The 'Best Parabolic of a Foreign Country' Indicator can target a major trend with MTF functionality!

The "Foreign Warrior" who has released numerous original indicators unveils a new work!

“Foreign Land's Best Parabolic”is a tool that displays multi-time-frame (multiple timeframes) parabolic on a single chart and only issues signals when the parabolic directions align! Compared to the standard Parabolic SAR, let's take a closer look at what makes it superior.

First, a quick introduction for those who are unfamiliar with the Parabolic

What is Parabolic SAR:

The formal name isParabolic SAR (Parabolic Stop and Reverse). It was devised by J. W. Wilder, who also created familiar technical indicators such as Pivot, ADX, and RSI. Parabolic is a “parabola,” and SAR stands for Stop and Reverse, that istrend reversal. It is an indicator that can read trend reversals.

Parabolic SAR Calculation Formula

SAR=previous bar's SAR + AF※1×(EP※2-previous bar's SAR)

※2:EP(Extreme Price:extreme value):the highest high / lowest low up to the previous bar

As the Parabolic SAR updates the high (low) during the signaling period, EP is also updated.

※1:AF(Acceleration Factor):acceleration factor (0.02≦AF≦0.20)

Each time a new high (low) is updated, AF increases by the step value up to a maximum of 0.20.

If the step is 0.02, AF increases by 0.02 each time a new high is updated.

On a trend reversal, AF resets to 0.

However, the maximum AF is 0.2, and it cannot exceed that.

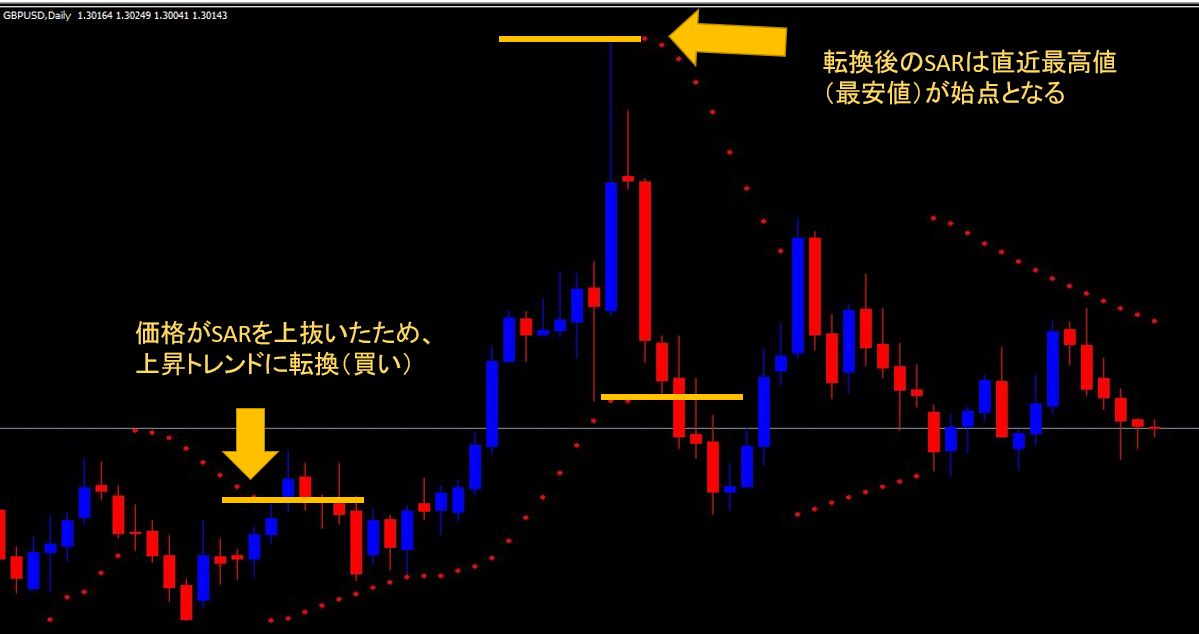

About Parabolic SAR Reversals

In a transition from short to long, when the price moves above the SAR dots drawn above the price, it signals a trend reversal.

Also, the new SAR after a trend reversal starts from the price of the previous low or high before the reversal.

Whether the SAR dots are below or above the candles indicates a buy or sell bias, making it a visually intuitive indicator.

As a trading strategy, you trade on trend reversals: when the bearish SAR (above price) signals, sell; when the bullish SAR (below price) signals, close and buy, i.e., a flip-trading approach.

Features of Foreign Land's Best Parabolic

First, the standard MT4 Parabolic SAR cannot display multi-time-frame; it only shows the SAR for the current time frame.

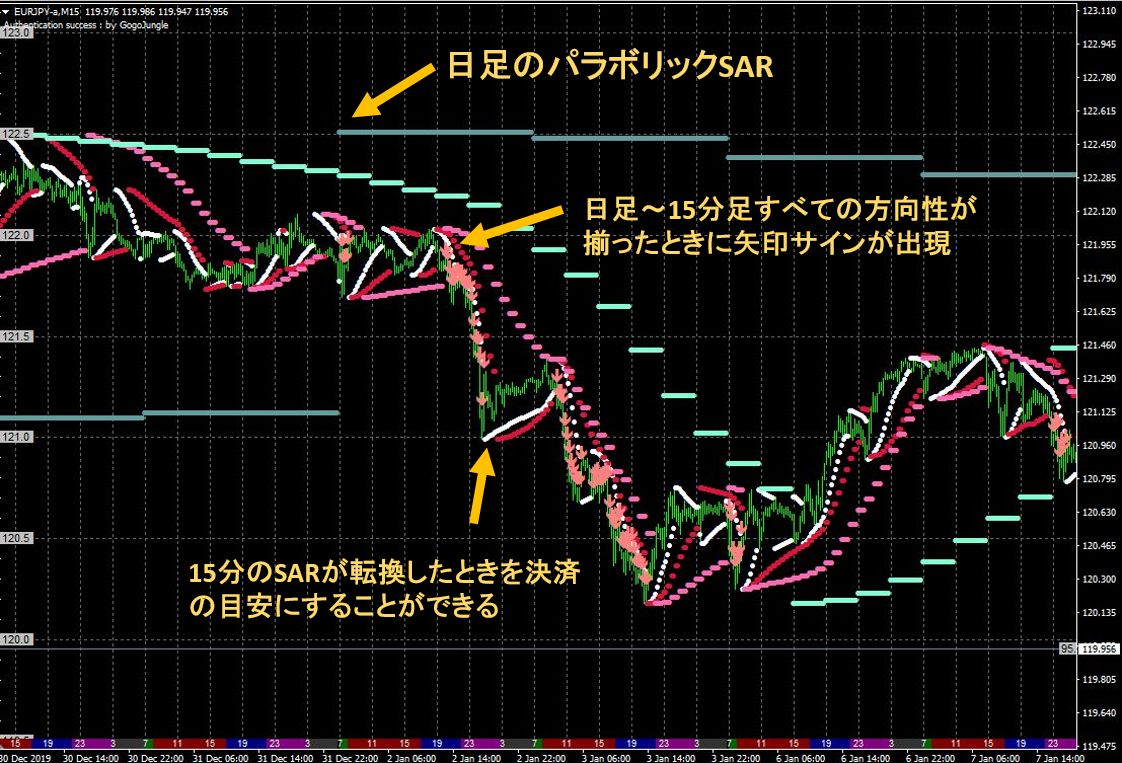

There are SARs that can set MTF, butan arrow signal appears only when all checked timeframes align—this convenience is not available in free indicators.

With Parabolic SAR alone, the chart can get cluttered, and due to the display position of the SAR, higher-timeframe SARs (especially daily and weekly) may be off-chart, making quick judgments difficult.

In such cases,an arrow is displayed only when the directions align, speeding up decision-making.

Also, by entering only in the direction of the major trend, the chances of retracements are reduced, andyou can use the smaller-timeframe Parabolic transitions as exit targets.

Markets Best Suited to Foreign Land's Best Parabolic, Markets It Struggles With

Favored Markets

Indeed, a strong trending market

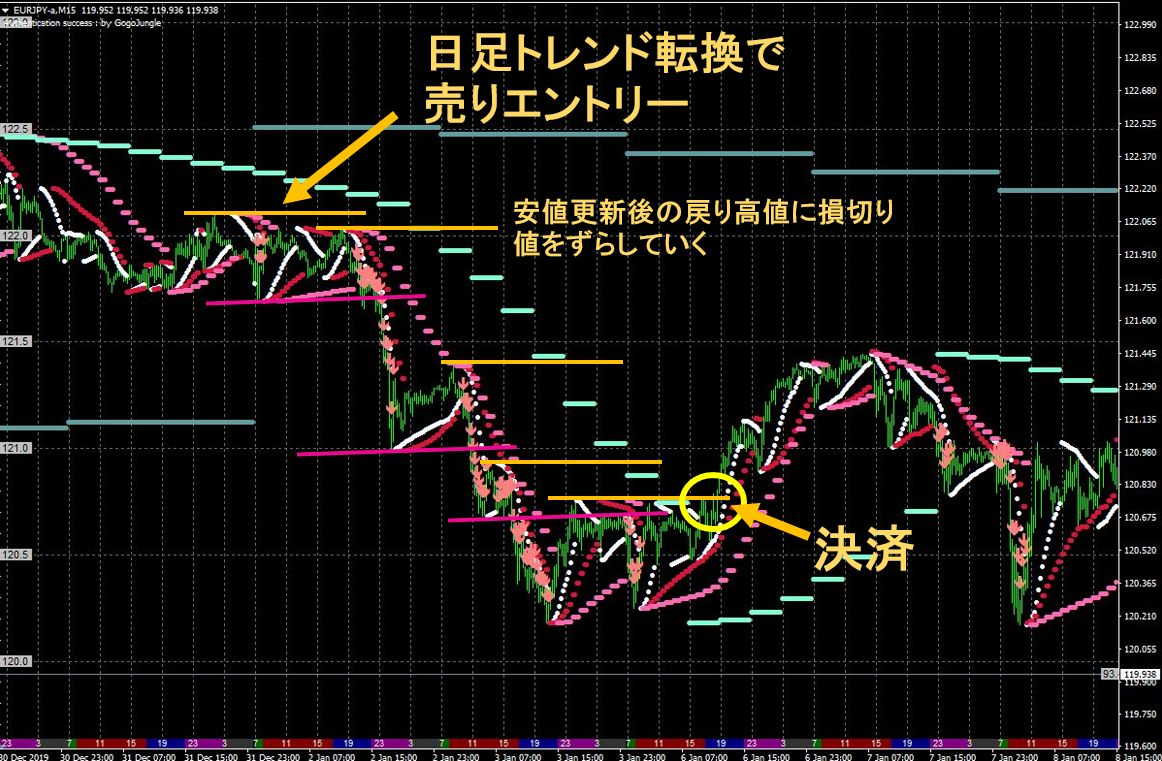

In trending markets where moves of 200 pips, 300 pips occur, you can easily determine the direction and enter at the timing of the daily trend reversal. For exits, use the opposite Parabolic on lower timeframes or place a stop at the most recent high or low, and gradually move the stop.。

Challenging Markets

As with any indicator, in markets with low volatility and narrow ranges that trade within a tight range,

the advantages of this MTF Parabolic become its drawbacks.

▲Although a daily uptrend reversal occurred, the follow-through after all directions aligned is weak. Also, even if the daily low is not broken, the price may quickly drop below the 15-minute arrow signal’s low.

Until now, I thought trading solely with Parabolic would be difficult, but by enabling MTF, it has proven to be a solid basis for entry and exit decisions.

First, focus on the daily reversal, then extend profits and decide how to manage exits, or how to capture pullbacks (pullback highs/lows); other ideas also come to mind.

Written by Tera GogoJungle Marketing.