If the daily chart closes with a bullish candlestick, I expect the next day’s price action to fill the wick.

I’d like to initiate selling near 1.188 or around 1.19.

I’d like to initiate selling near 1.188 or around 1.19.

This is fundamentally euro-buying bias, but I think U.S. stock selling could continue into the weekend.

Therefore, if U.S. stocks stay firm, I won’t enter this analysis.

Therefore, if U.S. stocks stay firm, I won’t enter this analysis.

I write morning analyses, so I’ve used this wording.

ECB as noted above.

Attention remains on persistent U.S. stock selling.

Attention remains on persistent U.S. stock selling.

The dollar index forms a clean neck line with a right-shouldered head-and-shoulders, so set an alert on the neck line.

Focus only on the neck line for monitoring.

Focus only on the neck line for monitoring.

Additionally, ahead of the shift from the Fed to the ECB and toward FOMC, we have a joint Twitter-cast on the 12th to discuss what happened and what to focus on going forward; a formal announcement will follow via tweet, so please watch.

No formal announcement yet.

No formal announcement yet.

× ![]()