Trend 282: Crude oil rises. However, the ball is not in OPEC's nor Russia's court. - Mr. Tetsuo Inoue

Publication date: 2017/05/16 10:06

As written in 'MD (Market Data)', the U.S. fear index VIX has continued to stay below 11% for 16 consecutive trading days, and crude oil prices have risen for four days in a row.

Watching this rise in the oil market, there is a noticeable trend among oil (commodity) analysts who advocate a strategy of 'bottoming out' → 'rally again on the production-cut agreement by the end of this month.' But is that really the case?

There is a 'Trend' to read on the back-issues page.

1/27 publication: 'Trend 206: Crude oil speculative positions are near capacity'

3/10 publication: 'Trend 238: I want to debate with the oil longs. And I will probably lose'

3/13 publication: 'Trend 239: For the first time in 10 weeks, IMM dollar buying increases. Does the rig count suggest another “knife”?'

And if you read these, you will understand that your view of oil so far has not been wrong.

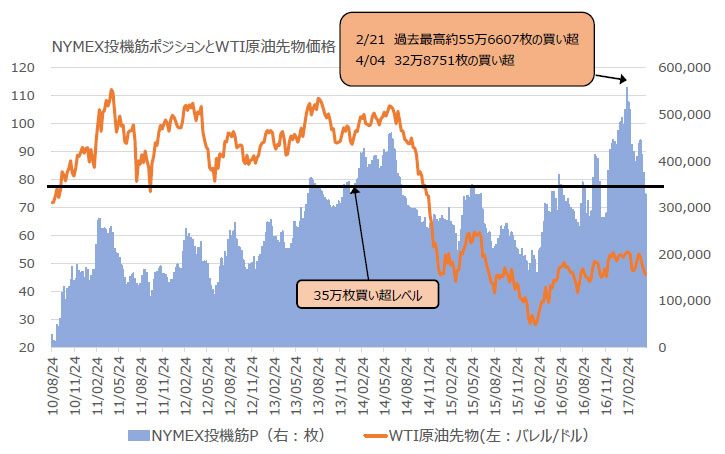

The chart of NYMEX speculative positions and WTI futures released last Friday shows that net long positions totaled 328,751 contracts on 5/9.

The number, which I have continued to write as a supplementary line, is 350,000 contracts, and you can see that we have finally broken away from this 'overdone, hoarded purchases' level that had persisted for 22 weeks since 12/6 last year. However, what can be learned here is merely that we have 'broken out'; as long as net long positions continue to decrease, there is no reason to expect a positive price impact from supply and demand.

Also, what is shown here is the tilt of speculative positions in the New York Mercantile Exchange (NYMEX) WTI futures (I won't go into detail here, but strictly speaking, it is not specified whether the number corresponds to 70% of contracts or 100% of contracts). There is also the Intercontinental Exchange (ICE) in the U.S. that similarly publishes speculative position tilt. (Again not elaborated here, but while NYMEX shows a similar trend, due to the smaller number of participants it can be quite volatile, and when measuring by the combined total of contracts across both exchanges, the correlation with oil prices tends to fall.)

The tilt at the Intercontinental Exchange (ICE) is also showing a decrease in net longs, and thus cannot be said to be a bottoming-out situation.

Now, yesterday's rise was driven by reports from U.S. media that Saudi Arabia and Russia had, the day before yesterday, reached a production-cut agreement through March next year at the level of energy ministers, independent of the Vienna meeting scheduled for the 25th of this month (Russia also expected to participate).

Therefore, an agreement to cut production at the OPEC meeting is not necessarily a positive for prices; it is fully anticipated to be already priced in.

What we must watch now when judging the oil market is not only the movement of crude itself, but also that of natural gas and the supply-demand for both.

Speaking of gas watchers, Simmons. When the U.S. Energy Information Administration (EIA) released February natural gas production, Simmons reported: 'An increase of 1.4 billion cubic feet per day? Unbelievable, three times the MAX forecast.'

The important thing is the regions where production increased. This is the Permian. At the end of 1/27 publication 'Trend 206: Crude oil speculative positions are near capacity', I explained why the Permian name and shale drilling rig counts are rising. You should already understand that the surge in daily natural gas production in the Permian is a byproduct of shale oil drilling.

Subsequently, the increase in shale rig counts spread across the United States, including regions such as Bakken and Eagle Ford.

This shows the trend since last year's production-cut agreement.

'Production-cut agreement' → 'speculators buying in anticipation of price rises' → 'price rise due to this buying' → 'Permian's break-even cost level exceeded' → 'rig counts begin to rise' → 'rig counts gradually increase in other regions' → 'daily natural gas production in the Permian, an oil byproduct, increases' → 'speculators accelerate their stop-loss selling.'

That is the current situation.

From here, what is expected is an increase in the daily production of 'byproduct natural gas' due to rising rig counts in other regions as well. There is no indication that crude oil's four-day rally will continue.

OPEC? Russia? The ball isn't in their court.

(The list of 46 companies that violated the 45-day rule will be posted tomorrow.)