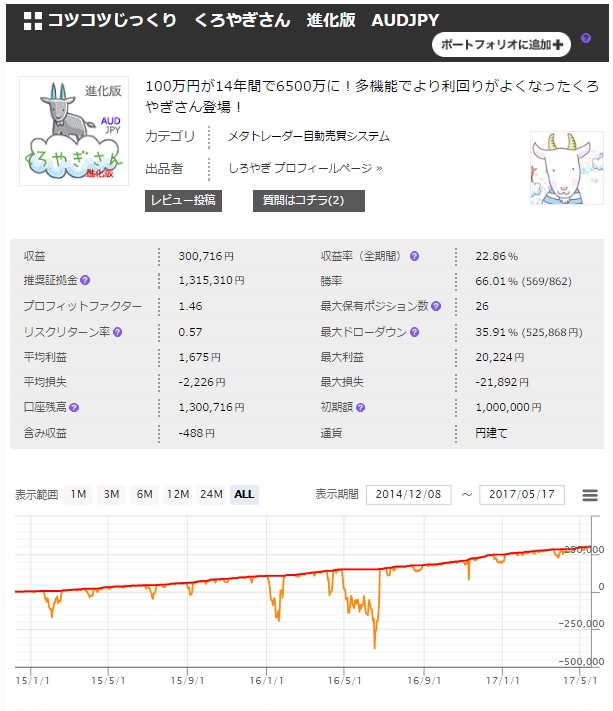

Swaps can also be expected! The Evolution Version of "The Steadily Patient Little Black Goat" with no currency-pair restrictions

Swap-based, safe-design EA that is currency-pair independent.

"Steady and patient Little Black Goat Evolution Version AUDJPY"

[Trading Logic]

In uptrends, entries are made using moving average entry logic, with a take profit at +20 pips.

In downtrends, place long averaging-down orders at the pip interval calculated from the configured minimum acceptable price; when total gained pips (profit) reaches 20 pips, close all positions.

[Key Points!]

1. By setting the acceptable minimum price, it automatically determines the optimal averaging-down width.

2. Compounding mode included

If you enable compounding mode, it automatically sets an appropriate lot size relative to the amount of capital.

Example: For AUDJPY, as of December 2014 when forward operation began, the price of AUDJPY was

around 97 yen.

AUDJPY's historical low was 55 yen, and the default minimum acceptable price is set to 50 yen.

From 97 to 50, there is a 47-yen allowable averaging-down width, and the maximum number of positions is 90, so

47÷90=51 pips

We repeat averaging-down with a width of 51 pips, and when total profit reaches +20 pips, close all positions for that trade.

Once a round of averaging-down ends, the next entry recalculates the averaging-down width; with default settings (90 averaging-downs), the lower the entry price, the narrower the averaging-down width becomes.

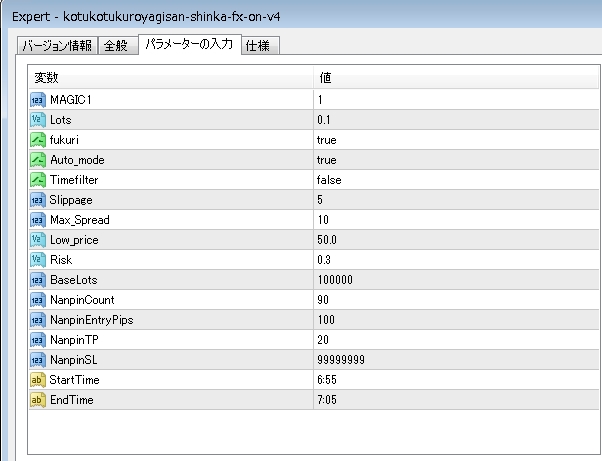

[Parameters]

When Auto_Mode is True, the averaging-down width is determined based on Low_Price (minimum acceptable price) and the number of averaging-downs (90).

Also, if Fukuri is True, it automatically sets the lot size based on the Risk value.

The default compounding settings are robust enough to withstand price movements over the past 14 years.

[Take risk with compounding, or lock in profits…]

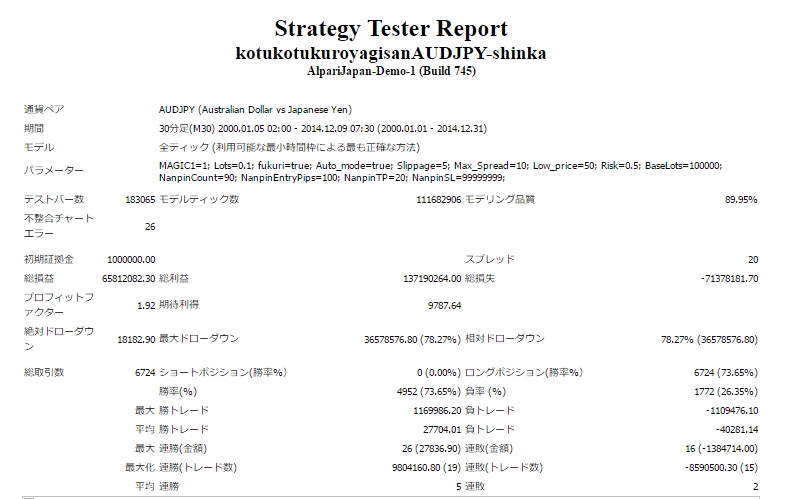

In backtests, a 14-year period from 2000 to 2014 shows

1,000,000 yen ⇒ 64,000,000 yen

This is the result, but the maximum drawdown is 78%, so it’s almost on the verge of collapse…

Please treat this as a reference for such usage with full awareness of the risks.

[Currency-pair free, enabling operation on NZDJPY, AUDJPY and other pairs!]

With the March 2017 update, currency-pair restrictions were removed.

This makes it possible to operate on swap-focused AUDJPY, NZDJPY, and other currency pairs as well.

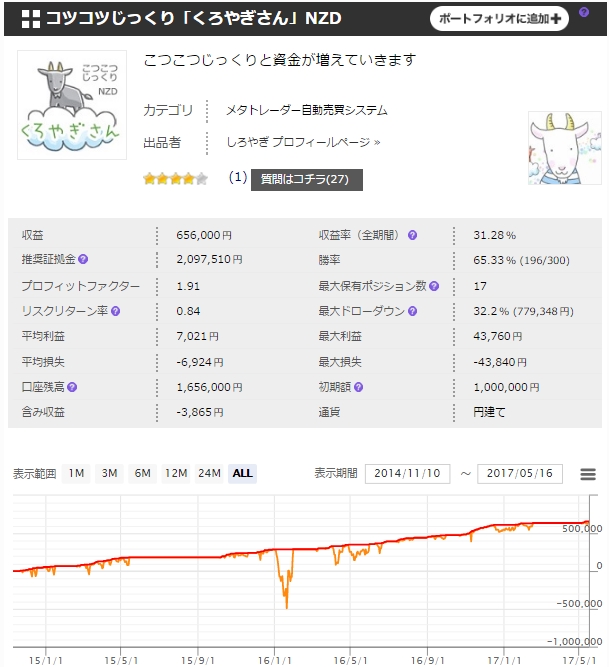

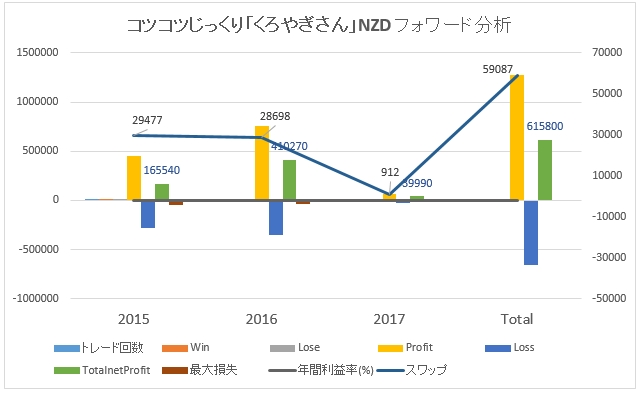

[NZDJPY version has 2.5 years of forward performance!]

The evolved NZD version’s predecessor did not have compounding or automatic averaging-down width features, but

it had a fixed averaging-down width of 60 pips (TP50) with 0.1 lot operation.

Maximum unrealized loss was 500,000 yen; maximum drawdown was 780,000 yen.

Here are the profits by year including spreads!

Over two and a half years of operation, trading gains were +615,800 yen and swap gains were +59,087 yen!

The steady, careful Little Black Goat Evolution AUDJPY can also operate in the same way as described above by manually adjusting the settings.

[Assess the risk and challenge yourself with steady + swap-focused trading!]

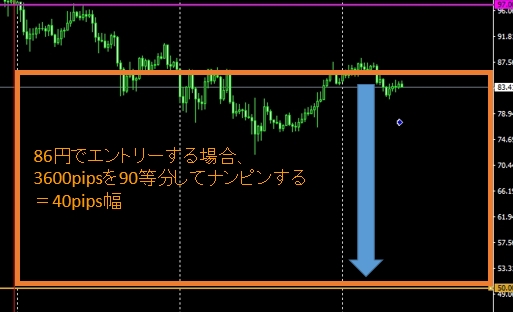

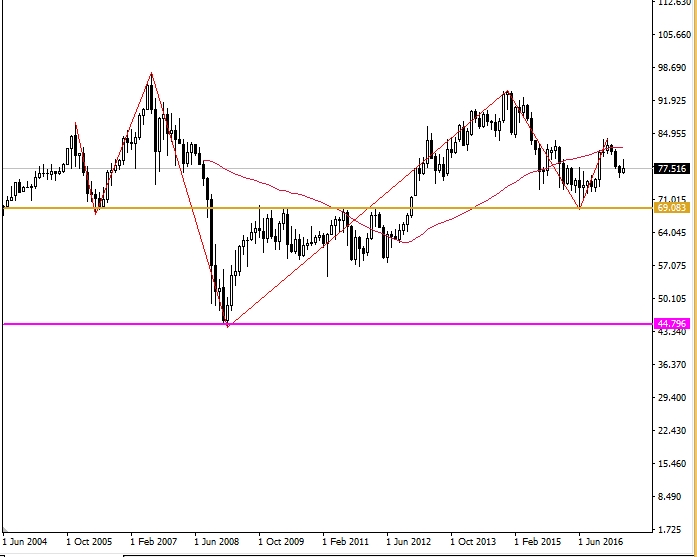

<From NZDJPY monthly chart>

If the minimum acceptable price is set to 40 yen, the difference from the current price is 3,750 pips

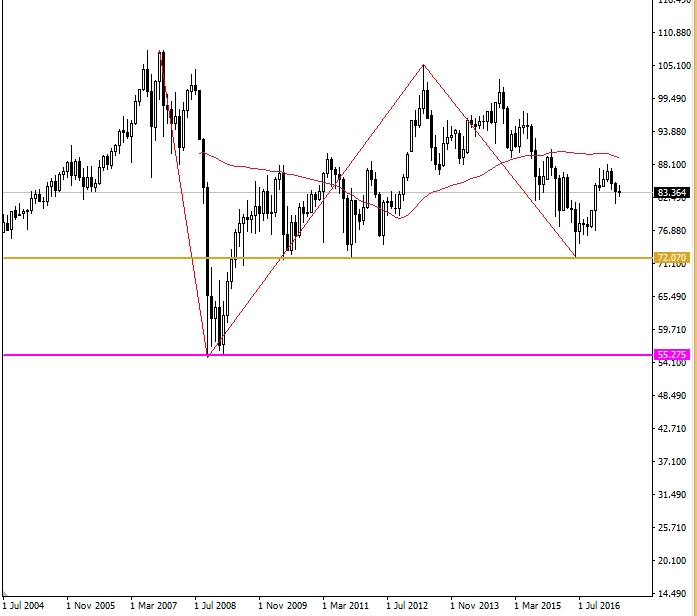

<From AUDJPY monthly chart>

If the minimum acceptable price is set to 50 yen, the difference from the current price is 3,300 pips

Both have reversed at a second bottom, so if you take on risk, you may set the acceptable price near the second bottom.

If you prefer a safer design, of course set it at the minimum price plus a cushion!

The compounding function, minimum acceptable price setting, and automatic averaging-down width setting have been added,

making the Little Black Goat Evolution version more versatile—definitely give it a try!

The price is also affordable!

Steady and careful Little Black Goat Evolution AUDJPY

15,800 yen