【Dollar/Yen / Euro Dollar / Pound Yen】 Market analysis from May 11, 2020 to May 15, 2020

【Dollar/Yen/Euro/Dollar/ Pound/Yen】Market analysis for May 11–15, 2020

Good morning everyone! This is Yururi mo Yururi.

Thank you very much for visiting our blog.

We have updated a blog post about market analysis forMay 11–15, 2020.

Dollar/Yen/Euro/Dollar and Pound/Yen—the three currency pairs—discussed in this post.

Please take a look!

★ Golden Week Special Sale in progress ★ Today, May 10th is the last day ♪ 20% OFF ♪

<<<Koropokkuru ~ Automatic Horizontal Line Display ~>>>

<<<Koropokkuru ~ Triple Display of Moving Averages ~>>>

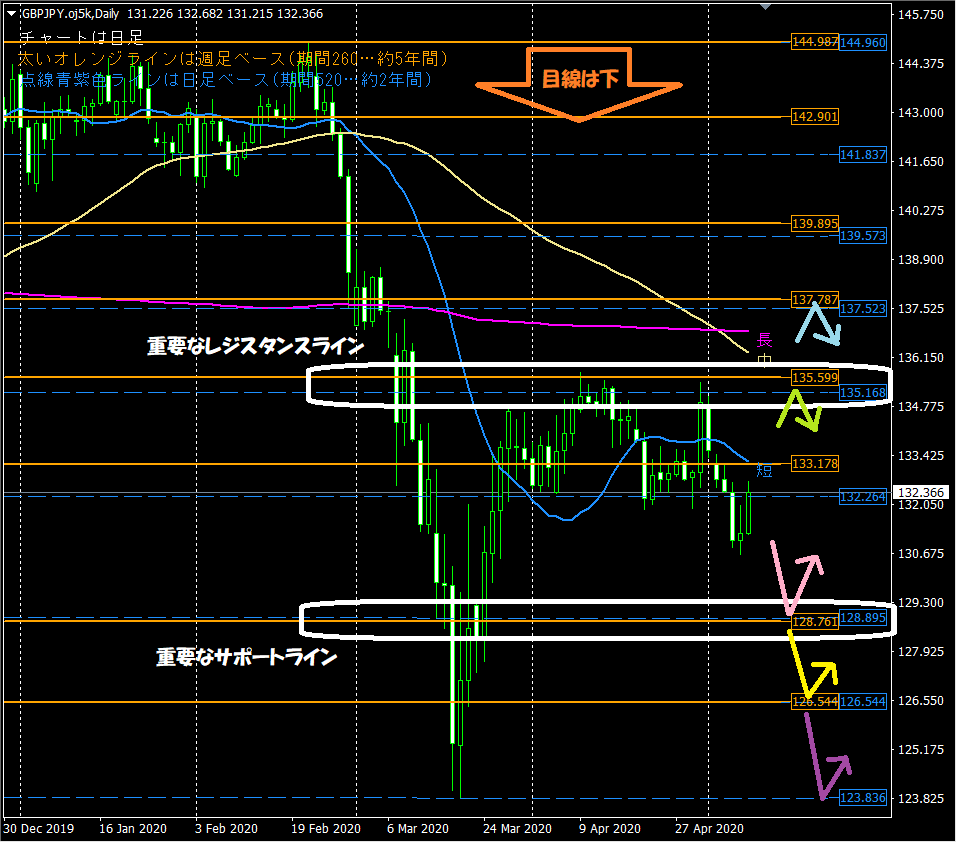

<<【Dollar/Yen/Euro/Yen】 Market Analysis May 11–15, 2020 >>

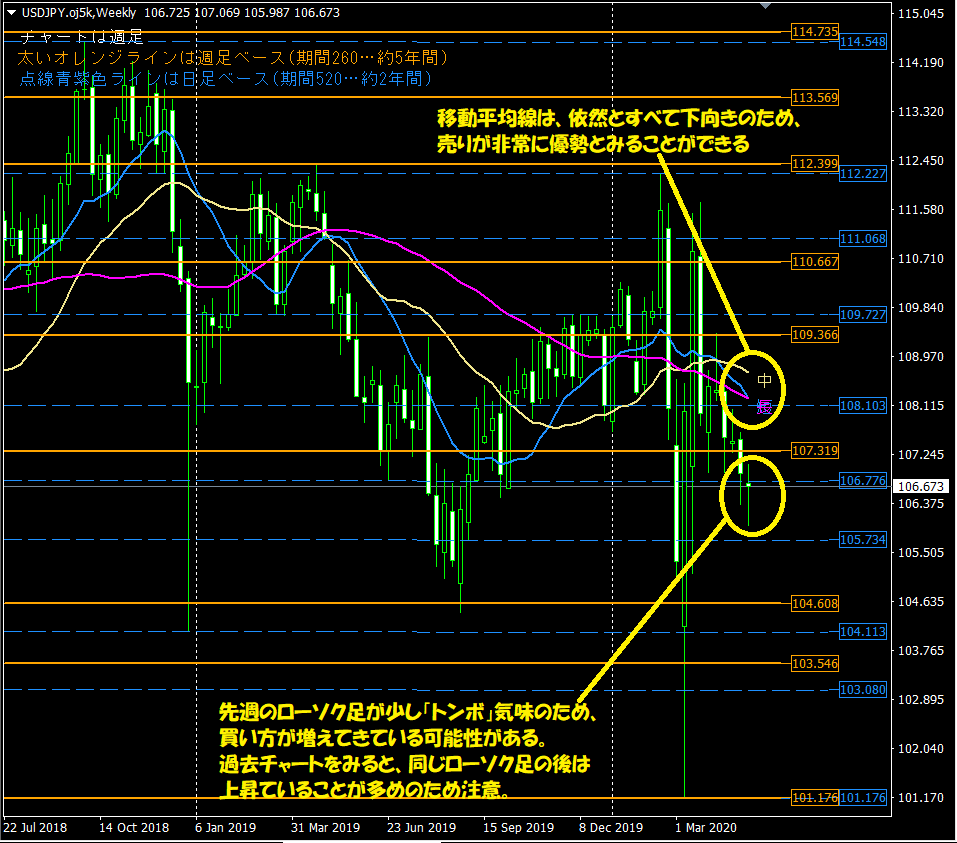

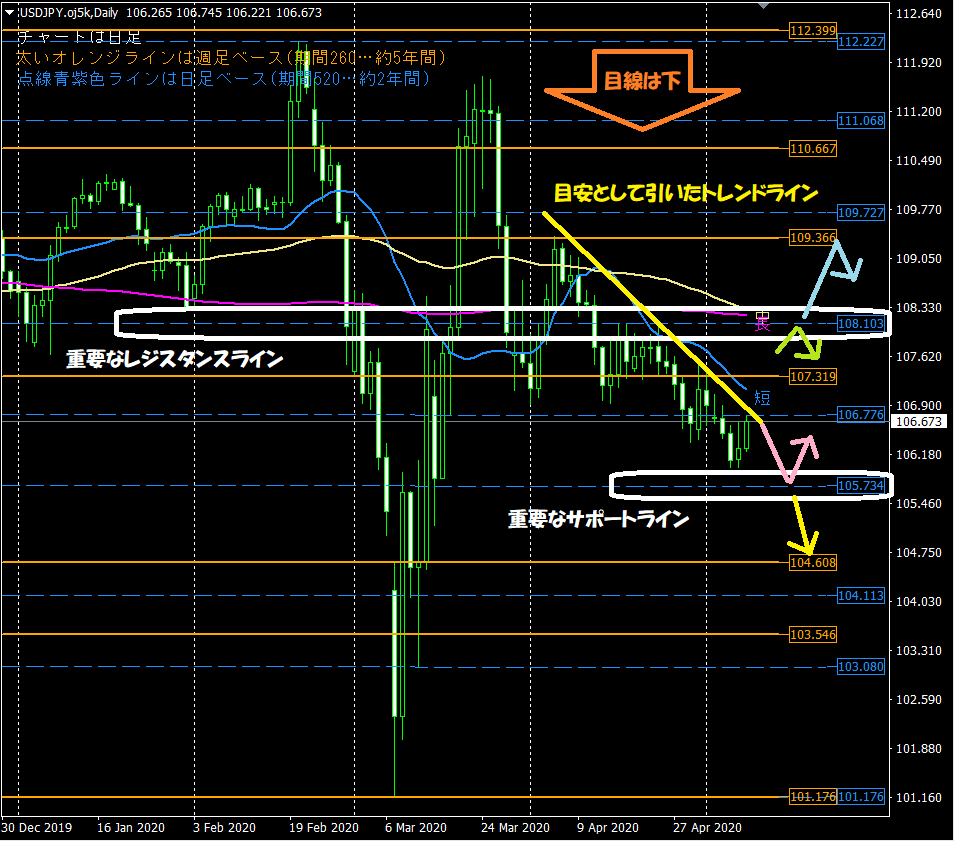

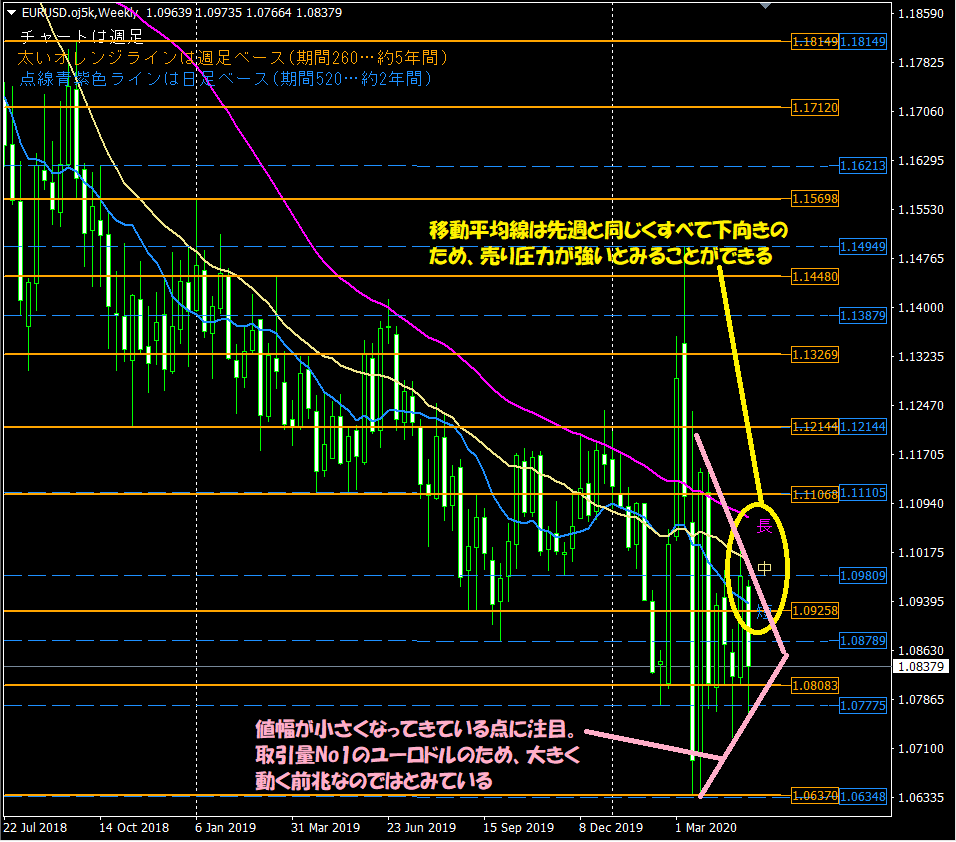

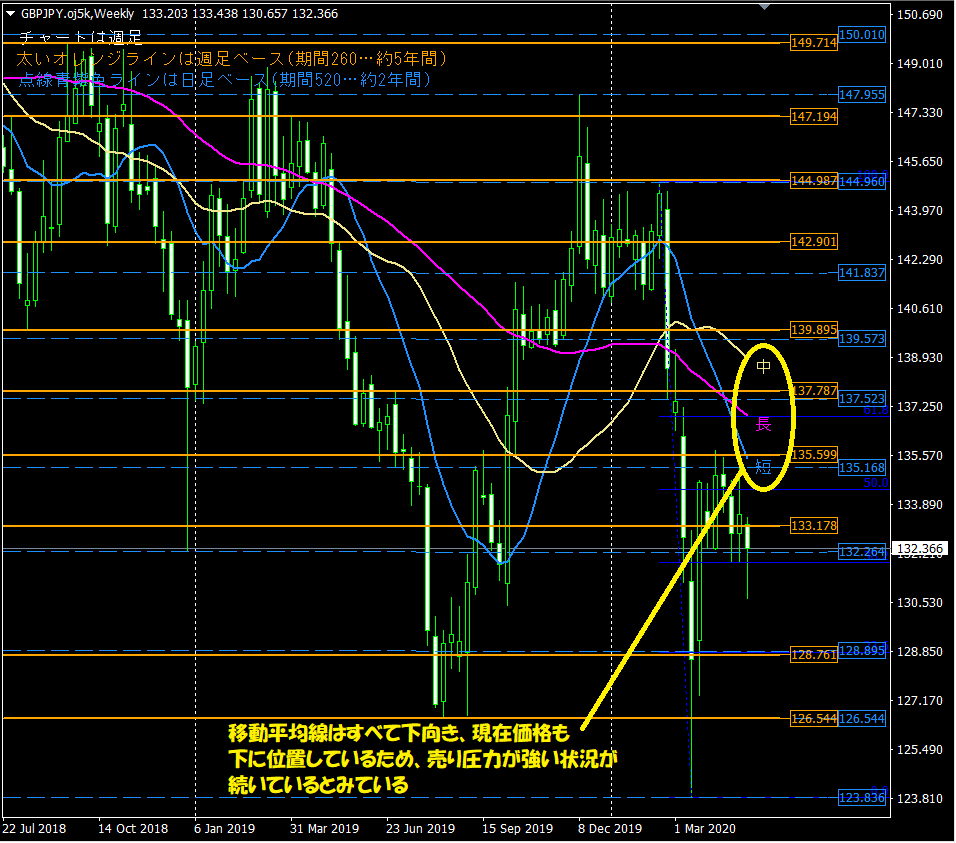

【Image used for the Dollar/Yen chart analysis】

【Backtest of Koropokkuru Series Indicator】

This is a video of backtesting the indicator for last week (May 4–8, 2020).

This is the 1-hour chart we use for chart analysis on the blog every morning. Key points to look at are the following two:1. The horizontal lines automatically displayed by the indicator function as support/resistance

⇒ Thick orange line (weekly basis period 260…5 years), purple dashed line (daily basis period 520…2 years)

2. The moving averages optimized for the 1-hour chart are frequently respected

⇒ Especially the short-term line (period 24…1 day) and the long-term line (period 480…1 month)

【Introduction of the product 'Koropokkuru ~ Automatic Horizontal Line Display ~' for sale】

The indicators used for market analysisare designed to automatically display horizontal lines to reduce trading burden.

It analyzes the highest and lowest prices within a set period by price band and automatically displays up to three optimal horizontal lines across up to three time frames.

Highly recommended for busy professionals and homemakers.

If you want to purchase or are just a little curious, please go to the product page from the links below!

★ Golden Week Special Sale in progress ★ Today, May 10th is the last day ♪ 20% OFF ♪

<<<Koropokkuru ~ Automatic Horizontal Line Display ~>>>

【Introduction of the product 'Koropokkuru ~ Triple Display of Moving Averages ~' for sale】

The moving average lines used for market analysis are displayed with the newly released indicator "Koropokkuru ~ Triple Display of Moving Averages ~"!

This indicator is aimed at those who are struggling with introducing and using moving averages.

If you have practiced else in FX or stock market analysis or trading, have you ever considered introducing moving averages?

In such cases,you may have had concerns like this.

・Tried adding moving averages but cannot determine the best values to set for parameters. Especially the 'period'.

・Added too many moving averages and lost track of what’s correct… want to reset the overused setup!

・Sites you refer to have 1 or 5 moving averages, but which is right?

・Tried implementing moving averages in your own way but feel uncertain about correctness.

This indicator solves all those concerns!

If you want to purchase or are just a little curious, please go to the product page from the links below!

★ Golden Week Special Sale in progress ★ Today, May 10th is the last day ♪ 20% OFF ♪

<<<Koropokkuru ~ Triple Display of Moving Averages ~>>>

【Introduction of the product 'Koropokkuru ~ Angle is Important Series ~' for sale】

Indicator that emphasizes the angle of MACD and OsMAthat shows signals.

Reliability-focused 'Standard Version', and early-detection-focused 'Early Version' are available.

Please take a look!

<<【All 4 Types Best Set】 Koropokkuru ~ Angle is Important Series ~ >>

We publish backtest results of indicators.

We also publish for other currency pairs and time frames, so please参考ください。

Indicator that emphasizes the angle of MACD and OsMAthat shows signals.

Reliability-focused 'Standard Version', and early-detection-focused 'Early Version' are available.

Please take a look!

<<【All 4 Types Best Set】 Koropokkuru ~ Angle is Important Series ~ >>

We publish backtest results of indicators.

We also publish for other currency pairs and time frames, so please参考ください。

We are active on Twitter as well, so please follow us!

<< Yururi mo Yururi Twitter >>

【Finally】

Thank you for reading this blog until the end!

We hope it will be helpful for your asset management.