0.1 lot operation with 3 positions, annual yield of 47.25%, annual average profit USD 1,381.61 『BeeOne_USDJPY』

The performance measurement for 4 years and 2 months since operation started is as shown above; the real account operation rate is 85.27% (active cases 249, purchases 292, as of June 21, 2020). BeeOne_USDJPY has customers requesting it today as well, so we ran a 17-year backtest by TDS and analyzed it in detail with Quant Analyzer.BeeOne_USDJPY has customers requesting it today as well, so we ran a 17-year backtest by TDS and analyzed it in detail with Quant Analyzer.

■Features

• It is a USD/JPY, 5-minute chart-only scalping EA.

• It aims for long-term stability with a simple logic based on RSI and Bollinger Bands.

• It excels at buying on dips and selling on rallies.

• The logic can hold up to a maximum of 3 positions.

• No averaging down, no martingale, and no hedging.

• We avoid entries during the morning Tokyo and London sessions and just after lunch in the New York session due to frequent unfavorable price movements.

• All positions are closed on Fridays at the end of the week.

• Because the logic is evaluated at chart-bar confirmation, there is no difference between backtest “every tick” and “control points,” and there is little deviation from forward results.

As described on the EA page, it operates with a simple Bollinger Band-based logic aimed at long-term stability, and the operating results reflect that.

It’s reassuring that it does not carry positions over the weekend.

Backtest Analysis

Backtest Conditions:

Spread: Variable

Period: 2003/5/5~2020/5/18

Lot: 0.1 lot

Let’s look at the detailed analysis from Quant Analyzer.

Annual average profit: $1,381.61

Monthly average profit: $115.13

Annual return: +13.81%

Win rate: 75.47%

Average gain: $9.51

Average loss: ▲$15.79

Risk-Reward Ratio(Average gain ÷Average loss):0.6

Profit Factor: 1.85

Next, let’s check the monthly and yearly trading results.

【Monthly Results】

Looking at the monthly results, losses are quite infrequent.

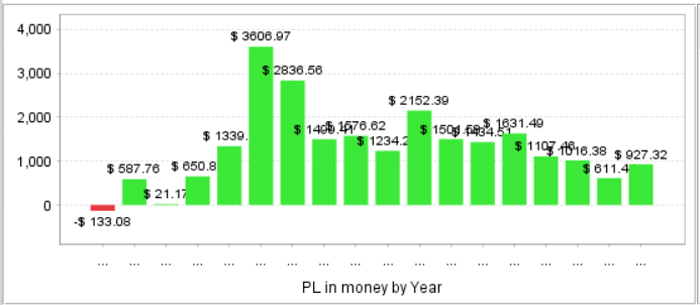

【Annual Results】

It has been profitable in every year except 2003.

2008 shows exceptionally good results.

Recently, it appears to be stable.

【Recommended Margin and Return?】

The calculation formula for the recommended margin (assuming 25x leverage) used in GogoJungle’s system-trade performance measurement is

1万通貨単位×取引通貨の日本円レート÷25倍×ロット数平均÷0.1×最大ポジション数+最大損失(バックテストの最大ドローダウンを採用)×2

ですので、

¥1,068,700(本日のレート)÷25×3ポジション + ¥92,134(最大ドローダウン)×2

推奨証拠金は、¥312,512(約2,924ドル) とします。

これに対し、年間平均利益は、1,381.61ドルですので、期待年利は、47.25%となります。

written by Hayakawa