Annual average profit ¥643,819, expected annual return 38.61%, truly an aggressive scalper

Under the catchphrase of a blend of scalping and mid-rate trading, Aggressive_Scalper_M1_USDJPYAggressive_Scalper_M1_USDJPY, which has been rising in performance and popularity, was analyzed by running the TDS backtest dataAggressive_Scalper_M1_USDJPY 19667 Gogojungle TDS backtest in Quant Analyzer.

The forward test results have shown improvements as follows.

The previous article on June 15.

According to the section “Real account usage rate by customers who purchased” (real accounts used ÷ number of purchases), it was 100.00%, with 154 real accounts used and 154 purchases; as of today, it has risen to 174 real accounts used and 174 purchases, an increase of 20 purchases, while the real account utilization rate remains at 100.00%.

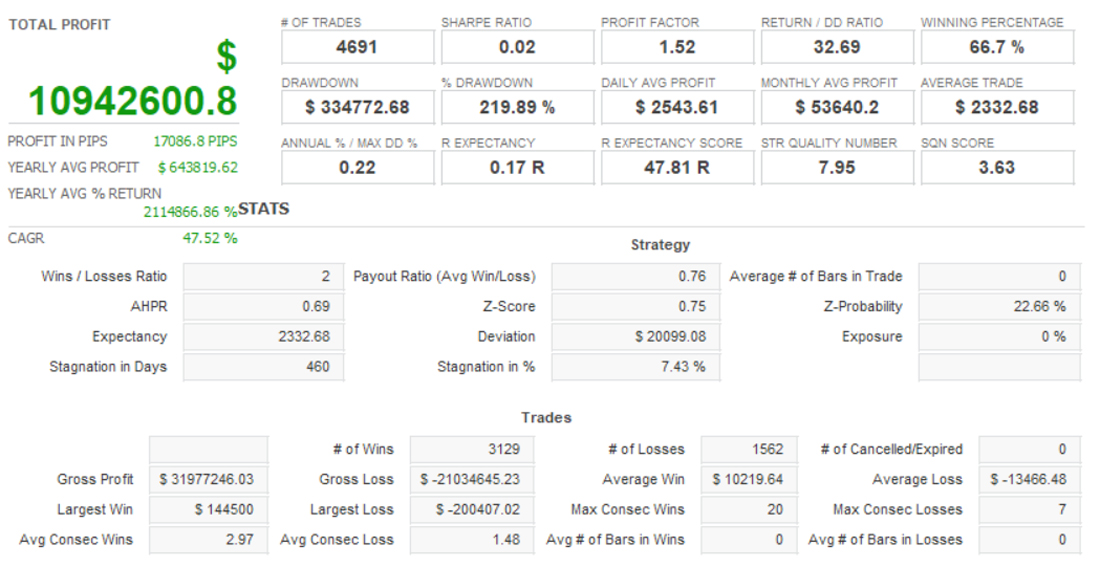

Now, let's look at the 17-year TDS backtest.

Spread: Variable

Lot: 0.1 lot(0.1lotで設定しましたが、自動的に1.0lotsでエントリーすることもありました。)

and this is how it was carried out.

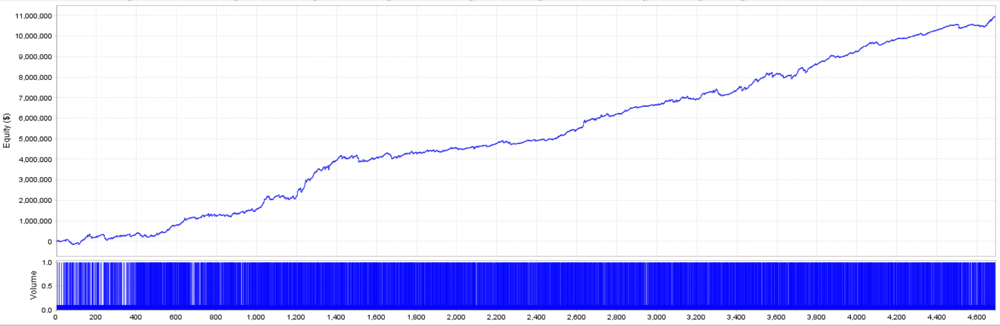

The profit and loss curve is as follows.

On the Aggressive_Scalper_M1_USDJPY EA page, it states that it uses USD/JPY on a 1-minute chart, with up to 2 positions, performing scalping and mid-rate trading.

Note: The unit is in dollars, but the backtest data uses the Japanese Yen base from OANDA JAPAN, so the unit is Japanese Yen.

Annual profit: ¥643,819

Monthly average profit: ¥53,640

Annual return: 38.88%

Win rate:38.61%

Average annual number of trades: 223

Average profit per trade: ¥10,219

Average loss per trade: ▲¥13,466

Maximum drawdown: ¥404,616 from backtest

Profit factor 1.52

Risk-Return ratio 27.04

Thus.

Monthly performance

Except for 2003, there has not been a year with an overall loss.

In recent years, losses on a monthly basis have greatly decreased.

【Recommended Margin and Return?】

The calculation formula for the recommended margin used in GogoJungel's system-trade performance measurement (assuming 25x leverage) is

10,000 units × the exchange rate of the traded currency in JPY ÷ 25 × average lot × 0.1 × maximum number of positions + maximum loss (using backtest maximum drawdown)×2

Therefore,

¥1,069,600(today's rate)÷25÷0.1×2 positions + ¥404,616(maximum drawdown)×2

The recommended margin is ¥1,667,144.

In contrast, since the annual average profit is ¥643,819, the expected annual return is 38.61%.

It could indeed be called an aggressive scalper.

written by Hayakawa