Using Swing High and Swing Low for Market Context to Help Beginners Move Beyond the Beginner Stage "SwingHL-mesen"

There is no doubt that 'environment awareness' is important in trading.

There are a great many traders who are looking for a convenient indicator that can properly perform 'environment awareness' on charts, and developer Eik's MT4 indicator 'SwingHL-mesen' has grown to well over 1,000 users, so I would like to report on its contents.

The MT4 indicator 'SwingHL-mesen' has the following effects and features.

✅ It marks highs and lows on the chart with clear rules.

✅ It allows you to set Swing Highs and Swing Lows.

✅ It can draw rule-based waves.

✅ It displays pullback lows and retracement highs as lines.

✅ It makes bullish and bearish markets easy to identify at a glance.

✅ Trend reversals are visually identifiable.

✅ Can be used with trailing stops.

✅ It notifies you by email when pullback lows and retracement highs are updated and when a trend reversal occurs.

✅ Formalizing environment awareness improves the quality of market analysis.

However, what I found as I read on is that, in addition to the indicator helping traders with 'environment awareness', the accompanying manual is also excellent, with depth comparable to a trading book.

Of course, if you want to delve deeper, you should pick up trading books, but it is packed with knowledge useful for trading.

It also discusses understanding price movements from market psychology and crowd psychology that form highs and lows.

To give a glimpse into Eik's thoughts on price movement:

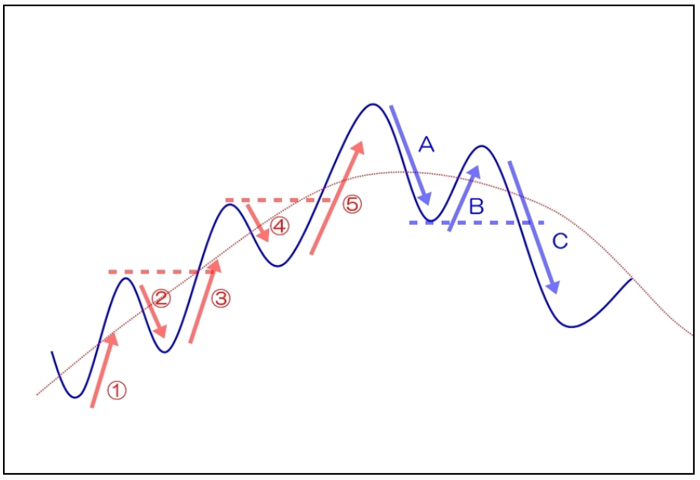

‘① Large institutions and other big traders with enormous capital begin buying and push up the price. The game begins!’

‘② Some profit-taking positions and contrarian traders enter, causing the price to adjust.’

‘③ However, seasoned individual traders notice the entry of large traders, take long positions, and price rises. Furthermore, the loss-cutting of contrarian traders in (②) pulls the price up. Seeing this, individual traders enter with more buy positions, and the price suddenly surges! …’

These are price traces left by buying and selling forces formed from market psychology and crowd psychology.

“Chart Analysis” and “Environment Awareness” are nothing other than analyzing the market's power relationships, he says.

By performing 'environment awareness' on the chart, and having as much fundamental knowledge as possible, it becomes advantageous to trade; this is clear from Eik's insights.

To perform this 'environment recognition' accurately, the MT4 indicator 'SwingHL-mesen' is based on Larry Williams's theory, which defines Swing Highs and Swing Lows by checking six candles to the left and right of the highs and lows.

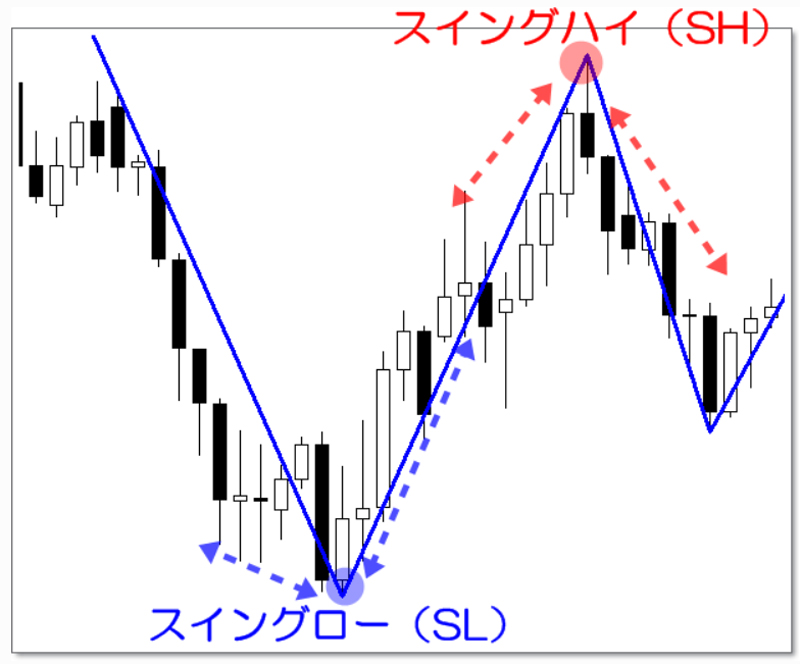

Swing Highs and Swing Lows Rules

Swing High

⇒ A candle with a high lower than the peak forms six candles to the left and right around the peak, making a Swing High.

Swing Low

⇒ A candle with a low higher than the trough forms six candles to the left and right around the trough, making a Swing Low.

As in the image above, both Swing High and Swing Low are established if the starting candle and the six candles on each side show bullish and bearish candles.

The six candles do not have to be consecutive; some people use five or three as the definition.

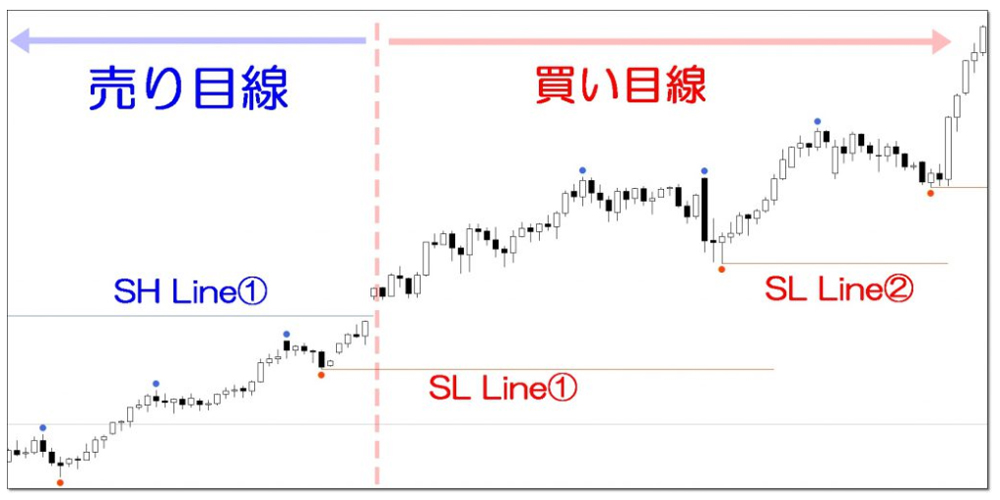

In practice, to use it for 'environment recognition', as in the figure below, when the SH Line ① (Swing High) line is broken and the rate continues to rise, you shift from a selling perspective to a buying perspective.

It is a crucial indicator for grasping the overall direction, and by viewing across multiple timeframes—1-hour, 4-hour, daily, weekly, etc.—the accuracy of recognition improves further.

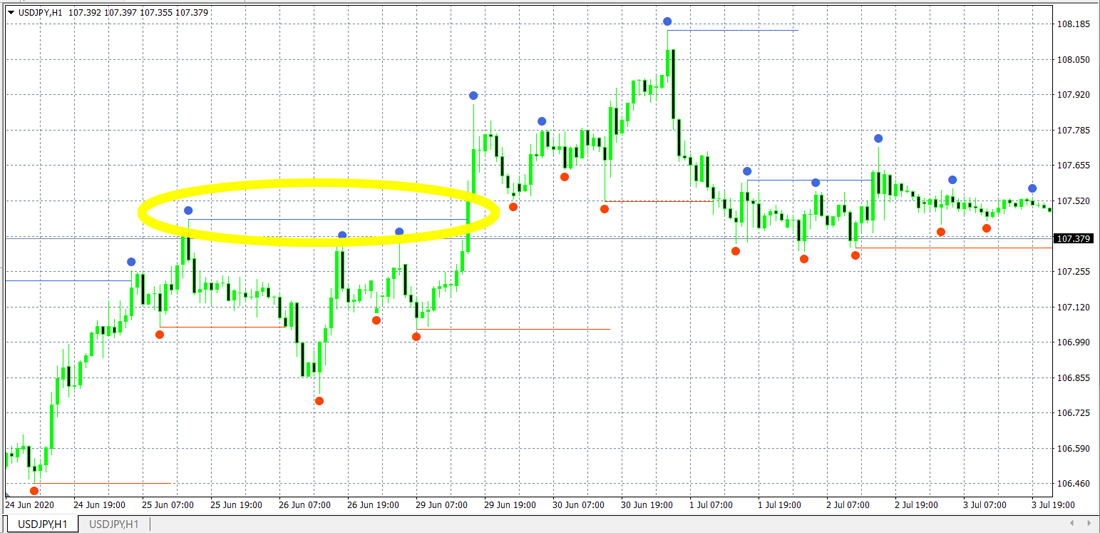

I placed the MT4 indicator 'SwingHL-mesen' on my MT4 USD/JPY 1-hour chart to check it.

The yellow-framed line is the Swing High line; when the USD/JPY rate breaks that line and rises, as of 15:00 on June 29, shifting to a buy view would have yielded a solid winning trade.

Written by Hayakawa