Nikkei 225 futures system trading: a detailed explanatory video using KENSHIRO225 that lets you refine trading methods and achieve automated trading

When it comes to investing in Japan, there are stocks, Nikkei 225 futures, FX, commodities futures such as crude oil and gold, and cryptocurrencies, etc., but still,the number of investors trading individual Japanese stocks is overwhelmingly large.

However, individual stocks can experience price movements that you wouldn't have anticipated, driven by the company's performance or unexpected catalysts (news).

Therefore, you can not only buy but also sell,the Nikkei 225 futures that target the stock price index of the 225 individual Japanese stocks,are important as hedging instruments for investors who trade individual stocks, and as standalone investments, and they have a certain level of popularity.

KENSHIRO225, which enables system-trade based trading of such Nikkei 225 futures, is a highly effective software for investors trading Nikkei 225 futures: as a tool to backtest their own trading logic, run it to improve it, and also to actually perform automated trading.

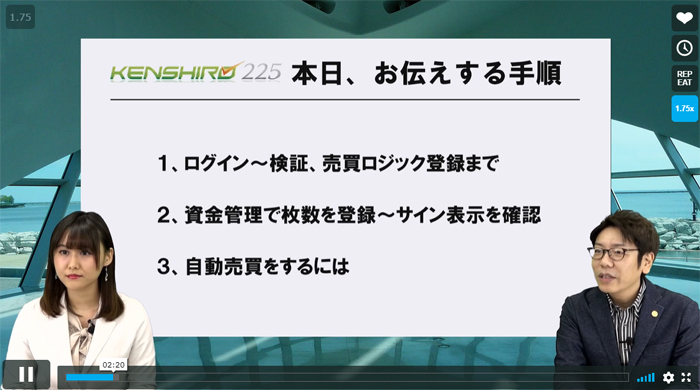

Today, in a video, President Murai of Excellent Horse Co., Ltd. and MC Emirin will present how to create the buy/sell logic for KENSHIRO225's NY Dow contrarian trading method.

KENSHIRO225 NY Dow Contrarian Method Verification!fromGogoJungleonVimeo.

Written by Hayakawa