Use Barusara's probability of bankruptcy to examine the safety of the EA

Are you aware of Balsara's ruin probability?

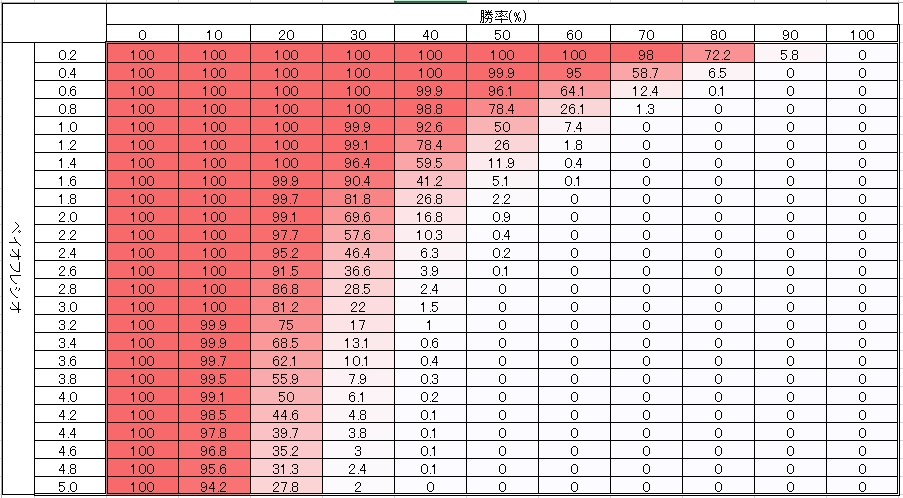

"This is a table that shows the probability of ruin—i.e., the probability you go bankrupt—if you continue trading with that risk-reward ratio and your win rate falls below a certain percentage."

If you have studied discretionary trading, you may have seen this at least once.

▲Balsara's ruin probabilityQuoted from here

Payoff ratio and the risk-reward ratio are the same thing,

(average profit) ÷ (average loss)

They are. For example, if the average profit is 1,000 yen and the average loss is -1,500 yen, the payoff ratio would be 0.66.

Using this payoff ratio, we derive from the above chart what win rate is required for profits to remain after hundreds of trades.

A payoff ratio of 0.6 yields a 12.4% ruin probability at a 70% win rate, and 0.1% ruin probability at an 80% win rate.

Ideally, you'd like to trade with as close to zero ruin probability as possible, but that's quite difficult.

Evaluating EA safety with Balsara's ruin probability

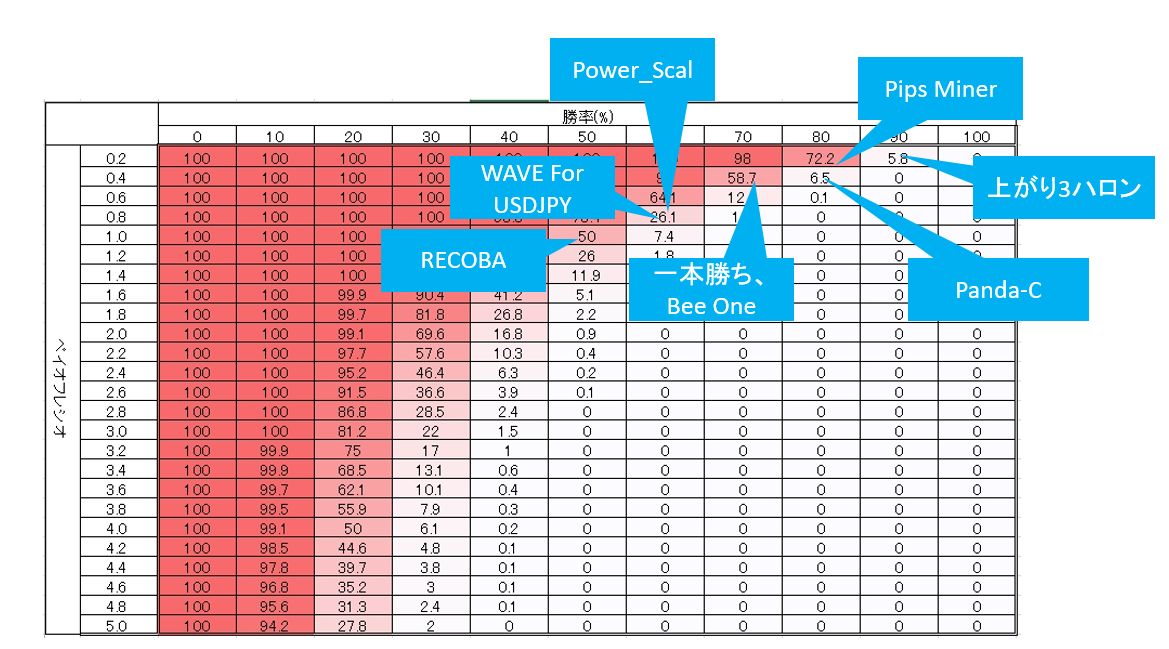

We tried applying a representative EA with a long-term forward performance to Balsara's ruin probability table.

Pips_Miner is calculated to have a ruin probability of 72%, but in reality it is close to a payoff ratio of 0.4, and the win rate is over 80%, so I think the ruin probability is nearly 6.5%. If there were a more finely grained ruin-probability table, that would be nice, but I couldn't find one quickly, so please forgive me...

When mapped to ruin probability, even excellent EAs end up in the 50% ruin-probability range. A 10% difference in win rate can sharply reduce ruin probability, so

it's also true that EAs using trailing stops are more prone to fluctuations.

We reference the average profit and average loss in forward testing, so there may be future variations, but

in both backtests and forward tests, choosing an EA with as low a ruin probability as possible according to Balsara's ruin probability can lead to

stable profits in the long run.

However, maximum drawdown and unrealized losses are not taken into account, so the risk of stop-out due to margin shortage is a separate matter.

Also, the rate of capital growth varies depending on the number of trades and the average profit per trade (or gained pips), so please use this only as a guideline for "forward-safety".

Those who prioritize win rate should pay attention to how the risk-reward ratio is designed, and

if you prioritize the risk-reward ratio, it serves as a guideline for determining what win rate is needed to expect profit increases.

If the risk-reward ratio is added as an evaluation criterion, the range of EAs to choose from would likely widen even more.

Written By Tera GogoJungle Marketing.