Nanpinia EURUSD is a trend-following Expert Advisor that sets itself apart from ordinary averaging-down martingale strategies

Nanpinia EURUSD Overview

Since the forward start, Nanpinia EURUSD has been steadily profitable, but with a name like Nanpinia EURUSD, is it really a nanpin martingale EA?

If you have avoided it, this EA is worth taking a closer look at.

Maximum positions: 6 (3 per side × 2) with a stop loss of 42 pips,

Martingale count is 3 and with a 0.1 lot setting the maximum holding is 0.7 lots,

it can be seen as not different from a multi-position EA that uses 0.1 lot × 7 positions.

What kind of trades does it make?

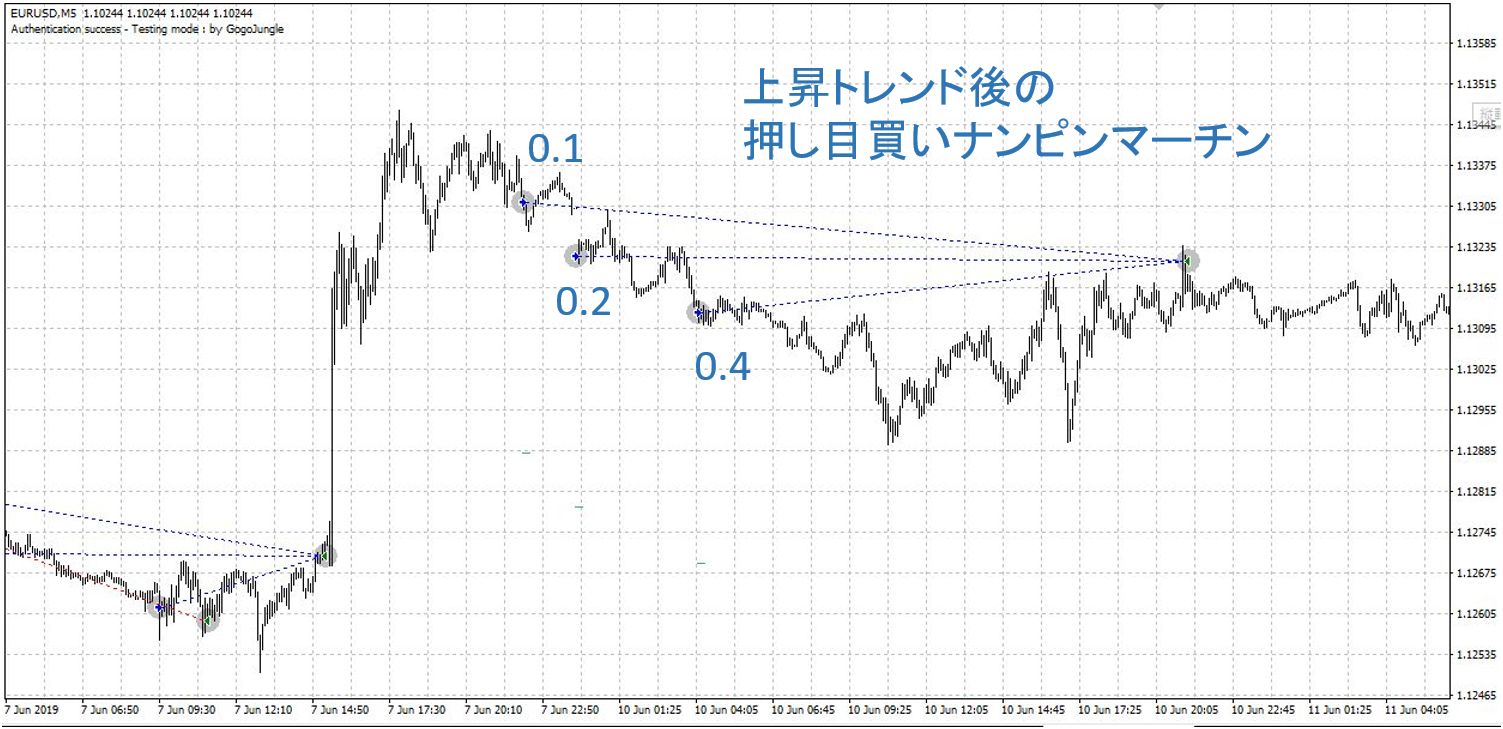

With a 0.1 lot setting, up to 3 positions can be held simultaneously on one side, and the lots increase as 0.1, 0.2, 0.4.Total lots: 0.7.

(Note: This does not mean each lot is maximum one position; theoretically you could hold 0.4, 0.4, 0.4 positions.)

The timing of entries is not simply a contrarian nanpin.

Usually nanpin involves buying when prices are falling and selling when they are rising, but,

Nanpinia EURUSDbuys on uptrends. In other words, it tends to pick up pullbacks via nanpin-martingale.Because entries align with the trend direction, the probability of a reversal is high—that is its characteristic.

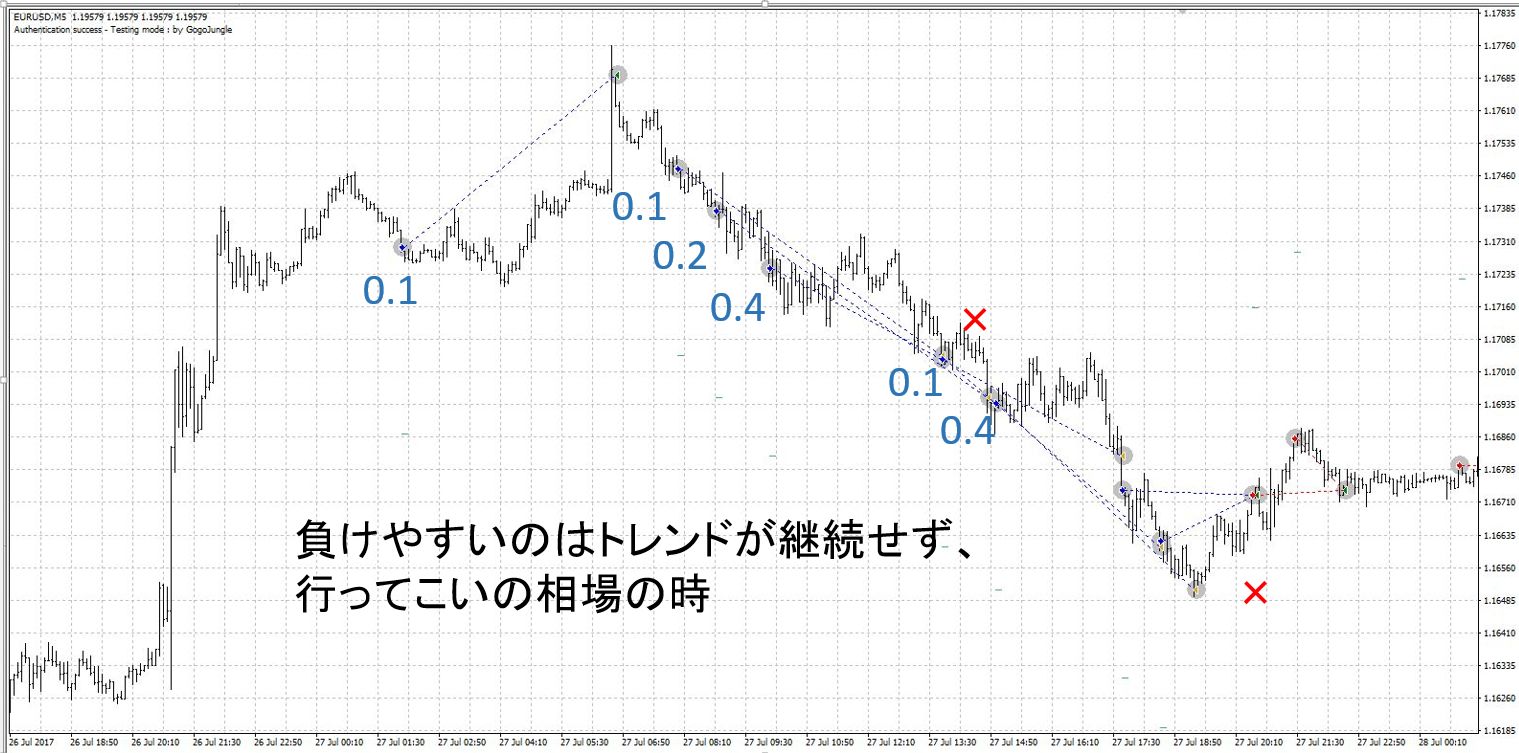

Additionally, there were contrarian nanpin-marting in the topping zone when the trend went too fartop-area contrarian nanpinwas observed.

In addition to trend-following buying dips and selling rallies nanpin, two types of "reversal-prone nanpin-martin" are used: the trend-following nanpin and the topping-zone contrarian nanpin-martin.

Nanpinia EURUSD advantages

When hedging, the required margin is offset, so it does not simply double; you only need the margin for one side, so even with nanpin-martin the required margin will not exceed 0.7 lots.On accounts with 25x leverage, the margin burden is a common issue for nanpin-type EAs, but Nanpinia EURUSD covers this with hedging.

Also, each position's SL is 42 pips, so even if all positions are stopped out, the losses are limited.

The amount lost in a single nanpin-martin at 0.1 lot is,

4,200 × 7 = 29,400 yen

Note: If three positions of 0.4 lot are open, the theoretical maximum simultaneous loss would be about 50,000 yen.

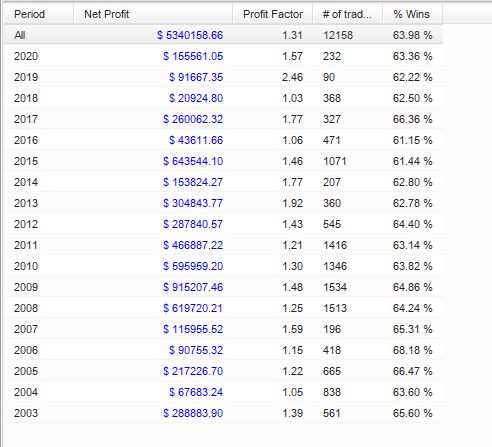

Backtest Analysis

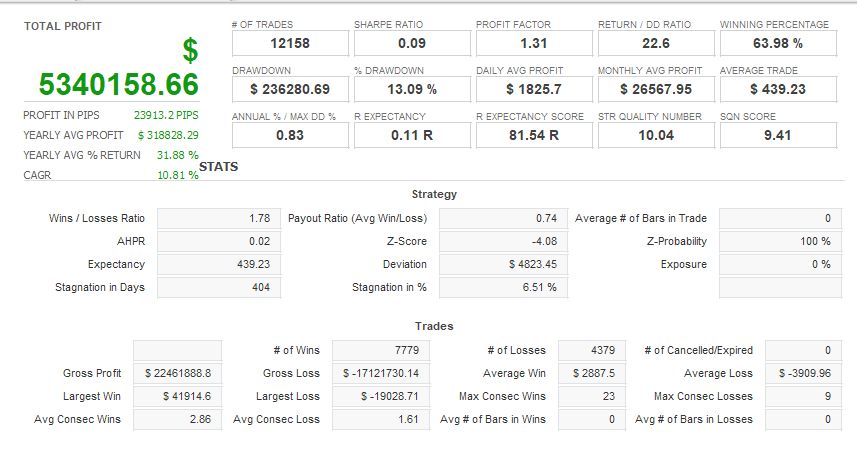

Nanpinia EURUSD uses batch settlement via nanpin-martin, so win rate is not a metric for evaluating this EA.

What stands out is a RETURN / DDRATIO of 22. This score indicates how much profit exists relative to drawdown.

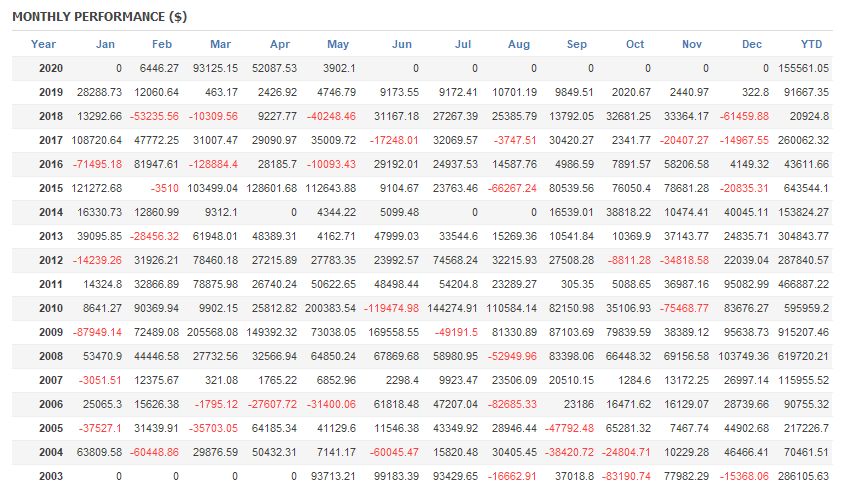

Monthly profit/loss, annual profit

▲ Monthly Profit/Loss

There are months with losses in the year, but overall there were no losses for the year.

The average annual profit over the past five years was 200,000 yen.

There is considerable variability in annual profit, but as the number of trades increases, the profit amount tends to grow.

Recommended Margin and Expected Annual Return

Operating with 0.1 lot per 1 million yen is recommended; let's calculate the recommended margin concretely.

Reference is backtest results for 17 years from 2003 to 2020.

On a 25x leveraged FX account, the required margin per 0.1 lot of EURUSD is about 50,000 yen.

Theoretically, up to 0.4 lots in three positions can be held, so 0.4×3 = 1.2 lots is the maximum.

(12×5万円)+(25×2)=110万円

That is the result.

Annual average profit:310,000 yen

Average annual number of trades:715

Maximum drawdown:250,000 yen

Expected annual return at the recommended margin is +28%Thus.

The maximum drawdown in long-term backtests is also limited,

and with multi-position lot control, it can profit from both trend-following and counter-trend strategies, making it a solid EA.

Don’t be fooled by the EA name—definitely review its actual performance.

written by Tera GogoJungle Marketing.