Panda-C has a high win rate and pairs exceptionally well with compounding investments - The concept of Risk value and performance comparison

For those who want to know Panda-C better, abbreviated Panda-C_PRO_USDJPY_M15, which is among the top-ranked,

This time

・Trade examples in visual backtesting

・Performance and settings for compounding

we would like to present.

Performance analysis with fixed lot is in the article below,

The recommended margin (calculated so that the maximum DD from backtest becomes 50%) yields an expected annual return of 20.62%, and the annual average profit for operating 1.0 lot was +296,000 yen.

With that in mind, we would like to take a closer look at the details.

What kind of trades do you make?

Let's look at trade examples in visual backtesting.

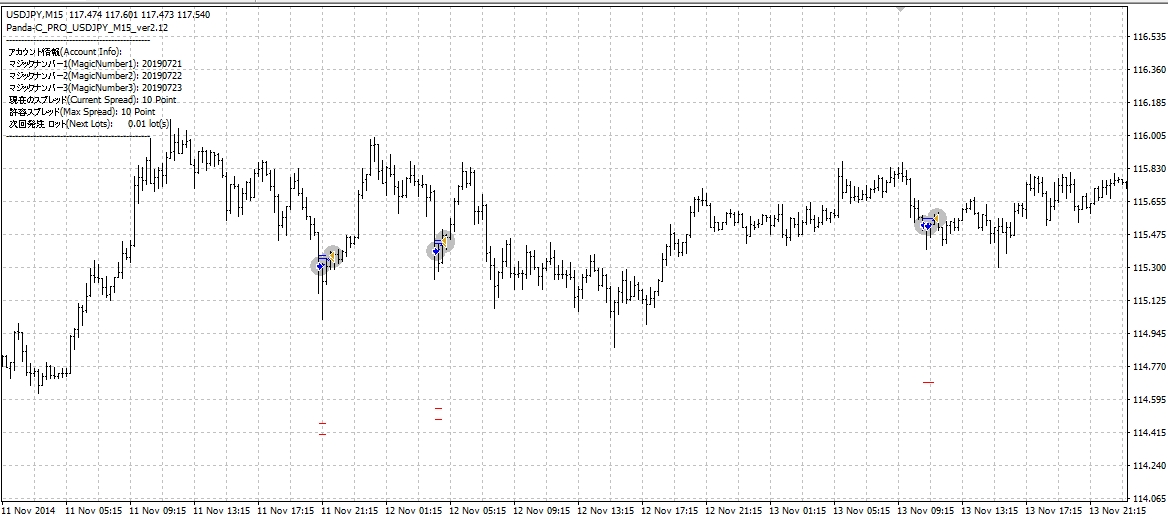

▲Blue: BUYWe enter buys on pullbacks after a price makes a higher high. The maximum number of open positions is 2, but we hold 2 positions at nearly the same time.

By having 2 positions, it is designed to keep the TOTAL positive. The number of positions cannot be changed.

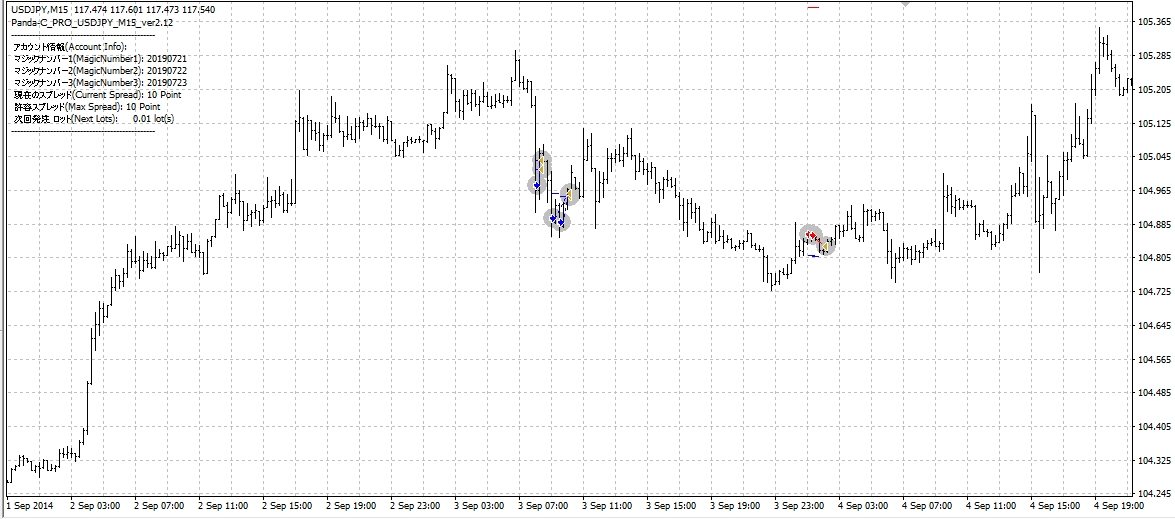

▲Red: SELLThe sell entries are made after breaking the recent low and turning into a downtrend. It is a trend-following trade that matches the 15-minute chart.

▲This is an example where a stop-loss was hit, but philosophically it is the right timing for a trend-following entry, so losses are understandable. The maximum SL is 100 pips, but because it uses a logic exit, the average is -11 pips.

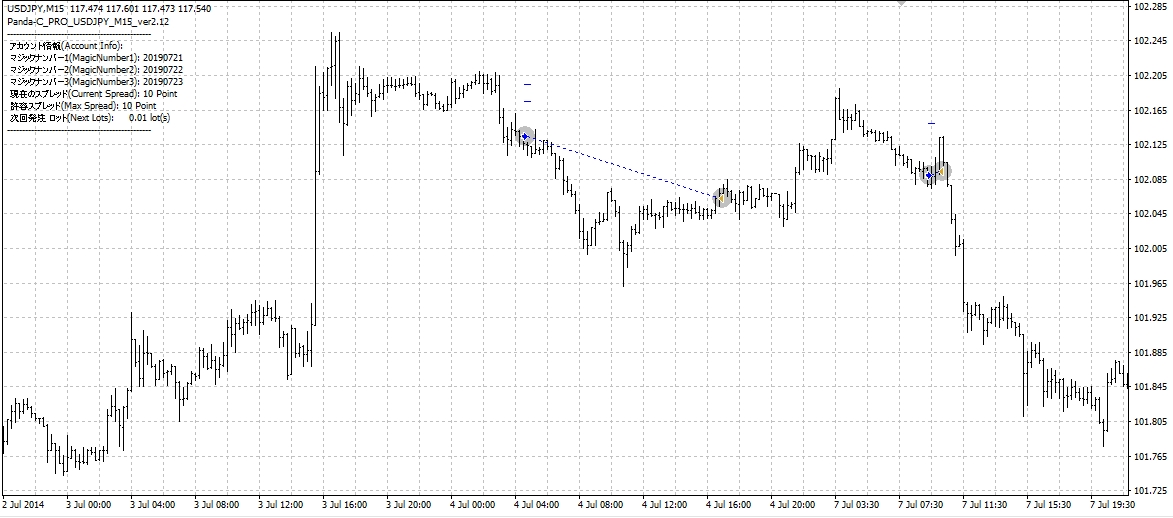

The trading logic is a trend-following trade aligned with the 15-minute chart, with early exit timing,Average gained Pips is 4.2 pips.

Because the gained pips are small, this type tries to maximize profits by increasing the lot size as much as possible.

What are the recommended settings for compounding?

By the way, Panda-C also includes a compounding feature in addition to fixed-lot operation.Average win rate 88%, maximum DD per 0.1 lot is 14,000 yenConsidering this, compounding by allocating larger lots relative to account funds becomes advantageous.

Types of compounding

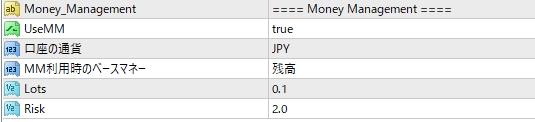

Looking at Panda-C's compounding parameters, you can choose the base money for MM from either “Balance” or “Free Margin.”

If you are running multiple EAs on one account, setting the base money to “Free Margin” avoids conflicts with other EAs’ margins.

The Risk value is a bit different; it is the percentage of the base money allocated to the held lots.

Example: with an account balance of 1,000,000 yen, you would hold 0.2 lots with Risk2.

If you hold 0.2 lots with 1,000,000 yen balance, 180,000 yen is tied up in the position ((4.5*2)*2) = 180,000 yen, and the free margin becomes 720,000 yen. Since the maximum SL is 100 pips, at worst 40,000 yen would be exposed as an unrealized loss. 40,000 yen is small relative to 720,000 yen of free margin, so leaving funds idle would be wasteful.

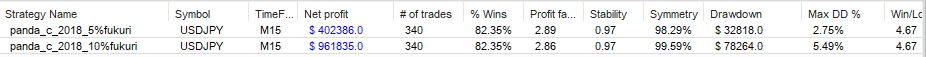

A comparison of compounding with Risk5 and Risk10 over the last two years (2018–2019)

In the case of Risk5, profit of +400,000 yen over 2 years, maximum DD was 32,800 yen.

In the case of Risk10, profit of +960,000 yen over 2 years, maximum DD was 78,000 yen.

Risk10 might seem workable, but considering drawdown, with 1,000,000 yen balance and 1.0 lot × 2, 900,000 yen would be tied up and free margin would be 100,000 yen. Then you might not withstand drawdown (100 pips × 2). So with 25x leverage, Risk5–8 would be reasonable. For those willing to endure a forced liquidation (since 90% of funds remain), Risk10 could also be acceptable.

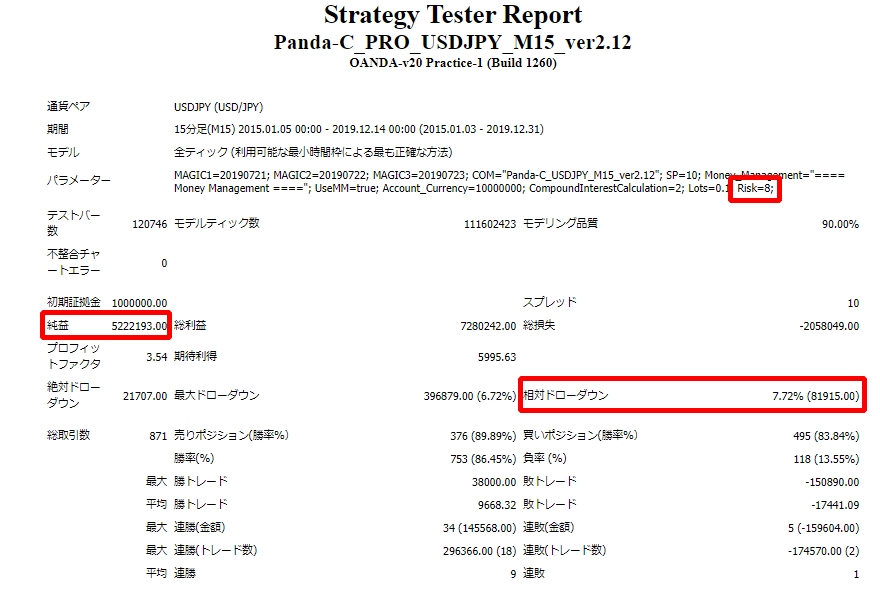

Risk8 compounding for 5 years results

Relative DD 7.7% (82,000 yen), net profit +5,220,000 yen5 years: +522%increase.

Panda-C, with high win rate and low DD, is an EA you should run with a broker offering low spreads.

Written by Tera GogoJungle Marketing.