7/23 Stock and Foreign Exchange Market Analysis

Good morning.

It’s Eles.

Real-time tweets are here.

twitter

How was yesterday's analysis?

The Dow index rebounded near the lower bound of the downside target from yesterday's analysis.

Because it’s earnings season, it seems to be moving a bit roughly.

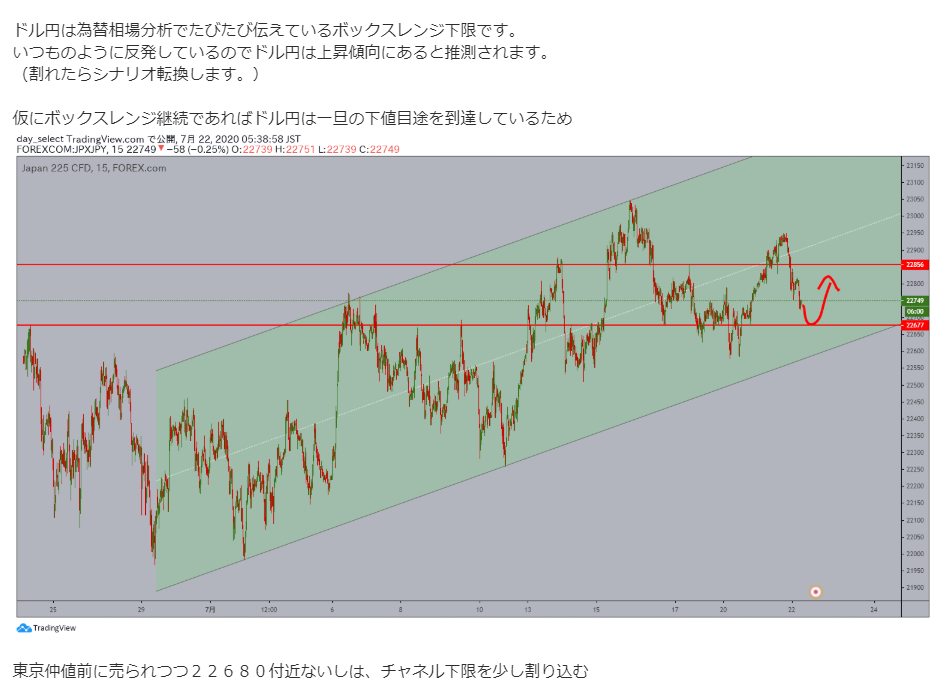

The analysis of the Nikkei 225 was

This was the analysis.

It seems to have rebounded as expected here as well.

However, given the narrow price range, it seems that profits have not yet been taken.

From today the Tokyo market will be closed, so the Nikkei is expected to move in a thin range.

Let's also take a look at the foreign exchange market.

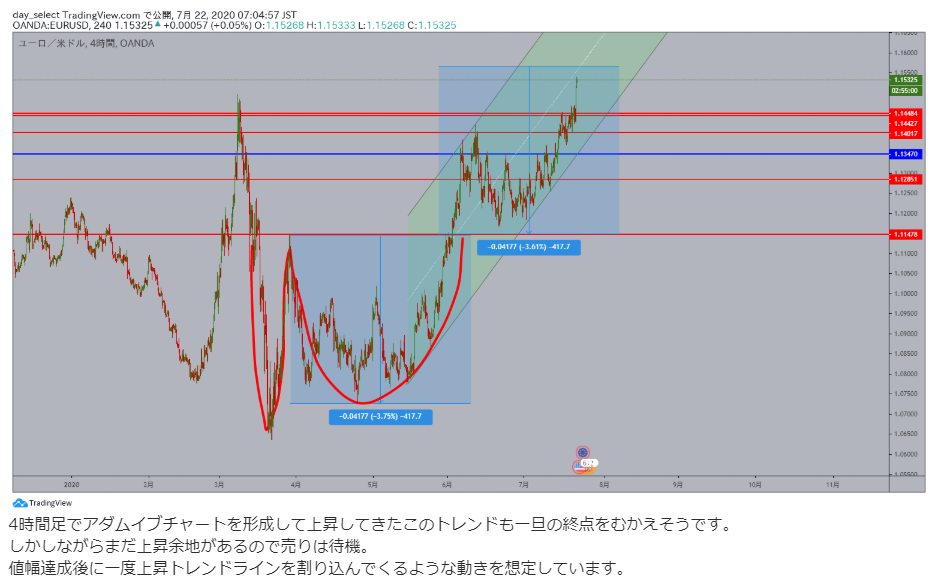

EURUSD

The EURUSD was viewed using the E-calculated price range.

The price range target was achieved and it rebounded a little after slightly breaking through.

This analysis was the target price range anticipated back in May before writing, so it took over two months to reach it.

I think the timing was quite appropriate as well.

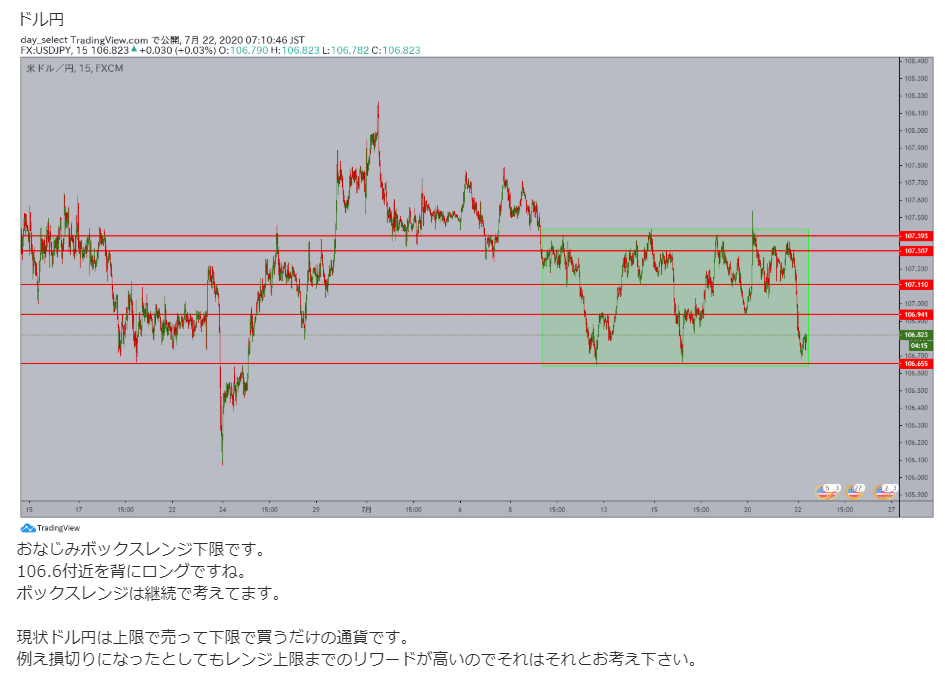

USD/JPY

This is how the USD/JPY article went.

A stable USD/JPY, isn’t it.

It has rebounded firmly and is currently around 107.17.

Now, I’ve introduced part of the articles.

I post almost every day, but the articles tend to be long.

I apologize for the time it takes to read, but since I cover multiple stocks, I can’t help it—I’d be grateful if you could read as best you can.

With that, here is today's analysis.

※This article does not give buy/sell timing or recommendations.

Please make your own investment decisions.

× ![]()