It wasn't just a simple averaging-down martingale called 'Euro Een'. The secret to its strength and how everyone can apply it are revealed!

The Classic Nanpin Martingale EA “Euro Earn”

Two-year forward earnings: +2.7 million yen; risks and tips for operation

With more than 1,000 buyers, it has become a representative EA, but Nanpin Martingale EAs inevitably carry the risk of ruin.

In this article, we will guide beginners on risk management and share popular advanced techniques for EA masters.

Table of Contents

・Euro Earn Forward Performance

・What kind of EA is Euro Earn?

・Features and risks of standard Nanpin Martingale EAs

・Was Euro Earn an EA based on forced liquidation?

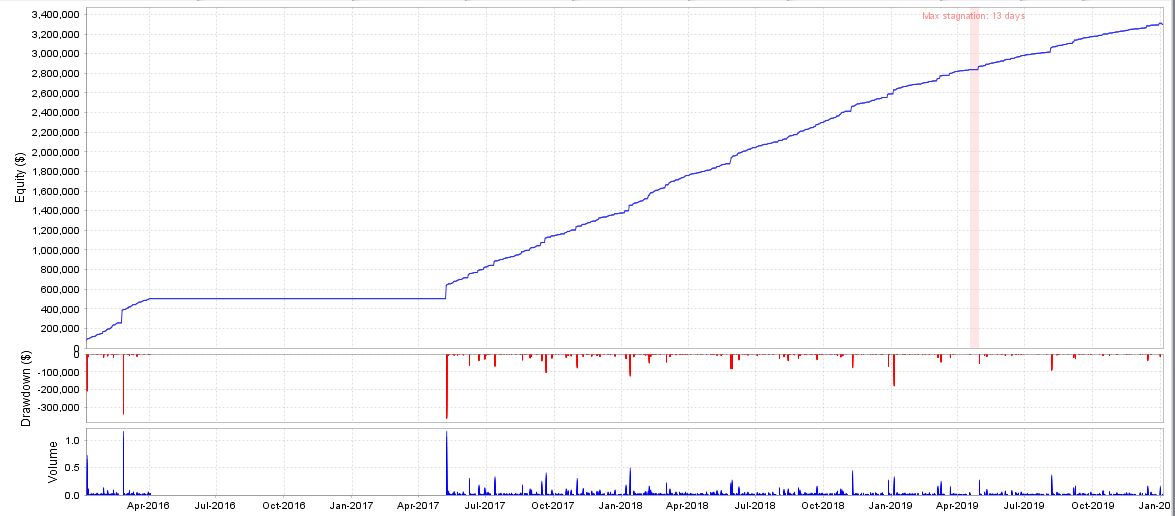

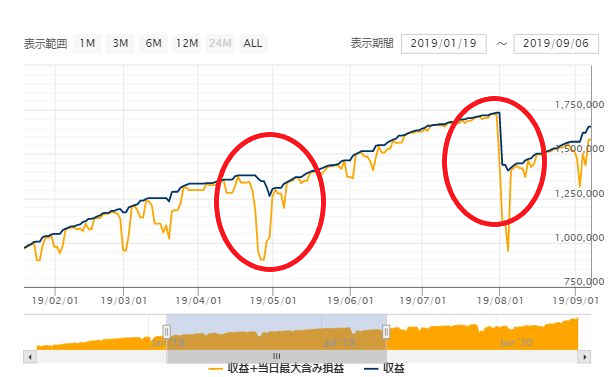

Euro Earn Forward Performance

Since September 2018, in about 1.5 years of forward testing, profit of +2,740,000 yen and a maximum drawdown of 923,000 yen have been recorded.

Win rate and recommended margin are not strongly related to the EA's evaluation, as this is a lump-sum settlement type via averaging martingale.

So far, the maximum number of open positions has been 34, but the design allows up to 50 positions (the maximum position count can be changed).

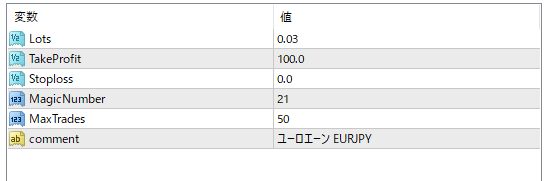

【Euro Earn Overview】

Currency pair: [EUR/JPY]

Trading style: [Position trading]

Maximum positions: 50

Maximum stop loss: 0; Other: configurable

Take profit: 100

【Euro Earn Default Parameters】

Initial lot is 0.03. GogoJungle’s forward test also starts at 0.03.

We will explain later whether it is safe to operate with 1 million yen margin on a 0.03 lot with 25x leverage.

What kind of EA is Euro Earn?

Euro Earn is a orthodox type among Nanpin Martingale EAs: it holds multiple sell positions in rising markets and multiple buy positions in falling markets, and when a reversal yields profit, it closes them all at once.

It holds both buy and sell, but while buying, the buy averaging martingale is closed in one go before taking the next direction in positions (buy or sell).

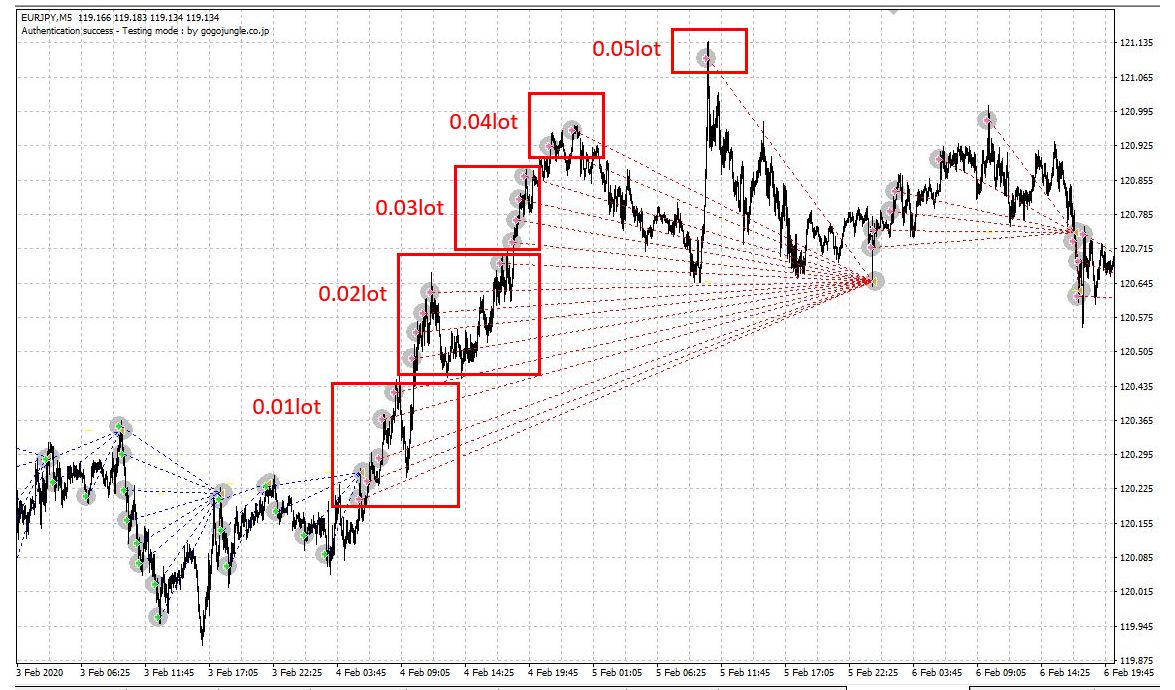

Trading Image

Red: SELL(Lot size changes when starting at 0.01)

In an uptrend, a sell nanpin martingale is triggered.

If the price reverses and a certain profit is realized, all positions are closed at once. The positions opened at the start will be in negative, so the win rate is not 100%.

Additionally, because positions are held until the all-at-once settlement, there are times when you must endure long unrealized losses.

Also, note that once you start the EA, positions are opened immediately; trading timing varies by user.

Since forward results do not exactly match GogoJungle’s forward results, please treat the forward as a reference.

Features and Risks of Standard Nanpin Martingale EAs

The profit-and-loss curve of Nanpin Martingale EAs tends to be an upward-sloping, because losses are not cut, the curve looks cleanly bullish.

To operate Nanpin Martingale EAs, first understand the following:

・What is the maximum number of positions and the maximum lot size? How much margin is required at that time?

・The one-way movement in pips until reaching the maximum position (pips before profit is realized and the maximum position is reached)

・Maximum drawdown (unrealized losses) over a fixed period of backtesting

That's the gist.

As I will explain later, for Euro Earn, the margin recommended by the maximum held position is actually meaningless.

What has been found from long-term backtests is that holding up to 50 positions with no SL leads to, the longer the backtest, the more likely you are to accumulate salted positions that you end up holding for a long time.

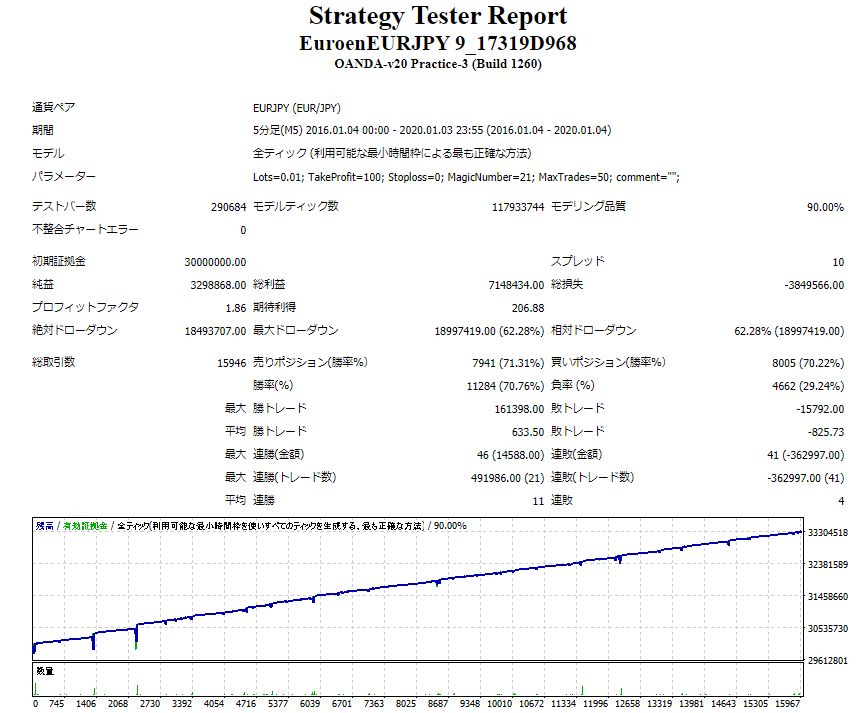

▲2016年~2017年までは最大保有ポジションまでとり、1年ほど塩漬けに。

2016年4月に最大ポジション数50まで取り、2017年5月に決済されるまで1年間も保有していたケースがありました。

その時の最大保有ロット数は12.79、必要証拠金はざっと563.2万円です。(1ロット=10万通貨)

さらに期間中の最大DDは1890万円でした。

こうなるとあまり意味がないバックテストだなあ・・・と思いませんか。

まあ、上記はあくまでも「損切りしない前提&強制ロスカットがおこらない資金を持っていた場合」です。

Euro Earn: Was it an EA Built on Forced Stop-out?

Regarding Euro Earn, the maximum number of positions held over a year and a half of forward is 32. However, the forward shows several stop-outs.

Strange, there should be no stop-loss setting…

Upon closer inspection,Forced stop-out due to insufficient maintenance marginwas triggered.

Moreover, this was said to be expected!

▲ From community Q&A

I see. I thought starting at 0.03 lots on a 1,000,000 yen margin might be too large.

Looking at the forward P/L curve, forced stop-outs occurred from early on.

Forced stop-out occurs (with 25x leverage) when the maintenance margin falls below 100%.

Calculation method isMaintenance margin (%) = (Available margin ÷ Required margin) × 100

Available margin is (account balance − unrealized losses). So on a 1,000,000 yen account using 450,000 yen margin, free margin is 550,000 yen.

Thus, when unrealized losses reach −100,000 yen or more and the required margin equals the available margin, the maintenance margin becomes 100% and a forced stop-out occurs.

However, after stop-out, the held positions are cleared, and the account balance ends up around −100,000 yen with about 80-90% of funds remaining.

In this way, by using more margin for high-volume positions, even with no stop-loss, you can resume operation after forced stop-out while retaining 70–80% of the balance.

However, on high-leverage accounts, because less margin is required, you may continue increasing positions and lots until forced stop-out, and unrealized losses grow, so the balance after stop-out can become very small, which requires caution.

In other words, the orthodox way to use Euro Earn is a 1,000,000 yen account with 25x leverage at 0.03 lots, which is acceptable.

If you’re considering starting with less funds, a setting around 0.01 lots for about 300,000–400,000 yen might be better.

Euro Earn Advanced Applications

It turns out Euro Earn can be used in several different ways.

【Official Advanced Edition】

One-sided operation in line with the trend

As stated on the sales page, by using a companion indicator,

”One-sided operation in the direction of the trend is possible”

This is what it means.

▲ One of the companion indicators. It shows the major trend direction. In the above example, in an uptrend, by only triggering BUY,

you can achieve a stable operation with a high probability of reversal despite Nanpin Martingale.

Additionally, as another application of one-sided operation, you can run BUY ONLY and SELL ONLY simultaneously.

In a hedged setup, margin is offset, so you would expect to need essentially one position’s worth of margin plus α. However, using the above stops means you cannot rely on the other side’s stop-out (it would occur sooner), so the actual effect remains to be validated through testing.

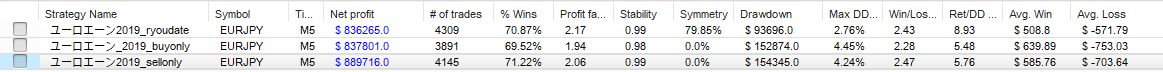

▼ Backtest, 0.01 lot setting, 2019.1.4–2020.14, one-year comparison

The top one is default, but operating BUY ONLY or SELL ONLY did not significantly change per-trade profitability.

So, is it more efficient to operate with two sides?

Everyone’s Euro Earn Usage

Finally, here are some popular advanced methods from Euro Earn users!

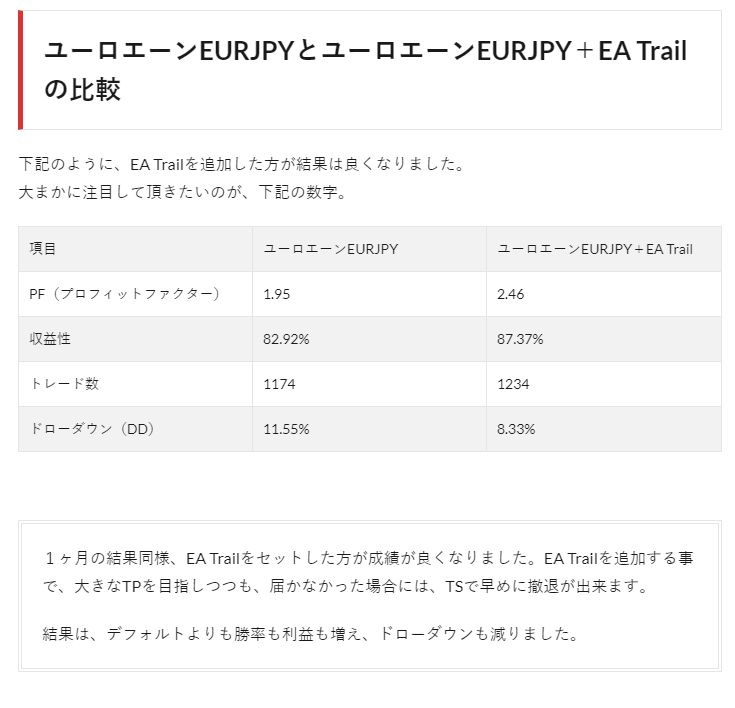

◆Add trailing function to settlements

Mr. GUNMAX uses his own original supportive EA “EA Trail” to add trailing to Euro Earn settlements.

He has been applying this combination for about five months; it’s a proven method.

Mr. GUNMAX’s original article is here

EA Trail and Euro Earn: What’s really going on? More

◆Operate on multiple timeframes simultaneously

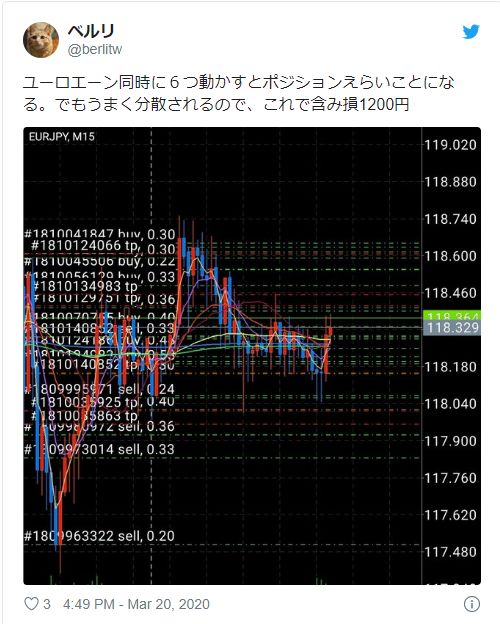

If you run Euro Earn on six timeframes at once, you’ll end up with many positions. But with good diversification, the unrealized loss is only about 1,200 yenpic.twitter.com/zLlCYRAlq4

— Berli (@berlitw)March 20, 2020

Berli focused on the lack of timeframe constraints and is running Euro Earn across multiple timeframes!

He conducts detailed analyses, avoiding the 5-minute timeframe where positions tend to accumulate, and runs BUY ONLY and SELL ONLY hedging on longer timeframes.

Of course, as the number of positions and lots increases, risk rises, so recommended parameters are published.

How to Low-Riskly Operate Euro Earn (MT4 EA)

Lastly, Euro Earn has shown steady forward profits, but please pay attention to the following points.

・The strong forward performance assumes 0.03 lots per 1,000,000 yen margin, operating with forced stop-out in mind

・The more funds the account has, the more positions you can hold up to 50, extending the duration before forced stop-out

Even with enough cushion funds to prevent forced stop-out, there is no guarantee of profit upon reversal

・Please understand the risks before using the one-sided ×2 hedging strategy and multi-currency trading.

※Note: Strategies differ completely between 25x leverage accounts and high-leverage accounts.

・There is a possibility of holding up to 12.7 lots simultaneously. In high-leverage accounts, you may reach this level.

・Depending on timing, forced stop-outs can occur multiple times.

It’s interesting to note that forced stop-out can also serve as a safety stopper; this highlights the depth and popularity’s secret.

Written by Tera GogoJungle marketing