The strongest EA in the Tomo_Wing series is... a thorough comparison of the four!

The forward performance of "Tomo_Wing_EX_TS" is favorable, but

In fact, "Tomo_Wing" is a series, and there are four similar EAs in total—did you know that?

Currently, in forward operation「Tomo_Wing_EX_TS」has the best profitability, but what is the potential of the other EAs?

After examining the details individually, I would like to compare them comprehensively!

【Tomo_Wingシリーズの説明】

The Tomo_Wing series is designed to trade in line with the flow indefinitely, and is designed to avoid forcing trades with contrarian methods.

In addition, it is equipped with AI features and continuously advances trades in the positive direction based on a certain number of trades (past trade history of two months or more).

Characteristics

① _EX・・ trading that leverages a volatility index in buying/selling. It yields large profits during big market moves.

② _TS・・ The indices for StopLoss and TakeProfit change over time, producing smooth gains without forcing losses.

③ _W・・ trades that emphasize ① and ②

Each EA makes use of its strengths, but Tomo_wing_EX_TS has been progressing smoothly.

(Quoted from a community member's comment)

【Tomo_Wing_EX_TSのポジション数の増減について】

The maximum number of positions is five, but depending on trading conditions it can reach up to five positions.

“Positions are hedged. Hedging occurs when the flow reverses sharply, so there may be both buy and sell positions hedged.

Therefore, please consider half of the number of positions stated in the EA description as the normal trading position count.

In “Tomo_Wing_EX_TS,” normal trading uses two positions.

Occasionally, when momentum is strong, three positions are taken to increase profits.

It is not designed to increase positions and wait for a stubborn exit like a contrarian system, so please rest assured.

When positions increase, please understand that profits increase as well.”

Now, I would like to compare the Tomo_Wing series!

Let’s focus on important EA comparison metrics such as “maximum drawdown” and net profit!

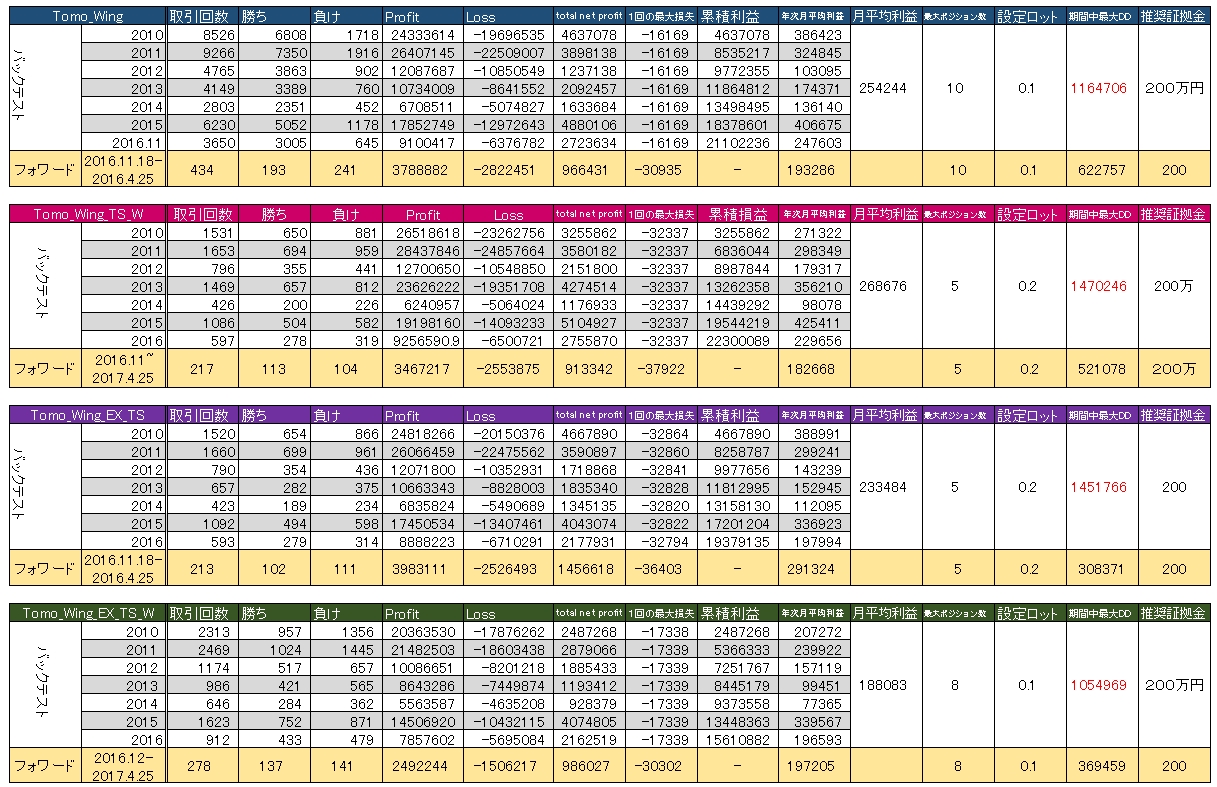

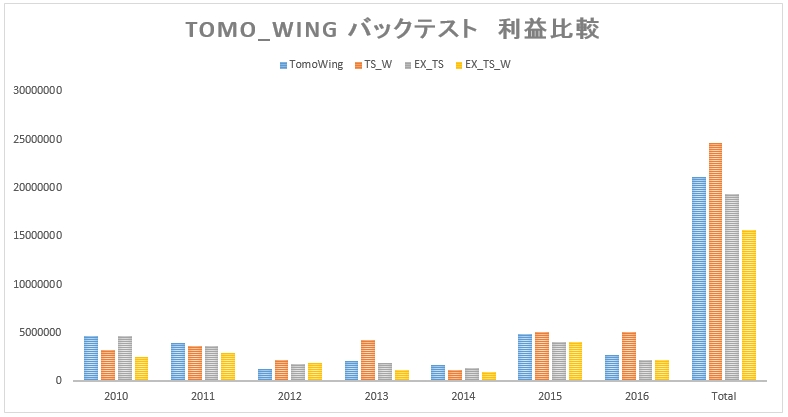

【Tomo_Wing シリーズ データ比較】

Maximum drawdown and cumulative profit are in a proportional relationship; _EX_TS_W has the smallest maximum drawdown, but its cumulative profit is also the smallest.

In terms of balance, Tomo_Wing provides the highest profit relative to its maximum drawdown.

From the perspective of profit, TS_W stands out with higher profits.

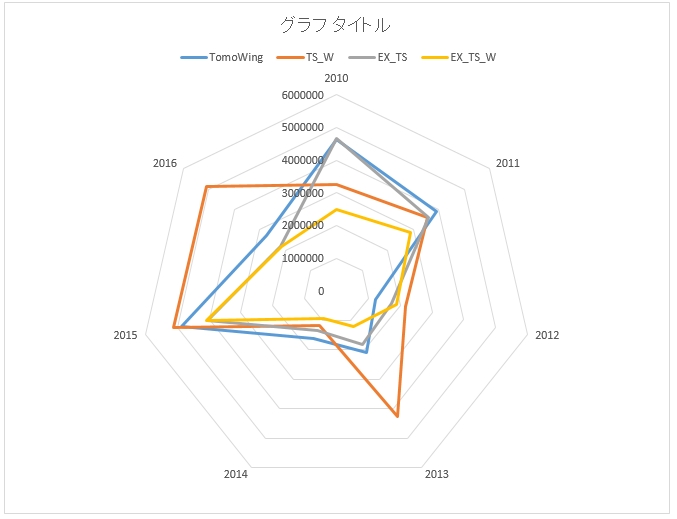

If you chart it as a pie graph, you can see which combinations can complement each other, but

In 2014, all of them were down; if I had to pick one, Tomo_Wing seems best.

If you prioritize profits, go with「Tomo_Wimg_EX_TS」,

If you want to minimize drawdown while operating, 「Tomo_Wing」 is better,

and if you want to form a portfolio,「Tomo_Wing」along with the others seems good.

All of them have a recommended margin of 2,000,000 yen, so

If you are operating with 1,000,000 yen, please set each setting's lot to half.

There isn't a huge difference in performance between the EAs,

so pricing them affordably now might be a good time to buy!

Tomo_Wing_EX_TS is currently 29,800 yen, but

the others are still priced at 19,800 yen for up to 50 units!

【Tomo_Wing】

Profits steadily accumulate as the natural flow progresses

【Tomo_Wing_TS_W】

Profits steadily accumulate as the natural flow progresses

【Tomo_Wing_EX_TS】

Profits steadily accumulate as the natural flow progresses

【Tomo_Wing_EX_TS_W】

Profits steadily accumulate as the natural flow progresses