Cumulative Japanese stock trading: 2 No whale buying activity Mr. Tetsuo Inoue

Trend 1008 Technical Graph 15 (Cumulative Japanese stock trading 2)Release date: 2020/03/27 08:18

I am resending with one additional chart added to yesterday's three charts.

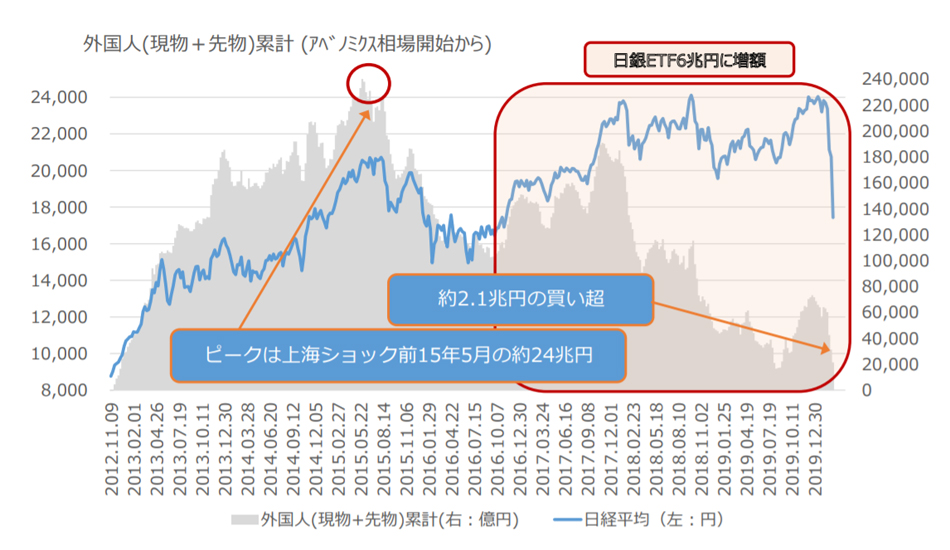

From this, looking on a weekend basis (usually Friday), over the five weeks from 2/14 to 3/13, foreigners continued to be net sellers in Japanese stocks in both the spot and futures markets.

The Nikkei average closed at 23,827.98 yen on 2/7 and 17,431.05 yen on 3/13, so the index fell by a cumulative 6,396.93 yen, or 26.8%. During this period, foreigners sold a total of 1.2834 trillion yen in the spot market and 2.9779 trillion yen in futures, for a total of 4.2613 trillion yen.

Here, listing the weekly decline in the Nikkei average together with foreigners' weekly net selling amounts in the combined cash and futures, we have: 2/14: -140.39 yen: 993 billion yen, 2/21: -300.85 yen: 2,845 billion yen, 2/28: -2,243.76 yen: 1.7696 trillion yen, 3/6: -393.21 yen: 1.1262 trillion yen, 3/13: -3,318.70 yen: 9817億円.

At first glance, it might seem that larger selling by foreigners would correspond to larger index declines, but a closer look shows that isn’t the case. In the week of 3/6, selling exceeded 1.1262 trillion yen, yet the Nikkei average fell only 393.21 yen, and the following week, foreigners' net selling was 9817億円 (very large, but slightly reduced), while the index fell by 3,318.70 yen.

The supply-demand factor behind the large drop in the week of 3/13 actually includes a decrease in the margin-buying balance, i.e., unwinding of long positions.

In that week, the margin-buy balance fell by 4040億円, dipping below 2 trillion yen. Consequently, the buy balance dropped to the level of February 2013, just three months after the Abe-nomics rally began. This, too, added to the foreigners' selling mentioned above.

So, did the GPIF (Government Pension Investment Fund) and the three mutual aid funds, the so-called “whales,” buy to offset the drop in Japanese stocks (on a mark-to-market basis) during this period? In January and February they sold a total of 4876億円 (about 5000億円). Moreover, in the crucial two weeks of 3/6 and 3/13, the “trust banks” purchases (which would reveal their tactics) were 236億円 and 286億円 respectively, and they did not step in to buy. A very disappointing result, or rather, an act.

As a result, applying the scatter plot formula shown in Graph 4, foreigners’ futures selling again faced a record net selling of 5.5 trillion yen, but even if everything were bought back, it would amount to 20,477 yen, not reaching 21,000 yen.

Written by Hayakawa