[MT4 EA] 'Nostalgia Ver1@' Testing portfolio effects with six currencies operated simultaneously for an expected annual return of 50%!?

NostalgiaVer1@ EA Overview

Currency Pairs | [USD/JPY] [EUR/JPY] [AUD/JPY] [GBP/USD] [USD/CAD] [EUR/CHF] |

|---|---|

| Trading Style | [Scalping] |

Maximum Positions | 1 (per currency) |

Timeframe Used | M15 |

Maximum Stop Loss | 50 Others: Primarily closed by internal logic |

Take Profit | 60 Others: Primarily closed by internal logic |

Hedging | None |

NostalgiaVer1@ Features

This is a single-position scalping EA that enters the market around 6:00 JST (7:00 when daylight saving time is in effect).

It does not enter every day; it only enters when the entry logic conditions are met.

Therefore, when operating with only one currency pair, the number of entries will be relatively low.

In GoGoJungle's demo forward, the six currency pairs are run simultaneously: USD/JPY, EUR/JPY, AUD/JPY, GBP/USD, USD/CAD, EUR/CHF.

Note: In the demo forward, the initial margin is set to 1,000,000 yen, but the trading lot is 1.0 (100,000 units), so if multiple currency pairs are held simultaneously and overlap, there is a possibility of insufficient margin preventing entries.

Currently, forward entries show up to a maximum of two currency pairs held simultaneously, but if you reduce the lot size, entries may increase further.

That covers the forward notes; what you may be interested in is the performance of each currency pair.

Entry Examples

All are buy entries. They enter at well-timed moments and close out early without carrying drawdown for long.

Backtest Analysis

【Backtest Conditions】

Period: 2010.01.04-2019.12.31

Initial Margin: 10,000 USD

Lot: 1.0 (100,000 units)

※Backtests include some lower-quality data, so please use as a reference only.

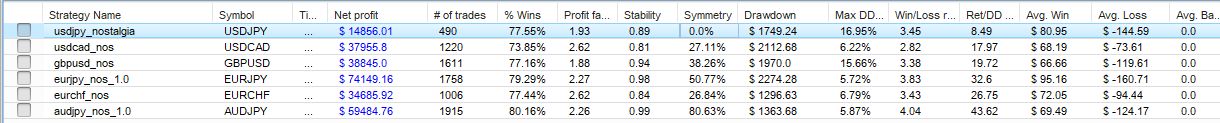

Performance Comparison of 6 Currency Pairs

All have a win rate of 77–80%, and maximum drawdown around 1,300–2,300 dollars, which is a manageable risk for operating one lot per currency pair with a 1,000,000 yen capital. In terms of stability,EURCHF, and in terms of profitability,EURJPY and AUDJPY

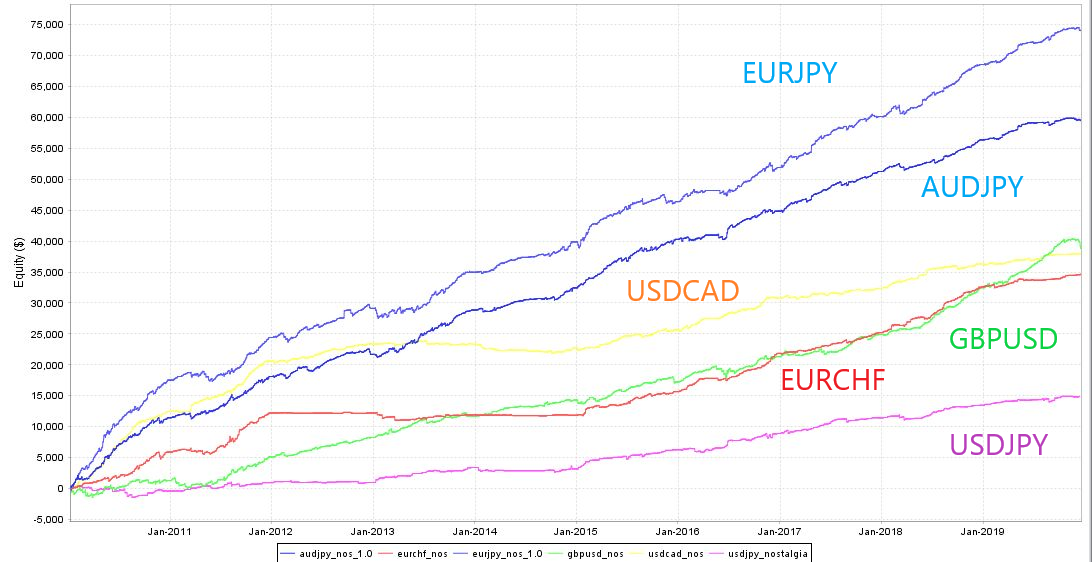

▲ Six-currency-pair P/L curve comparison. The less similar the profit curves, the better the portfolio compatibility.

In terms of correlation of the profit curves, EURJPY and AUDJPY are similar, and USDCAD and EURCHF are similar.

GBPUSD has its own unique profit curve, so you might consider selecting and combining currency pairs such as EURJPY with GBPUSD, AUDJPY with GBPUSD, EURCHF, etc.

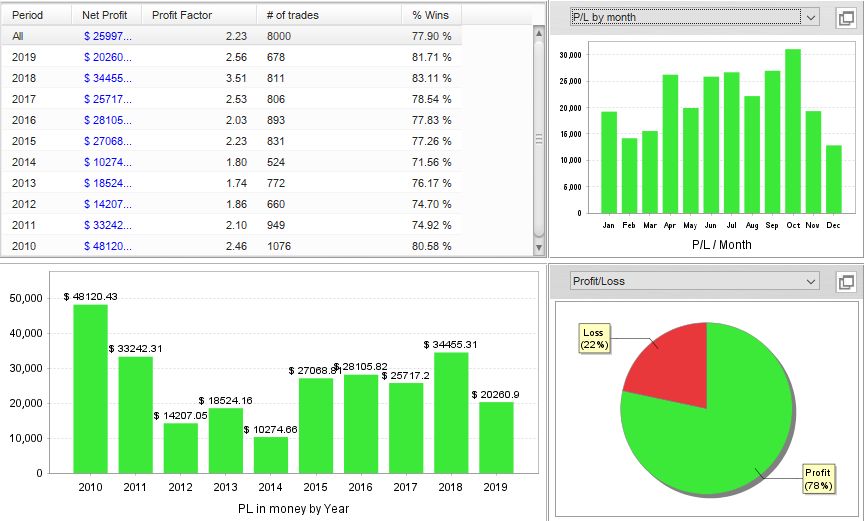

▲ Annual profit/loss trend for six-currency-pair simultaneous operation.

2010 had the highest profits, and in the most recent three years the annual return is around $20k–$30k.

We previously recommended a margin of about 1 million yen per currency pair; here we provide more detailed margin recommendations.

About the Recommended Margin

※All figures are per 1 lot

【USDJPY】

4,400 + (1,749*2) = 7,898 dollars

【USDCAD】

4,400 + (2,112*2) = 8,624 dollars

【GBPUSD】

7,200 + (1,970*2) = 11,140 dollars

【EURJPY】

4,900 + (2,274*2) = 9,448 dollars

【EURCHF】

6,000 + (1,296*2) = 8,592 dollars

【AUDJPY】

2,900 + (1,363*2) = 5,626 dollars

※If converted to yen, multiply by about 110.

That’s the result.

If operating all at 1.0 lot, on an account with 25x leverage, you would need about $51,328 of recommended margin. In practice, the likelihood of holding all positions at once is low, so you could use somewhat less.

Ten-year backtest total profit is $259,976, so the annual return is $25,997, and the annualized yield is about 50%.年利約50%approximately.

With 0.1 lot, a margin of about 500k–600k yen suffices, and the expected annual return would be around 200k–300k yen.That’s about right.

Portfolio example with carefully selected currency pairs

If you want to narrow down currency pairs further, combinations like the following seem good.

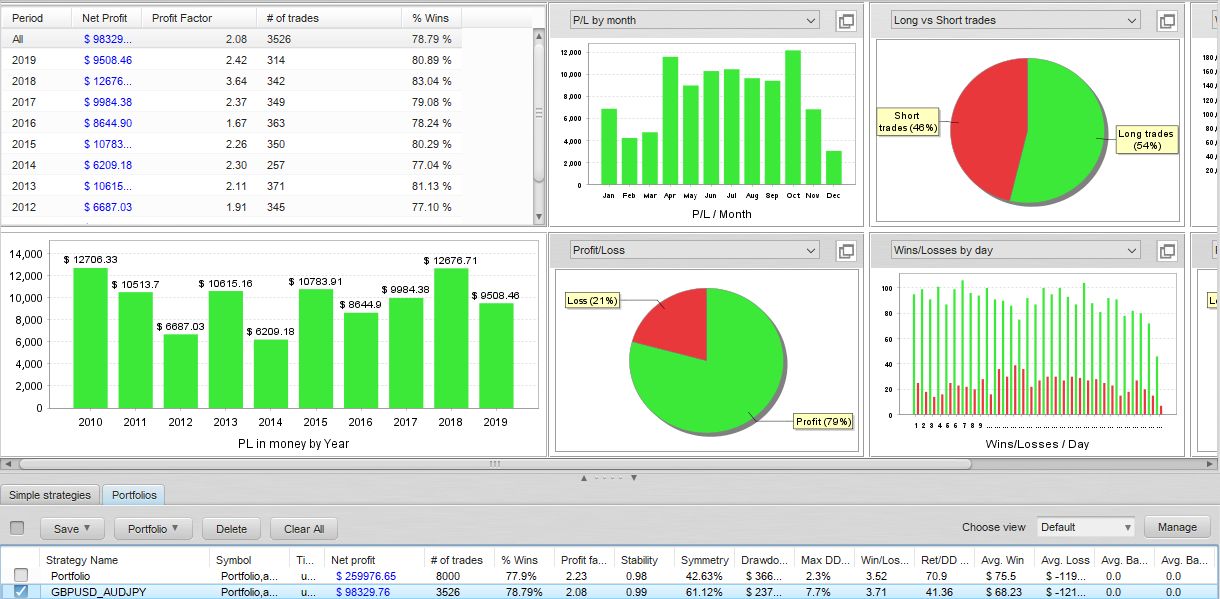

Combination of AUDJPY and GBPUSD

This pattern has relatively little variation in annual profit.

With a recommended margin of about $12,000, this yields an annual return of 60–100% .

The low recommended margin for AUDJPY contributes to the high return rate!

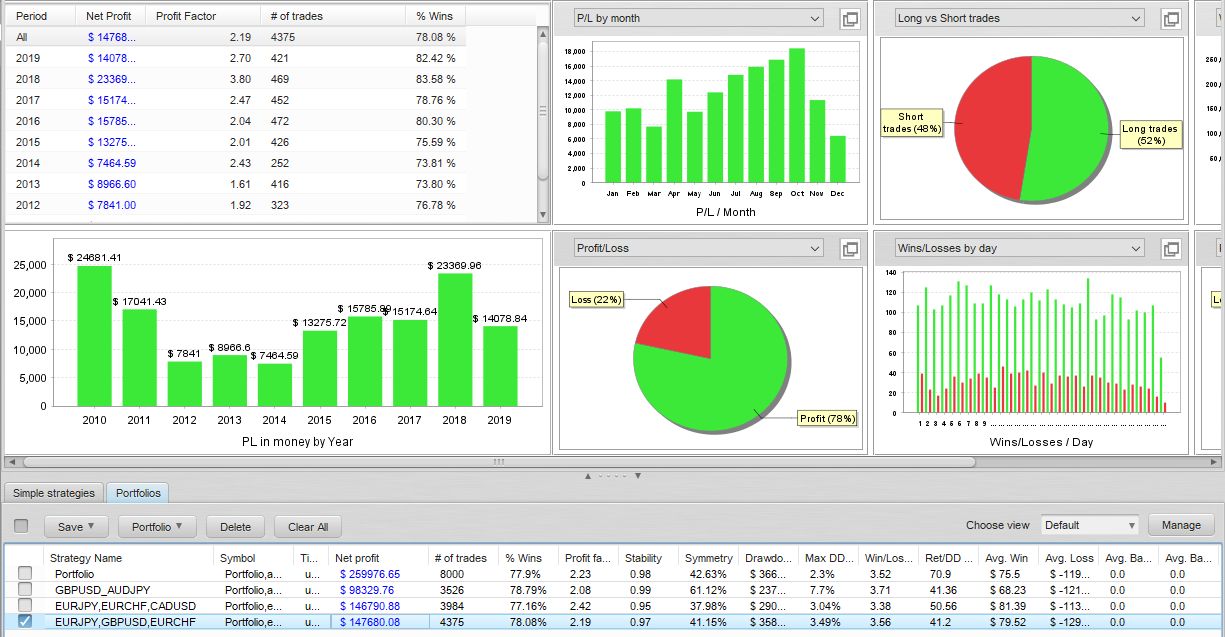

Combination of EURJPY, GBPUSD, EURCHF

This one has some volatility, but recent profits are high.

With a recommended margin of $29,000, returns are expected in the 25–100% range.

Nevertheless, even with six currency pairs, an expected annual return of around 50% is achievable, so operating all currencies is another appeal.

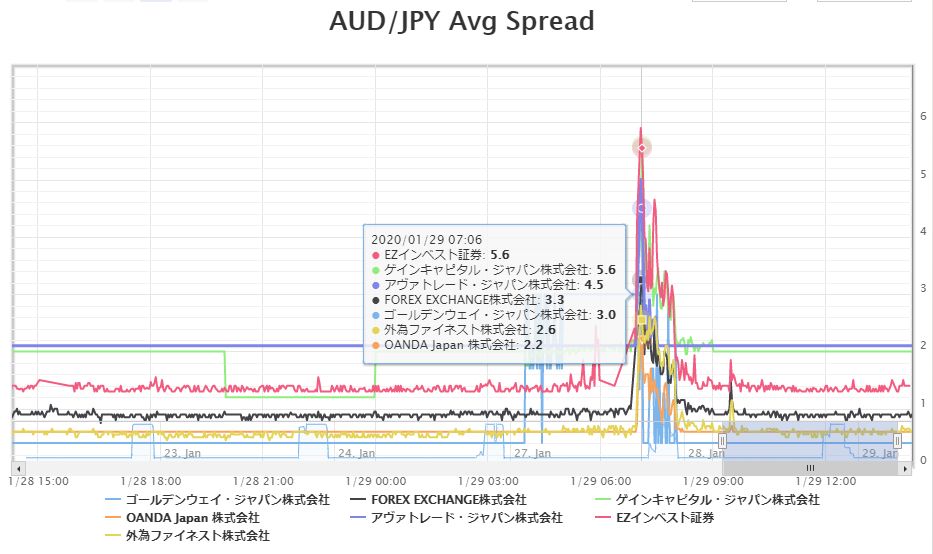

Early-morning Spread Issues as the Key

One concern is that this EA enters around 6:00–7:00 JST, a time when spreads tend to widen, so there may be cases where entry is blocked by spread filters.

For some currency pairs, widening the spread filter may help ensure entry frequency.

If you want to secure reliable profits over entry frequency, use the spread filter value recommended by the seller.

Also, according to the seller Alberto, Nostalgia Ver1@ has a better close logic than entry logic, so chart shape changes due to early-morning maintenance time have little effect.

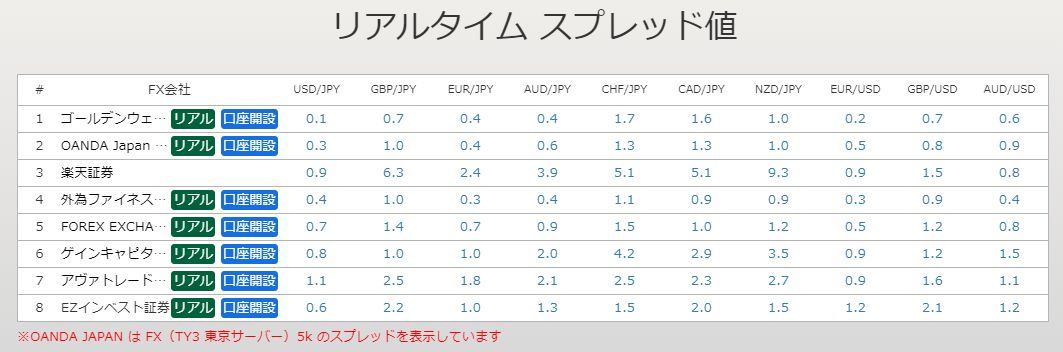

As with any EA operation, tighter spreads directly impact profits, so we recommend operating with a broker that has low spreads.

⇒ View real-time spread comparison

Written by Tera from GogoJungle Marketing.