The euro-dollar is preparing for a major reversal with full commitment

In the U.S. employment statistics released on the 5th, the contents were solid, so

expectations for a June rate hike rose,

but the rise in USD/JPY ended up being limited despite that.

In terms of the content, it was not strange to see it close around the 113 yen level,

and it is also true that, even with strong U.S. data, there is less and less appetite for buying dollars.

In particular, the movement on the previous day may have influenced this as well・・・・・・

In Thursday’s New York market, crude oil and U.S. stocks collapsed, and USD/JPY aimed to break 113 yen

but then suddenly tumbled.

Market participants initially thought, could Sell in May have begun as a nightmare? But

the movement was temporary, and after the following day’s employment data release there was no speculative action.

Now, the currency I want to focus on this time is that even though the U.S. data is strong, dollar selling is starting to take hold

and I focused on the euro-dollar.

The euro-dollar exchange rate has seen repeated breaches of near-term support toward 1.00

across various sites, but in this decline, it slightly dipped below the 2015 low

and then reversed, so on daily charts the Ichimoku cloud is being broken above

and it is rising while being supported by the cloud.

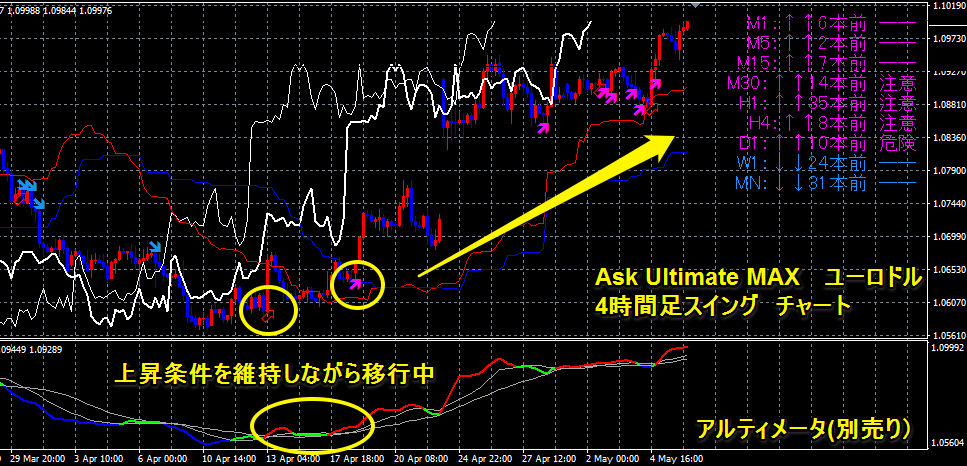

The chart on the euro-dollar 4-hour timeframe shows a clear buy signal in a rebound phase.

Last year during Brexit, the euro was sold off, but currently both the pound and the euro are being bought back

and particularly the euro is seeing concerns within the euro area ease due to the presidential election, so currently

for dollar-straight currencies, the U.S. dollar is being sold more dominantly,

which means the euro-dollar exchange rate now has a sudden influx of factors to reduce selling pressure.

As for future euro movements, with the France presidential election results expected early next week, the market is already

driven toward euro buying, but if there is volatility, euro selling could push it back temporarily.

However, on the weekly chart, a large bullish candlestick is forming, and we are approaching a thin cloud twist next week,

and breaking this point could be comparable to the starting point of the decline during Brexit in the UK,

so investors looking at the euro-dollar pair may have a changed perspective.

It is possible that investor perspectives on the euro-dollar pair will change accordingly.

★ Indicators used on the euro-dollar chart

They detect signs of a major market reversal and guide you to the perfect moment to exit!

With this, you can grasp the flow of the market!