System Trade Search feature added! You can filter by buyer activity rate and price

A new feature has been added to the System Trade Detailed Search.

To access advanced search, please proceed from "System Trade FX" > "Search with detailed conditions".

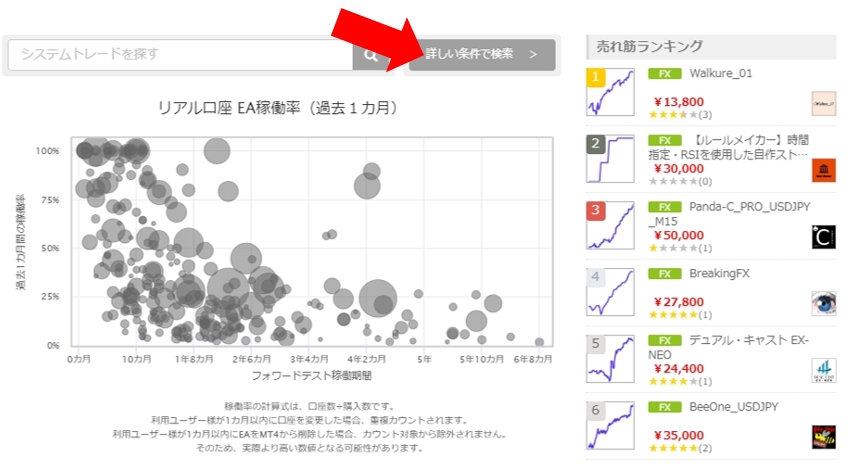

Searchable by Purchaser EA Run Rate, On Sale, and Sale Price

"Real Account EA Run Rate"can be searched by the number of buyers who are running the EA and the utilization rate (%).

Although it is not directly related to the EA's own performance,

A higher utilization rate means profits are being earned in the current market,

and a longer operating period means profits from long-term operation.

This trend is inferred.

"Product Information"… The difference between statuses "On Sale" and "Measuring" is that, although forward operation measurement continues, if the seller wishes to "Pause Sale", selecting "On Sale" will cause it not to appear in search results.

This happens more often than you might think, so you’ll likely be less disappointed thinking "So it’s not for sale?!"

"Price"… You can filter by the EA sale price. However, sorting by price is not possible, so the EAs that meet the specified conditions are extracted and displayed in order of earnings. If an EA has good performance, the sale price won't matter much, but this is handy when you want to try a good-looking but inexpensive EA first.

Find well-performing EAs by run rate

Search criteria:

Running period: 1 year or more

Run rate: 80% or more

Then search.

Then you can extract EAs where more than 80% of buyers have been operating for over a year—the right-upward-trending good performing EAs.

This was surprising: there is indeed a correlation between run rate and performance.

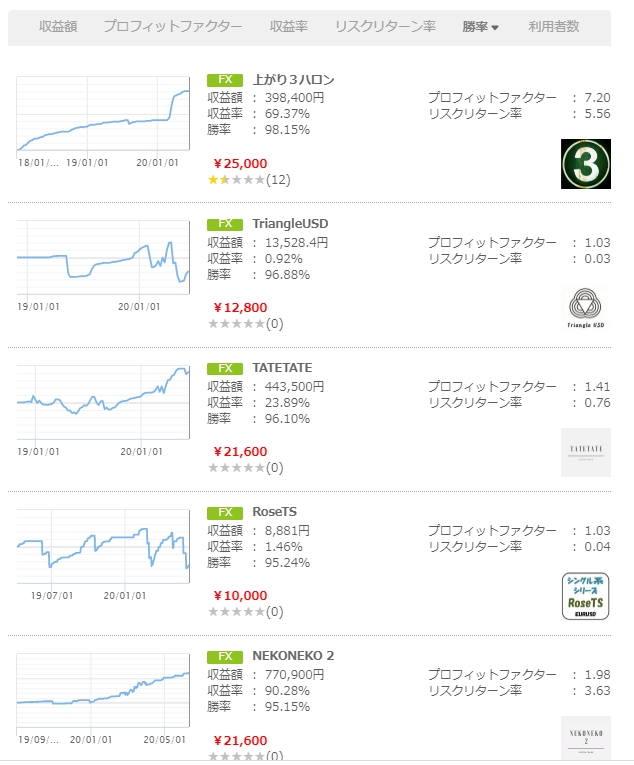

Search Application Method: Find high-performing EAs with a single-position EA

Position count: up to 1

Max DD: up to 30%

Measurement period: 3 months

Number of trades: 50 or more

Search with these, and try sorting by win rate.

This way you can extract EAs that trade at least 10 times per month with a high win rate.

If the equity curve is upward, you can expect good performance for compounding-friendly operation.

Some are already operated with compounding, so you can’t identify them without visiting the sales page, though…

Also, sorting by return rate and PF, if an EA ranks highly on multiple axes, it can be considered excellent from multiple perspectives.

Regarding search filters, it would be nice to have a simple "Pips gained" comparison when the number of positions is aligned.

Sorting by profit would still tend to bring up EAs with larger lot sizes, though…

Also, filtering by TP and SL would make selection even easier. See you next time!

Search Application Method: Compare performance of multi-position EAs

Multi-position EAs include grid trading types and averaging/martingale types.

Maximum positions: 5 or more

Max DD: up to 30%

Measurement period: 12 months

Let's search with these.

In the case of multi-position EAs, as the number of positions increases, unrealized loss tends to grow, so max DD filtering becomes important.

Also, a measurement period of at least 3 months is desirable.

We will look at profit amount and return rate.

Note that when you specify a measurement period of 12 months, results are aggregated as "~12 months," which includes EAs that have less than 12 months of data.

Because you sort by earnings within a maximum 12-month period, those with shorter periods that rank highly can be considered highly profitable.

▲ Example of sorting by return rate.

Return rate is "Profit / Required Margin." The required margin for multi-position EAs varies with the number of positions, so it is not an absolute index.

However, for EAs with longer measurement periods, the required margin tends to approach the MAX, making it easier to estimate the actual return in operation.

Even for multi-position EAs, those ranked highly in both profit amount and return rate can be expected to yield significant profits.

Please use the search function to find an EA that suits you.

Written by Tera GogoJungle Marketing.