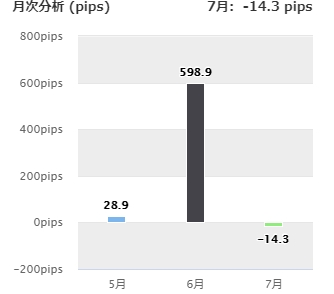

System Trading Ranking for June 2020

Wasn't June 2020 a month when many EAs performed well?

In a fairly clear trend market, it seemed that trend-following EAs were active.

1-Position Pips Gained Ranking (June 2020)

First, a ranking of EAs that earned the most pips per 1 position, regardless of currency pair.

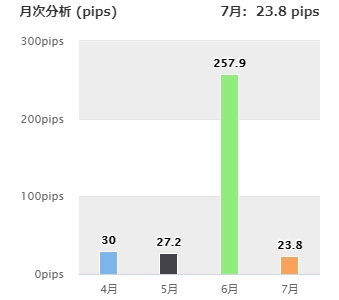

Blue-Seal GBPJPY H1

In June,+598 pips gained.

As an EA that detects the start of a trend and enters, it rode the downward wave of GBPJPY to accumulate a large number of pips.

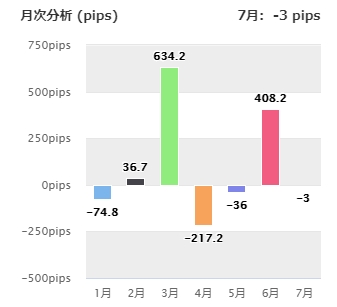

One-Shot-kun

A USDJPY swing EA, with compounding in forward testing.

In June,+408 pipsgained. March also saw large gains. It is said to be a type that has a low win rate but hits big when it wins,

Indeed there are frequent negative months, but the positives far exceed them.

Because the backtest used compounding, the annual average pips performance is not clear.

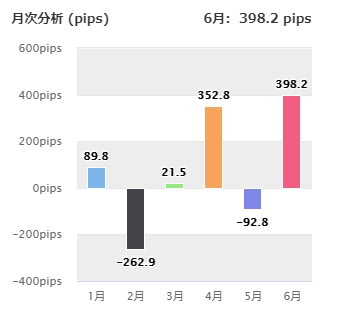

Castor USDJPY M5

USDJPY day-trading and swing EA.

In June,+398 pipsgained.

Max SL 80 with about 60% win rate. Backtests cover only roughly the last two years, so it seems optimized for recent market conditions, but

with low DD, if the win rate is above 60%, steady profits seem attainable.

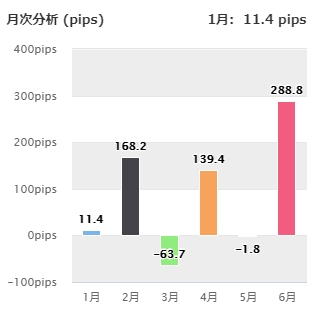

Miami 9:00 AM NZDUSD

NZDUSD day-trading and scalping EA

In June,+288 pipsgained.

With a max SL of 75, while swing-type strategies are performing well, this EA earns pips via scalping.

Backtesting suggests an expected annual gain of +640 pips, and the maximum DD per 0.1 lot is 100,000 yen.

EUROSTAR

EURJPY scalping EA.

Max SL 60 enables low DD trading.

Backtesting suggests an expected annual gain of 1100 pips, and the maximum DD per 0.1 lot is 170,000 yen.

Since this is only June, there is no guarantee of good performance year-round, but among scalping strategies with many pips, the results do not seem to be highly volatile.

Swing-type strategies have good months and bad months, so a good approach might be to balance them by combining multiple swing EAs into a portfolio to smooth out the fluctuations.

Also, when choosing EAs with high pips gained, check the maximum drawdown and adjust your margin accordingly. If the pips gained are large but the drawdown is also large, the time spent enduring it can be quite tough.

ROI Ranking (June 2020)

ROI is calculated as (profit ÷ required margin). If the period's max DD is large or the number of positions is high, the required margin increases, so ROI tends to be lower.

Top ROI tends to come from cases with small max SL and low margin requirements, or those operating with large lots to generate higher profits while having low drawdown.

There is some overlap with the Pips Gained ranking, so here is the list.

Black Rose_AUDNZD is a grid-averaging EA with up to 10 positions. In the forward test's first half month, it had only up to 2 positions, so the required margin was low, and the profits relative to that were large, resulting in a high ROI.

Hyper Booster AUDNZD gains 58 pips, not a lot, but it runs at 1.0 lots and had a max DD of 17,000 yen, resulting in a favorable ROI.

GZ_Freyja_GBPJPY_Alpha_M15 is a two-logic, two-position EA. In June it earned +797 pips, and the high pips contributed to a good ROI.

If ranking by ROI, you should look at a period of at least about 3 months.

This ROI ranking is for reference.

That concludes the June 2020 system-trading ranking!