For those who can't withstand drawdowns. Ultra-short-term trading with a 10-pip stop loss and high profits 'Impulse'

Impulse EA Overview

Currency Pair | [GBP/JPY] |

|---|---|

| Trading Style | [Scalping] |

Max Positions | 1 |

Time Frame Used | M1 |

Maximum Stop Loss | 10; Others: adjustable |

Take Profit | 100; Trailing Stop available |

Special Notes | Recommend brokers with Stop Level 0 |

Impulse Features

"Small losses, large profits, and high capital efficiency — these are the characteristics of Impulse."

"Impulse often completes from entry to settlement in a matter of minutes, making it highly capital-efficient. High-leverage scalping is feasible even with domestic broker leverage."

As described, forward results show many trades settled within a minute.

In some cases, settlements occur within one minute and then re-entry occurs.

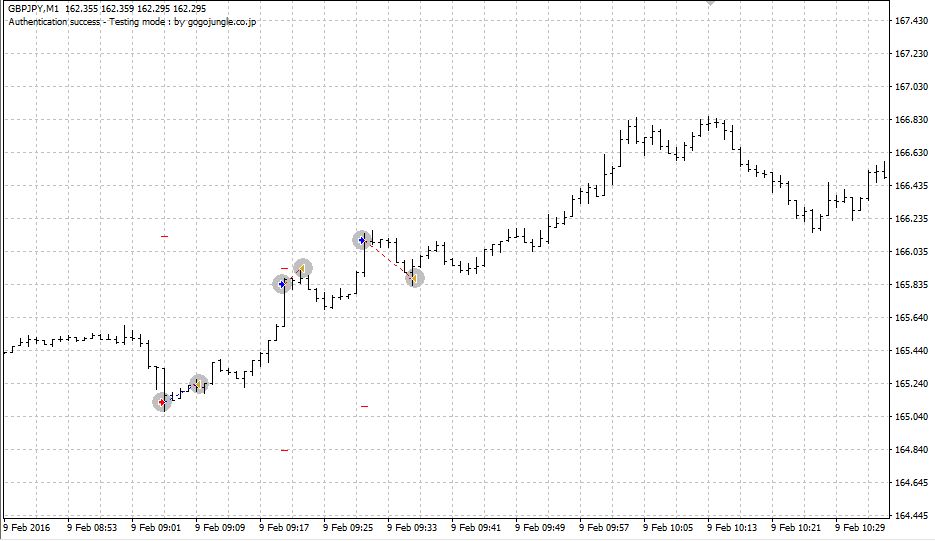

▲Forward performance: ultra-short-term trading completed within a few minutes.

As a note,“Stop Level 0”FX brokers are recommended, and the key to operation seems to lie exactly in this area.

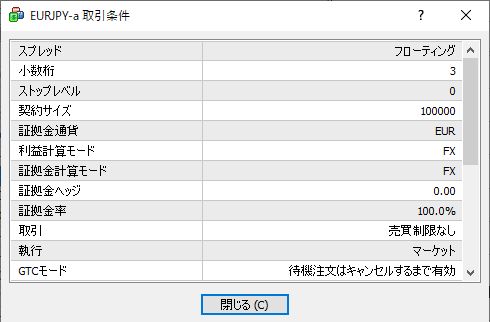

What is Stop Level

It is the minimum distance in pips you must keep from the current price when placing limit orders or stop orders.

Depending on the broker and currency pair, the wider this distance, the less favorable it is for short-term trading.

In domestic Japanese FX brokers, Stop Level is often 0, but operating with Stop Levels that are wide without knowing this can significantly affect performance.

If you operate scalping EAs or trailing-stop EAs on brokers with wider Stop Levels, performance can vary greatly.

How to Check Stop Level

From the market depth display, right-click any currency pair →Specifications, click

You can check the Stop Level. (In this case it was 0.)

The advantages of Stop Level 0 are that you can place limit and stop orders with only a few pips distance, you can reduce the starting width of trailing stops, and you can set smaller trailing-stop step sizes.

For EAs aiming for a few pips in scalping, this is a point you should highly consider.

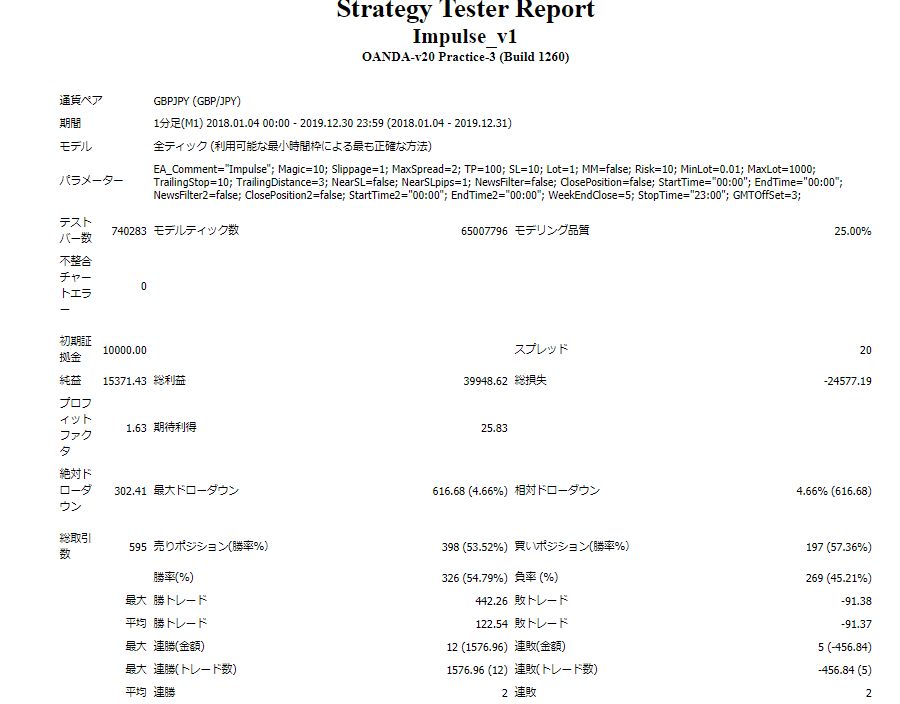

Impulse Backtest Analysis

We backtested the most recent two years with a spread of 2.0

Period: 2018.1.04-2019.12.31

Spread: 2.0

Lot: 1.0

Max Drawdown: $616

Total Trades: 595

PF: 1.63

Net Profit: $15,371

This is the result.

For this case, the recommended margin is,

(5500) + (616*2) = $12,232

Expected annual return: 63%.

This is the recommended margin for 1.0 lot, but above all, since the stop loss is 10 pips, even at maximum drawdown it stays in the $600 range, making it a highly capital-efficient operation.

Also, although it is scalping, each trade yields more than 10 pips, and the annual average pip gain is around 700 pips, so you likely won’t worry about having too few pips.

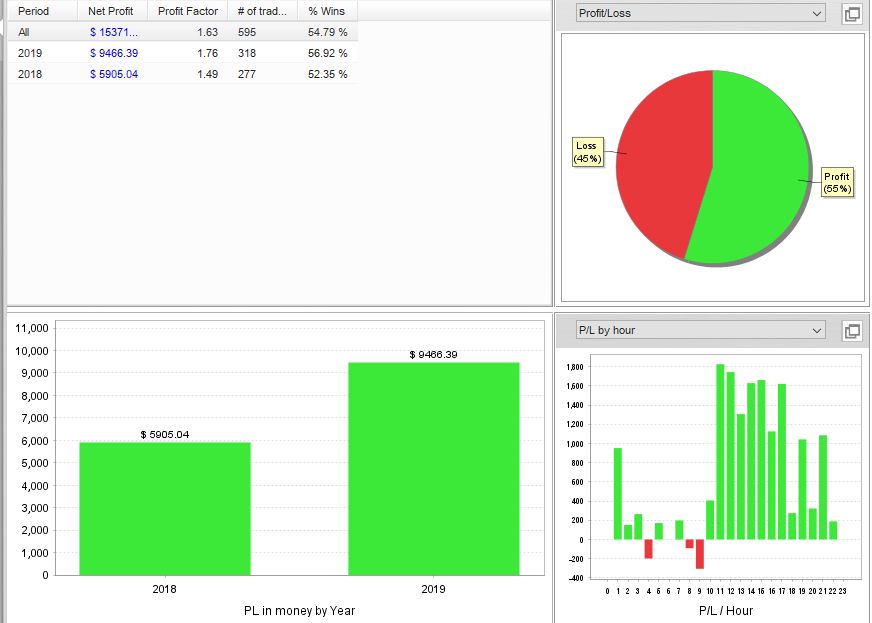

▼ Overview

Win rate 55%, PF 1.63. Annual profit: $6,000-$9,000.

▼ Monthly P/L

Monthly losses are modest, with June slightly weaker.

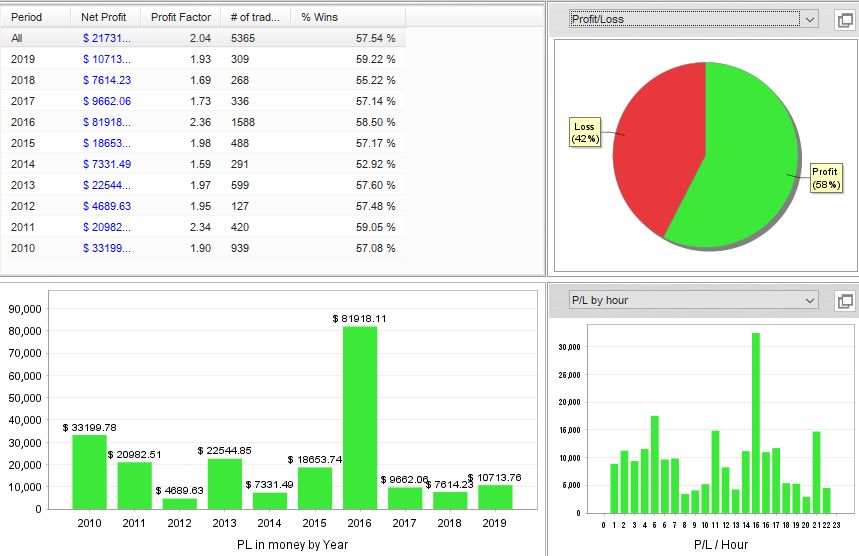

【Long-Term Backtest】

This time we ran about 10 years of backtest starting from 2010

Spread 1.5

Lot 1.0

Somehow 2016 turned out extreme…

There were more trades than usual, so 2016 might be considered a bonus year.

In such a case, calculating the average yearly return loses meaning, so I’ll just report the maximum DD:10-year backtest

showed $1,392drawdown.

Whether the last three years indicate lower profits or if it’s a backtest-only miracle remains to be seen in future forward results.

Trade Examples

We will present notable trade examples via visual backtest.

▲Red: Buy、Blue: SellWe are counter-trading on the 1-minute chart and exiting quickly.

▲When a single candle moves strongly, we also enter contrarian trades multiple times. It seems that in 2016 this pattern led to many trades. The stop loss does not exceed 10 pips, but take profit can reach up to 100 pips thanks to trailing stops working well.Cases where up to 100 pips can be earned.

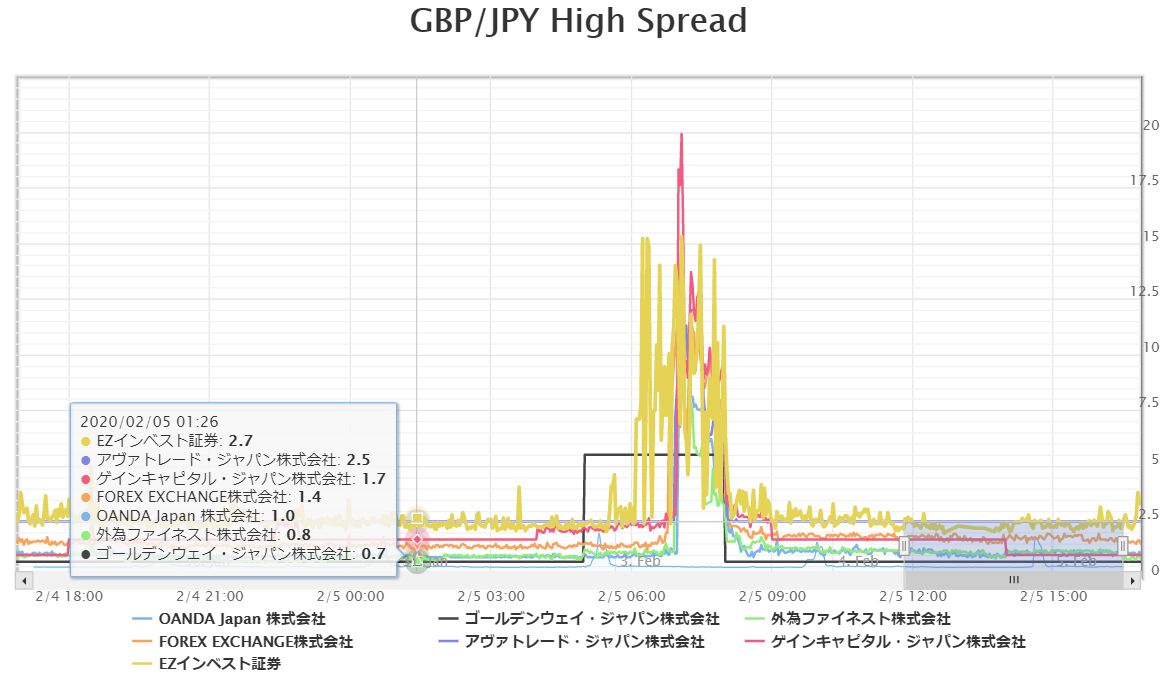

Which FX brokers offer tight GBPJPY spreads?

>Real-time Spread Comparison Here

Golden Way Japan (FXTF) offers a fixed 0.7 pips; others are variable. Gaitame Finest and Oanda Japan tend to be lower, making them suitable for GBPJPY EA operation. However, FXTF appears to have a stop level around 5 pips, so

you must choose between lower spreads or tighter stop levels (or zero).

For those seeking a short-duration scalping EA, this was a best-match EA introduction.

Written By Tera GogoJungle Marketing.