Low drawdown risk return rate 9.52 real operating rate 100% ESCADA-USDJPY

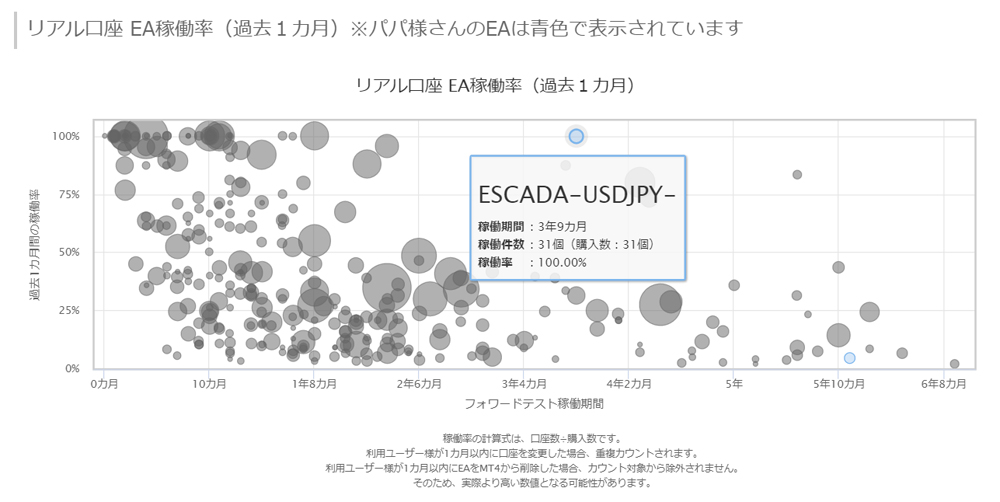

ESCADA-USDJPY-has delivered steady results for about 3 years and 9 months.

Moreover, recently, real account usage has risen to 100% (31 in use, 31 purchased).

Because this EA has a long performance measurement period, those who purchased it at launch have used it for more than three and a half years, proving that they have continued to trade the EA in the FX market.

From our side as the provider, there is nothing more gratifying than this.

As stated on the EA page, it is an EA for USD/JPY, including day trading, scalping, early-morning entries, and low drawdown; in addition to its strong performance, the low drawdown is also highly valued.

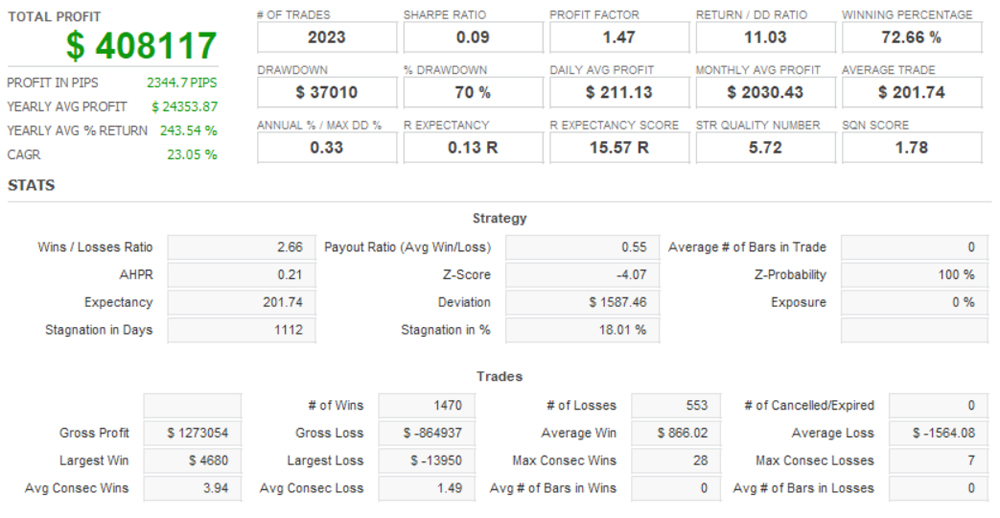

17-year TDS backtestESCADA-USDJPY 10277 Gogojungle TDS backtest analyzed with Quant Analyzer.

Backtest settings:

Spread: Variable

, Lots: 0.01

※The units are in dollars, but the backtest data are based on Japanese yen from OANDA Japan, so the units are in yen.

Annual average profit: ¥24,353

Monthly average profit: ¥2,030

Annual return: 6.80%

Win rate:72.66%

Average annual number of trades: 119

Average profit per trade: ¥866

Average loss per trade: ▲¥1,564

Maximum drawdown: ¥42,855 from backtest

Profit factor 1.47

Risk-reward ratio 9.52

This is the result.

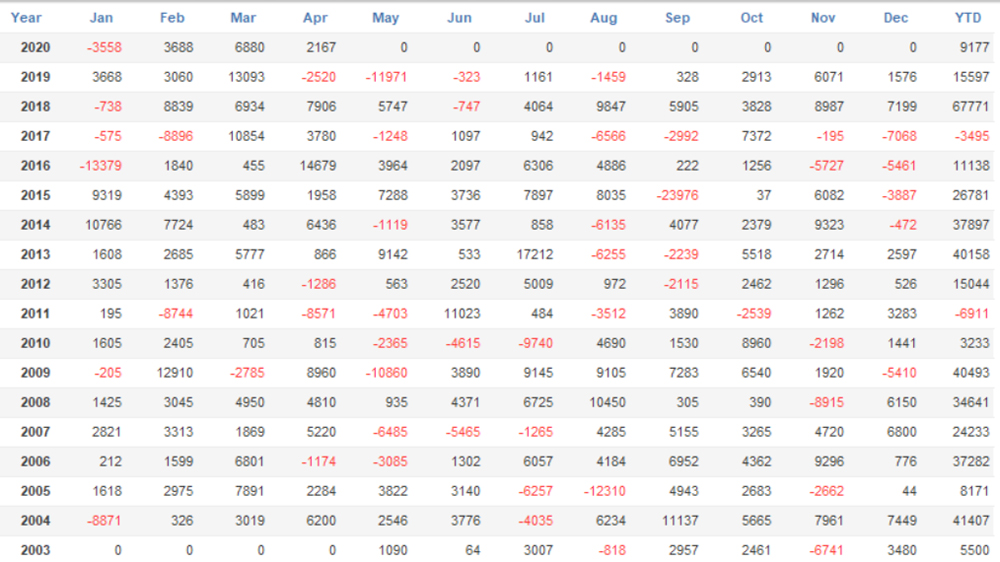

Monthly performance table

The years with losses on an annual basis were 2011 and 2017, with only small losses.

【What are the recommended margin and return?】

The calculation formula for the recommended margin (assuming 25x leverage) used in GogoJungel's system-trade performance measurement is

10,000 units × exchange rate of the traded currency in yen ÷ 25 × average number of lots ÷ 0.1 × maximum number of positions + maximum loss (using the backtest maximum drawdown) × 2×2

therefore,

¥1,072,000(Today’s rate) ÷ 25 × average number of lots ÷ 0.1 × 2 positions + ¥42,855(maximum drawdown) ×2

Due to compounding, the average lot size was estimated at 0.2 lots.

The recommended margin is ¥358,030.

In comparison, the annual average profit is ¥24,353, so the expected annual return is 6.80%.

Many people are reintegrating an EA that steadily builds up with low drawdown into their portfolios, and I think the real account utilization rate has risen to 100%.

Written by Hayakawa