Dollar-yen: If we lag, the momentum of the rise will fade away

USD/JPY did not rise significantly despite solid U.S. jobs data and wage statistics,

and it looked like it was aiming to stay within the daily cloud and could not be easily surpassed,

as you cannot pass this point without paying attention to it.

Seasonally, there have been many occasions in the past where big moves occurred around this time,

so participants may have anticipated that a risk-off move observed in Thursday’s New York market after the employment data

could occur again.

In the end, the first week of May passed without incident,

keeping the possibility that USD/JPY could test higher intact as we move into the second week of May

while watching near-term moves and probing for the remaining upside scenario.

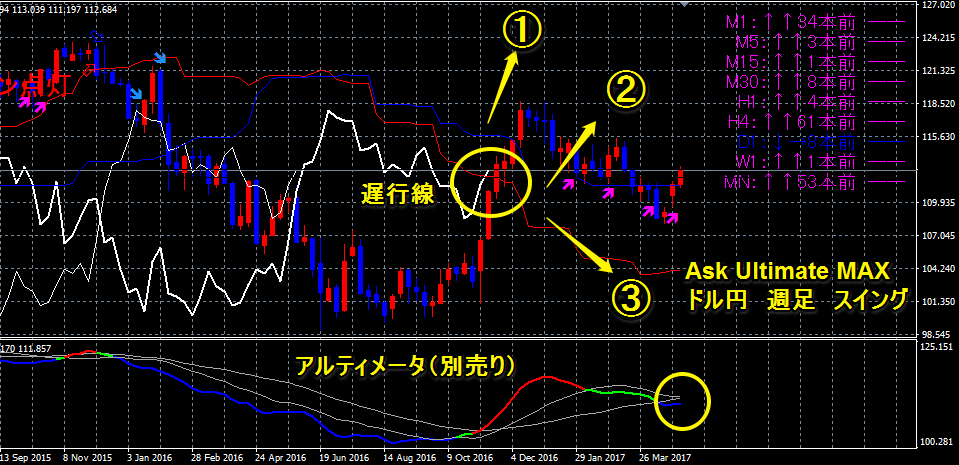

The chart is the Ask Ultimate MAX USD/JPY weekly chart with sub-indicator Ultimater,

First, in Pattern ①, the lagging line resumes a rising trajectory at the same angle as during the Trump-era celebratory rally,

which at present is becoming increasingly difficult but still possible. If this pattern collapses,

the momentum of the rise is likely to fade.

In Pattern ②, the lagging line temporarily falls below the real line, but if the real line remains above the cloud upper boundary and maintains its intention,

the lagging line may again cross above the real line and resume rising; if this pattern holds, there is also a possibility of testing lower again.

Pattern ③ has the lagging line below the real line, and if it cannot attempt a real-line breakout,

the scenario could eventually aim for the 100 yen level, though the likelihood is low at present.

In any case, it seems that May and June markets will unfold in one of these scenarios,

and while there are many fundamental factors, for now the upside remains possible,

but if you judge from near-term moves, the upside would require a solid breakout above 113 yen to reach 115 yen;

the downside could extend to around 111 yen if Thursday’s pullback low breaks.

★ Indicators used in this USD/JPY chart

They detect signs of a major market turning point and signal optimal timing for exits!

With just this, you can grasp the market flow!