Profit Update! The resale of "Breaking FX" has started — Compare the performance of three currency pairs!

On July 21, 2020, the popular breakout EA "Breaking FX" has been re-released for sale!

Although a drawdown occurred in the latter half of June,profits were updated in just two weeks!

It is a breakout EA with no blind spots, boasting a maximum stop-loss of 20 pips and a win rate of 87%.

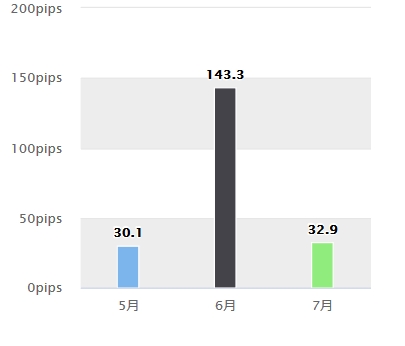

Forward Performance

We started tracking from May 18, and as of July 21, in about+200 pips gained over two months.

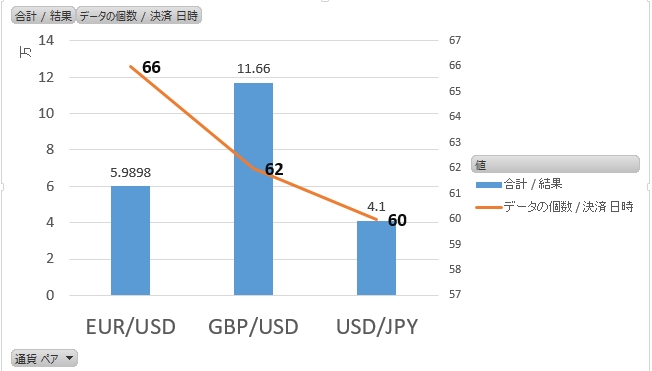

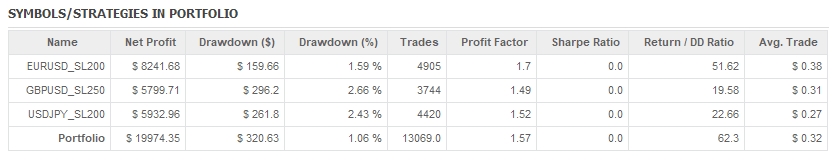

▲Profit and loss and number of trades by currency pair (5/18-7/21)

In comparison to volatility, GBPUSD yields the largest profit. Since trailing stops are used for settlements,

higher volatility yields higher profits.

Now that USDJPY volatility is decreasing, you can cover profits by incorporating other currency pairs into the portfolio.

Evaluating and Tuning a High-Quality Overseas EA

Actually, Breaking FX seems to be based on a highly regarded breakout EA that was originally sold overseas.

However, the original EA had many parameters and high customization, and the currency pairs were not specified.

Alberto, the seller, bought the copyright from the developers, searched for the best currency-pair combinations, and adjusted the parameters to create Breaking FX.

Because for a highly flexible EA, parameter tuning and currency pair selection are crucial elements, in other words, the set file that comes with Breaking FX is essential.

With forward testing by several people for about four months, and then re-coding, this could almost be considered a different product.

Backtest Data Included!

BreakingFX can be operated on 30-minute and 1-hour charts. It can also be operated with stop-loss settings from 15 to 25 pips (GBPUSD 20 or 25).

Fortunately, each backtest data is included, so you can operate with your preferred settings.

1 Hour vs 30-Minute Chart

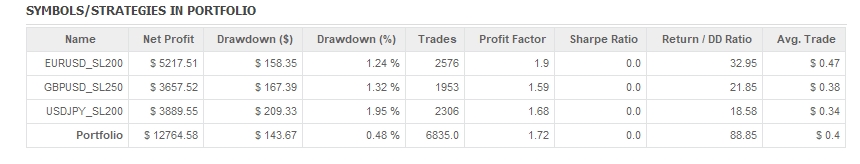

Backtest results with the settings: 1-hour chart, USDJPY_SL20pips, GBPUSD_SL25pips, EURUSD_SL20Pips

(2010–2019, with lot size 0.1)

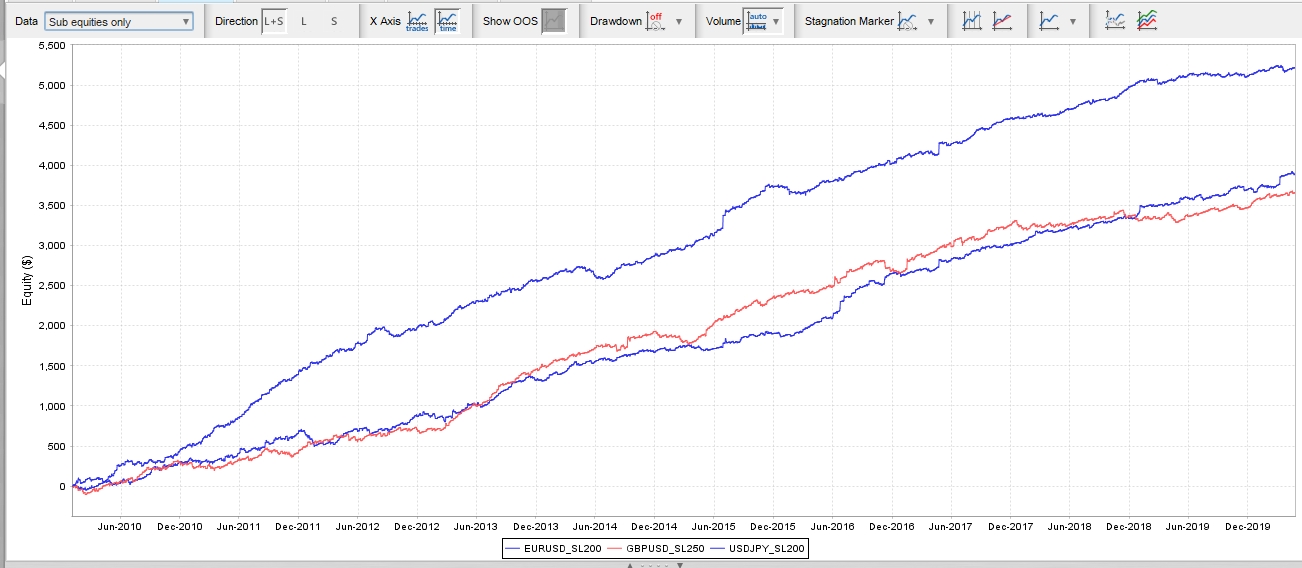

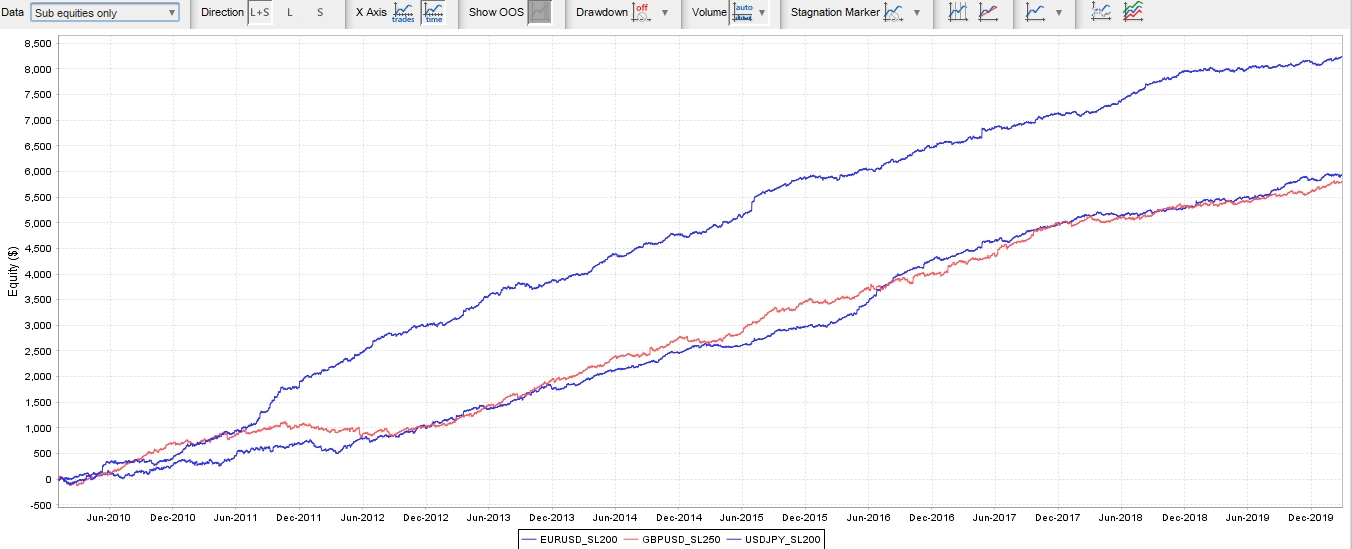

EURUSD > GBPUSD > USDJPY in performance.

Backtest results with the settings: 30-minute chart, USDJPY_SL20pips, GBPUSD_SL25pips, EURUSD_SL20Pips

Compared with the 1-hour chart, the number of trades is doubled,for EURUSD the maximum drawdown hardly changes, while profits are 1.6 times.

Across all three currency pairs, the number of trades is doubled, the maximum drawdown is doubled, and profits are 1.5 times. Although a larger maximum drawdown slightly worsens the return performance, this setting is recommended for those who enjoy trading across multiple timeframes.

▲ Profit and loss curves by currency pair.

What are the recommended margin and expected annual return?

Now, the recommended margin, assuming three currency pairs are operated simultaneously,

1-hour chart settings

USDJPY 45,000 yen

GBPUSD 73,000 yen

EURUSD 50,000 yen

per 0.1 lot required margin.

(4.5+7.3+5)+(1.5*2)=19.8

The annual average profit is 1,276 USD (about 136,000 yen), soan expected annual return of about 68%.

In portfolio operation, the maximum drawdown can be smaller than when operating a single currency pair, and the 1-hour timeframe demonstrated this precisely.

Position offsets reduced risk, and with three currency pairs, the maximum drawdown was $148 (about 15,000 yen), making the required margin smaller.

If you're uneasy, using max DD × 3 would be safer.

30-Minute Chart

(4.5+7.3+5)+(3.4*2)=23.6

The annual average profit is $1,997 (about 210,000 yen), sothe expected annual return is 89%.

Breakouts with SL of 20-25 pips and win rates exceeding 80% are hard to find.

Given the high ratings in reviews, you can infer its performance.

Don’t miss the timing of the re-release and profit updates!

Written by Tera GogoJungle Marketing.