Catch the signs that the market is about to move explosively! Breakout method using NR7

In trading, being able to wait for the right opportunity is considered important.

Trade opportunities can be identified from various angles depending on the trading method, but how many people are actually able to trade with solid justification?

A common pitfall is the "posi-posi disease": wanting to trade every day, or wanting to trade whenever there is a chance if you have the time.

Common manifestations of the posi-posi disease include the following.

✓ Repeatedly doing range reversal trades in low-volatility markets, but suffering a large loss when a new trend begins

✓ Wanting to trade in the direction of the trend but unable to find proper pullbacks or retracements

✓ Entering a trade but the placement of stop loss and take profit is vague

It's common when you're just starting out, but even so, if losses continue repeatedly, you may lose the motivation to trade.

What we will introduce this time is an indicator called NR7, using

・A breakout method that captures the timing of a breakout as the market contracts and then expands

This is.

Make NR7 more efficient with OaNR7!

What NR7 is

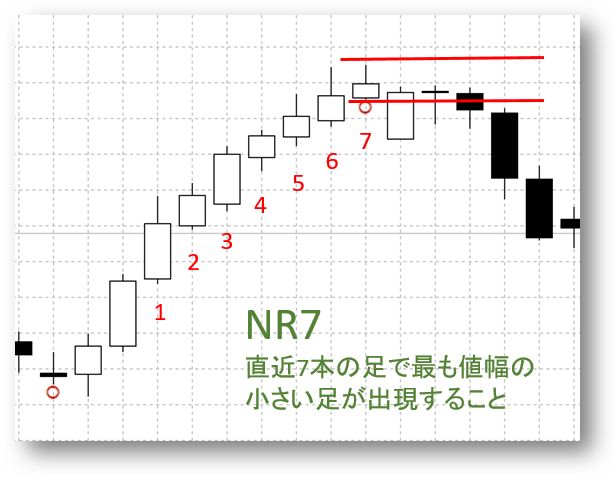

NR7 stands for Narrowest Range of the last seven bars, representing the bar with the narrowest price range over the past seven candles.

It is often used on daily charts, indicating that market volatility is shrinking, and there is pressure for a breakout to occur in one direction.

NR7 often appears at turning points, and you can follow it by going with the breakout direction.

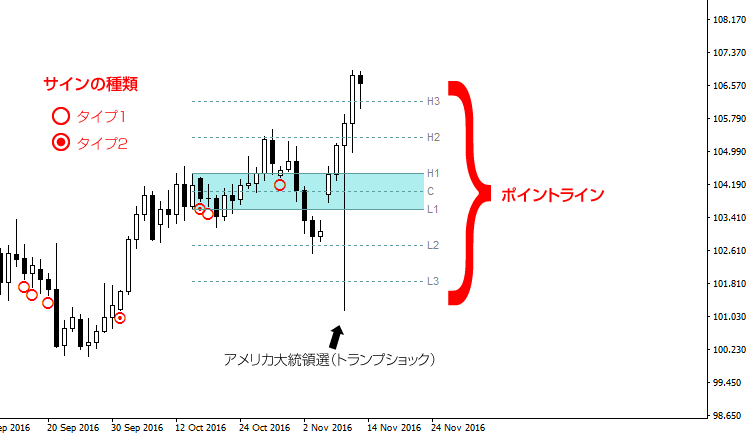

▲ Typical NR7 signal. Tends to appear as a precursor to market turning points or breakouts

The OaNR7 we introduce this time adds to the standard NR7,Inside Bar price action NR7is displayed by this unique indicator.

What’s the difference between OaNR7 and NR7?

NR7 by OaTools (hereafter called OaNR7) adds one more condition to NR7. That is “inside bar.” By combining the inside-bar, which tends to appear near market turning points or before range breakouts, with the existing NR7, we’ve designed to further narrow the basis for discretionary judgment.

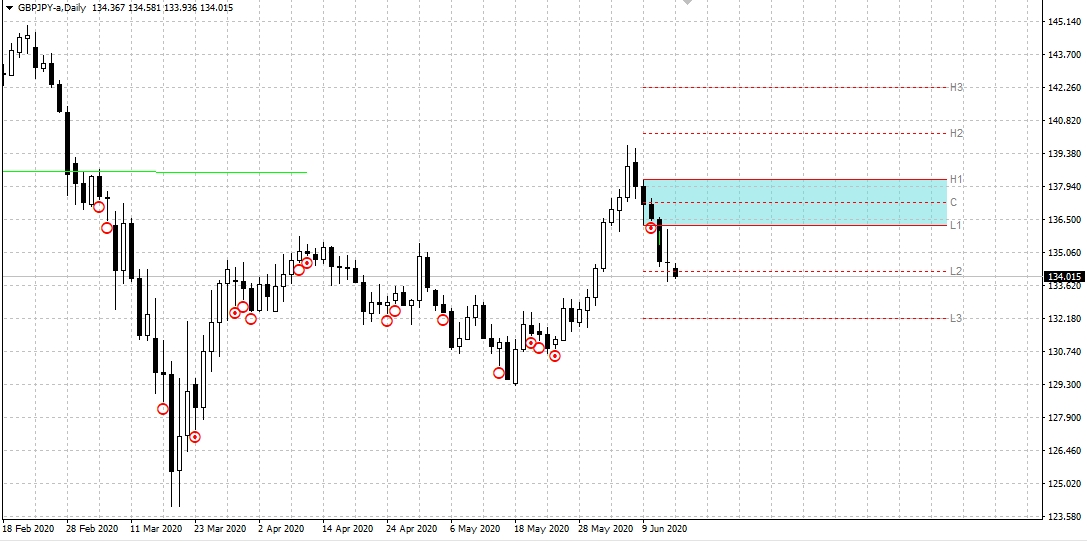

Another difference is that when a signal for Type 2 (inside-bar NR7) occurs, it automatically draws a point line. The point line can also be used as a discretionary reference for entry, take profit, and stop loss.

Also, OaNR7 includes a chart capture sending feature. From MT4, you can send a chart capture at the time of a signal to your smartphone. It can also be sent from your home PC! Of course, sending from a VPS is possible as well. Since you can see signal occurrences in near real time while you're out, you won't miss entry opportunities.

※1 Windows-based VPS only

Signal Type

Type 1is the basic NR7 signal. It is not an inside-bar.

Type 2is the NR7 signal that forms the inside-bar of the previous candle.

Point Line

The point line is drawn based on the candle that triggered the inside-bar condition, with three lines above and below (H3,H2,H1 / L3,L2,L1). Also, the C line is the median. Please use the point line as a reference for discretionary trading.

Sign push notifications via SMS & chart image delivery feature

On June 10, the OaNR7 signal lit up; if you had sold at the L1 line of 136.215, you would reach the first target at 134.2 for a gain of +190 pips,

and if it extended to around the L3 near 132.2, that would be about 400 pips of profit.

Of course, in low-volatility periods where NR7 or OaNR7 signals occur frequently, you may experience several stops, but in such situations the stop and take-profit ranges are narrow, so

if volatility increases, taking larger moves should yield a net positive overall.

Isn't this an ideal indicator tool for those looking for a daily-chart approach or who don't want to spend much time trading?

Moreover, it's only 3,000 yen!

Written by Tera GogoJungle Marketing.