Make good money in a volatile market! Use long and short positions according to the time zone "Time_Zone_EA"

Time_Zone_EA Forward Performance

【Time_Zone_EA】Strategy Overview

Currency pair: [GBP/USD]

Trading style: [Scalping]

Maximum number of positions: 10

Timeframe used: M5

Maximum stop loss: 100

Take profit: 60

"In this EA, we adopt a 'Time Zone Strategy' that deliberately differentiates the entry time windows for selling and buying."

"What the 'Time Zone Strategy' is,

・In time periods that tend to be bearish → sell entry only

・In time periods that tend to be bullish → buy entry only

This design philosophy aims to achieve high performance."

As explained, this is an EA that has separate selling-only time zones and buying-only time zones.

The forward period is relatively short, but as Dr. Neko's EA, it's different from past ones, so it's intriguing!

From the backtests, let's assess the EA's performance.

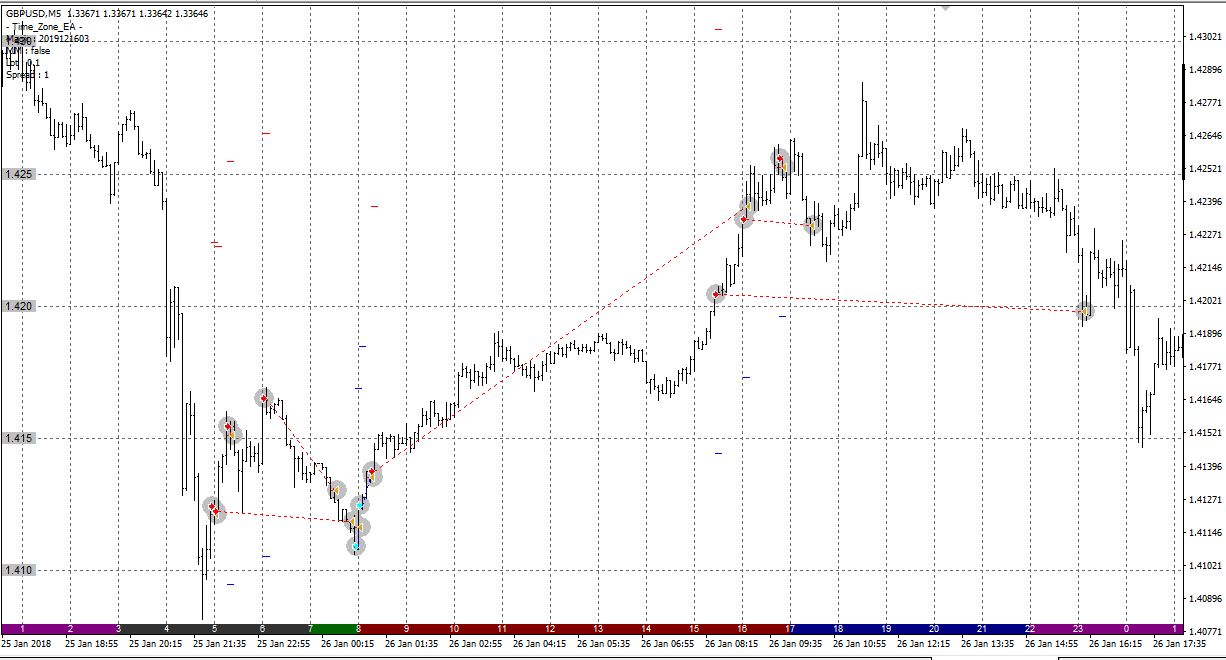

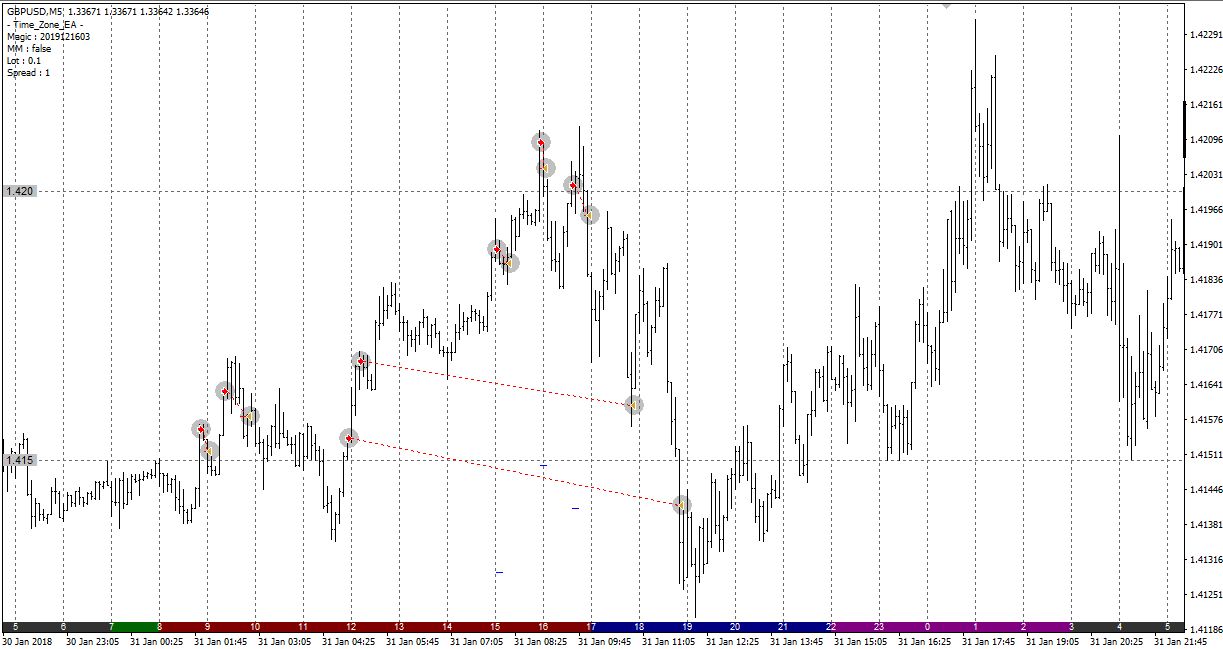

Trading Image

Red: SELL Light blue: BUY

In the morning hours, buying is more common, and otherwise selling is more common.

Although the maximum open positions are 10, simultaneous holdings seem to be around 5 positions at most.

Backtest Analysis

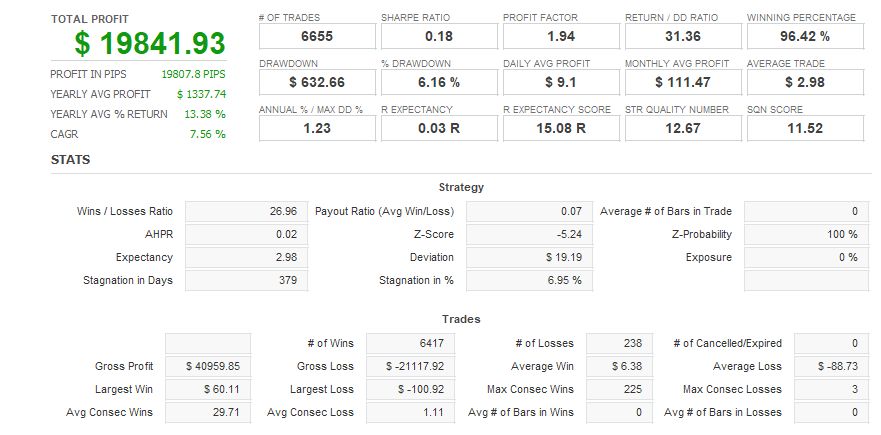

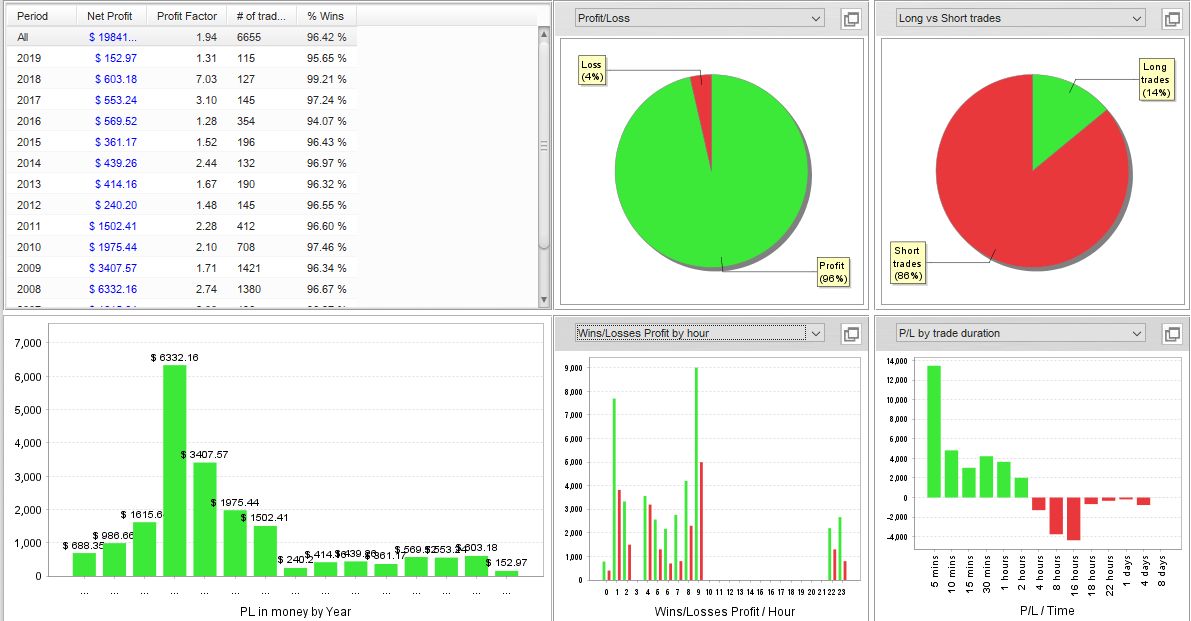

Let's analyze the official backtest with Quant Analyzer.

Average gain in pips: 6 pips

Average loss in pips: -88 pips

The risk-reward ratio isn't great, but the Profit Factor is 1.9, meaning profits are nearly twice the losses.

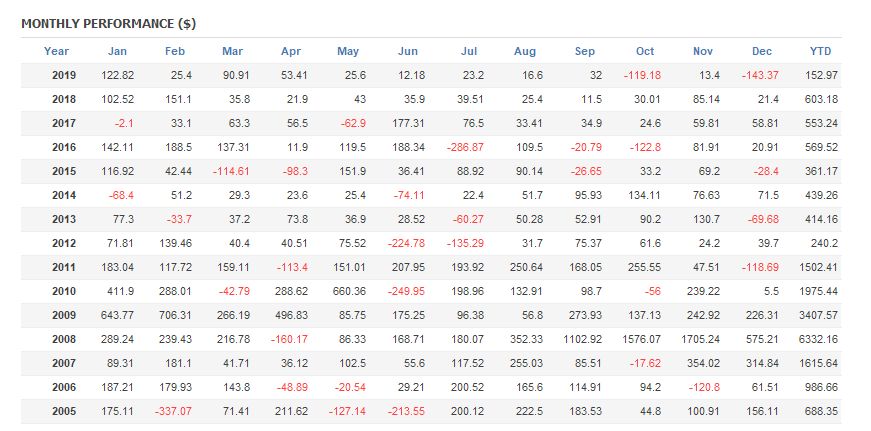

▼ Monthly Profit and Loss

Not only is there little negative P/L on a monthly basis, there are no losses on an annual basis either!

▼ Yearly Profit and Loss, Detailed Analysis

2007–2011 has exceptionally strong performance.

Also, the win rate is extremely high, boasting 96% win rate.

2020 might be a big market year, but let's estimate the expected annual return over the last 5 years.

5-year average profit = $447

5-year average number of trades = 227

Maximum drawdown during the period = -$600

Recommended margin (calculated for up to 5 positions)

(440*5) + (600*2) = 3200 dollars

Expected annual return

447 ÷ 3200 × 100 = 13.9%

That's how it stands. Over the last 5 years, the expected annual return doesn't seem that high.

However, at the very least,An annual stable gain of 400-500 pips is being achieved, andIt is a type that increases trading frequency and profits in turbulent markets.

If you take the five years from 2008 to 2012, the average annual profit becomes $2,691, and the maximum drawdown is about -$600, so the average annual return rises to about 84%.

We don't know what kind of year 2020 will be, but at least it's an EA that won't incur losses, right?!

Written By Tera GogoJungle Marketing.