Types of FX automated trading services and their differences from MT4 EAs

◆Table of Contents: Getting Started with MT4 EA◆

2. MT4 Accounts Compared by Spreads, Swaps, and Order Execution

3. Types of FX Auto-Trading Services and How They Differ from MT4 EAs←Here

Speaking of it, when I searched to start automated FX trading, the first information that came up were FX company auto-trading services like Toraripi (Traripi) and TriAuto.

Exactly. MT4 EA is one of the options for FX automated trading, so,

as you research, you tend to arrive at MT4 EA.

Besides, since it can be used for free, and unlike MT4 you don't have to keep it running 24/7, it's convenient, right?

There are many user tips published, and FX company support is strong, so it may be a good service for first-time users. So this time, let's summarize what kinds of FX automated trading exist.

Much appreciated!

Table of Contents

- Five Types of FX Auto-Trading Systems

- FX Company–specific Auto-Trading Service Classifications

- Basics of Repeat-Type Auto-Trading

- Advanced Features of Repeat-Type Auto-Trading

- Fees and Spreads for Repeat-Type Auto-Trading Services

- What Features Are Still Missing in Repeat-Type Auto-Trading?

- Strategy-Select Type (Original Type) Generally Uses MT4 EA Signals

- Is MT4 EA for Advanced Traders?

- GogoJungle Multi-Function Grid & Repeat-Type EA!

Did you know that when you search for “FX automated trading,” you’ll often see MT4 EA… not MT4, but “Repeat-Type Auto-Trading Services” such as Toraripi and Repeat If Done?

Yes, among retail investors, services that automatically trade on your behalf by simply selecting them are more well-known and popular than MT4, which requires mastering how to use it.

Repeat-type and other proprietary FX auto-trading services are now offered by more than 10 FX companies/brokers in Japan as flagship services

Fees can be free, and some brokers offer low spreads like 0.4 pips for USD/JPY, making them appealing.

In addition, some services let you create your own strategies or choose original strategies. Compare the many auto-trading services available and find the investment approach that suits you.

Five Types of FX Auto-Trading Systems

1. Repeat-Order Type (Loop Type)…A basic trading method that repeats orders within a set price range; you configure the width and number of orders yourself.

TorariPi, TriAuto, Loop IF-Dun, etc.

2. Strategy-Select Type (Original Type)…Choose from multiple original auto-trading strategies with published results and use them.

SystemTrade24, Everyone’s System Trade, etc.

3. Mirror Trader Type…Copy-trade the trades of skilled discretionary traders as-is.

Macaso, Avra Mirror Trader, System Trade 24, etc.

ChoiTrade FX, TriAuto FX Auto-Trading Orders, etc.

5. Strategy Development Type…Investors develop auto-trading programs (Experts Advisors) using a variety of trading strategies, which run only on MT4.

For repeat-type or strategy-select auto-trading, you can complete everything on their website, so no installation is required.

FX Company–Based Auto-Trading Service Classifications

| Company | Service Name | Type | |

| 独自プラットフォーム系 | MoneySquare | TorariPi | Repeat-Order Type |

| Monex Securities | Repeat-Order Type | ||

| Himawari Securities | Repeat-Order Type | ||

| FX Pro Net | Repeat-Order Type | ||

| LIVESTAR Securities | Repeat-Order Type | ||

| Gaitame Online | Repeat-Order Type | ||

| INet Securities | Repeat-Order Type | ||

| Invast Securities | Repeat-Order Type, Strategy-Select Type, Mirror Trader Type | ||

| Traders Securities | Strategy-Select Type | ||

| Excite One | Mirror Trader Type | ||

| Central Tsu*** FX | Strategy Creation Type | ||

| FX Prime by GMO | Strategy Creation Type | ||

| au Kabucom Securities | Strategy Creation Type | ||

| MT4 Series | FOREX EXCHANGE | My EA | Strategy Development Type |

| Forex.com | |||

| Gaitame Finest | |||

| FXTF (Golden Way Japan) | |||

| Rakuten MT4 | |||

| Oanda Japan | |||

| AvaTrade Japan | Strategy Development Type | ||

| Saxo Bank Securities | |||

| DucasCoppy Japan |

If you can use auto-trading services on a broker’s own platform, spreads tend to be relatively wider.

However, because you can access proven auto-trading options with abundant information, you can treat the service as a fee for the convenience.

On the other hand, when MT4 is available, spreads tend to be relatively tight.

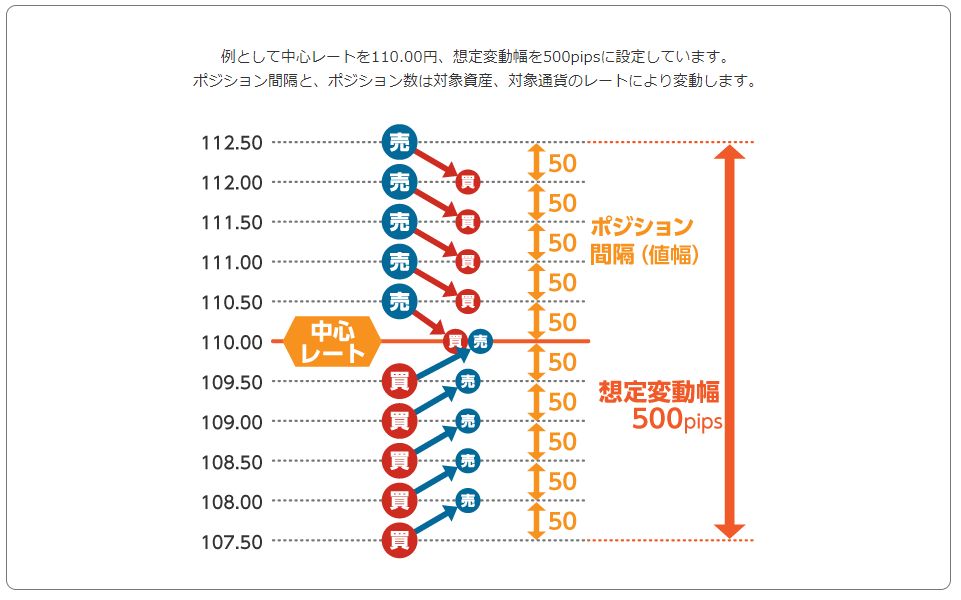

Basics of Repeat-Type Auto-Trading

If you already know this, feel free to skip.

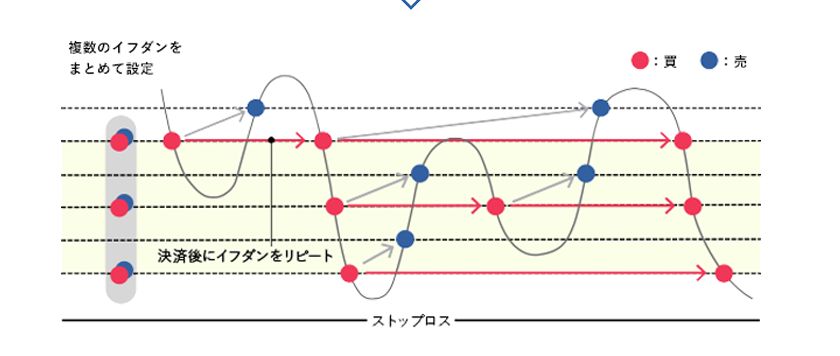

Basic order method

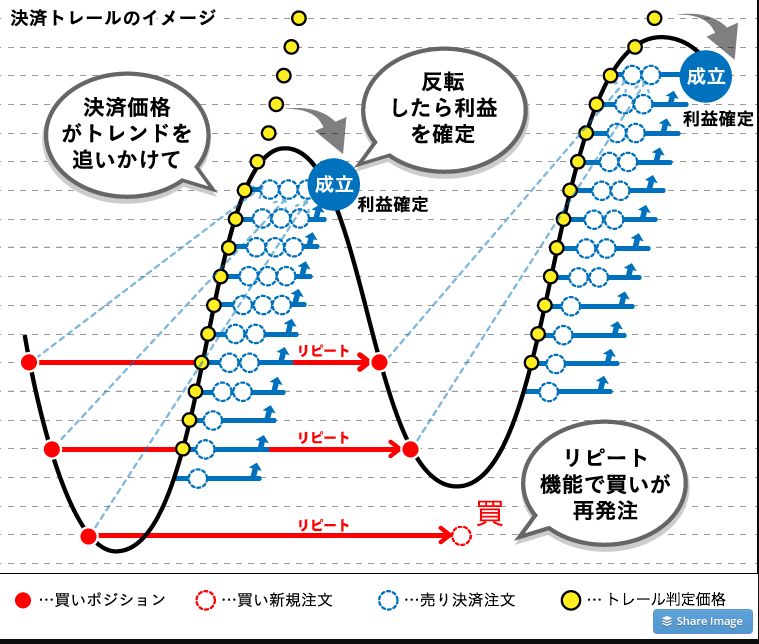

(Image source:MoneySquare)

Such trading can be set as buy-repeat or sell-repeat on either side (for range-bound markets).

Drawbacks: You must decide the expected range and the repeat interval yourself, and if the price moves outside the range, you’ll incur unrealized losses and may hit stop-loss (automatic or manual).

Two Purposes of Repeat-Type Operations

1: Trade automation to save effort — for operational gains

You don’t need to guess every day whether to buy or sell, and you can automate for a fairly long time horizon.

Even people who don’t have time for investing can easily manage it.

2: Swap income + operational gains

Focus on high-swap currencies like Turkish Lira, Mexican Peso, and South African Rand/JPY with buy-leaning repeat-type auto-trading. In addition to operational gains, you also collect swap profits, a style suited for long-term investing.

Now, that covers the basics of repeat-type auto-trading. Let’s introduce some newer services that have appeared recently.

Evolved Features of Repeat-Type Auto-Trading

Popular Half & Half

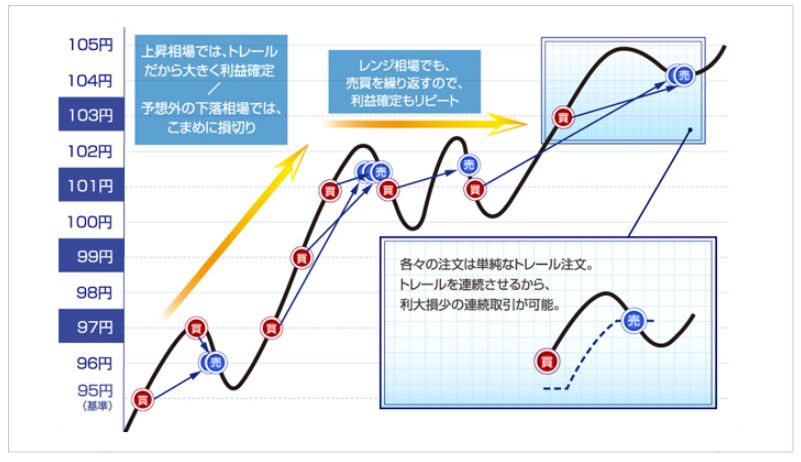

Trend-Following with a Trail Function

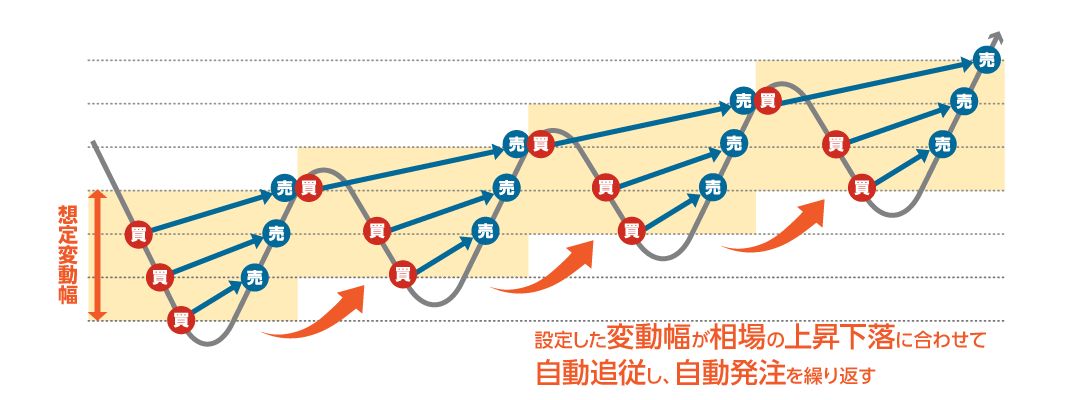

Repeat-type auto-trading often faced losses when the market moved outside the expected range, especially with tight repeat intervals and narrow expected ranges.

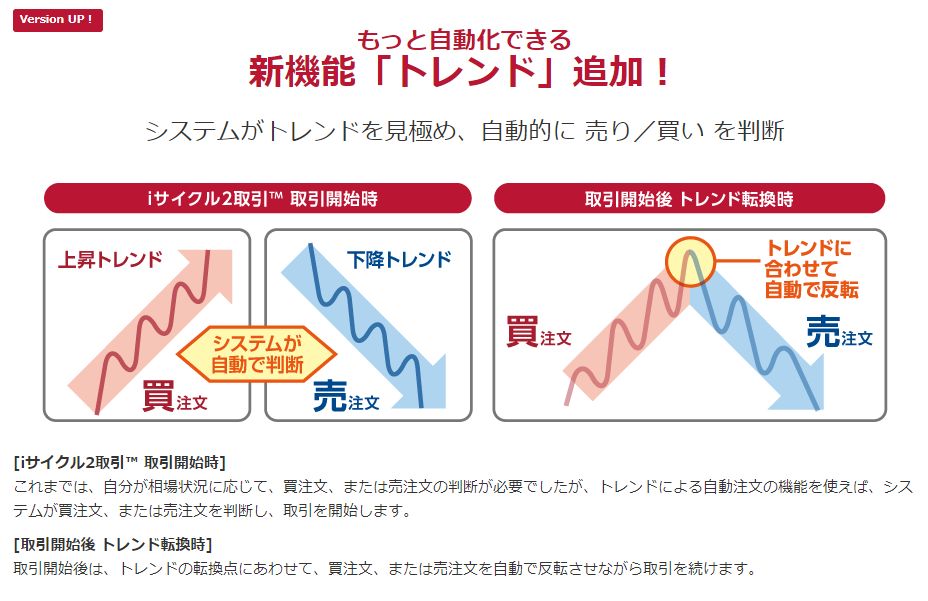

Automatic Trend Following and Reversal Detection… Automatically?

Fees and Spreads for Repeat-Type Auto-Trading Services

Because these strategies trade frequently, tight spreads directly affect profitability. Here’s a comparison of four representative companies.

| Service Name | Broker | Stop-Loss Setting | Fees | Main Spreads | Number of Currency Pairs | ||

|---|---|---|---|---|---|---|---|

| AUDJPY | GBPJPY | NZDJPY | |||||

| Toraripi | MoneySquare | Yes/No selectable | Free | 5–6 pips | 6–7 pips | 6–7 pips | 12 |

| Loop IF-Dun | iNet Securities | Yes/No selectable | Free | 4 pips | 5 pips | 6 pips | 20 |

| TriAuto FX | Invast Securities | Yes/No selectable | For less than 10,000 not round trip: 4 pips For 10,000 or more: 2 pips round trip For 100,000 or more: 1 pip round trip |

0.6 pips | 1 pip | 1.7 pips | 17 |

| i-Cycle 2 & Cycle 2 | Gaitame Online | Fees: 1000 units round trip 20 yen 10,000 units: round trip 200 yen (Fees waived until 2019/12/31) |

3 pips | 3 pips | 6 pips | 26 | |

iNet Securities is popular for its low fees and wide currency pair coverage.

Functions Not Yet Available in Repeat-Type Auto-Trading

So far, these evolved and popular repeat-type auto-trading services—how do they compare to MT4 EA in terms of capabilities?

Let’s compare features.

1) Consolidated Profit/Loss All-at-Once Settlement

Repeat-type auto-trading usually has pre-set take-profit/stop-loss for each order, with only basic trailing features. With an EA, you could set a combined condition such as total profit or loss across multiple positions to trigger a single settlement.

2) Change the Averaging (Nampin) Width Dynamically

Repeat-type auto-trading typically uses evenly spaced repeat widths. An EA can vary the number of lots and spacing depending on price bands, allowing irregular averaging widths by price range.

3) Apply Martingale

4) Use Technical Indicators as Entry Filters

This is where the real advantage of EA lies.

Strategy-Select Type (Original Type): Most Use MT4 EA Signals

Among repeat-type auto-trading, MT4 EA can realize complex trades that other types cannot. You can see how MT4 EA signals are leveraged in strategy-select auto-trading.

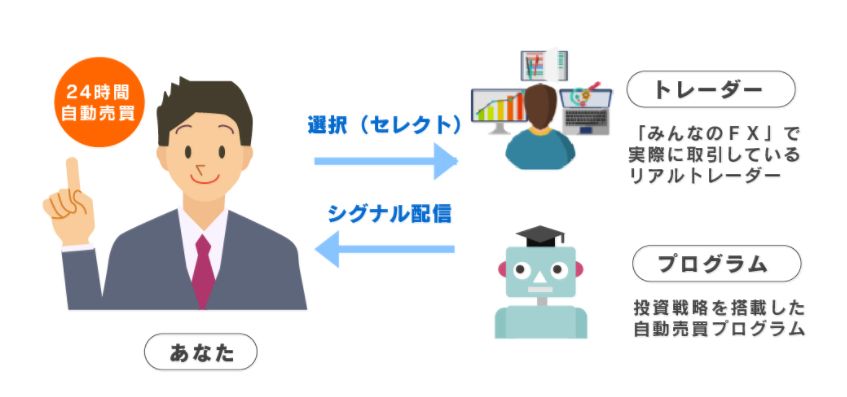

Auto-trading using MT4 EA signals is common in Strategy-Select Type (Original Type).

Even though Everyone’s System Trade and System Trade 24 don’t run on MT4, they use MT4 EA signals to automate trading.

Choosing a good EA from MT4 EA can be tough, but services that pick proven performers and let you auto-trade by simply selecting are effectively MT4-free auto-trading services.MT4-free auto-trading conveniencedescribes these well.

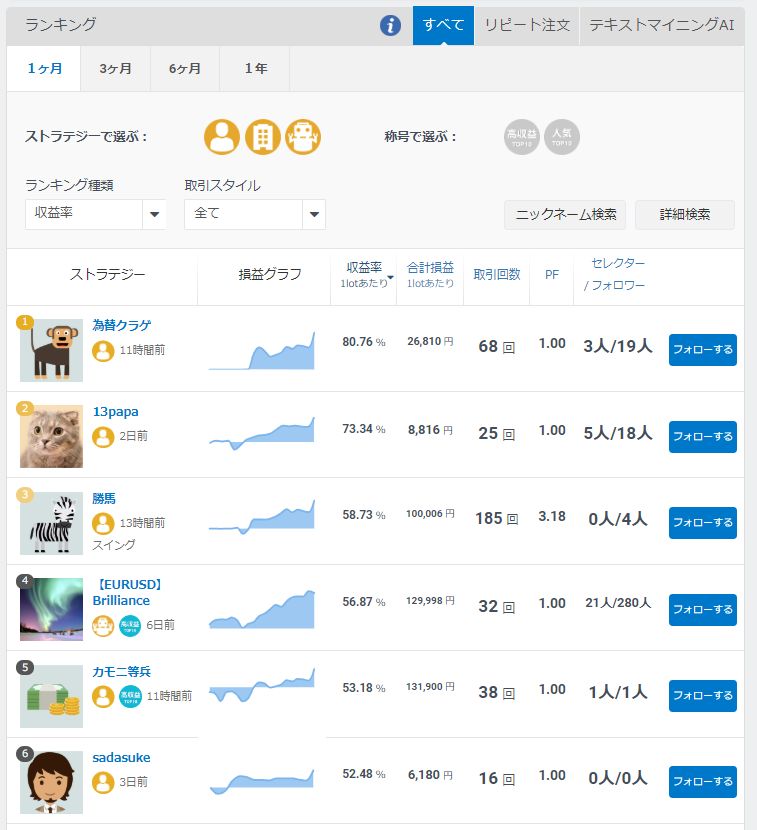

Invast Securities’ “System Trade 24”

Traders Securities’ “Everyone’s System Trade”

MT4 EA: For Advanced Users?

Moreover, because spreads are often quite wide on MT4, even trades that would be profitable may become less profitable due to spreads.

GogoJungle Multi-Function Grid & Repeat-Type EA!

Grid-type EAs are often avoided, but what if you think of them as affordable repeat-type EAs?

You can operate with a wide range of EAs from highly customizable to developer-recommended presets.

◆Nanpin Maker

The all-in-one Nanpin EA now in the spotlight

By default,

・Maximum 12 positions

・Selected three currency pairs customized by the seller (AUDCAD/EURUSD/AUDNZD) with parameter files

・Three settlement styles to choose from

・Irregular safety averaging (gradually widening intervals)

・Protection closeouts at weekend gains

・Technical counter-trend entries

・Compounding feature

◆Honeycomb Grid That Grows Hands-Off

・Maximum positions: 30

・Technical averaging via short-, medium-, and long-term indicators; if you place a new order on the short-term, you won’t enter long-term/medium-term

・Includes a selling out feature for emergencies

・Seller-recommended sets for USDCHF/AUDNZD/ZARJPY/AUDNZD and a fund management sheet included!

◆Two-Sword Revenue Robot USD “FX Gain + Swap Interest” TBTR_Swapro_USD

・EA that pursues swap interest + operational gains on USDCHF

・Swap gained over 3.5 years exceeded 300,000-yen

◆Nan-chan Pin-chan CADCHF

・Technical counter-trend entry type with pyramiding

・Parameters optimized for each currency pair

The contrarian entry logic is not fully clear, but backtests show high recovery factors.

◆Grid Trade Order-Kun

A grid-trade EA capable of Half & Half.Trailing and break-even stop features, and an entry filter that triggers only when a trend emerges.Used skillfully, it can significantly reduce costs.

◆Euro EA

・Loose 10-pip pyramiding

・Stop loss setting available

Written By Tera Gogojungle Marketing.