Expected annual interest rate of 60% or more! You can reduce margin by hedging with both short and long positions 『MILAN_EURJPY_M5』

MILAN_EURJPY Features

This is a scalping-swing hybrid EA that enters from 23:00 to 03:00 MT4 time.

In Japan time, it corresponds to 5:00–9:00, so it falls into the morning scalping category.

Also, MILAN_EURJPY consists of two EAs dedicated to long-only and short-only, and when operating you place each on two EURJPY charts.

As described on the sales page,Average TP: SL around 20 pips: around -40 pips, and the average gained pips are large enough not to be offset by spread costswhich is a major attraction.

Backtest Analysis

Official backtest data is freely available and anyone can download and verify it.

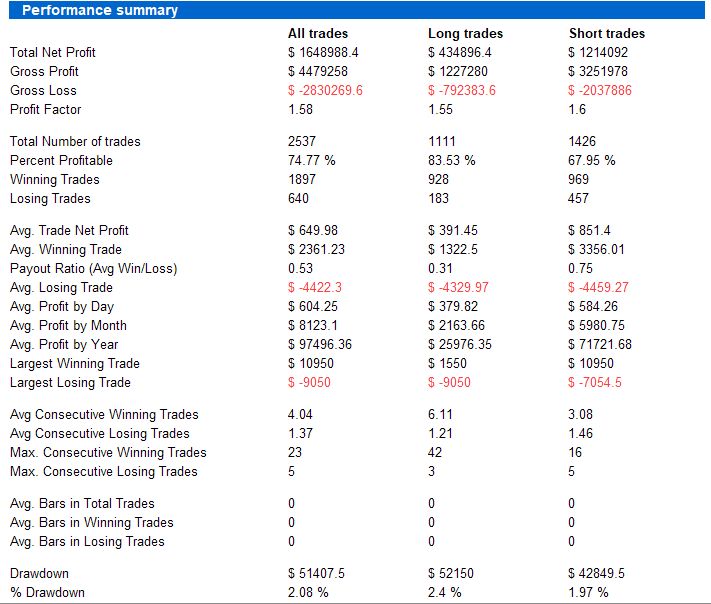

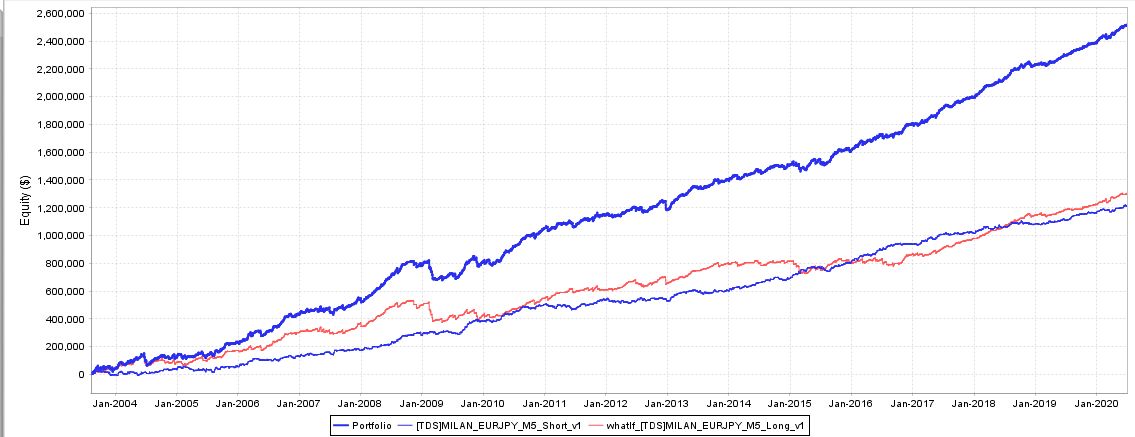

From 17 years of backtest data from 2003 to 2020, we compared the performance of long vs short.

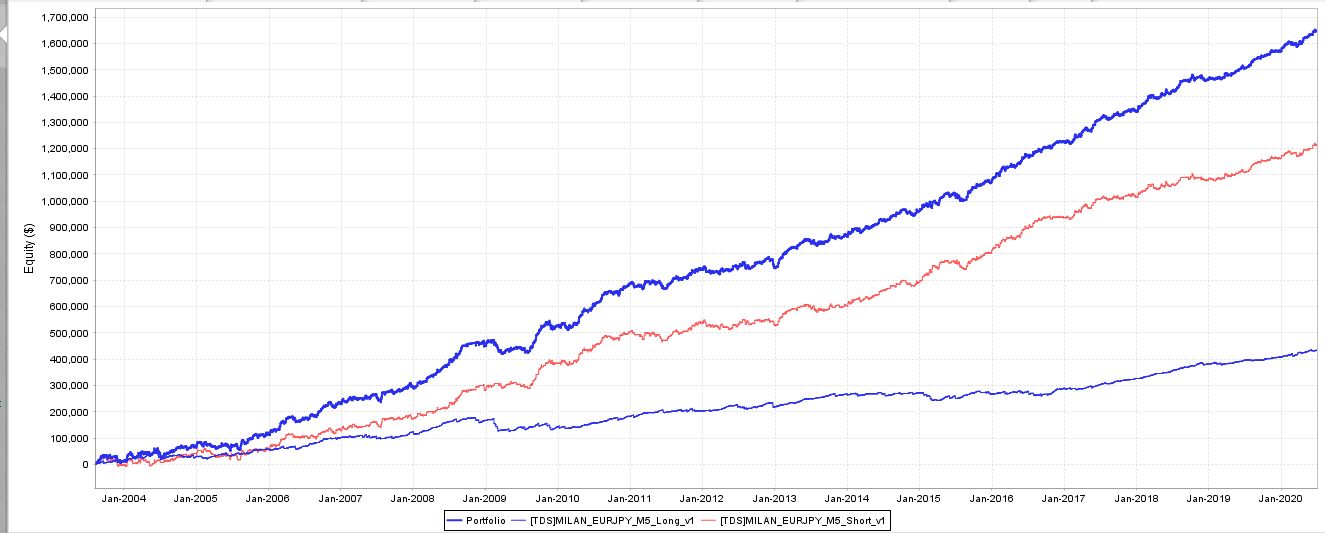

Blue: Long & Short Portfolio

Red: Short-only P&L Curve

Blue: Long-only P&L Curve

The short-only side is clearly more profitable.

When run two in parallel, drawdowns do not simply double; they can complement each other. MILAN, too, shows a smaller maximum drawdown when run together than individually.

▲ Long and Short Performances

Looking at the detailed data, the long side has a higher win rate, but the ratio of average gain pips to average loss pips is 13 pips to -43 pips, giving a low payoff ratio; thus, even with a higher win rate, the profit amount ends up smaller than the short side.

The short side does not have as high a win rate, but has a higher payoff ratio, and the expected profit per trade is higher than on the long side.

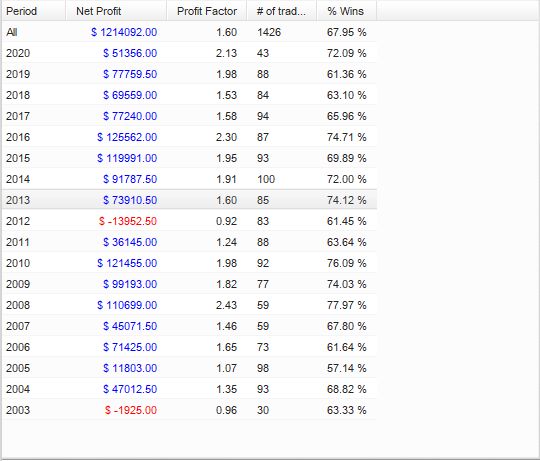

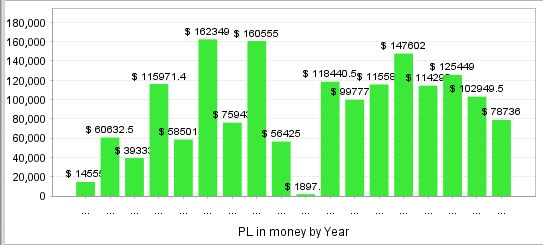

▲ Short: 2003 and 2012 show slight losses (in yen terms, not a large amount).

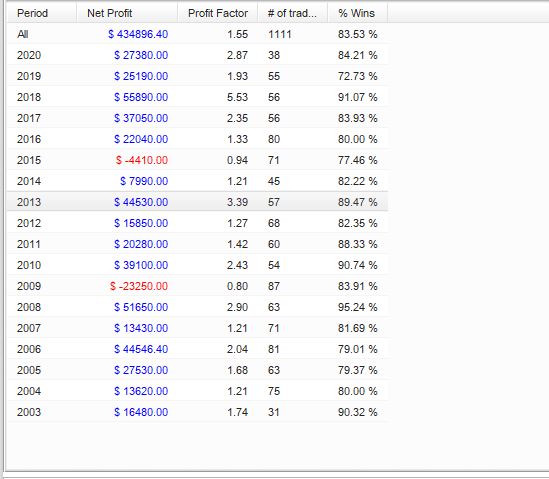

▲ Long

2009 and 2015 are negative.

Comparing short and long, the negative years differ, so when combined into a portfolio, annual losses are offset effectively.

Also, if you want to balance the profit amounts between short and long, increasing the long lot by 2x or 3x would likely yield a more ideal profit curve.

▲ Portfolio curve when short is 0.1 lot and long is 0.3 lot.

The long side effectively covers the drawdown periods of the short.

If you set the long to 0.3 lots, the maximum drawdown will of course increase, but it's still around 140,000 yen, so not too large.

By separating the EA into two, you can freely adjust long and short lots, or stop one if it is underperforming, allowing more flexible operation.

Recommended Margin and Expected Annual Return?

When both short and long are set to 0.1 lots

(5) + (5.1*2) = 15.2 (ten-thousand yen)

The number of positions is 1 for short and 1 for long, totaling up to 2, but since hedging offsets margin, you don't multiply by 2; keeping it at 1 is fine.

Annual average profit/loss: 9.7万円

Average annual number of trades: 149

Expected annual return: 64%

That’s the result.

When short is 0.1 and long is 0.3

(5*3) + (14*2) = 43(万円)

Annual average profit/loss: 14.8万円

Expected annual return: 34%

★The annual number of trades is relatively low (around 140), but the average gained pips are large, so less affected by spreads

★Hedging long & short reduces required margin and allows efficient operation

★An annual gain of 700–1000 pips seems feasible

★Expected annual return is 60% or higher

★A rare currency pair, EURJPY, makes it well-suited for hedging

Therefore,「If EURJPY, this is the one!」Isn't this a highly promising EA that lives up to that marketing line?

Written By Tera GogoJungle Marketing.