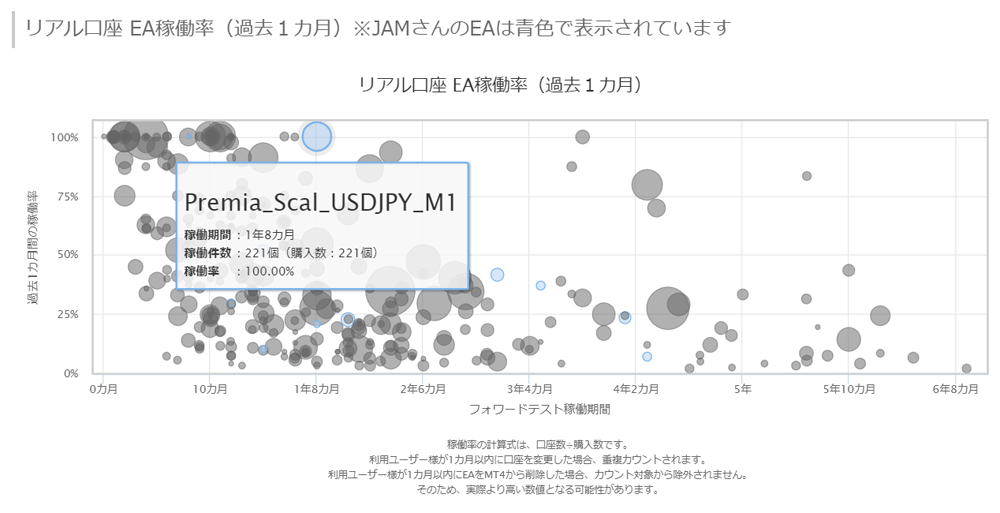

The mystery of Premia_Scal_USDJPY: 100% real operating rate despite morning scalping with 20 positions and purchasing 221 units

Premia_Scal_USDJPY_M1 is a high-risk EA that performs morning scalping, aiming to accelerate profit accumulation by holding up to 0.1 lot × 20 positions, but after about 1.5 years of operation, the performance is solid with a profit of ¥632,820.

Although it's described as high-risk, the real-world usage rate among actual customers is astonishing: 221 active instances, 221 purchases, a 100% activation rate according to the data, and as of now, 1 year and 8 months after the start of operation, everyone is using it.

With its fast margin-increase pace, the EA has contributed to as many as 221 customers in some way. It is meeting expectations. This makes me feel that, as a provider of investment content, it is a privilege to operate, and I think the developer JAM will become even more involved in development.

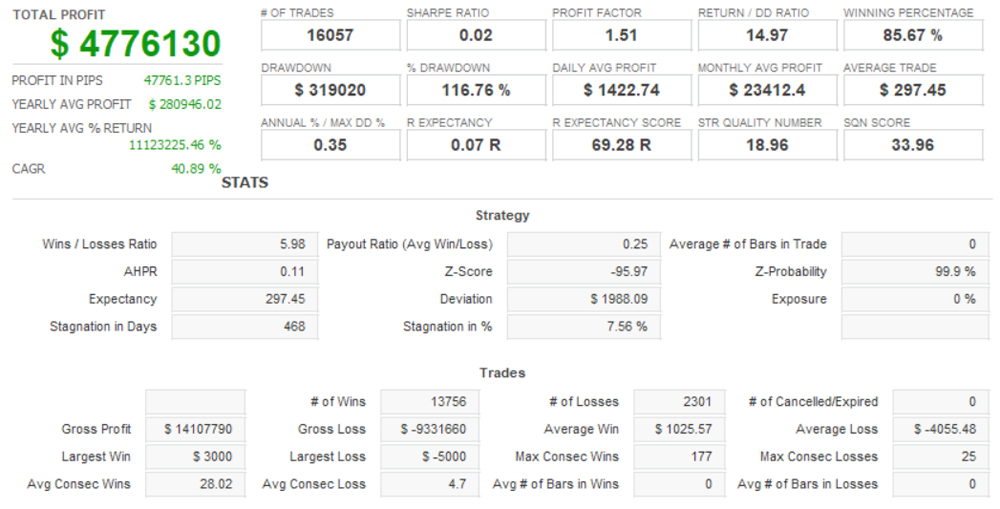

Today, we will review the results of applying Premia_Scal_USDJPY_M1 15757 Gogojungle TDS backtest to Quant Analyzer, examining risk and return.

Backtest is

Spread : Variable

Lots : 0.1

and is conducted with these settings.

※The units are in dollars, but the backtest data are based on Japanese yen from OANDA JAPAN, so the units are in yen.

Annual average profit: ¥280,946

Monthly average profit: ¥23,412

Annual return: 18.15%

Annual average number of trades: 944 trades (the number of positions is high because it holds up to 20 positions).

Average profit per win: ¥1,025

Average loss per trade: ▲¥4,055

Maximum drawdown: ¥344,410 from the backtest

Profit factor 1.51

Risk-reward ratio 13.86

This is the result.

Monthly performance table

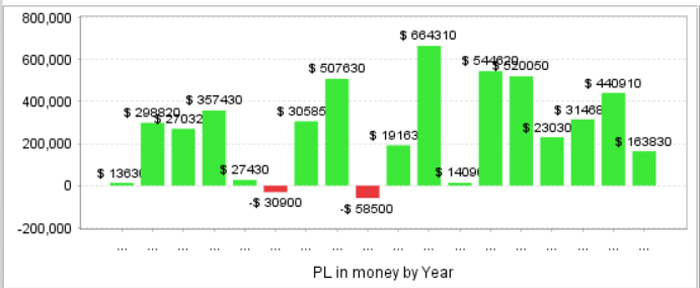

Annual performance graph

Apart from 2008 and 2011, it has been profitable on an annual basis.

According to NEET's FX automated trading blog, which investigates the spreads used by Dukascopy for TDS, NEET's FX automated trading blog, according to

In the USD/JPY rate, the spread has changed every five years since 2005

20051.61→20101.01→20150.41→20190.37(pips)

Therefore, since spreads have been changing, more recent years better reflect the EA's capability, but even under the spread environment before 2015, aside from the two years mentioned above, the annual results were profitable, which is a noteworthy finding.

【Recommended margin and return?】

The calculation formula for the recommended margin used in GogoJungle's system-trade performance measurements (based on 25x leverage) is

10,000 units × Japanese yen rate of the traded currency ÷ 25× average number of lots × 0.1× maximum number of positions + maximum loss (using the backtest's maximum drawdown) × 2

Therefore,

1,074,000(today's rate) ÷ 25 × average number of lots ÷ 0.1 × 20 positions + ¥344,410(maximum drawdown)× 2

The recommended margin is ¥1,548,020.

By contrast, annual average profit is ¥280,946, so the expected annual return is 18.15%.

Compared with the EAs for which TDS backtests have been written so far, the expected annual return isn't higher; however, one reason the 221 purchased EAs have 100% real-account usage could be that the forward-test period of 1 year and 8 months, and customer operational drawdowns, are lower than those in the 17-year backtest.

Written by Hayakawa