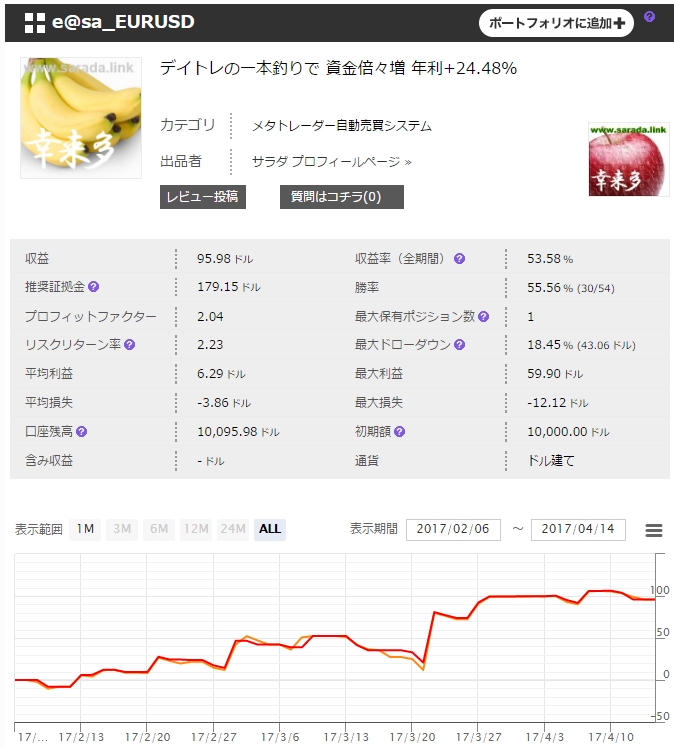

Losing steadily and then increasing dramatically 'e@sa_EURUSD'

Introducing the new EA from the up-and-coming developer 'Kōraita (Salad)'!

Forward-testing period: 2 months; supports 10-year backtests

'e@sa_EURUSD'

[Features]

Position sizing with a minimum lot of 0.01 and a maximum of 2.0 (20x the minimum)

Slowly lose and win big!This is the EA.

Because the lot size fluctuates, the number of pips earned is not a reliable reference for evaluating the EA, so let's look at it on a monetary basis!

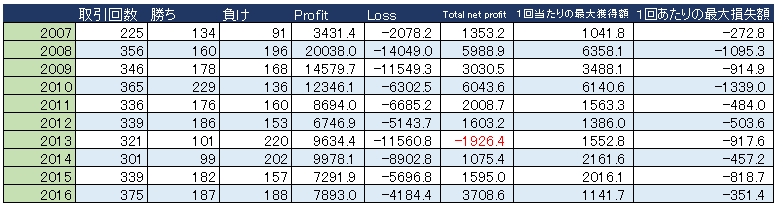

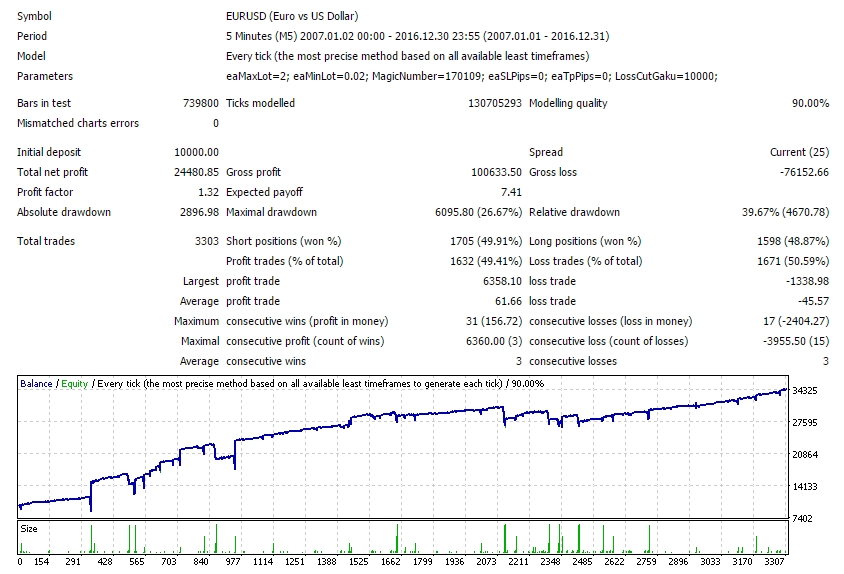

10-year backtest features

Annual trade count ranges from 225 to 375, i.e., over 20 per month. Since it operates at 1 lot, you can expect roughly one entry per day, so it's not sparse.

In fact, the win rate isn't strongly tied to profitability.

Both 2013 and 2014 had a win-to-loss ratio of 1:2, resulting in a negative win rate, but

2013 finished the year with an overall loss, while 2014 was positive.

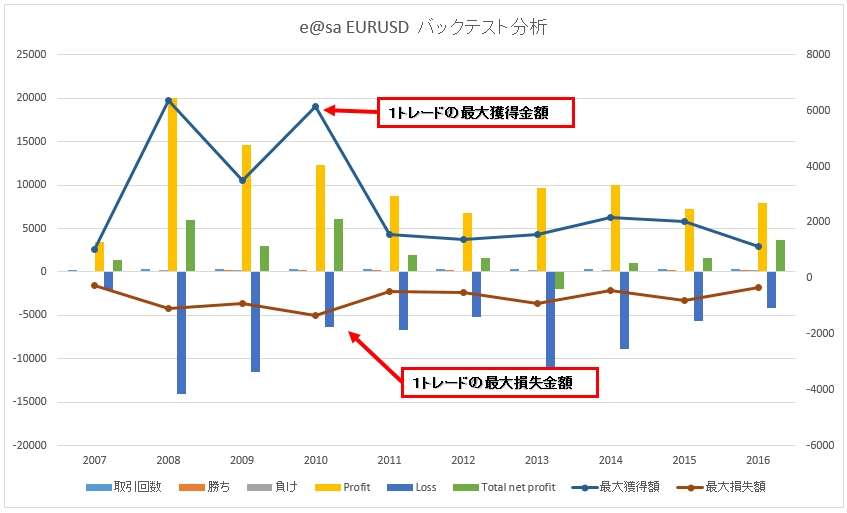

The reason becomes clear when comparing the annual maximum gain against the maximum loss per trade.

The maximum loss to maximum gain ratio is 1:2–5, meaning profits are substantially larger.

When graphed, the maximum gains are clearly larger.

Looking at the backtests, after a drawdown, it tends to rebound to compensate for the recent losses, as if doubling back up.

profits continue to rise.

In the last 2-3 years, it has been steadily rising.

[Notes for operating the EA]

Because this is an EA that varies positions, if you run it with the default parameters,

You will need at least 1,000,000 yen in funds with leverage of at least 25x.

It may use up to 200,000 units of currency, i.e., about 800,000–900,000 yen in account funds. If you are running multiple EAs or margin is insufficient, you won't be able to place larger-lot trades to cover prior losses, and performance will suffer.

Launch promotion: limited to 50 copies!

19,800 yen⇒ 9,800 yen