Takada Asset Consulting Co., Ltd., various data analyses that drive the Nikkei 225 futures

I think some of you have skimmed Takada Asset Consulting's report “Practical Methods for Supply-and-Demand Analysis of Nikkei 225 Futures and Options,” even if only the free portion.

If you are well versed in Nikkei 225 futures, you probably have substantial experience recognizing that the various data below carry significant implications for the Nikkei 225’s price movements.

For those who trade Nikkei 225 futures, or engage in FX and individual stock trading, these data have important relationships to price movements.

Today, we are publishing the full text of yesterday’s July 22 report, so please take a look.

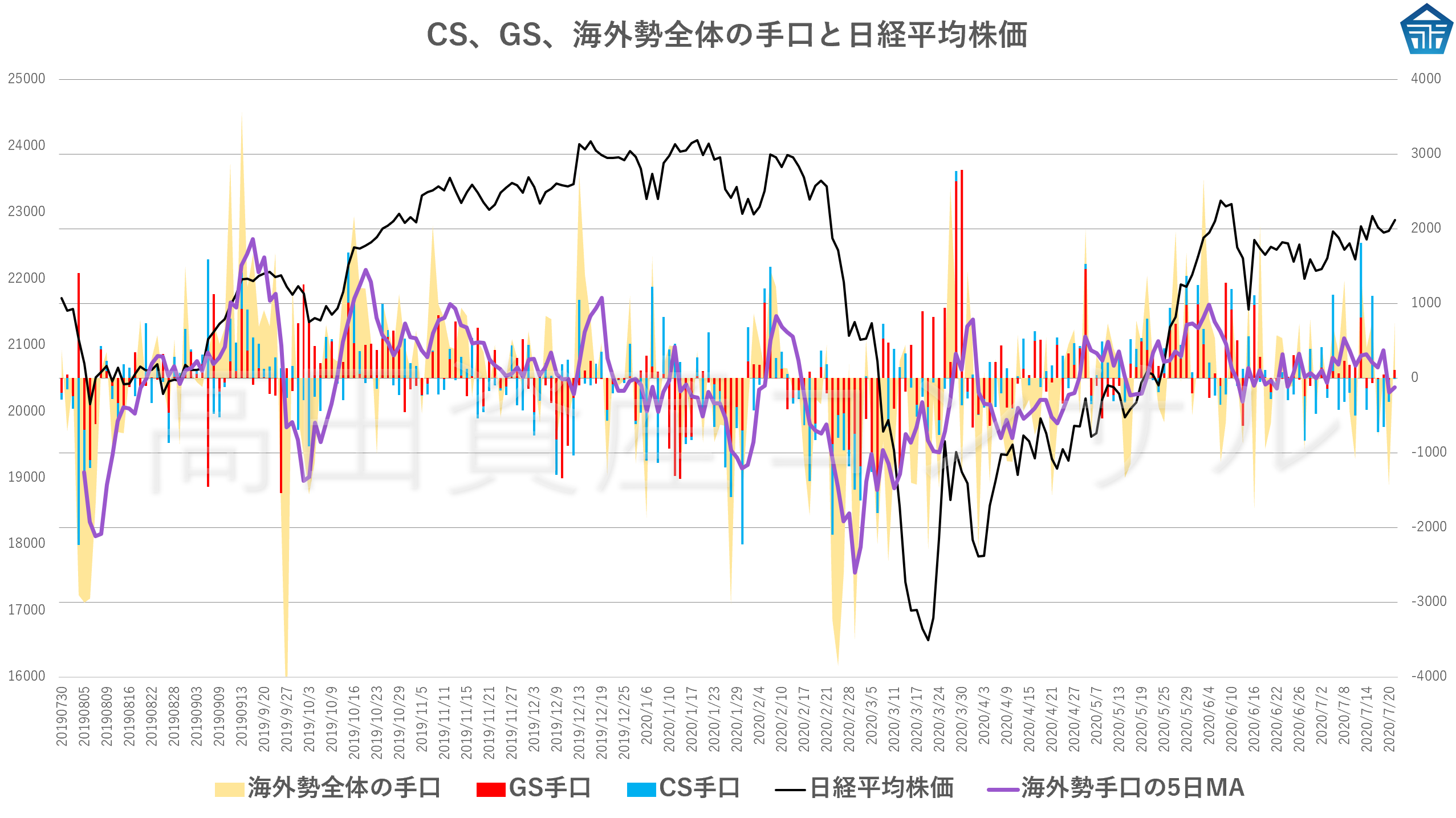

(1) July 21: Overall foreign participants’ futures activity, as shown in the figure,

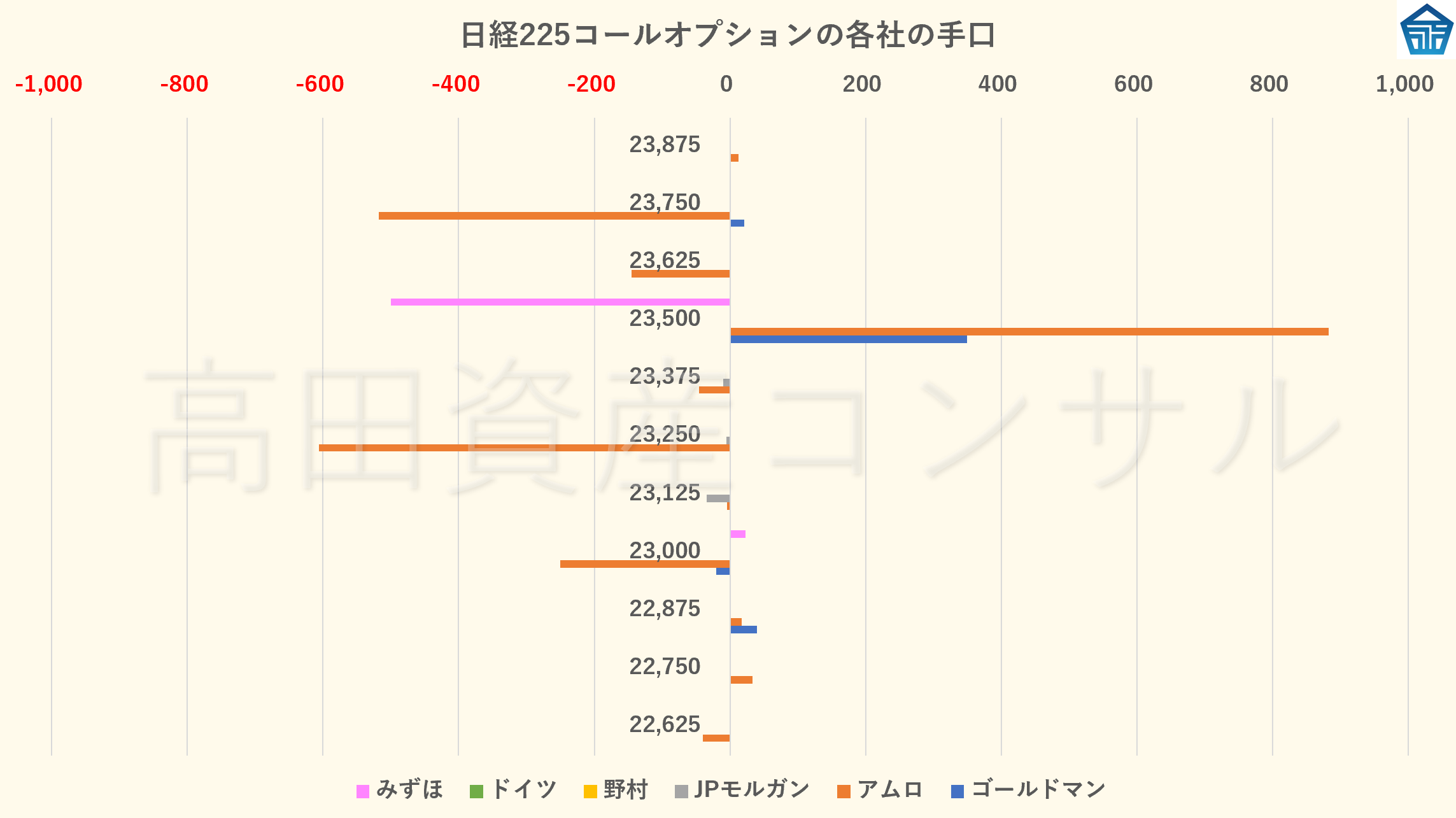

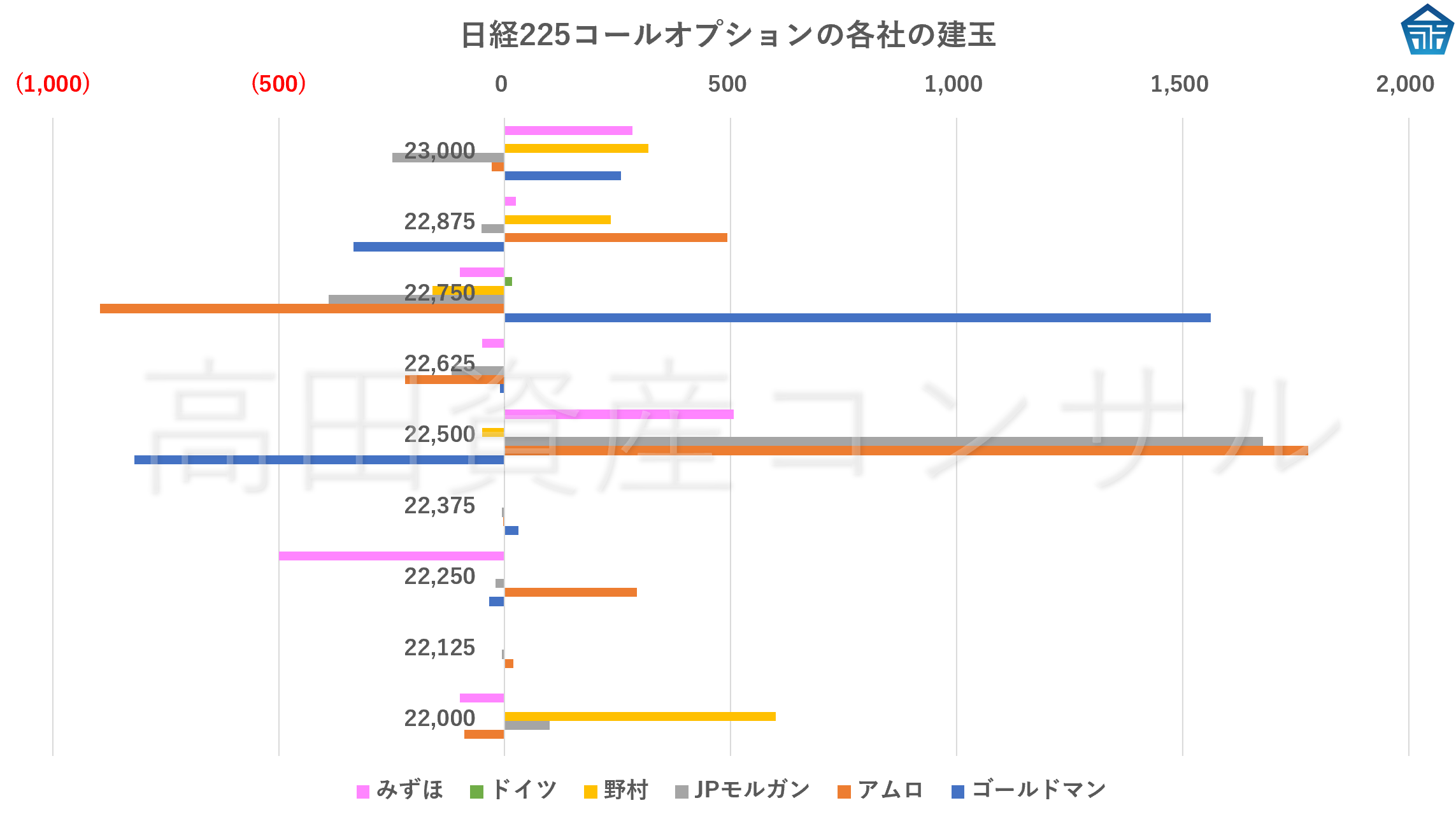

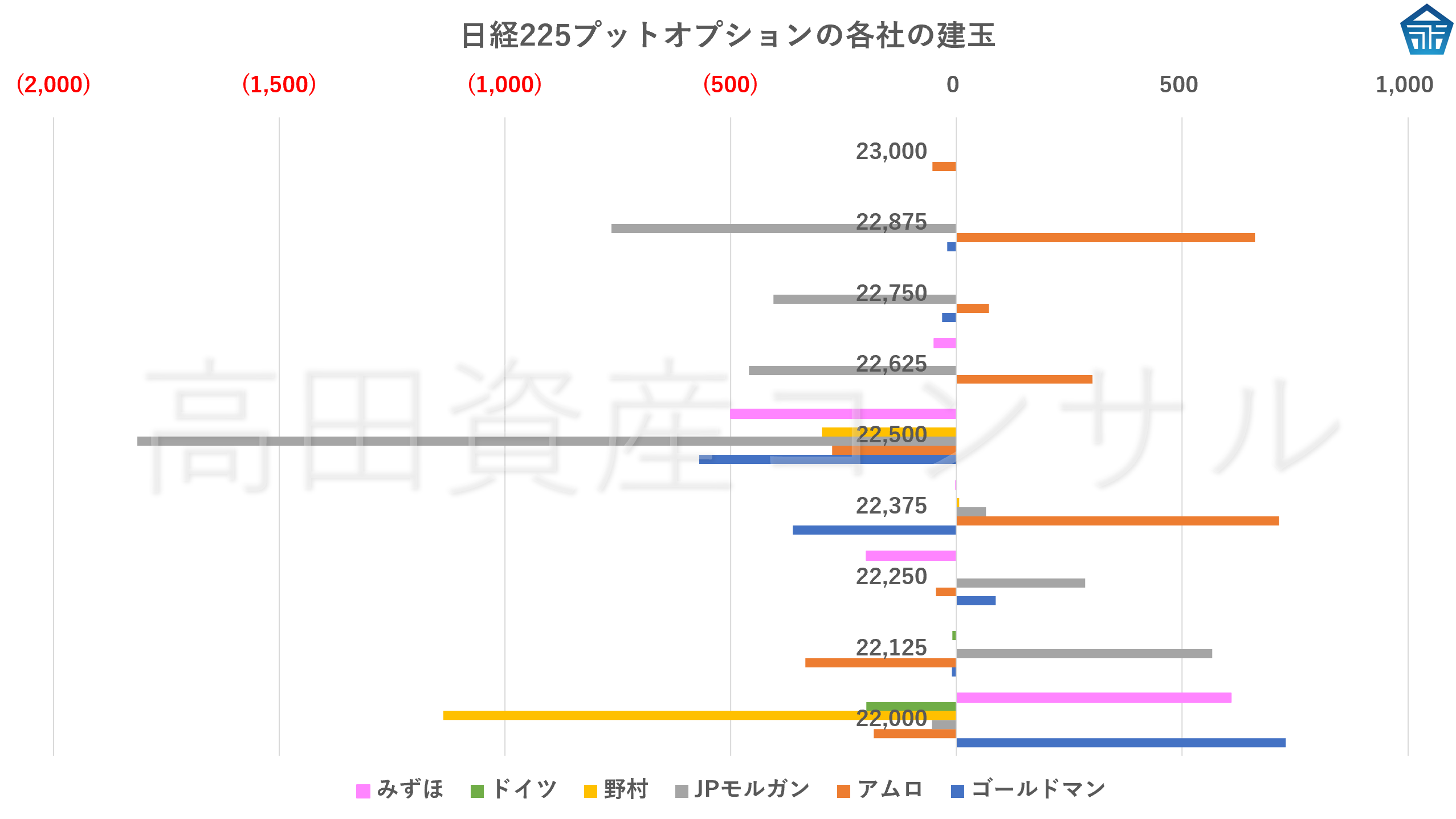

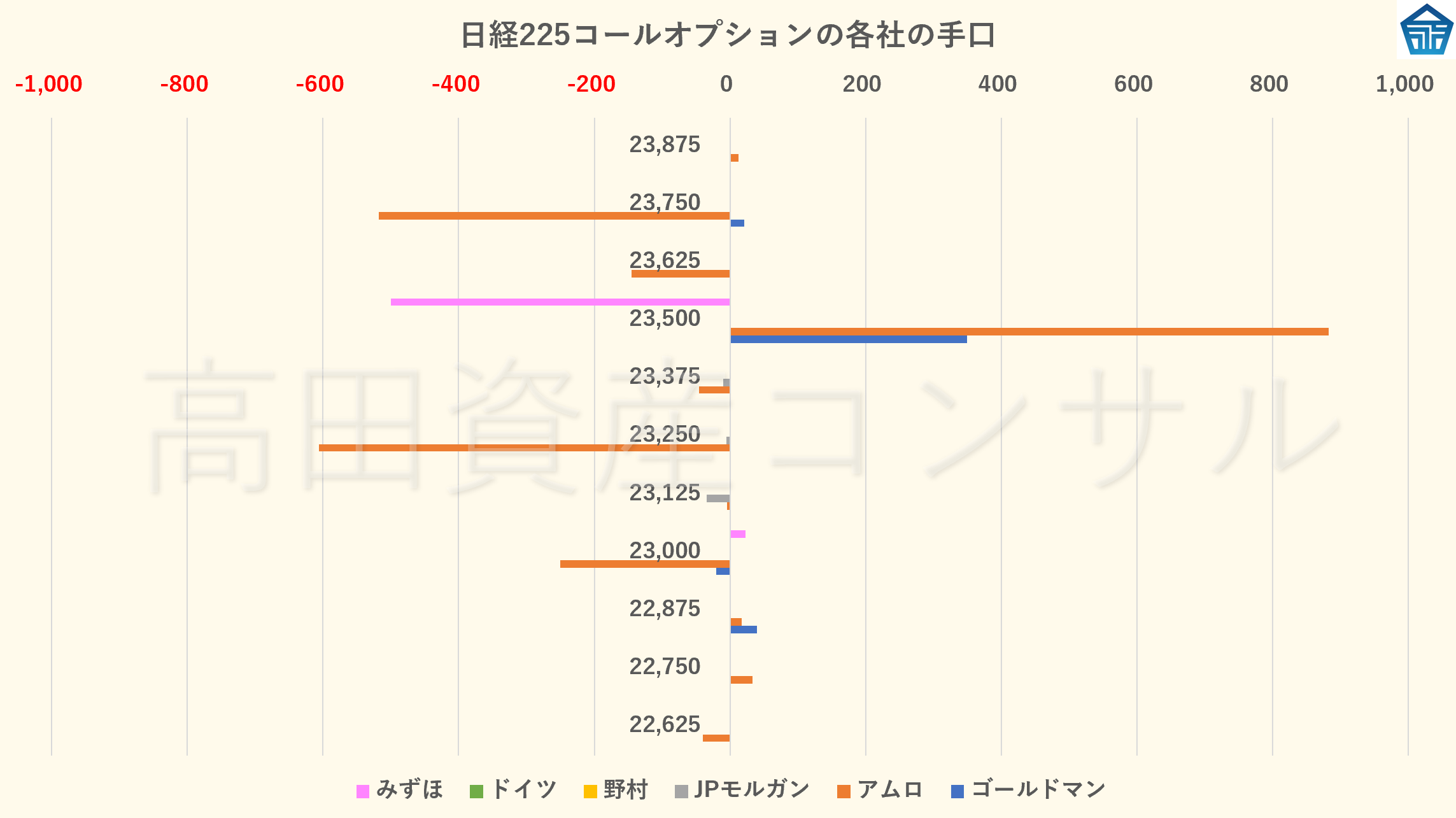

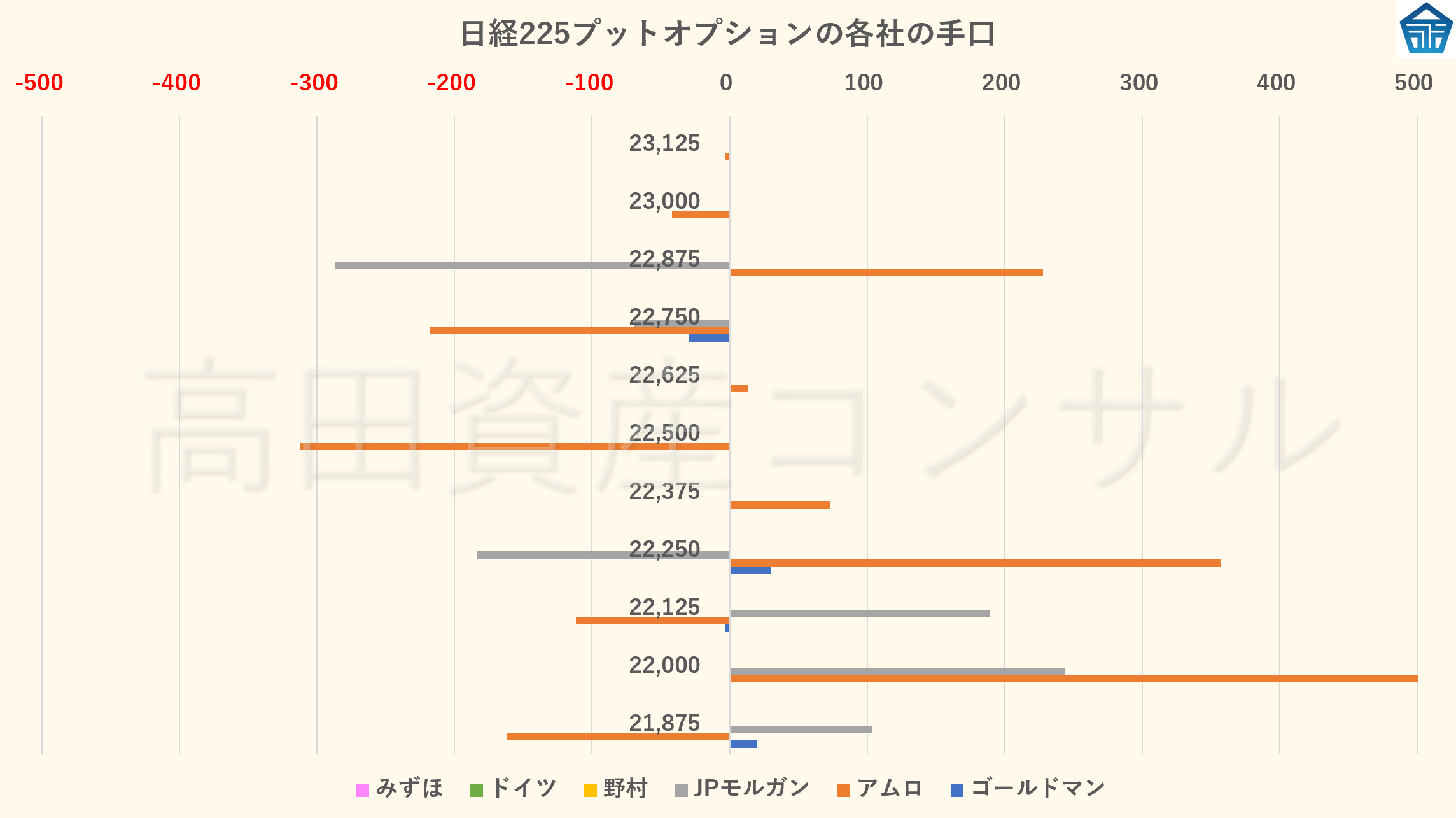

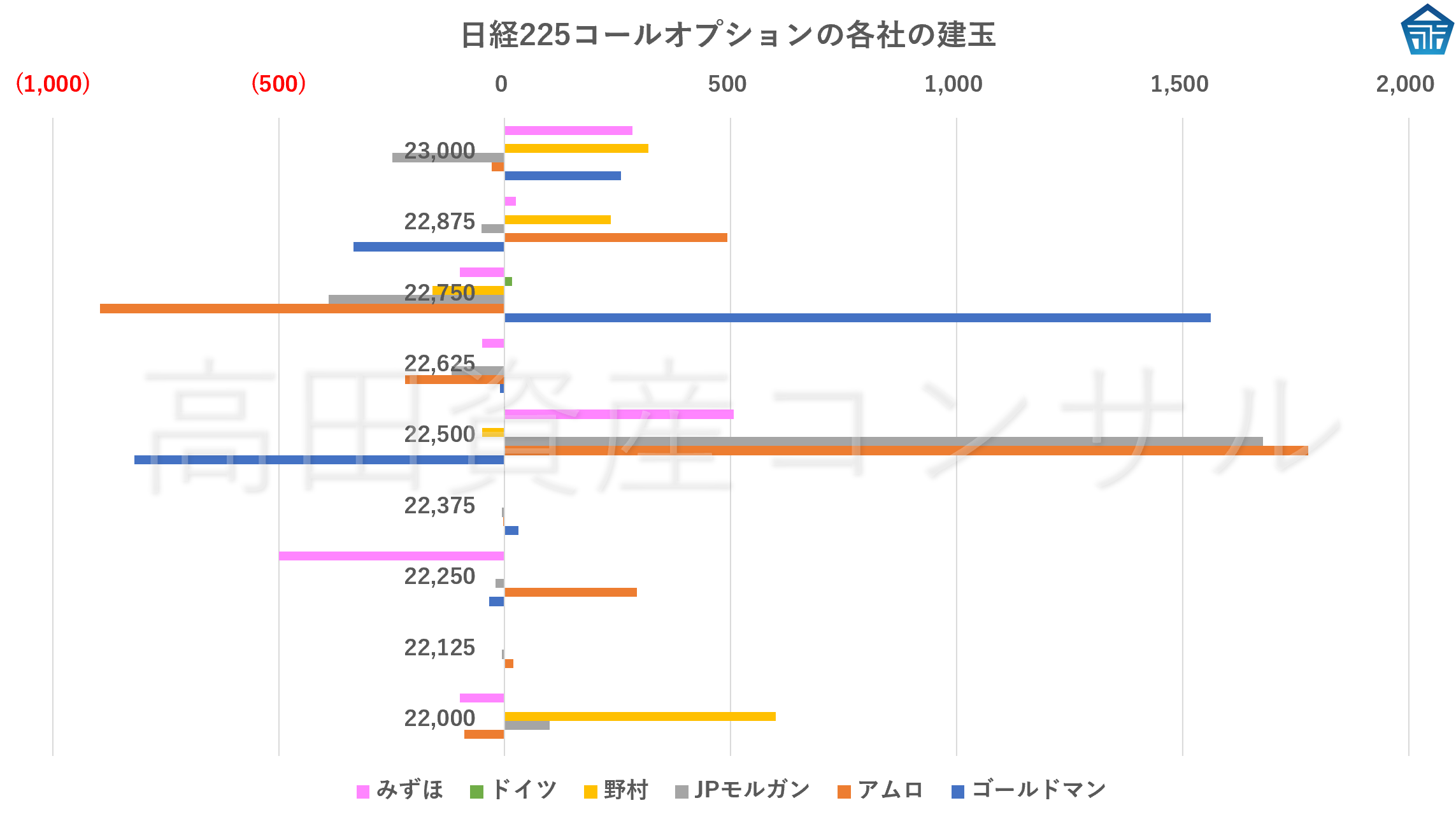

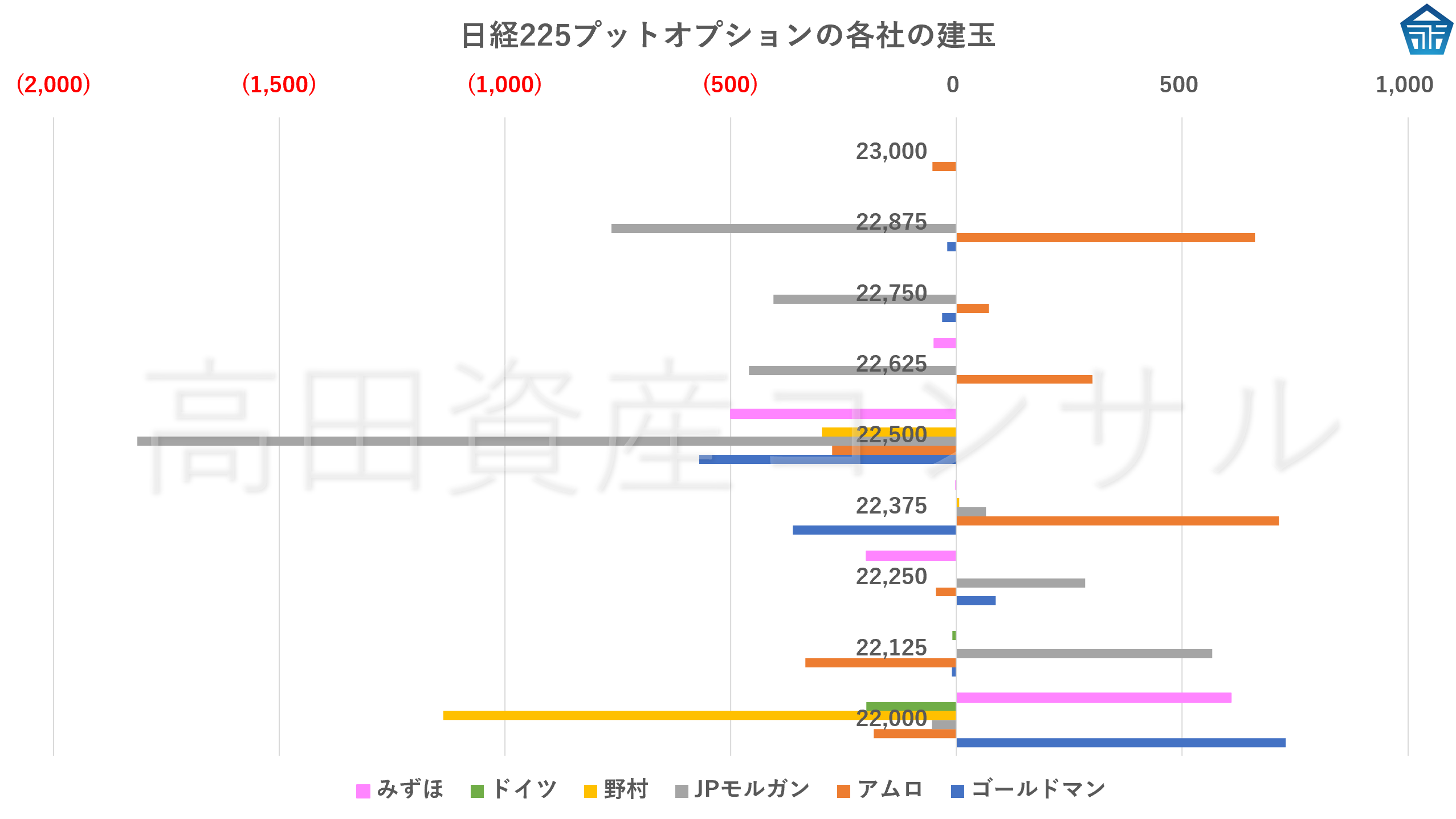

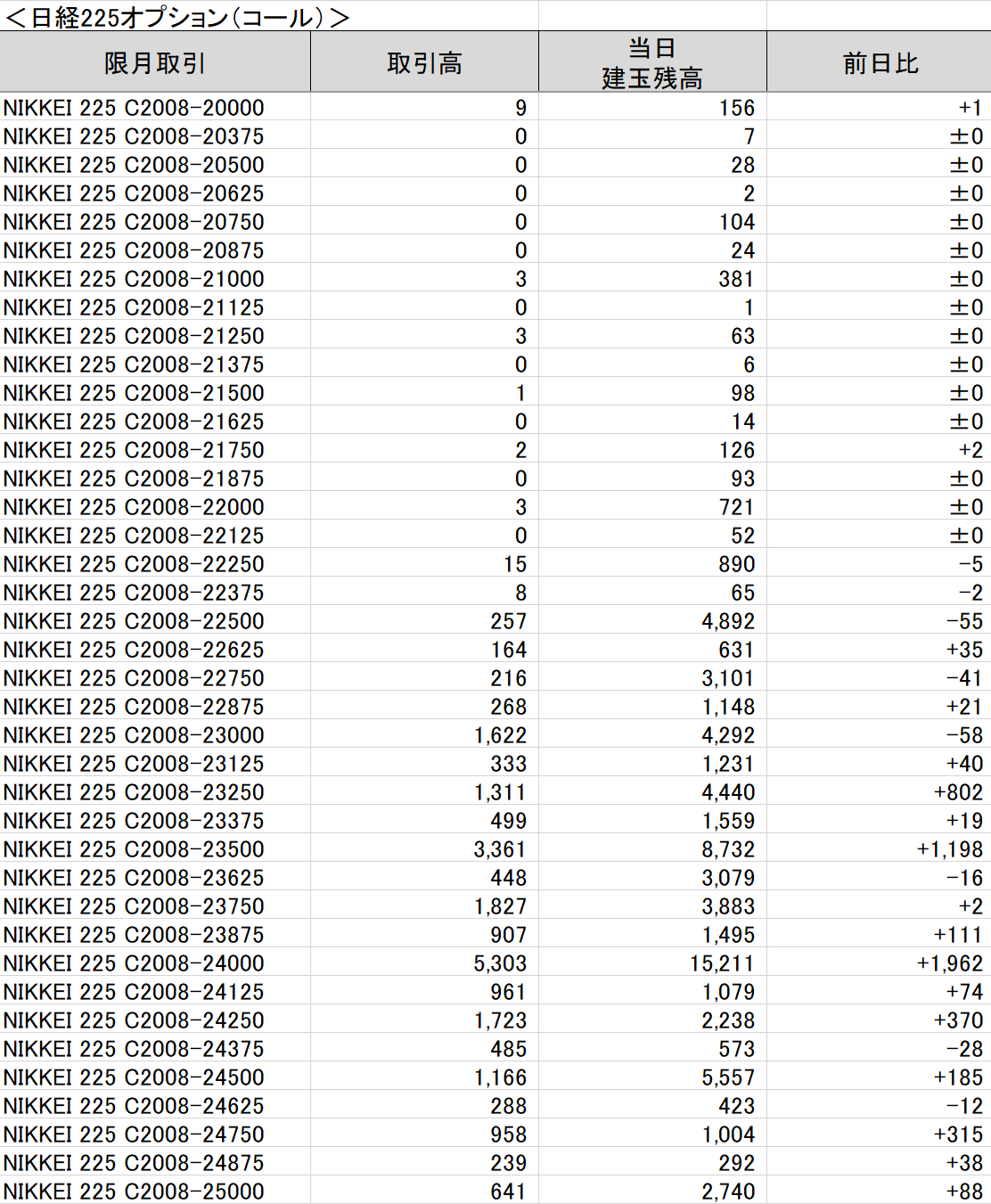

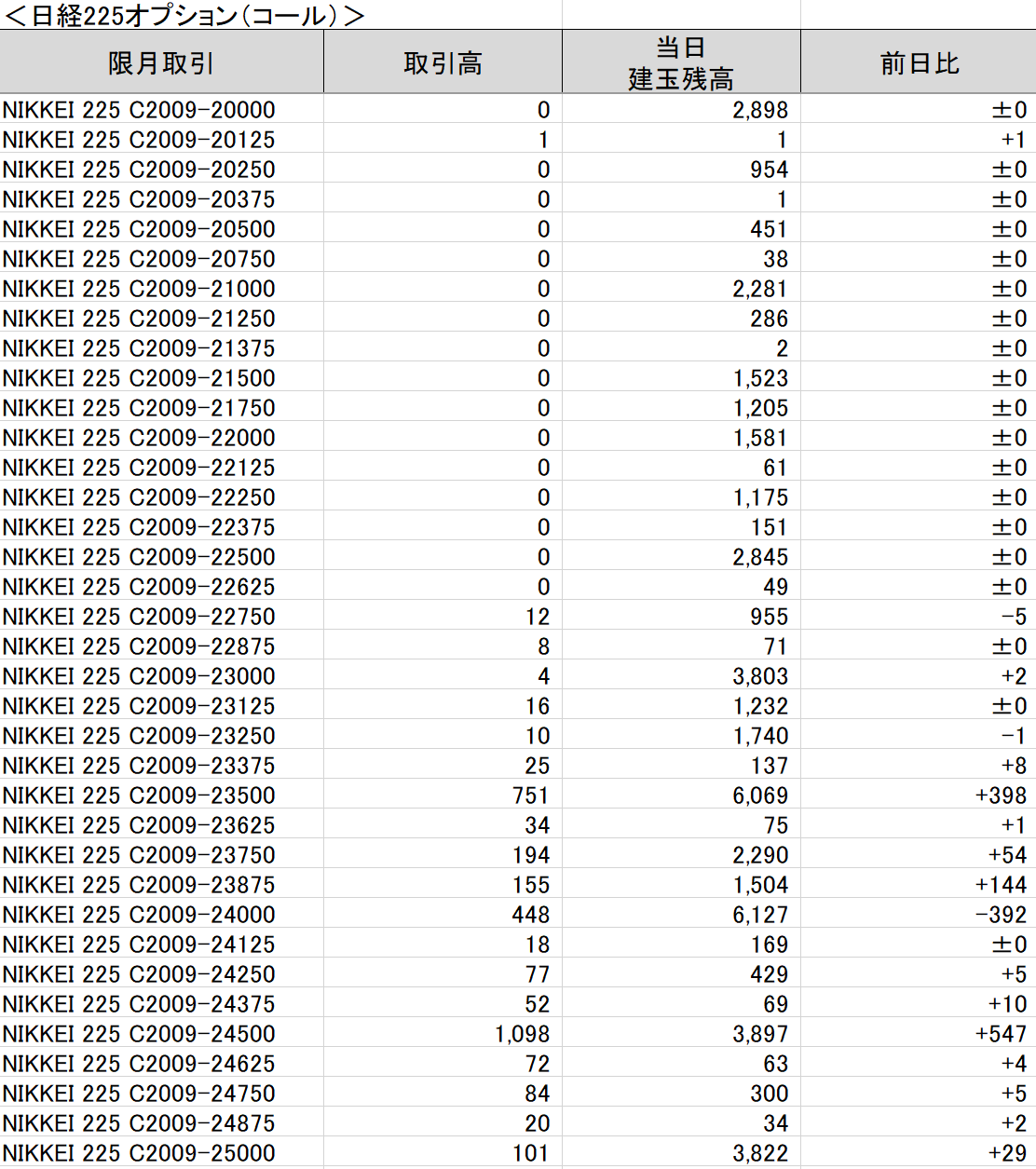

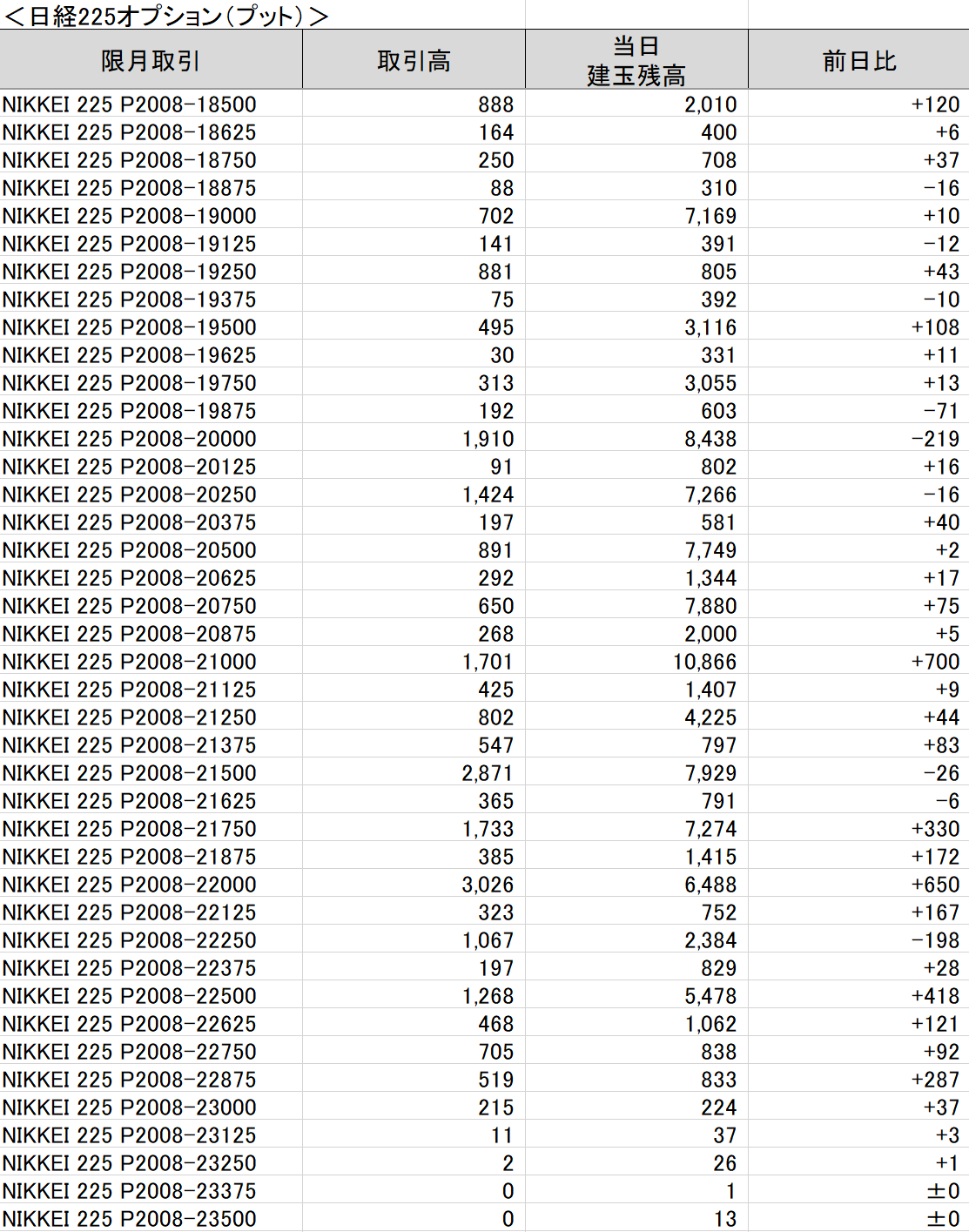

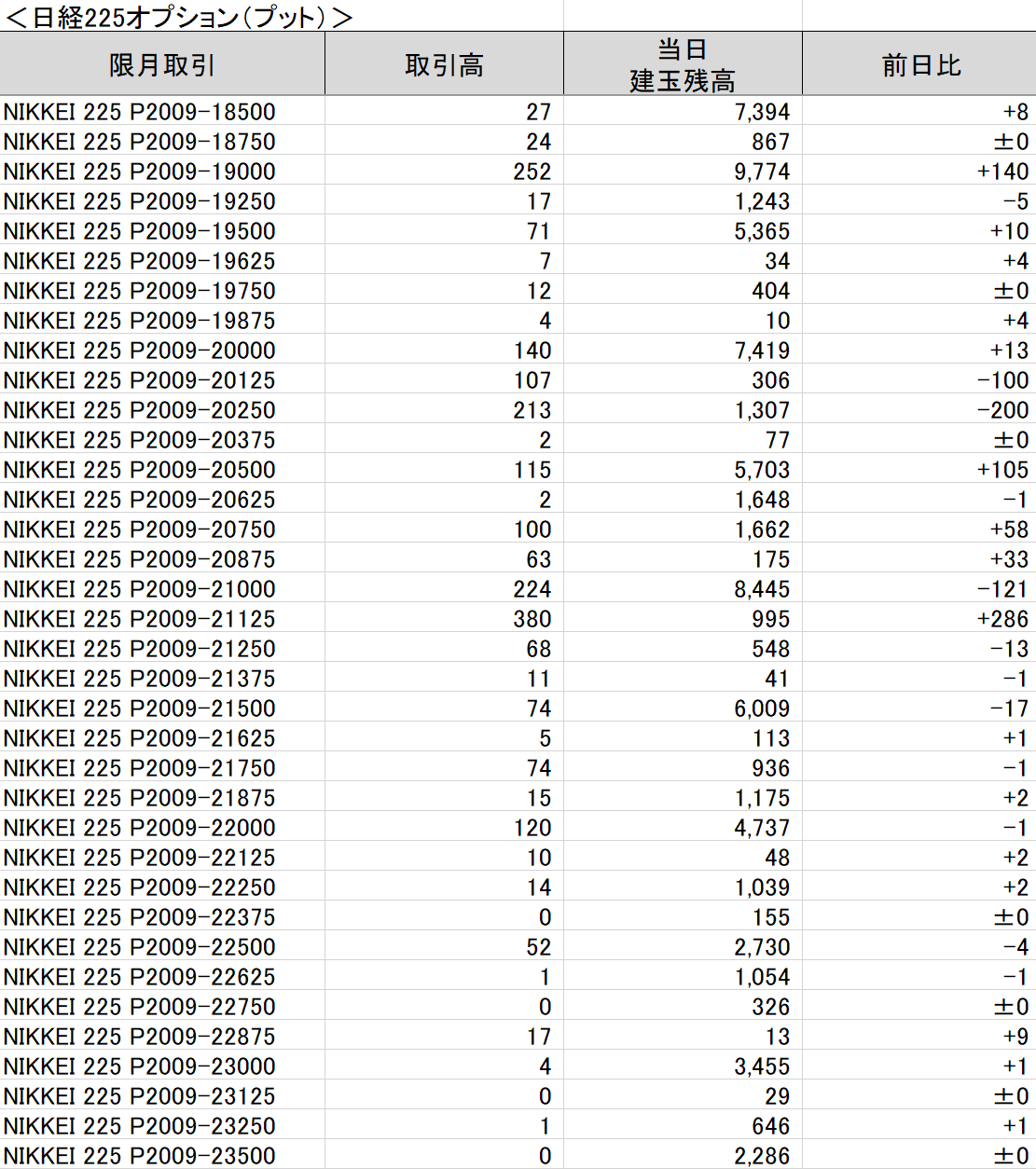

(2) About each firm’s options activity and open positionsis as shown in the figure.

foreign participants overall were net buyers, Goldman Sachs was a net buyer, and Credit Suisse showed mixed buying and selling.

(2) About each firm’s options activity and open positionsis as shown in the figure.

(3) Large-option activity and cross trades

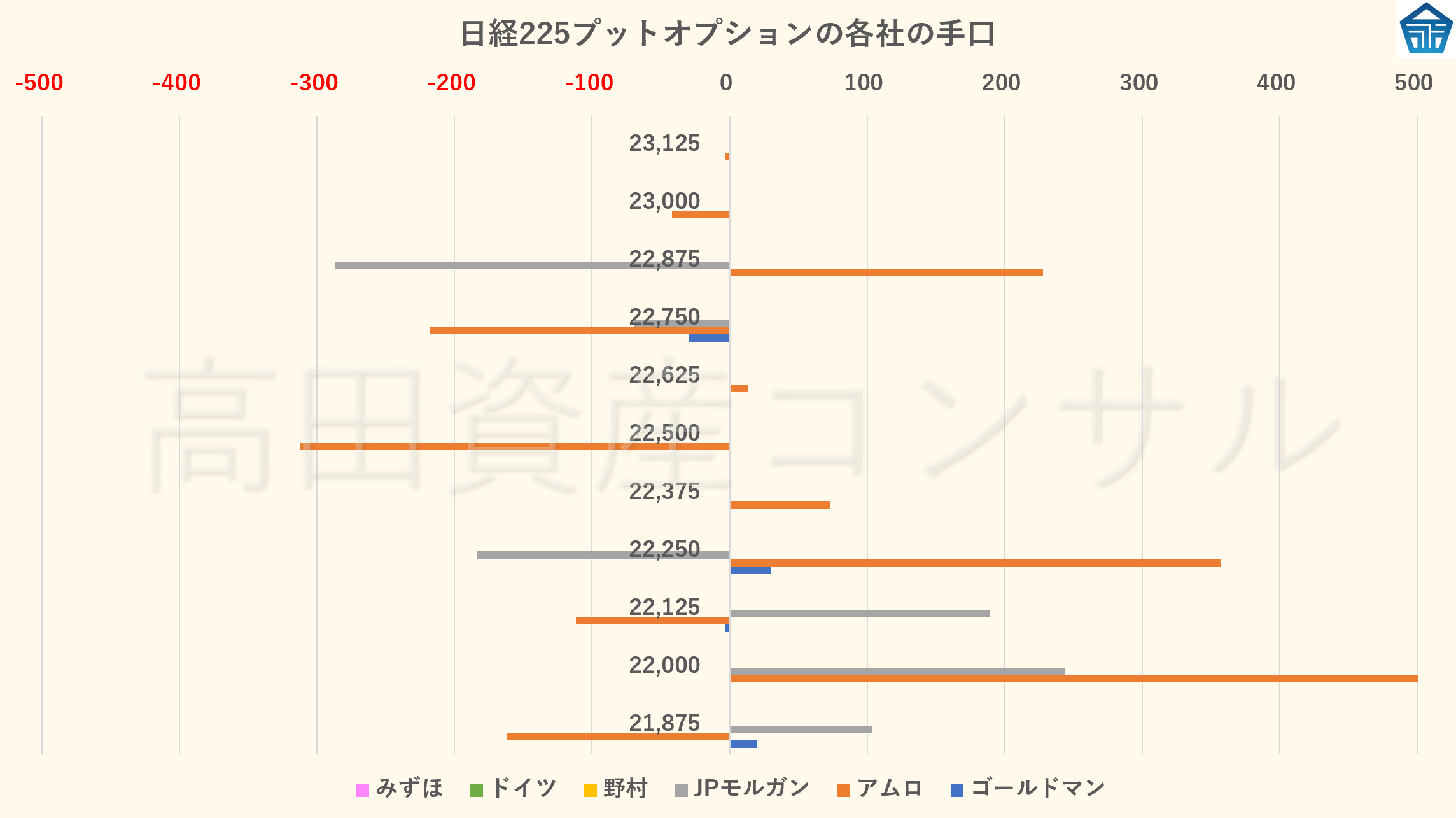

Regarding options, ABN AMRO’s

the 22,500 put open interest has turned to net selling again,

therefore, the 22,500 yen level remains a strong downside support that large investors are watching.

(4) About chart reading and interpretation

For July 21 futures activity, foreign participants overall were net buyers, Goldman Sachs was net buyers, and Credit Suisse showed mixed buying and selling.

If foreign participants overall and Goldman Sachs turn to buying, the Nikkei Average may rise via a band-walk,

if buying pressure does not materialize, the range-bound movement will continue,

today too, if both foreign participants overall and Goldman Sachs are net buyers, a bullish bias can be seen to emerge,

otherwise, if selling dominates, it cannot be considered bullish.

otherwise, if selling dominates, it cannot be considered bullish.

As for options, ABN AMRO’s put 22,500 open interest has turned to net selling again,

therefore, the 22,500 yen level remains a strong downside support that large investors are watching.

Also, Goldman Sachs sold new puts of 22,875 on the 20th, and yesterday sold new puts of 22,750,

JPMorgan also sold new puts (increasing short positions) of 22,875 and 22,750, thereby contributing to downside pressure on the market.

Also, Goldman Sachs sold new puts of 22,875 on the 20th, and yesterday sold new puts of 22,750,

JPMorgan also sold new puts (increasing short positions) of 22,875 and 22,750, thereby contributing to downside pressure on the market.

As for call options, ABN AMRO is believed to have newly sold the 23,250 call and to be accumulating short positions,

at present, large investors appear to intend to cap the upside around the 23,000–23,250 call levels,

while the downside is being reinforced by selling the 22,500 put as noted above,

based on past trends, large investors could deploy upside moves during the holiday period and after the holidays.

at present, large investors appear to intend to cap the upside around the 23,000–23,250 call levels,

while the downside is being reinforced by selling the 22,500 put as noted above,

based on past trends, large investors could deploy upside moves during the holiday period and after the holidays.

The chart, as long as it maintains the daily Bollinger Band (25) +1σ,

indicates there is potential for the band-walk to rise at any time.

Therefore, in terms of upside actions by large investors,

ABN AMRO has been accumulating selling of the 23,250 call,

yesterday’s large buy setup for ABN AMRO’s 23,500 call may come into focus,

and the large buy setup for ABN AMRO’s 23,750 call on the 20th could also come into play.

Conversely, if downside moves occur, Goldman Sachs, ABN AMRO, JPMorgan Chase, Mizuho, and others

are likely to focus on the net-sold 22,500 put.

and the large buy setup for ABN AMRO’s 23,750 call on the 20th could also come into play.

Conversely, if downside moves occur, Goldman Sachs, ABN AMRO, JPMorgan Chase, Mizuho, and others

are likely to focus on the net-sold 22,500 put.

However, as noted above, there are times when such overt downside support positions are breached,

and if that happens, a temporary crash could occur, with attention on the levels of Goldman Sachs’ 21,875 put cross trades on the 20th and

the scenario targeting the accumulated 21,750 puts remaining a potential target,

so it is necessary to monitor the market without letting guard down.

Additionally, regarding the relationship between foreign futures activity and the Nikkei 225 index when the Nikkei rises in an uptrend,

as shown in the figure below, the cumulative total (the gray area) will build up.

and if that happens, a temporary crash could occur, with attention on the levels of Goldman Sachs’ 21,875 put cross trades on the 20th and

the scenario targeting the accumulated 21,750 puts remaining a potential target,

so it is necessary to monitor the market without letting guard down.

Additionally, regarding the relationship between foreign futures activity and the Nikkei 225 index when the Nikkei rises in an uptrend,

as shown in the figure below, the cumulative total (the gray area) will build up.

and does not constitute buy/sell instructions, advice, or guidance for investment decisions.

While this information is intended to be accurate, its completeness is not guaranteed at all times, and

the company does not take responsibility for its content; please make your final investment decisions on your own.

× ![]()