【Dollar/Yen / Euro/Dollar / Pound/Yen】Market analysis for May 4, 2020 to May 8, 2020

【Dollar/yen/Yen-Euro/GBP/Yen】 Market analysis from May 4, 2020 to May 8, 2020

Good morning, everyone! It’s Yururi mo Yururi.

Thank you very much for visiting this blog.

I updated the blog on market analysis forMay 4, 2020 to May 8, 2020.

The three currency pairs: Dollar/Yen, Euro/Dollar, and Pound/Yenare written about.

Please take a look!

★ Golden Week Special Sale in progress ★ ♪ 20% OFF ♪

<<<Koropokkuru – Auto display of horizontal lines <>>>

<<<Koropokkuru – Triple display of moving averages <>>>

<<【Dollar/Yen/Euro/Dound/Yen】 Market analysis for May 4, 2020 to May 8, 2020 >>

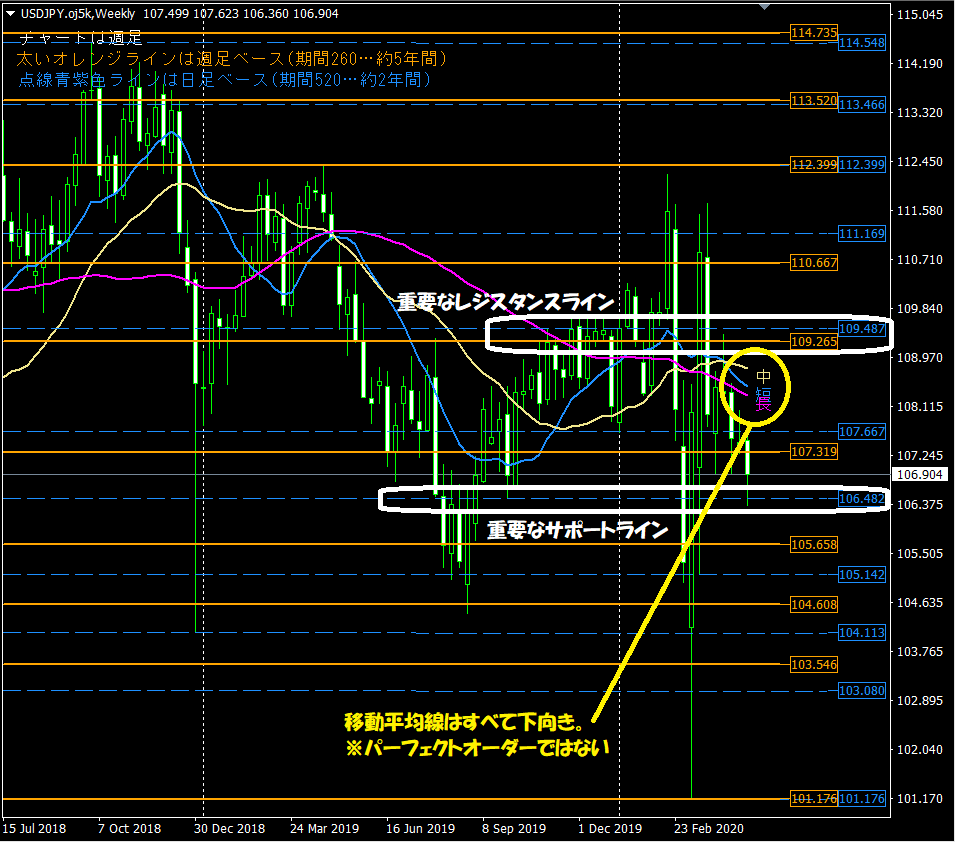

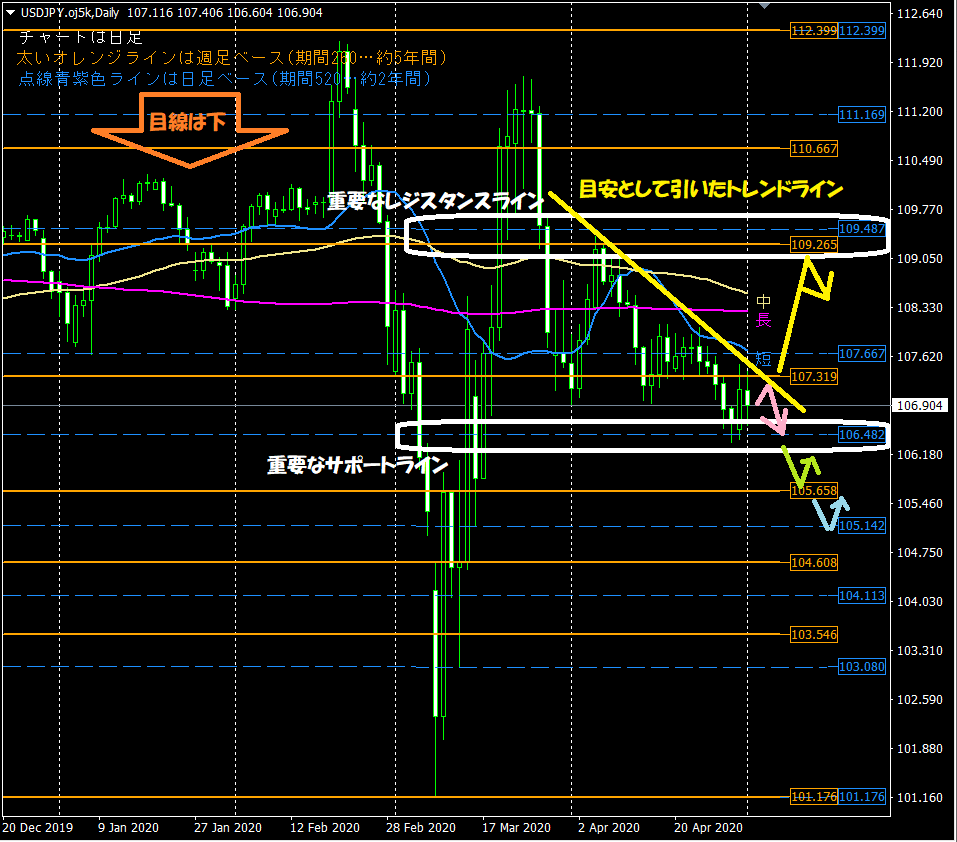

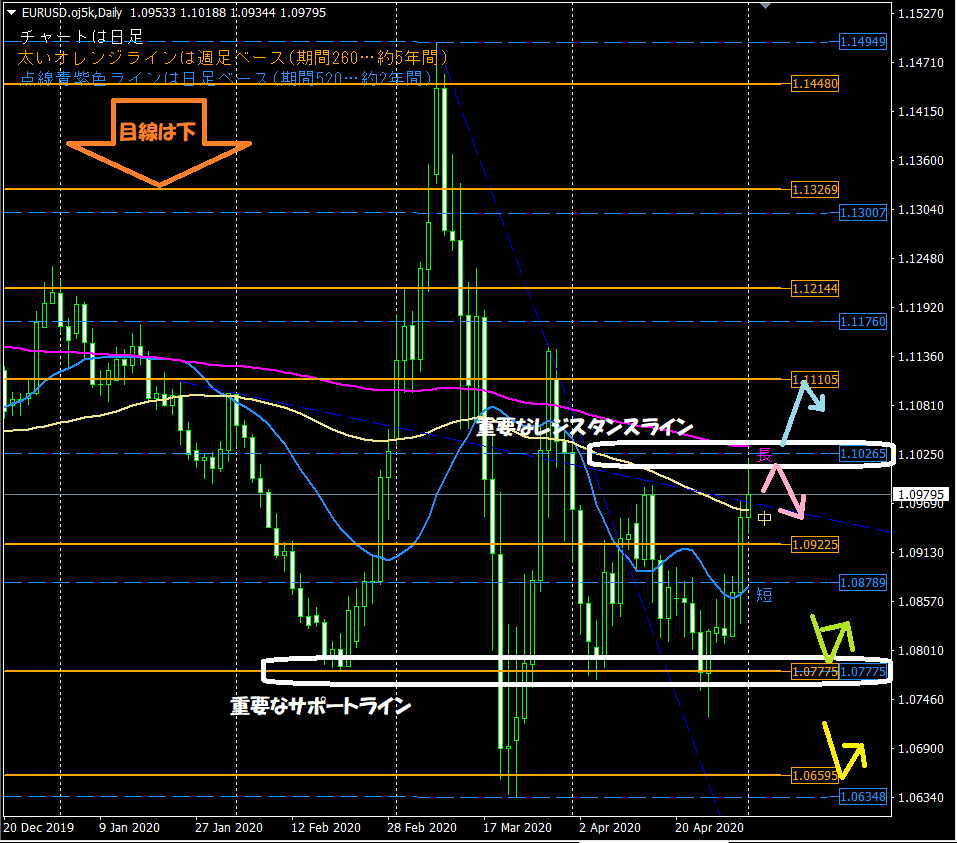

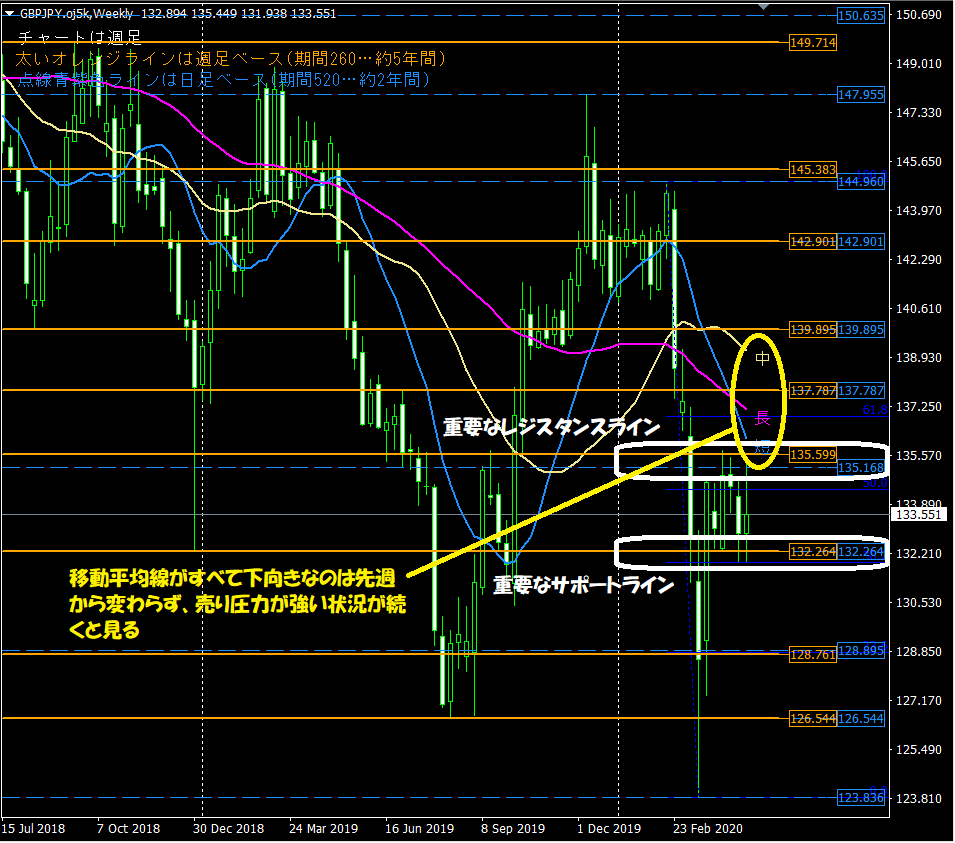

【Image used for Dollar/Yen chart analysis】

【Backtest of the Koropokkuru series indicators】

This is a video showing backtests of the indicator for last week (April 20–24, 2020).

This is the 1-hour chart used for chart analysis on the blog every morning. The two points to look at are below.1. The horizontal lines automatically displayed by the indicator are functioning as support/resistance

⇒ Thick orange line (weekly basis, period 260… 5 years), purple dashed line (daily basis, period 520… 2 years)

2. The moving averages optimized for the 1-hour chart are frequently being watched

⇒ Especially the short-term line (period 24… 1 day) and the long-term line (period 480… 1 month)

【Introduction of product being sold: ‘Koropokkuru – Auto display of horizontal lines’】

The indicators used in market analysis are designed to auto-display horizontal lines to reduce trading workload. They were created with that goal in mind.

It analyzes the highest and lowest prices within a set period by price range and automatically displays up to three optimal horizontal lines across three timeframes.。

Highly recommended for busy businesspeople and housewives.

If you want to purchase or are a little curious, please go to the product page from the link below!

★ Golden Week Special Sale in progress ★ ♪ 20% OFF ♪

<<<Koropokkuru – Auto display of horizontal lines>>>

【Introduction of product being sold: ‘Koropokkuru – Triple display of moving averages’】

The moving averages used in market analysis are displayed by the newly released indicator “Koropokkuru – Triple display of moving averages”!

This indicator is for those who are unsure about introducing or using moving averages.

Have you analyzed FX, stocks, etc., or studied them, and considered introducing moving averages?

If so, you may have had the following concerns.

・You tried moving averages but cannot determine the best parameter values to set. Especially the 'period'.

・You introduced too many moving averages and don’t know what is correct… you want to reset to a moderate setup!

・Some sites show only one moving average, others five—how many are correct?

・You tried implementing moving averages in your own way but are unsure if it is right.

This indicator solves all those concerns!

If you want to purchase or are a little curious, please go to the product page from the link below!

★ Golden Week Special Sale in progress ★ ♪ 20% OFF ♪

<<<Koropokkuru – Triple display of moving averages>>>

【Introduction of product being sold: ‘Koropokkuru – Angle is everything series –’】

An indicator that emphasizes the angle of MACD and OsMAas a key signal.

A safer ‘Standard’ version, and an early-detection ‘Early’ version are prepared.

Please take a look!

<<【All 4 Types Best Set】 Koropokkuru – Angle is Everything Series – >>

Backtest results of indicators are published.

Other currency pairs and timeframes are also published, so please refer to them.

An indicator that emphasizes the angle of MACD and OsMAas a key signal.

A safer ‘Standard’ version, and an early-detection ‘Early’ version are prepared.

Please take a look!

<<【All 4 Types Best Set】 Koropokkuru – Angle is Everything Series – >>

Backtest results of indicators are published.

Other currency pairs and timeframes are also published, so please refer to them.

I’m also active on Twitter, so please follow!

<< Yururi mo Yururi Twitter >>

【In conclusion】

Thank you for reading this blog until the end!

I hope it helps with your asset management.