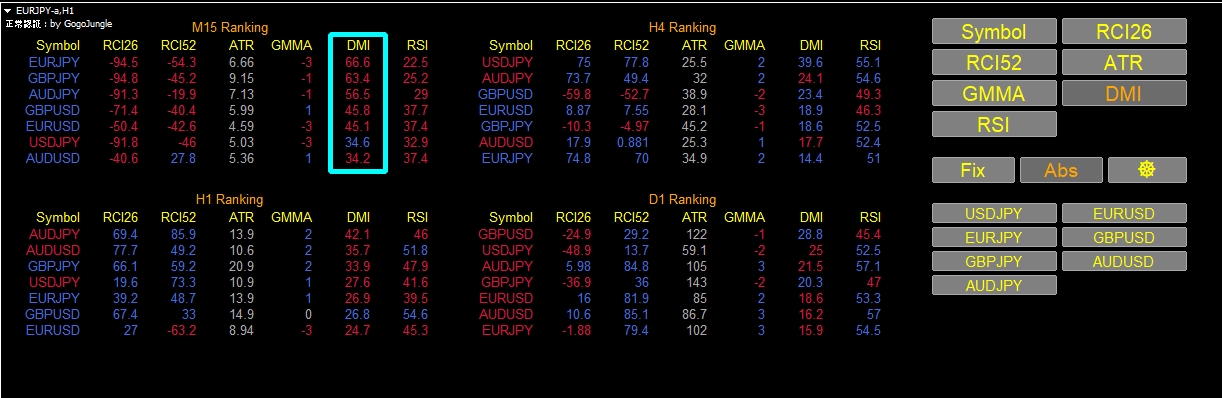

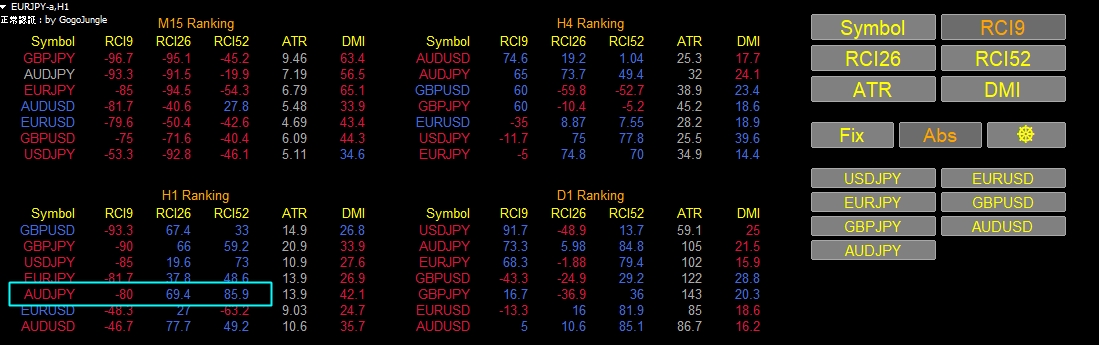

Using multiple technical indicators to monitor currency pairs that are currently a good opportunity, "Technical Ranking"

The "Currency Strength" Index is commonly used to select currency pairs with trading opportunities, but

Discretionary traders, when looking at actual charts, examine MACD conditions and moving average conditions to holistically assess entry opportunities, I think.

Today we introduce a handy indicator that allows you to monitor the state of the indicators you normally use across multiple currency pairs.

Best for monitoring multiple currencies, Technical Ranking

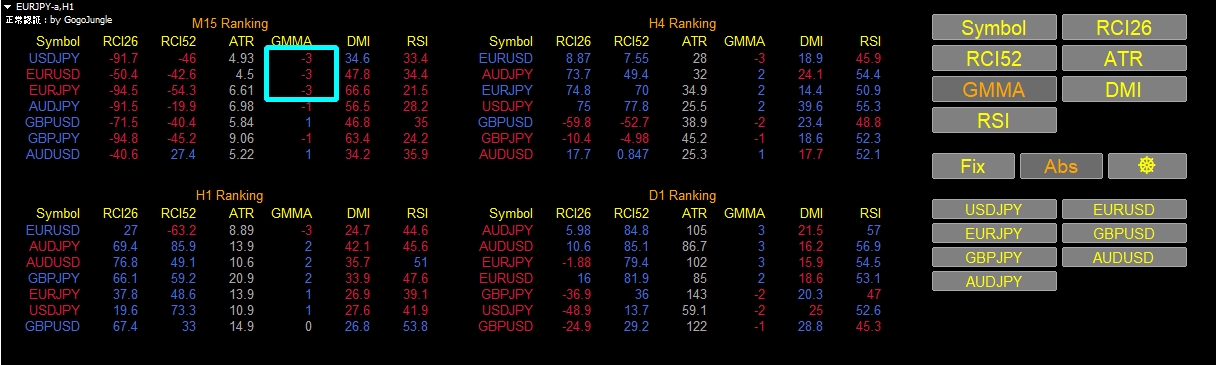

”Technical Rankingaggregates the technical information of the registered currency pairs by time frame and displays it on a single screen.

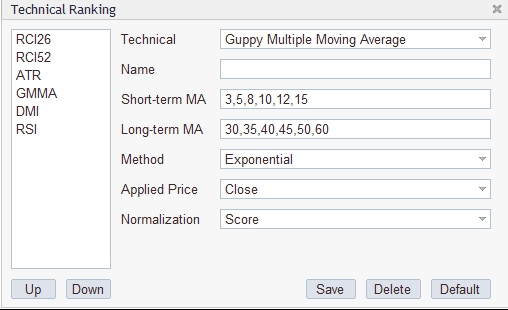

There are more than 40 technical indicators available! You can freely combine and display them.

They are color-coded for up and down, so the direction is understood at a glance.

You can sort by item, highlight specific currency pairs, so you can easily find the best currency pairs for trading.

The currency pairs to display and the timeframes displayed can be changed freely.

In addition, you can configure highly flexible parameters.

By using Technical Ranking to select the most favorable currency pair, and then adding refined trendline analysis and wave analyses to it, it becomes a game changer.

A high-win-rate trading can be expected.” (Quoted from the sales page)

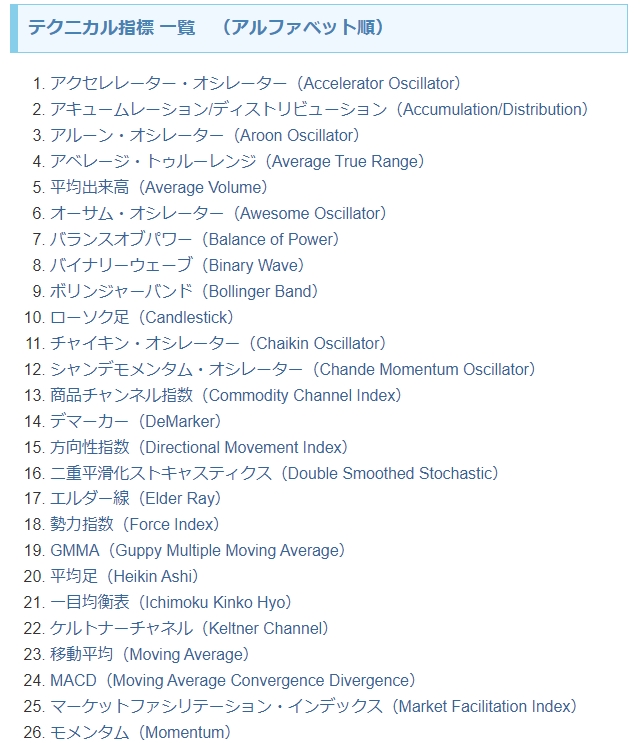

There are more than 40 usable technical indicators! The list can be checked on the author's Peaky FX blog.

▼Technical Indicator Reference

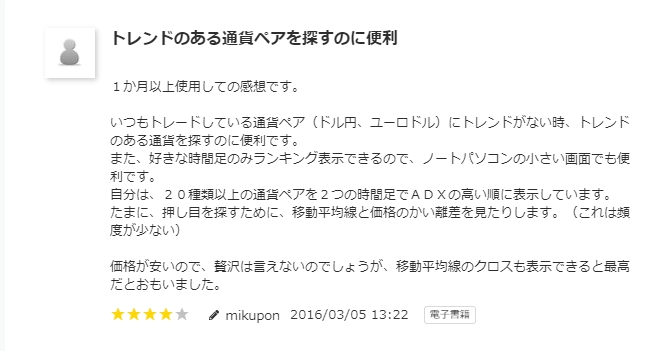

What users say

Trading methods proposed using Technical Ranking

1) Look at the mid- and long-term state of RCI to buy on dips and sell on rallies

If the mid- to long-term is around ±80, you are in a strong trend direction.

2) Enter in the direction of the trend by looking at the Moving Average Perfect Order (GMMA) state

3) Check volatility and trend state with ATR and DMI

With ATR (Average True Range), you can know the volatility of the timeframe (the average range of price movement over the reference period).