Gap openings, regardless of key indicators! Stable operation with the EA "Genuine" that operates from 9 to 17

The new release from Alexa, known as the creator of InstaFX, makes its highly anticipated debut!

An EA that is less affected by gap openings and indicator effects, trading only during Japanese daytime hours"Genuine"

Until March 22, 2020

Regular price 19,800 yen → 15,000 yen

EA Overview

Currency pair | [EUR/USD] |

|---|---|

| Trading style | [Scalping] |

Maximum positions | 2 (for two independent logics) |

Timeframe used | M5 |

Maximum stop loss | 62 (minimum 29 pips) |

Take profit | 87 (minimum 14 pips) |

Notes | Equipped with two logics and hedging allowed |

Forward performance covers a period of less than a month, but even in the highly volatile March market due to the coronavirus, it has delivered solid results without large losses, which is highly commendable.

Genuine Features

Details are explained on the sales page, but what is noteworthy is"Trade only from 9:00 to 17:00 Japan time"that is, the fact that it only trades during 9:00–17:00 Japan time.By avoiding the time periods that are challenging for a rule-based EA, such as Monday gap openings and key U.S. economic indicators during New York hours, it maintains a stable win rate (88%) and you can expect forward results in real trading that are similar to the backtests.

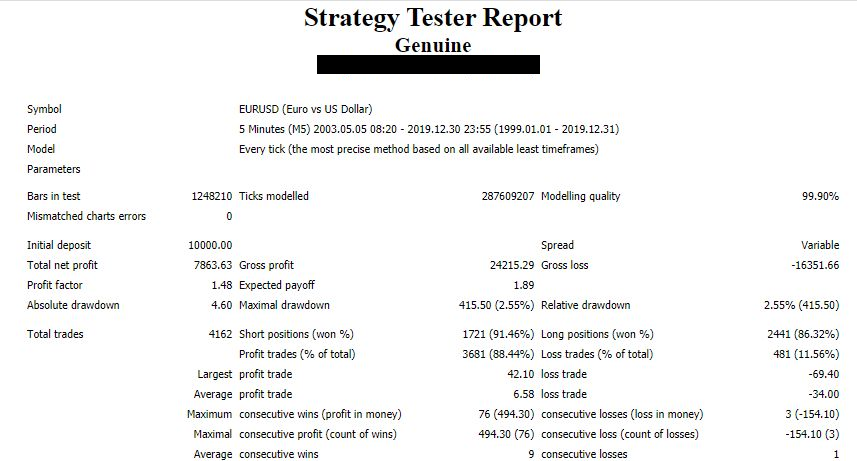

Backtest Analysis

Backtest period

2003.5~2019

Current spread

Total net profit +$7,863

Annual average profit +$477 (470 pips)

Average annual trades 252

Maximum drawdown -$415

Average profit $6.58

Average loss -$34

Win rate 88%

Trade holding time:From as short as 7 minutes to as long as 5 hours

Recommended margin

(500*2)+(415*2)=1830 USD

Expected annual return is about 26%.

With about 200,000 yen, you can expect about 50,000 yen per year.

Also, since the maximum holding time is about 5 hours, it requires only a very short time, which is attractive.

▲Monthly P/L

▲Yearly P/L

The annual average profit is $450, but it varies by year.

2013 and 2016 are slightly negative, but not significantly so.

In 2008 and 2010, profits were higher, thereforeIt seems that years with higher volatility tend to earn more.

Trading Image

Red: BUY Blue: SELL

Open in the trend direction with two positions held simultaneously.

There appears to be both a scalping type that captures range markets in detail and a mid-term trend logic that enters as new highs and lows are set in the trend direction.

In Niagara-market conditions like the chart above (midnight), it does not trade; it enters during the relatively stable hours from morning to evening Japan time, reducing the chance of large losses.

Also, since the maximum SL is 67 pips, large losses are unlikely even in worst-case scenarios.

Even in the volatile market of February–March 2020, its stability without excessive profits or losses attracted EA users' attention,

and since launch it has sold 100 copies of the discounted edition immediately.

The EA's settings (parameters) are simple, so it's a recommended pick even for beginners.

Written by Tera GogoJungle marketing.